| | The European Union's Markets in Crypto Assets Regulation (MiCA) establishes the bloc's regulatory framework for crypto, offering regulatory clarity and opening the EU's vast single market of 450 million consumers to innovation. But will it also deliver on its promises to foster a competitive local market, particularly in the euro-denominated stablecoin sector? | | | Measuring network REV: | | Real economic value (REV) is a topline monetary demand metric used to make apples-to-apples comparisons between chains. Specifically, REV measures all transaction fees and MEV tips that users pay to transact onchain. Where REV used to be dominated by Ethereum in 2021, that share is more equitably split with Solana in the past year. | While REV is a useful measure to tell which chain generates the most value, it may not necessarily reflect the most "active" chain. For instance, Ethereum's soaring REV in 2021 was in large part due to high activity, but also the congestion costs of using a chain that failed to scale for bull market usage. Widely-used apps may also not reflect in REV if the particular chain had ultra-low fees. | — Donovan Choy (X: @donovanchoy | Farcaster: @donovan) | | Will euro stablecoins see a renaissance? | As of Dec. 30, 2024, MiCA officially went into force, marking a turning point for the European Union's approach to crypto assets. | Despite the euro's prominence in TradFi — accounting for 20-30% of global FX reserves, SWIFT transactions and trade flows — it represents less than 0.5% of global stablecoin circulation. | Patrick Hansen, an industry expert and Circle's EU policy lead, expects this to change. He emphasized MiCA's significance as "the world's most comprehensive regulatory framework for crypto assets." | "The EU has a unique opportunity to position itself as a global hub for crypto innovation," Hansen told Blockworks. | Why the euro lags in stablecoins | Hansen attributes the disparity in onchain euros compared to dollars to several factors: | Dollar-dominated liquidity:

"Network effects created around US dollar stablecoins were just impossible to catch up for euro stablecoins. European users interacting with global crypto markets choose whatever is cheapest and most liquid."

Historical negative interest rates:

"For a long time in the euro area, negative interest rates put the stablecoin business model into question."

Regulatory uncertainty: Until MiCA, euro stablecoins lacked a dedicated regulatory framework, deterring institutional players.

| MiCA addresses this third point by creating a clear framework for stablecoins. Hansen notes that the entry into force has already attracted institutional interest, with major European banks and other players exploring or launching euro stablecoin products. He highlights Circle's launch of EURC under MiCA-compliant conditions, with reserves fully managed by a French-regulated entity, noting that "we've seen 60-70% growth in EURC supply, driven by launches on multiple blockchains." | MiCA mandates stablecoin issuers hold reserves proportional to tokens circulating in the EU. Circle uses a "dynamic rebalancing" model to comply, Hansen explained. | "If we see the number of USDC held in the EU increase, we increase the European reserves accordingly," he said. | Emerging use cases for onchain euros | Hansen sees two main drivers for euro stablecoin adoption: regulated crypto capital markets and stablecoins' real-world applications. | "Only stablecoins authorized under EU rules will ultimately be used as trading pairs in regulated crypto markets," Hansen said. "I'd not be surprised to see significant growth in this area." | This change has driven crypto exchanges to delist USDT as trading pairs for customers in the EU.

| Corporate use cases, such as cross-border payments and tokenized financial instruments, are gaining traction, according to Hansen.

"Corporate suppliers in the euro area will inherently demand euro-denominated assets for risk management," he said.

| However, while MiCA offers a solid foundation, Hansen cautions that it's only "version 1.0" and must evolve to address emerging challenges. He also warns that the EU's Travel Rule (TFR), which requires additional user verification for certain transactions, could create friction — particularly for self-custody wallets. | Ultimately, MiCA's success will depend on whether it can balance fostering innovation with protecting consumers and creating a competitive local market. | As Hansen put it, "only time (and the market) will tell whether MiCA can achieve its goals." | — Macauley Peterson (X: @yeluacaM | Farcaster: @Macauley) | | | Unpacking REV: | | Interpreting real economic value: | Dan Smith: In 2021, blockchains saw about $2 billion of REV generated, compared to about $700 million today. But it's a misnomer to say that demand was greater then. There is far more computation happening onchain now. The price to execute transactions onchain decreased by multiple orders of magnitude. So with cheaper transactions, blockchains need to be selling more units. We're starting to see the very early innings of that. | Ryan Connor: Trading is what matters to the profits of the chain. People got really excited about Polymarket, but it didn't drive a lot of trading volume, so it wasn't noticeable on the REV chart for Polygon. | On the AI Agent meta: | Danny Knettel: A lot of the creator-based AI tokens have entered a memecoin trading paradigm where it's hard to value based on fundamentals. You're wondering if the momentum of attention can grow via integrations with other social media platforms. This becomes a reflexive flywheel thing where price drives the narrative. They're wrappers on models essentially to do things onchain, but may eventually evolve into a generalized product that one might use to interact onchain. The fact that so much of this is getting built open sourced greatly speeds up the development timelines, but how successful it will be depends on whether LLM hallucination rates are driven down, or whether the more powerful models get cheaper — that's going to be where the real gains are made. | | |  | raghav @rargulati |  |

| |

I just sent this to a founder who asked if they should do an ICO on CoinList or raise with Echo: TLDR: Syndicate platforms like Echo are for young projects that want to add a few $100K to an angel or VC round—it's not a retail crowdsale and tokens may not be distributed for… x.com/i/web/status/1… | | | 4:45 PM • Jan 2, 2025 | | | | | | 546 Likes 42 Retweets | 109 Replies |

|

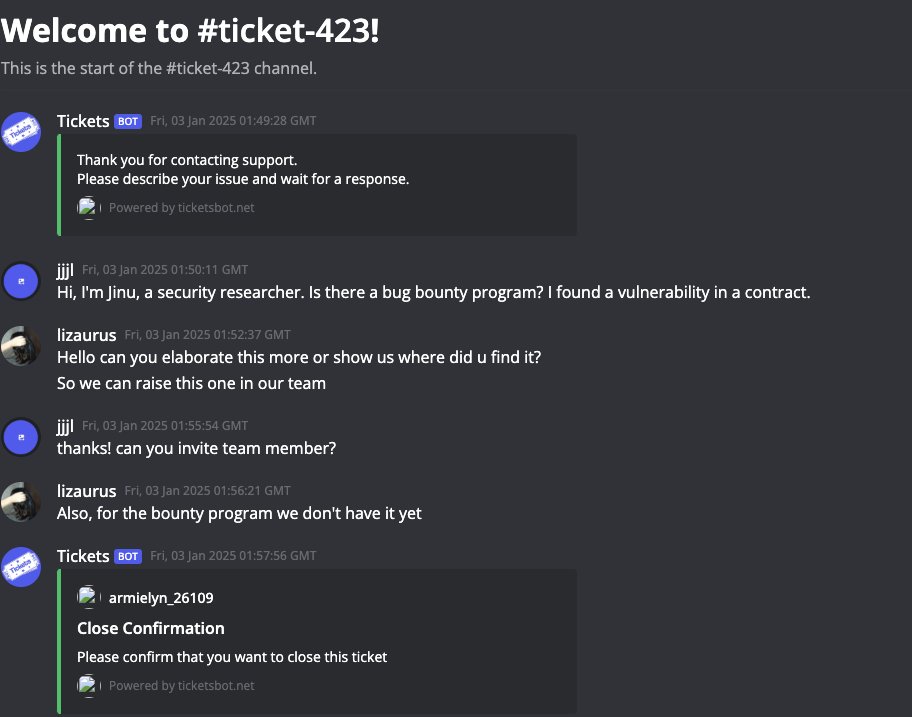

|  | jinu @lj1nu |  |

| |

I took a quick look at the code and found the vulnerability in @virtuals_io They seem to have been audited, but when I contacted them, the team replied that they were not running a bug bounty. And they closed the discord channel I created to report the vulnerability. | |   | | | 3:27 AM • Jan 3, 2025 | | | | | | 696 Likes 70 Retweets | 48 Replies |

|

| |

|  | Patrick Hansen @paddi_hansen |  |

| |

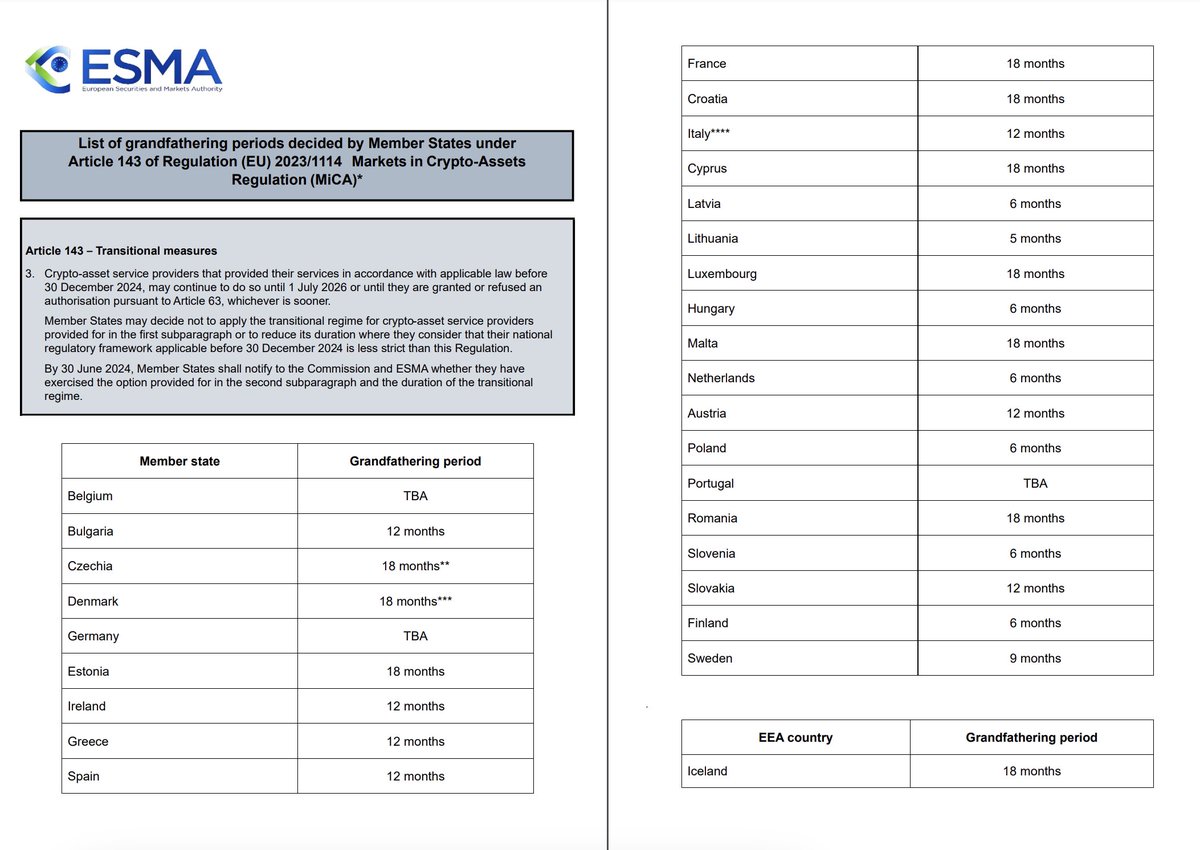

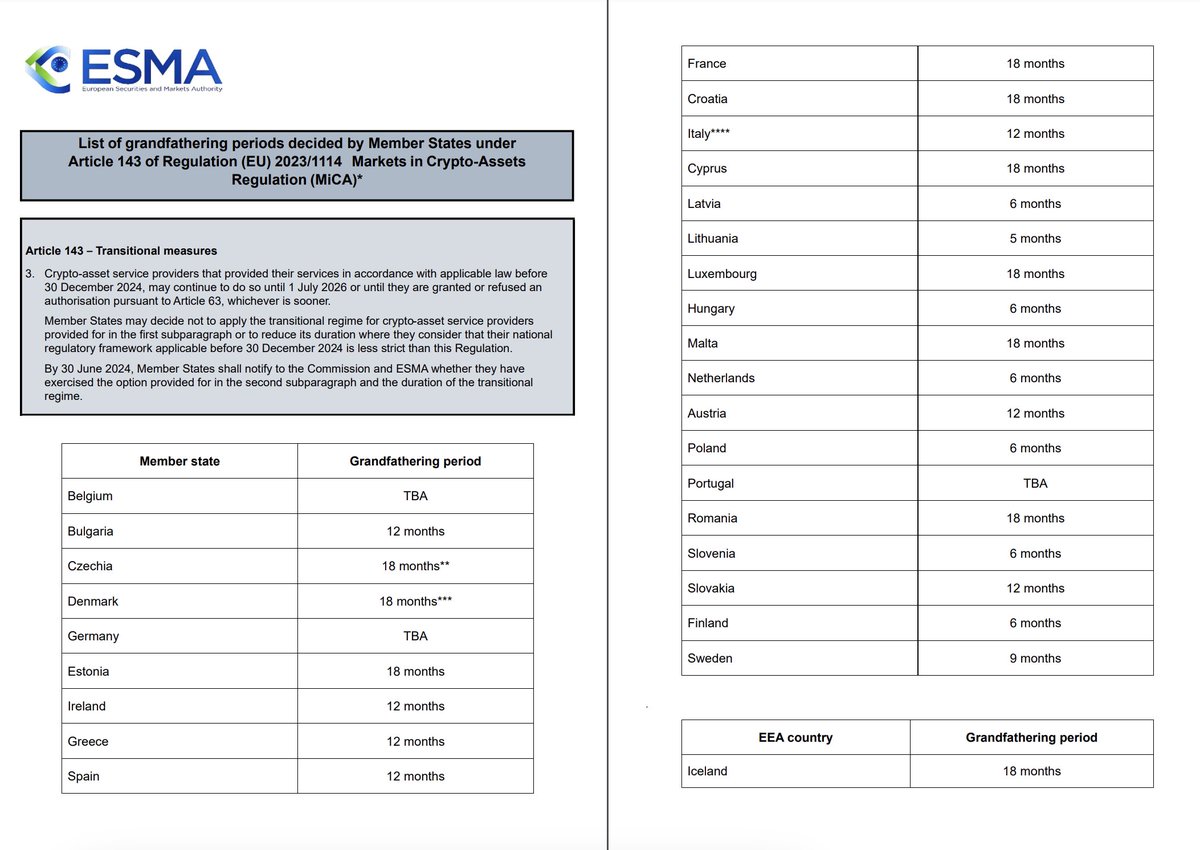

🇪🇺 MiCA is live, but CASPs (e.g. exchanges) that were licensed/registered in an EEA country before can benefit from additional national transition periods. These range from

-5 months in 🇱🇹

-6 months in 🇳🇱

-12 months in 🇩🇪

-to up to 18 months in 🇫🇷 More below👇 |  Patrick Hansen @paddi_hansen Patrick Hansen @paddi_hansen

MiCA is officially live! 🇪🇺 After years of consultation, heated debates, contemplated bitcoin bans, last-minute amendments, and countless votes, MiCA now (actually since Dec 30 2024) officially applies to crypto-asset issuers and service providers in the EU - even if the latter… x.com/i/web/status/1… |

| |  | | | 2:20 PM • Jan 3, 2025 | | | | | | 48 Likes 12 Retweets | 3 Replies |

|

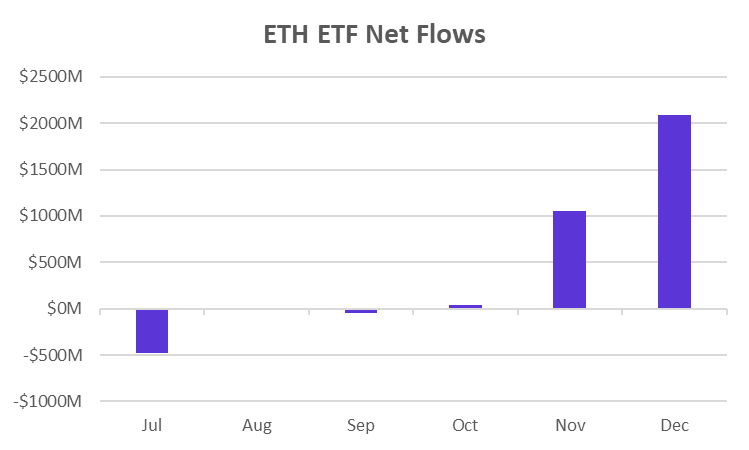

|  | Marc Arjoon 🟪 @marcarjoon |  |

| |

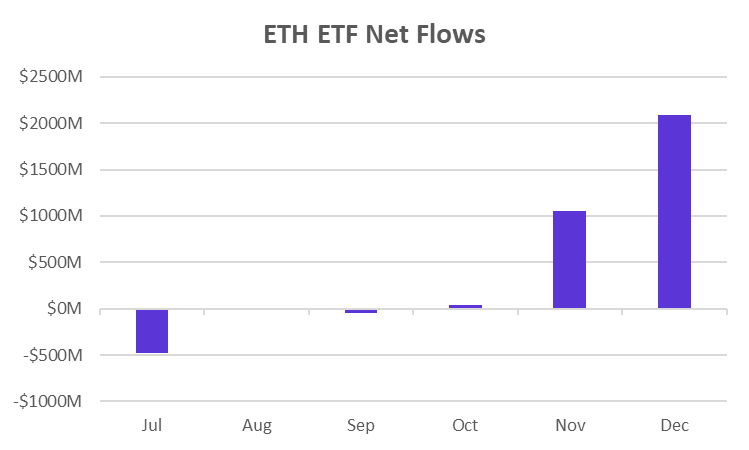

How are more people not encouraged by this? | |  | | | 2:38 PM • Jan 3, 2025 | | | | | | 11 Likes 1 Retweet | 1 Reply |

|

| |

|

| | |

|

No comments:

Post a Comment