| Bloomberg Evening Briefing |

| |

| Donald Trump on Monday echoed his first inauguration speech eight years ago, painting a dark picture of an America where, in 2025, many still struggle to make ends meet though employment is high and the Federal Reserve well on its way to achieving a soft landing. Trump said he would reverse America's "horrible betrayal" and instead usher in a "golden age" while taking on "a radical and corrupt establishment." He pledged to tackle residual inflation by declaring a "national energy emergency" to encourage more domestic fossil fuel production, with policy changes that would enable new oil and gas development on federal lands and roll back Biden-era climate regulations. Still, much of Trump's agenda hinges on Congress, where Republicans have narrow majorities in both chambers and where splits are already emerging over plans that could expand the country's monstrous national debt. Trump will also weigh the extent to which he wants to orient his administration around personal grievances, including his frequent falsehoods about his 2020 electoral defeat and efforts to prosecute him after leaving office. Earlier Monday, now-former President Joe Biden announced pardons for family members and some government officials that Trump had threatened to go after. At 78, Trump is the oldest president to be sworn into office, as well as the first Commander-in-Chief to be a convicted felon and the subject of two separate impeachments by the House of Representatives for high crimes and misdemeanors. Nevertheless, he returns to office more emboldened than ever, and with fewer likely checks given full Republican control of the US government. —David E. Rovella | |

What You Need to Know Today | |

| Trump has delayed his promised renewal of the trade war he launched against China seven years ago. Instead, he is ordering his administration to address unfair trade practices globally and investigate whether Beijing had complied with a deal signed during his first term. Trump's first administration negotiated a "phase one" trade deal with Beijing that ended years of tit-for-tat tariffs, but few of China's promised purchases of US goods materialized. Trump's moves today call for key federal agencies to address alleged currency manipulation by other countries. The decision not to immediately target Beijing as promised comes after a campaign season in which promised a 10% to 20% charge on all imported goods and 60% on Chinese products. He has also vowed a 25% tariff on all products from Canada and Mexico. | |

|

| Trump has promised executive orders on everything ranging from immigration, energy, the military and federal workforce, casting many as attempts to reverse the policies of his predecessor. He has said he could sign about 100 executive orders, and the White House on Monday pledged "an unprecedented slate" of actions rescinding Biden's orders. It's expected that many of them will be challenged in court. Here's a rundown of what might be coming.  Migrants near the Rio Grande along the US-Mexico border in Juarez, Chihuahua state, Mexico, on Dec. 18. Photographer: Bloomberg | |

|

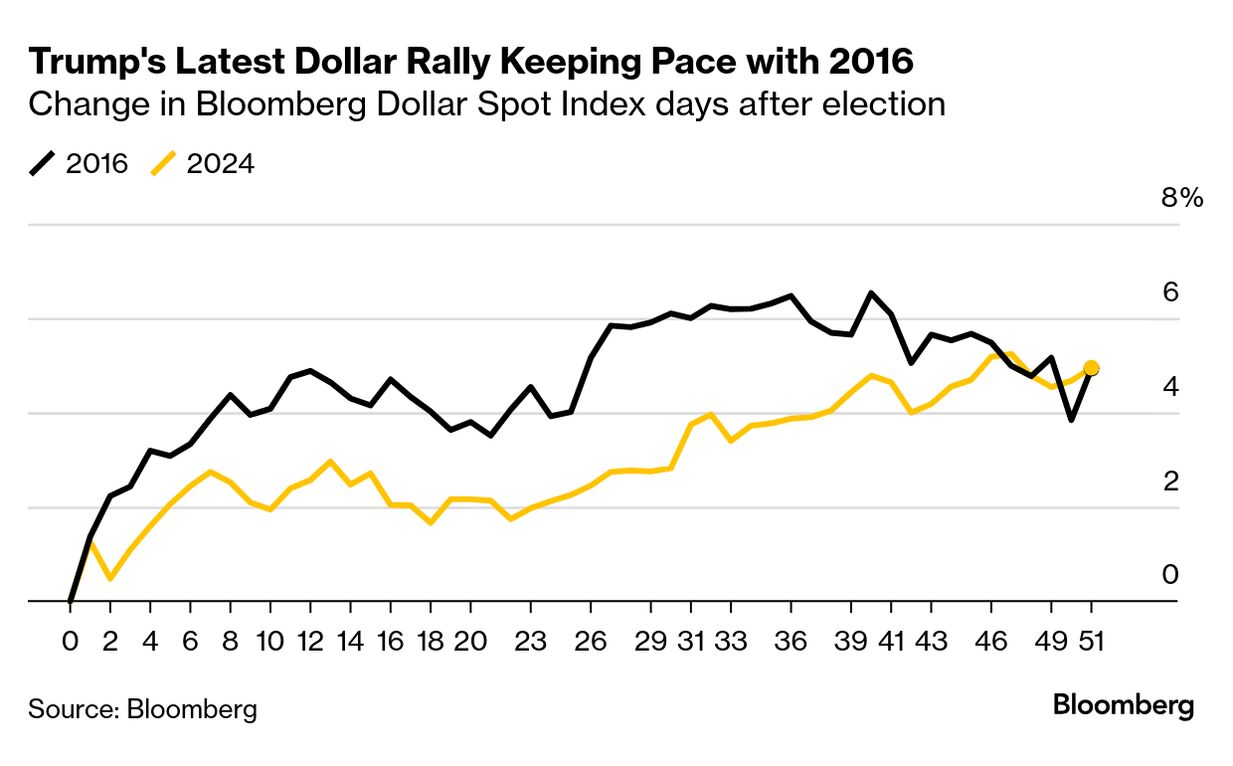

| Wall Street reacted positively to Trump's initial tariff backpedaling, pushing US equity futures higher. Signs that he may pursue a less protectionist approach, for now, is a boon for multinational companies that rely on cross-border commerce, giving them time to adjust pricing and mitigate any impact to profit margins. The dollar however slumped. Betting on the greenback has become one of Wall Street's favored trades for those investors expecting that sweeping trade tariffs will crimp global growth, accelerate US inflation and potentially cause the Federal Reserve to refrain from interest-rate cuts this year. "I do think, and maybe it's just a hope, that Trump backs off from his most extreme rhetoric, especially on the deportation and tariff fronts," said Marvin Loh, senior macro strategist at State Street Global Markets. | |

|

| |

|

| Many of Trump's announced executive orders are sure to be the subject of litigation. But even before that can begin, other lawsuits already have been filed. A union representing hundreds of thousands of federal employees sued the Trump administration over its as-yet detailed cost-cutting effort to be led by Trump adjutant Elon Musk. The lawsuit from the American Federation of Government Employees and government watchdog groups Public Citizen and State Democracy Defenders Fund was one of three cases filed as Trump was being sworn in on Monday challenging the "Department of Government Efficiency," or DOGE after Musk's favorite cryptocurrency. The AFGE case claims that the initiative violates a 1972 US law requiring checks on conflicts of interest, ideological balance and transparency for groups with a direct line to the White House. | |

|

| Instead of waiting to see whether Trump follows through on his endorsement of a national "strategic" Bitcoin stockpile, some states are taking matters into their own hands. As local legislative sessions get underway, eight states have already introduced bills proposing crypto reserves. But while the push to ensure that state governments hold Bitcoin in one form or another has generated momentum among long-time crypto advocates, the clamor may not be more than just loud noise. | |

|

| Some of the world's richest people turned out Monday to pay homage to Trump. It was a who's who of the world's wealthiest—gathering a combined net worth exceeding $1.3 trillion for the occasion. Seated prominently behind the Trump family for Monday's swearing-in were the top three individuals on the Bloomberg Billionaires Index: Elon Musk, Jeff Bezos and Mark Zuckerberg. Also spotted inside the Capitol Rotunda for the inaugural ceremony were LVMH Chief Executive Officer and France's richest man, Bernard Arnault, and Alphabet co-founder Sergey Brin. Present in the crowd as well were hedge fund billionaire John Paulson and Apple CEO Tim Cook, who enjoyed a cordial relationship with Trump during his first term.  From left, Mark Zuckerberg, Jeff Bezos, Sundar Pichai and Elon Musk during Donald Trump's inauguration in the rotunda of the US Capitol. Photographer: Julia Demaree Nikhinson/AP Photo | |

What You'll Need to Know Tomorrow | |

| |

| |

| |

|

Your regular Evening Briefing Americas returns tomorrow, Jan. 21.

| |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment