| I'm Craig Stirling, an economics editor in Frankfurt. Today we're looking at the path for central banks in 2025. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Aides to US President-elect Donald Trump are considering tariffs on all countries that would limited to specific critical imports, the Washington Post reported.

- The Bank of Japan chief sent a fresh reminder that he's going to hike interest rates if the economy keeps improving this year.

- Coming up: German inflation probably accelerated in December and Israel is likely to keep policy on hold.

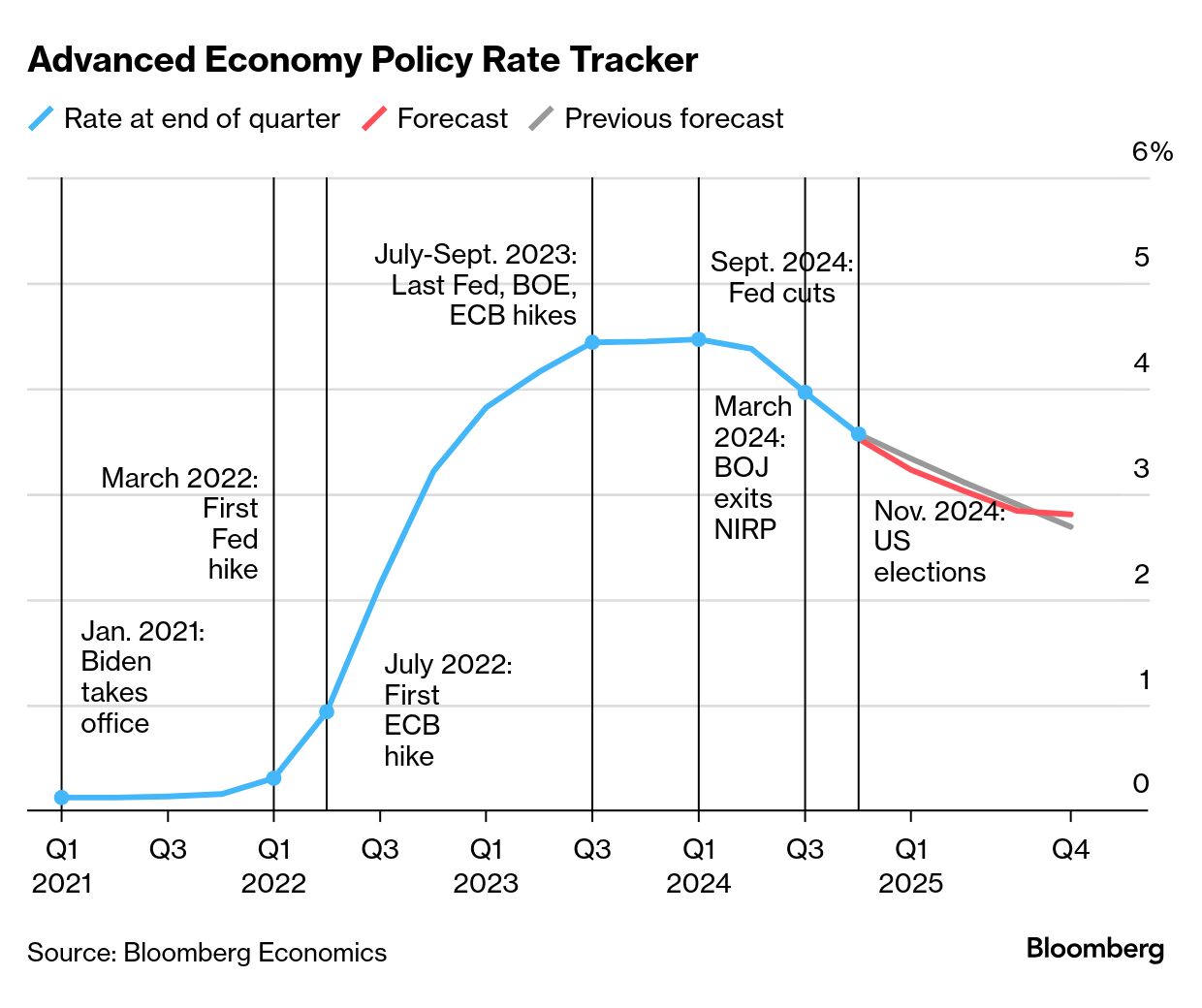

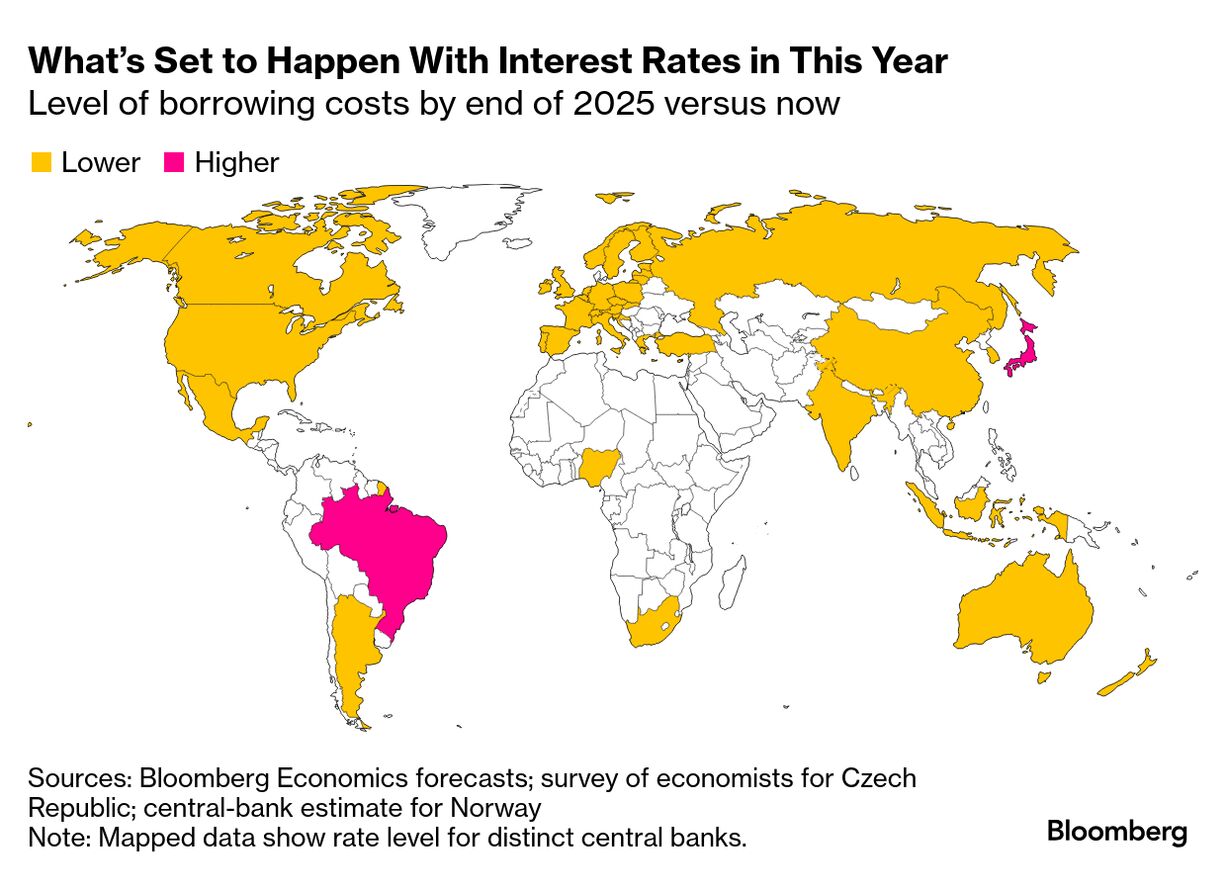

Global central bankers are poised to cut borrowing costs further in 2025, but only warily — and with a keen eye on the policies of Trump. While almost all major economies should see monetary easing during the coming year, the pace is likely to slow. Bloomberg Economics projects its aggregate measure of advanced-world interest rates to drop just 72 basis points in 2025, less than than it did in 2024. The shifts in that gauge tell a tale both of easing cycles that have already progressed, of lingering caution about inflation pressures that might yet need to fully dissipate, and of the unknowns posed by the impending second era of Trump. The next US president is a haunting presence for central bankers around the world. If enacted, his threatened trade tariffs could hurt economic growth, and stoke consumer prices too in the event of retaliation. In the US itself, the Federal Reserve has already switched its attention to the danger of resurgent inflation, curbing the prospect for much easing for now. Other major counterparts, from the euro zone to the UK, are poised to keep lowering borrowing costs to aid economic growth, but with no sign of a hurry. Out of 23 central banks focused on in Blomberg's quarterly guide, just two may end the year with higher rates. Japan's hiking cycle is likely to continue, while Brazilian officials remain set on action to contain fiscally driven inflation. "For central banks on the path to policy normalization, the last mile won't be smooth," said Tom Orlik, global chief economist at Bloomberg Economics. "Uneven progress toward 2% inflation, shocks from the incoming Trump administration, and uncertainty about neutral rates all add to potential for surprises. Bloomberg Economics sees the average advanced-economy central bank rate headed from 3.6% at end 2024 to 2.9% at end 2025. Sometimes even short distances are hard to travel." For full story, click here. The Best of Bloomberg Economics | - Speaker Mike Johnson vowed that an ambitious bill addressing a range of Trump's priorities will be voted out of the US House in April.

- China's central bank said it will step up financial support for technology innovation and consumption stimulation.

- UK business confidence has dropped to its lowest level since Prime Minister Liz Truss's disastrous mini-budget more than two years ago, according to a BCC survey.

- Indonesia has started its program of free school lunches, which could cost as much as $30 billion a year as the rollout broadens.

- Saudi Arabia raised oil prices for buyers in Asia next month, in a sign the world's largest crude exporter sees tighter supply in its largest market.

- Thailand saw foreign tourist arrivals jump 26% last year after the tourism-reliant nation eased entry rules and waived visas for Chinese.

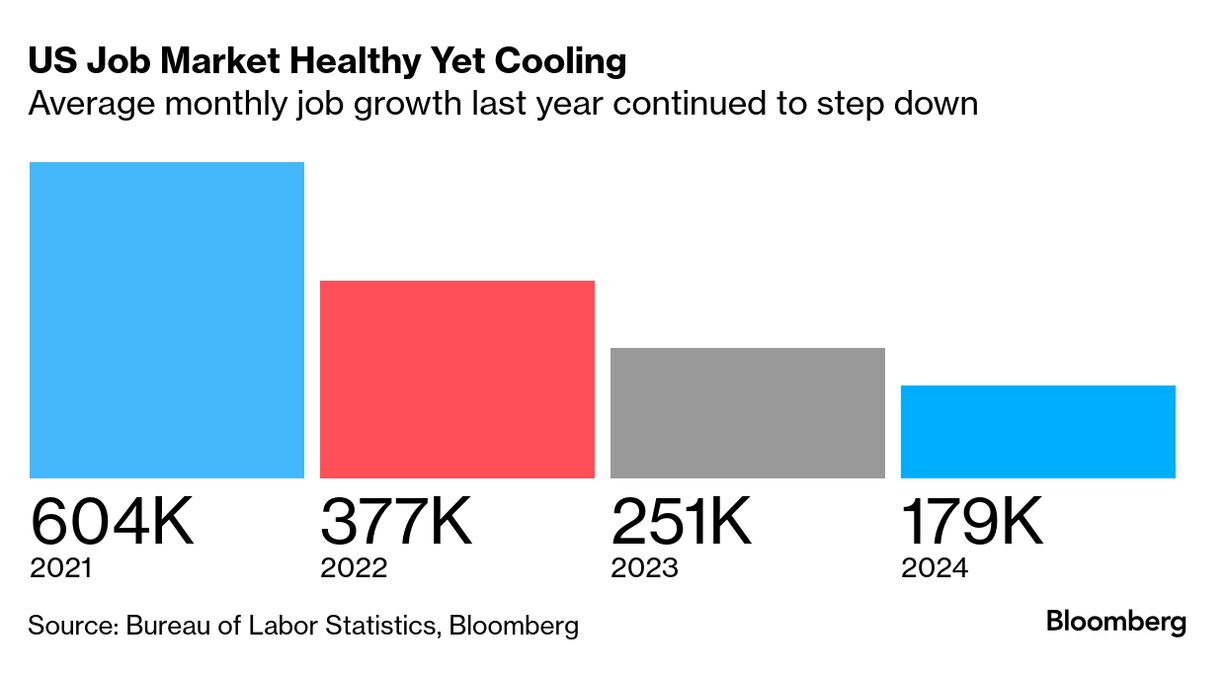

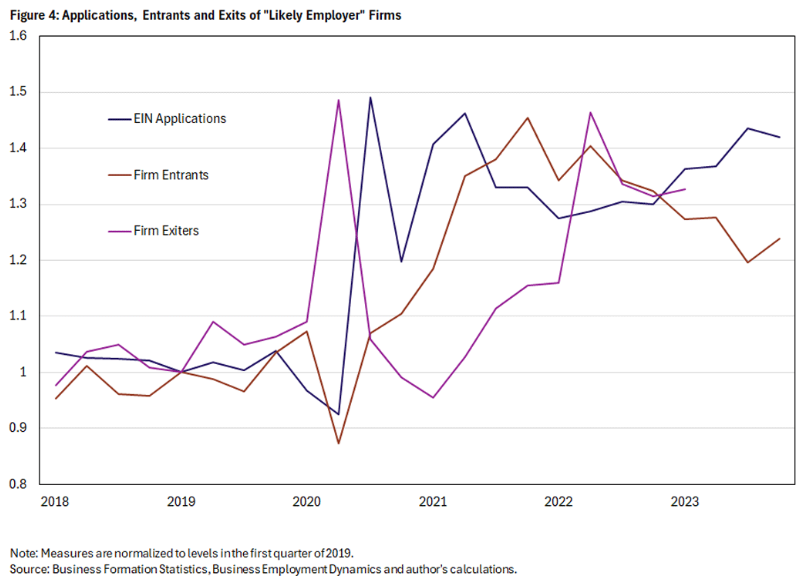

US employers probably tempered their hiring last month to wrap up a year of moderating yet still-healthy job growth that economists expect to carry on in 2025. Payrolls increased 160,000 in December, when the labor market moved beyond distortions caused by hurricanes and strike activity in previous months, according to the median projection of economists surveyed by Bloomberg. That would put average monthly job growth near 180,000 for 2024 — lower than the prior three years but consistent with a firm labor market. See here for the rest of the week's economic events. The formation of new businesses in the US surged after Covid hit, spurring a narrative that stepped-up investment in connectivity, along with the embrace of working from home and a spurt of old-fashioned individual determination might bring in a new era of productivity. Sadly, that's probably not the case, according to a Richmond Fed economic brief that concludes that the heightened levels of startup activity will prove to be a flash in the pan. While applications for employer identification numbers (EINs) are still elevated, the number of actual new businesses formed has been dropping in recent years. "Indicators on employer business and entrant job creation are reverting to historical trends, implying that the pandemic surge in business formation has been temporary," Richmond Fed senior economist Chen Yeh wrote. Also, most of the business sectors that saw a jump in job growth from startups showed "almost no" productivity gains in recent years — making it unlikely even this temporary jump in entrepreneurial activity helped with productivity, he wrote. |

No comments:

Post a Comment