| I'm Cécile Daurat, an economics editor in the US. Today we're looking at the labor market. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - UK bond turmoil is drawing comparisons to 1976, amid worries surging borrowing costs leave the government struggling to contain the deficit.

- Boston Fed President Susan Collins said she favors fewer interest-rate cuts in 2025 than she had anticipated just a few months ago.

- China's consumer inflation weakened further toward zero at the end of 2024.

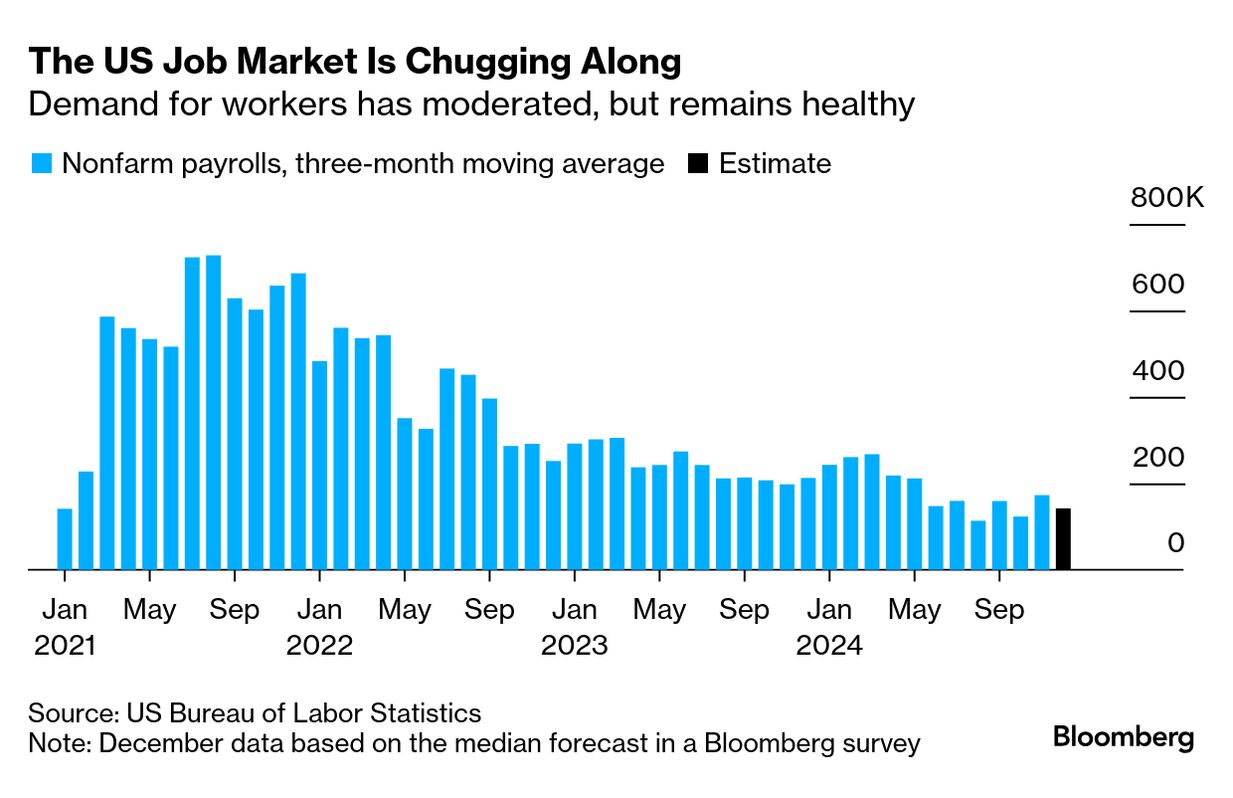

The US labor market likely ended 2024 on a better note than many expected around mid-year, when a surge in unemployment and weak job creation spooked Federal Reserve officials. Since then, policymakers have come around to view demand for workers as moderating but still healthy — Fed Chair Jerome Powell described the labor market as "in solid shape" last month. The data seem to back them up. Based on median forecasts for December's employment data, due Friday, the three-month moving average of nonfarm payrolls growth would come to almost 143,000, which is sluggish compared with the heydays of the pandemic recovery but by no means alarming. In fact, it's in line with the December months of 2019 and 2018. Looming large on economists' minds are revisions, which Bank of America says have been large in recent months because of low response rates to surveys. Annual revisions to payrolls are due Feb. 7 along with the January employment report. Preliminary benchmark data published in August marked them down by 818,000 for the 12 months through March 2024, the most since 2009 (a recession year). And Philadelphia Fed estimates based on state-level figures showed that the weaker employment trend likely extended into the second quarter. BNP Paribas economists estimate that if half of the downward revisions extended past March, that would lower the recent monthly run-rate to about 100,000 job additions. They reckon the data don't fully capture undocumented workers, however, which means the "true" number could be less weak. For now, based on reported numbers and December forecasts, the US economy added a robust 2.1 million jobs in 2024. That's below the 3 million seen in 2023 but above the 2 million created in 2019. The Best of Bloomberg Economics | - The Biden administration plans an additional round of US restrictions on the export of artificial intelligence chips from the likes of Nvidia.

- The Bank of Japan indicated it sees progress in wage gains, while refraining from giving any clear hints on whether a hike in borrowing costs is coming this month.

- Top Fed officials including Powell are increasingly pointing to an obscure price gauge as a reason for confidence in their outlook: "market-based" inflation.

- German industrial production increased in November, offering hope that the manufacturing may have begun to stabilize toward the end of last year.

- Taiwan's trade surplus with the US surged to a record high in 2024, a haul that could rankle Trump as he returns to the White House.

- Budget talks between left-wing parties and the French government are advancing before premier Francois Bayrou's presentation of policy priorities next week.

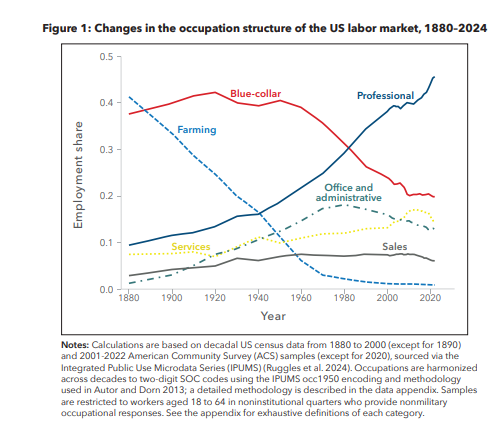

We may be entering an era of more pronounced labor-market changes in the US, possibly because of technological disruption brought by artificial intelligence, according to a working paper by Harvard researchers David Deming, Christopher Ong, and Larry Summers. The authors looked at the types of jobs that grew and vanished over more than a century with the advent of new technologies — from electricity to the personal computer. They found that 1990-2017 was the most stable period in the history of the labor market going back nearly 150 years. Since then, however, the economists see four indications that the pace of labor-market change has accelerated. Among them are the surge in employment in science and technology sectors and the decline in retail jobs.

It's too early to assess the full impact from AI, the authors said. Still, "at least in the near term, artificial intelligence is more likely to increase the need for knowledge workers than to replace them," they wrote. |

No comments:

Post a Comment