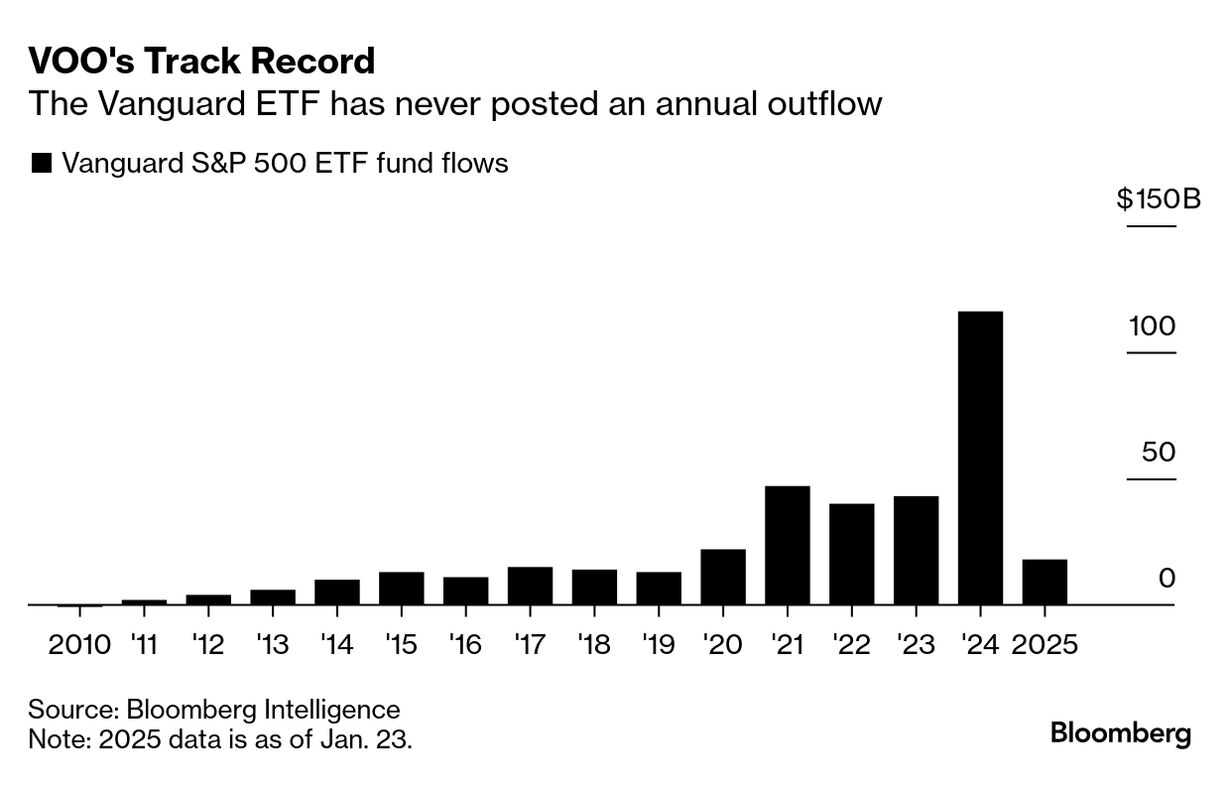

| Vanguard is on the cusp of a coup as investors shovel ungodly sums of money into the firm's S&P 500 ETF (ticker VOO). Nearly $18 billion has flowed into VOO in the opening days of 2025 — more than five times that of its closest runner-up, which happens to be another Vanguard fund, data compiled by Bloomberg show. That's on top of last year's $116 billion haul, which shattered the annual flow record and then some. As a result, VOO now commands $626 billion in assets as of Friday, putting it on track to eclipse the $637 billion SPDR S&P 500 ETF Trust (SPY) — currently the world's largest ETF. It's a familiar story. Vanguard is well-known for its dedicated core audience of cost-conscious financial advisers and retail investors who tend to funnel money in and rarely withdraw. That buy-and-hold loyalty is thanks to Vanguard's rock-bottom fees. The firm's unique corporate structure — fund shareholders elect its board members — means that its products charge relatively little. VOO charges 0.03% on an annual basis, for instance, compared to SPY's 0.095% fee. SPY, on the other hand, is prized among professional traders for its liquidity and razor-thin spreads. But the fund's superior trading volume often translates into chunky two-way traffic in the fund. Case in point: VOO has never posted an annual net outflow since its 2010 inception, while SPY has seen net withdrawals in five years during the time period. While VOO is hot on the heels of SPY, it's worth noting that BlackRock isn't too far behind. The $610 billion iShares Core S&P 500 ETF (IVV) has also soared in size, absorbing nearly $87 billion last year alone. IVV's fee currently matches that of VOO at 0.03% . But that could change, according to Todd Rosenbluth, head of research at TMX VettaFi. "We also think BlackRock might become more aggressive in pricing IVV," Rosenbluth said. "Being the king of the ETF market is worth fighting for." |

No comments:

Post a Comment