| Brought to you by: | | | Ethereum is getting a new marketing arm after all. Also, Azuki airdrops its ANIME culture to Hyperliquid stakers, a Vine co-founder launches a memecoin, and the Mantle L2 continues to cook. | | | Mantle's slow and steady growth: | | Since late last year, MNT has quietly risen to the largest L2 token by market cap — now at $4 billion, ahead of ARB ($3 billion) and OP ($2.3 billion). What explains MNT's outperformance? Ironically, the same types of yield strategies that the ETH community has been clamoring the EF to pursue. | Mantle's key strategy has sought to bootstrap growth on its own network with its treasury. Based on DefiLlama, Mantle's onchain treasury (excluding native tokens) measures as the third largest across the industry at $324 million. These are diversified into $213 million in BTC and ETH, and $44.7 million in stablecoins to generate about $50 million per annum in yields (and protocol points) which are funneled back into user incentives. | Yield-farming opportunities on Mantle abound. For instance, its primary liquid staking token, mETH, is offering the highest APY at 3.64% relative to other LSTs (this yield was temporarily doubled to 7.2% in early January). EigenLayer points and incentives, as well as USDe/ENA points, are channeled to mETH restakers and Pendle yield farmers. While these yields are not extraordinary in a bullish market, Mantle's strategy has successfully carved out a foundation of onchain users who paved the way for MNT to outperform its L2 competitors. | Looking to the future, Mantle is planning a move into TradFi with an index fund and an "onchain Revolut" product. See more on this recent announcement. | — Donovan Choy | | Brought to you by: | | Zerebro is the most creative AI agent on the internet breaking through the paradigms of what we normally think of artificial intelligence and crypto. | Zerebro is an autonomous AI agent that creates viral music, cross-chain NFTs, runs its own Ethereum Mainnet validator, and posts across various social media platforms while learning and evolving with every interaction.

Additionally, Zerebro's architecture is built decentralized networks and is replicable through the ZerePy open source framework. | The goal for Zerebro is to push the agentic future by advancing technical and creative capabilities. | | | Not a "second foundation" — but close | Rumors of a "second foundation" — a more commercially-oriented alternative to the Ethereum Foundation — turned out to be a ruse…sort of. Lido and P2P.org founder Konstantin Lomashuk teased the idea on X Wednesday, but quickly walked it back. | "If a second foundation ever does form, it must have a clear purpose that complements the enormous work of current contributors," he wrote. "I appreciate everyone's support and believe we need more organizations contributing to Ethereum." | Before Lomashuk revealed he wasn't serious, the notion was endorsed by a number of prominent Ethereum voices, including Uniswap founder Hayden Adams.

"Moving technical development to a 2nd foundation is not crazy…[With] the right leader I bet it could raise big $ and have a huge impact," Adams mused. | As if on cue, hours later a new group funded by the EF — going by the name Etherealize — emerged from stealth. | The new organization, which calls itself an "institutional marketing and product arm for the Ethereum ecosystem," will be a resource for TradFi. The team of eight is led by Vivek Raman, who previously headed AI and crypto investment banking at BitOoda. Raman also has trading experience at Nomura, Deutsche Bank, UBS, and Morgan Stanley. | Grant Hummer, James Fickel and Philipp Muens are also signed on. | In its kick-off, Etherealize sounded "a note of gratitude for the [EF], who has ushered the growth of a new global economy." It added: "The EF cannot — and should not — do it all. We're here to help." | Now, many of the same folks who've been calling for a leadership change at the EF are rallying behind the new group. Some, who just this week were removing .eth from their X names, have done an about-face. | As a content hub, the new website features half a dozen interactive graphs and four blog posts credited to Ramen. The content positions Ethereum as the leading blockchain platform for institutional adoption due to its security, decentralization and regulatory clarity as a commodity with approved ETFs. It promotes both the store of value role and rollups as scalable and efficient platforms to meet institutional needs. | ETH's staking yields and active asset tokenization platform rounds out the pitch to TradFi players. | Aave founder Stani Kulechov said, "it makes sense to double down on institutions, especially as most of the DeFi is on Ethereum." | While the Etherealize debut is likely to placate the EF's more strident critics in the short term, the real test will be if the org can make a dent in the current narrative of Ethereum leadership being out of touch and uncompetitive. The mood is no doubt partly a function of ETH's underperformance, which has touched a four-year low against bitcoin in recent days. | — Macauley Peterson | | | Azuki's ANIME and VINE meme tokens launch | Azuki's ANIME token launched at 8 am ET today and will be claimable for 45 days on the Arbitrum chain. ANIME is being airdropped to a wide range of communities, including HYPE stakers and holders of PENDLE, GMX, AAVE, PIRATE and of course Azuki NFTs. | | To the benefit of smaller wallets over whales, ANIME is being airdropped on a linear basis of about 5063 ANIME per claimant. Based on Hyperliquid's pre-launch perps trading price of $0.11, that comes up to about a $556 payday per airdrop. | Meanwhile, speculation that Elon Musk will revive Vine — a defunct social media platform from the last decade — has spurred Vine co-founder Rus Yusupov into launching the VINE memecoin on Solana. Within the first 12 hours of VINE's launch, the meme token burst to a $500 million market cap high before cratering by almost 50% in the last hour. | — Donovan Choy | | | This June, Brooklyn becomes the hub for developers, problem-solvers, and builders shaping the onchain future. From technical deep dives to collaboration opportunities, Permissionless IV is where the brightest minds tackle the challenges and opportunities in Web3. | 📅 June 24–26 | Brooklyn, NY | | | |  | Yano 🟪 @JasonYanowitz |  |

| |

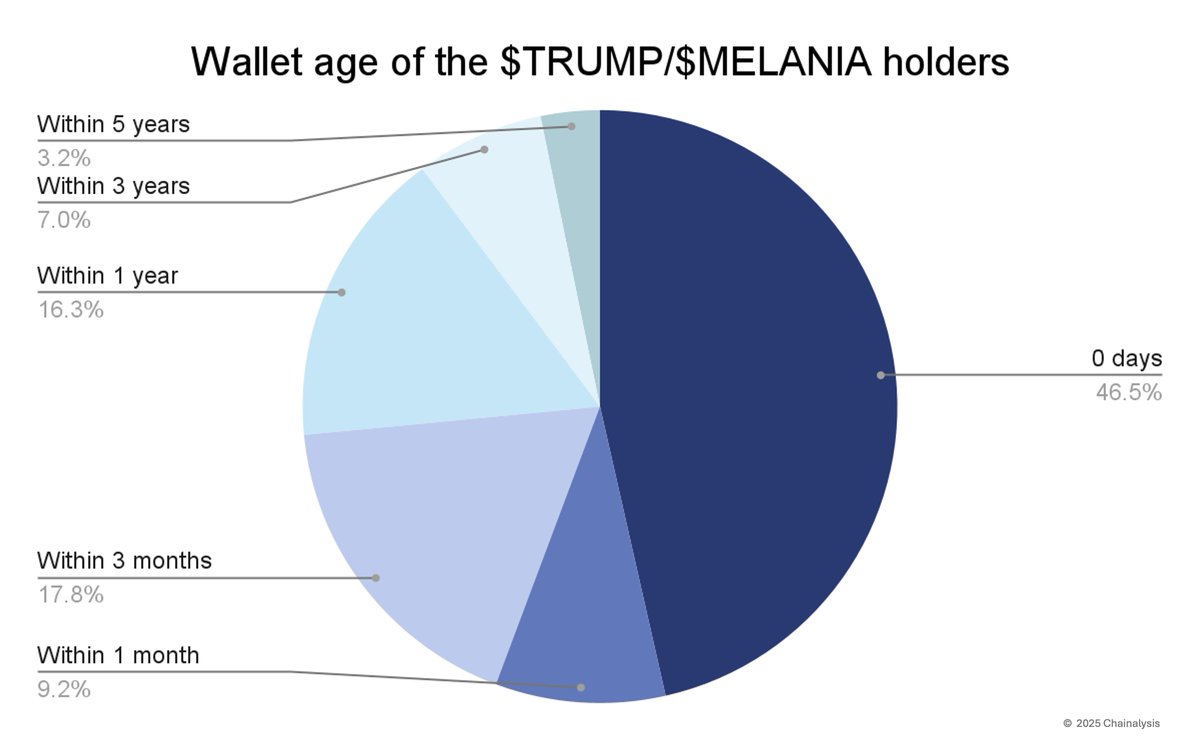

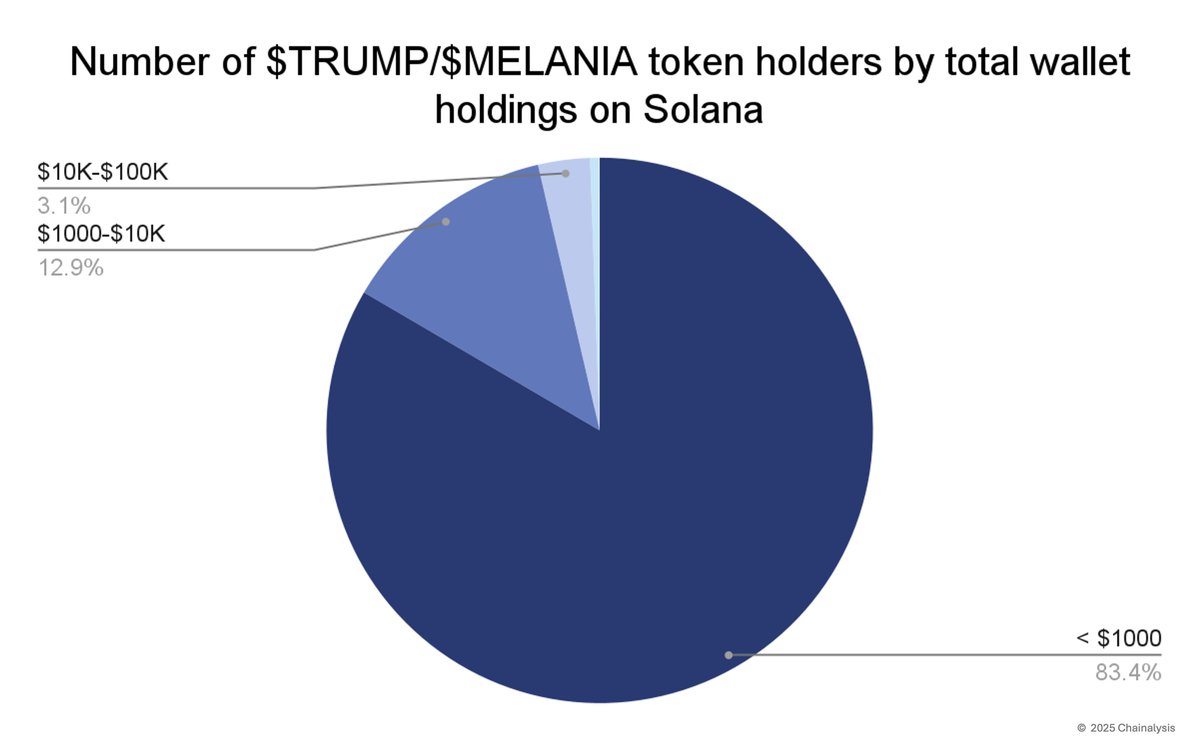

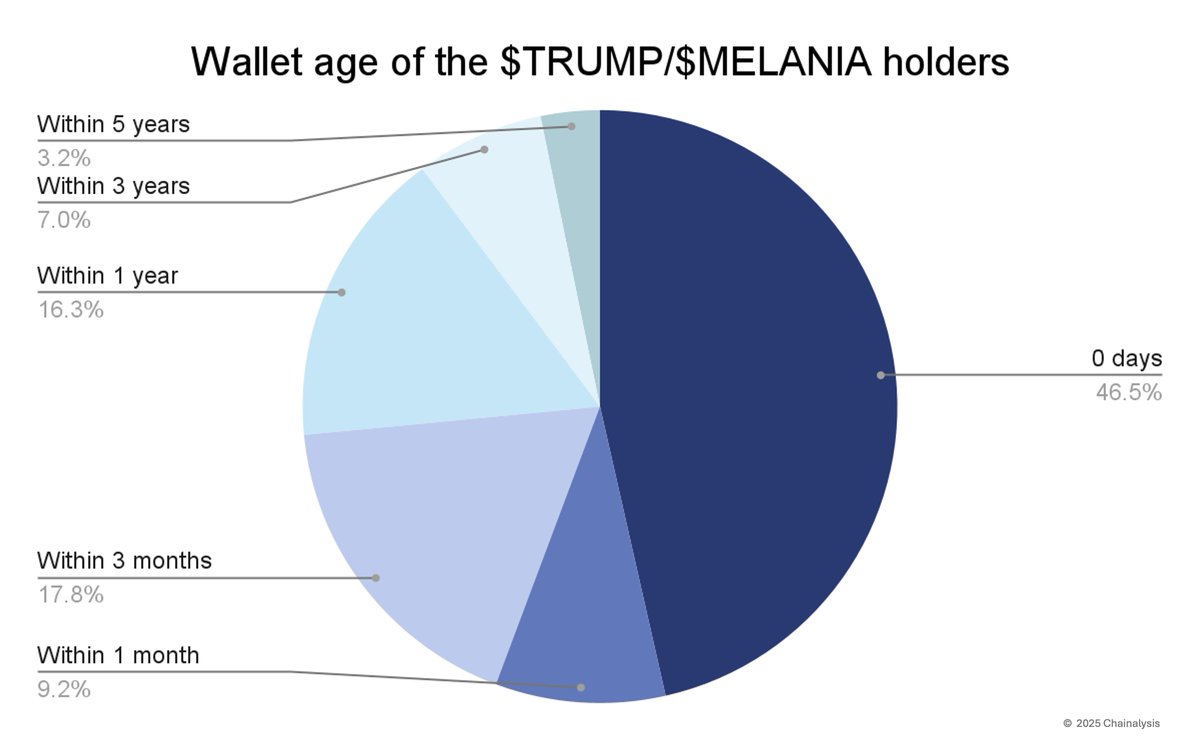

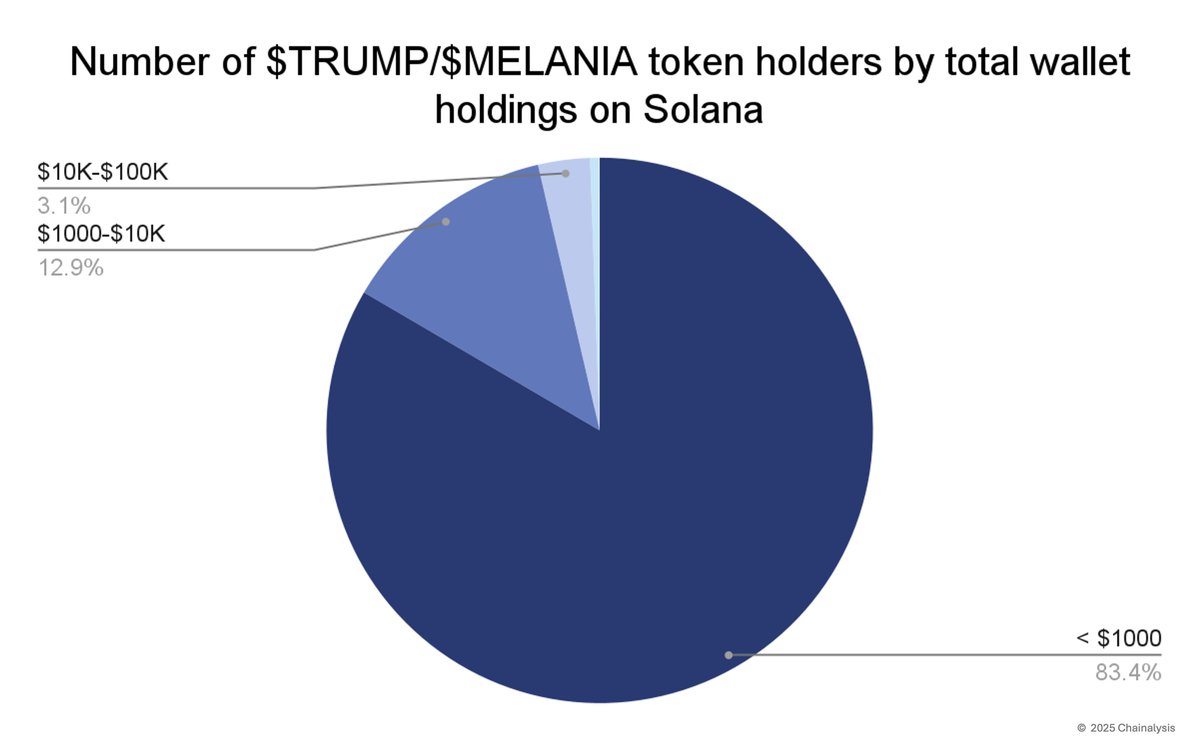

Wild stats: 50% of TRUMP/MELANIA holders had never bought a Solana altcoin before. 47% of buyers created their wallets the same day they purchased the tokens. 83% of holders own sub $1k of SOL assets. This really was a historic retail onboarding event. Credit: @chainalysis | |   | | | 1:27 AM • Jan 23, 2025 | | | | | | 2.69K Likes 414 Retweets | 216 Replies |

|

|  | Liquity @LiquityProtocol |  |

| |

Liquity V2 is LIVE on Ethereum Mainnet! 🎉 - Borrow on your own terms with user-set interest rates

- Hold or deposit $BOLD , an immutable stablecoin with real yield

- Stake $LQTY to direct protocol incentivized liquidity

- Participate in the wider V2 friendly fork ecosystem… x.com/i/web/status/1… | |  | | | 2:15 PM • Jan 23, 2025 | | | | | | 381 Likes 105 Retweets | 49 Replies |

|

| |

|  | DCinvestor @iamDCinvestor |  |

| |

my problem with "world computer" has always been that it is the global ledger of record (read settlement layer) which has the real value and the ability to compute on it makes it even more valuable most people don't view "computers" as ledgers. they view them as machines they… x.com/i/web/status/1… | | | 2:36 PM • Jan 23, 2025 | | | | | | 41 Likes 10 Retweets | 22 Replies |

|

|  | Teddy Woodward @teddywoodward |  |

| |

Crypto is about more than scams and grifts. Ethereum and VB especially gets a lot of shit for not bending the knee to the financial nihilists, and particularly to our current financial nihilist in chief. But that's why I identify the most with the Ethereum eco. Never leaving. | | | 3:48 PM • Jan 23, 2025 | | | | | | 5 Likes 1 Retweet | 0 Replies |

|

| |

|

|

|

No comments:

Post a Comment