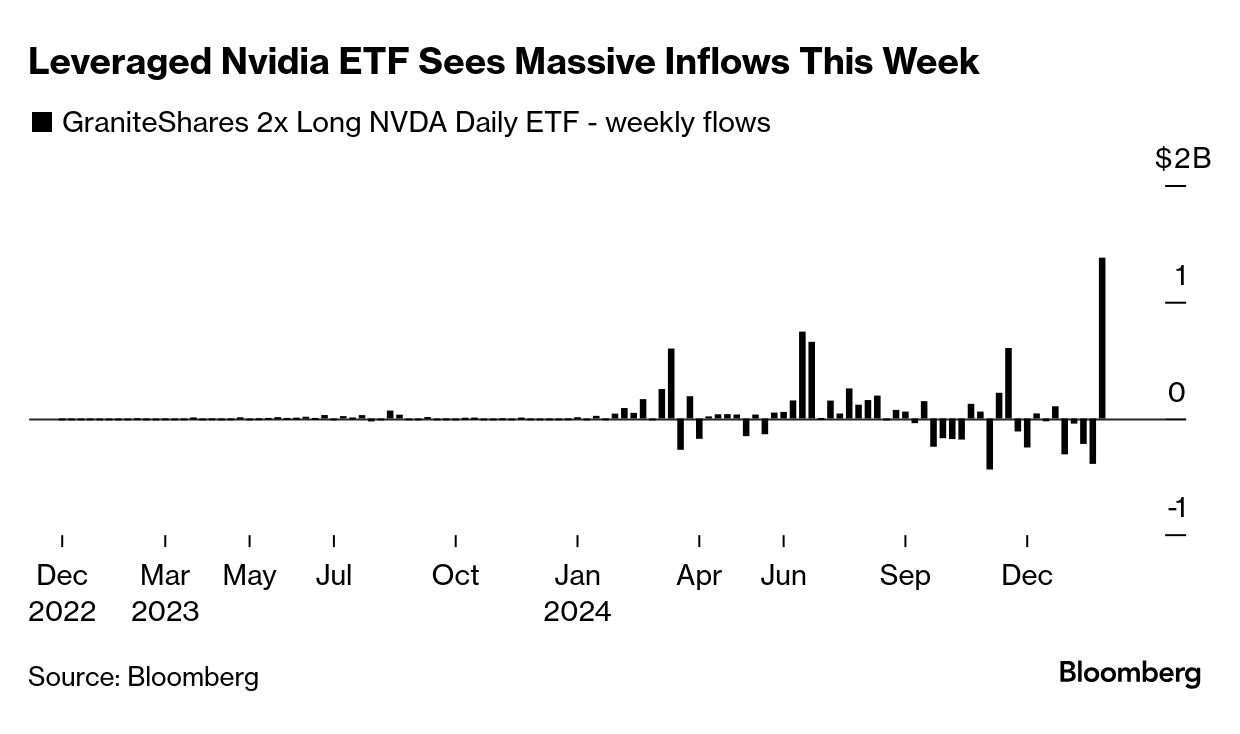

| Monday's global stock-market selloff — spurred by fear that a cheap Chinese AI model could undercut existing American trailblazers — didn't scare off ETF investors. In fact, they saw it as an opportunity to buy the damn dip. (This is a family friendly newsletter, so we won't use the other, more risqué acronym). Case in point: the Invesco QQQ Trust Series 1 (ticker QQQ), which saw $901 million come in in the four days through Thursday, with its cheaper counterpart QQQM seeing $440 million added, according to data compiled by Bloomberg. But the big news revolved around the inflows into leveraged funds that got seriously dinged during Monday's selloff. Astonishingly, $1.3 billion went into the Direxion Daily Semiconductors Bull 3x Shares (SOXL) — which, as the name suggests, is an uber-bullish chips fund — on Monday, a day when the fund dropped 23%. And then more came in over the subsequent days — investors poured a combined $1.8 billion into it in the four sessions through Thursday. But perhaps most impressive of all, the GraniteShares 2x Long NVDA Daily ETF (NVDL) saw an inflow of $1 billion on Monday, the same day when the fund itself lost 34%. It, too, absorbed even more as the week went on, with a net $1.4 billion added so far this week, which puts it on pace for a record week of inflows. Talk about eye-popping. This wasn't an isolated event. Equity flows following weekly drops in the S&P 500 have gone up in the past two months, with investors taking selloffs in December and January as buying opportunities as well, according to Athanasios Psarofagis at Bloomberg Intelligence. "ETF investors appear to be taking advantage of recent market weakness by adding to equity funds," he wrote in a note. "Flows show there's a growing appetite for buying market dips," he said, adding that one measure — the spread between leveraged long and inverse equity ETF — suggest a "bullish tilt." And as long as this ratio is in a positive tilt, he wagers investors will continue to buy the dips. |

No comments:

Post a Comment