| I'm Chris Anstey, an economics editor in Boston, and today we're looking at reporting by Laura Curtis on US housing. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - UK inflation unexpectedly slowed, stoking bets on interest-rate cuts. Coming up, forecasters expect US consumer prices to have risen for a fifth month.

- Germany's economy shrank for a second year in 2024 and is unlikely to grow much in 2025, according to data just weeks before a crucial snap election.

- Donald Trump's new term promises an era of upheaval in global commerce, forcing governments around the world to scramble in preparation.

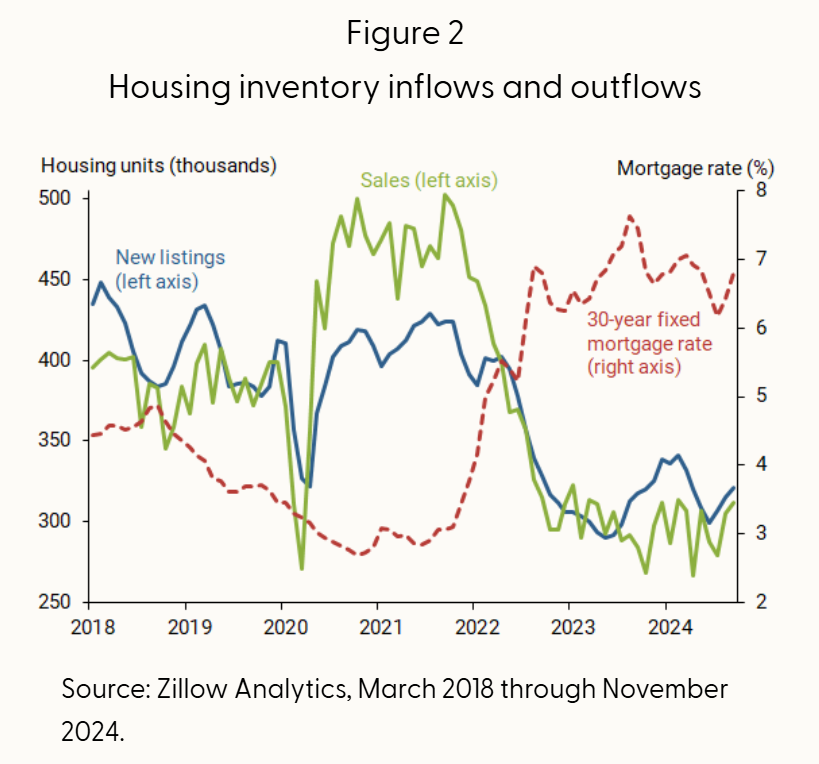

One of the narratives woven by many to explain why the US economy was so resilient in the face of the most aggressive Federal Reserve monetary tightening campaign in four decades was that a big swath of the population — homeowners who'd locked in ultra-low mortgage rates — were beyond the Fed's reach. Analysis as of the spring of 2023, about a year after the Fed had started hiking, showed that more than 40% of all US mortgages had been originated in 2020 or 2021, when the Covid crisis had driven borrowing costs to historic lows. And, unlike in some advanced economies, the large majority of American homeowners have fixed rates — theoretically impeding the transmission of central bank policy decisions. Both actual data and anecdotal reports showed that US housing inventory was particularly tight in recent years, adding to the impression that homeowners were reluctant to sell, locked in to their super-low mortgages. Nevertheless, Fed Chair Jerome Powell in his December press confidence suggested the US central bank had had a major impact. "Housing activity is very low, and that's significantly because of our policies." Now, fresh analysis by San Francisco Fed economists shows what Powell was getting at. In fact, the Fed's rate hikes went far in moderating demand — which was the main culprit of those tight inventories, rather than anything on the supply side. It turns out that property listings recovered quickly from the initial Covid-induced shutdowns, returning to 2019 levels, according to John Mondragon, Adam Shapiro and Valeska Fresquet Kohan. But sales soared, spurred by the tumble in rates, and that's what shrank inventories. "It was the change in the sales which was actually driving it, as opposed to the change in the new listings," Shapiro said in an interview. Once the Fed started hiking, and mortgage rates soared, that squeezed demand and brought the market into better balance, the economists found. "It was a really strong signal that, yeah, we are moving demand around as the interest rates are moving down," Mondragon said. Shapiro points out the impact was swift: "within a few months of interest rates going up, you just saw sales fall too." While listings have come down since 2022, the Fed-influenced tumble in sales came down also, helping defuse pressure in the market. The lesson is in the speed and sensitivity of the housing markets to mortgage rates, the trio concluded. Which, with home-loan rates still near 7%, raises the stakes for further Fed rate cuts. The Best of Bloomberg Economics | - Trump's plans to shrink the federal workforce would have disparate impacts on Black employment, while potentially eroding a key conduit to economic mobility.

- France's government aims to achieve €53 billion of savings as part of plans to narrow the deficit, Budget Minister Amelie de Montchalin said.

- Five of China's most important provinces plan to grow at or above 5% this year, signs that officials will set an ambitious target for the whole country.

- The European Central Bank is pushing back against bets that firmer inflation, sturdy US jobs and Trump's economic disruption will narrow the scope for rate cuts.

- South Korea's unemployment rate rose to the highest in more than three years, further evidence of an economy shaken by upheaval and a deadly airline crash.

- Argentina's central bank will slow the peso's controlled depreciation to 1% a month in the first shift in currency policy since President Javier Milei took office.

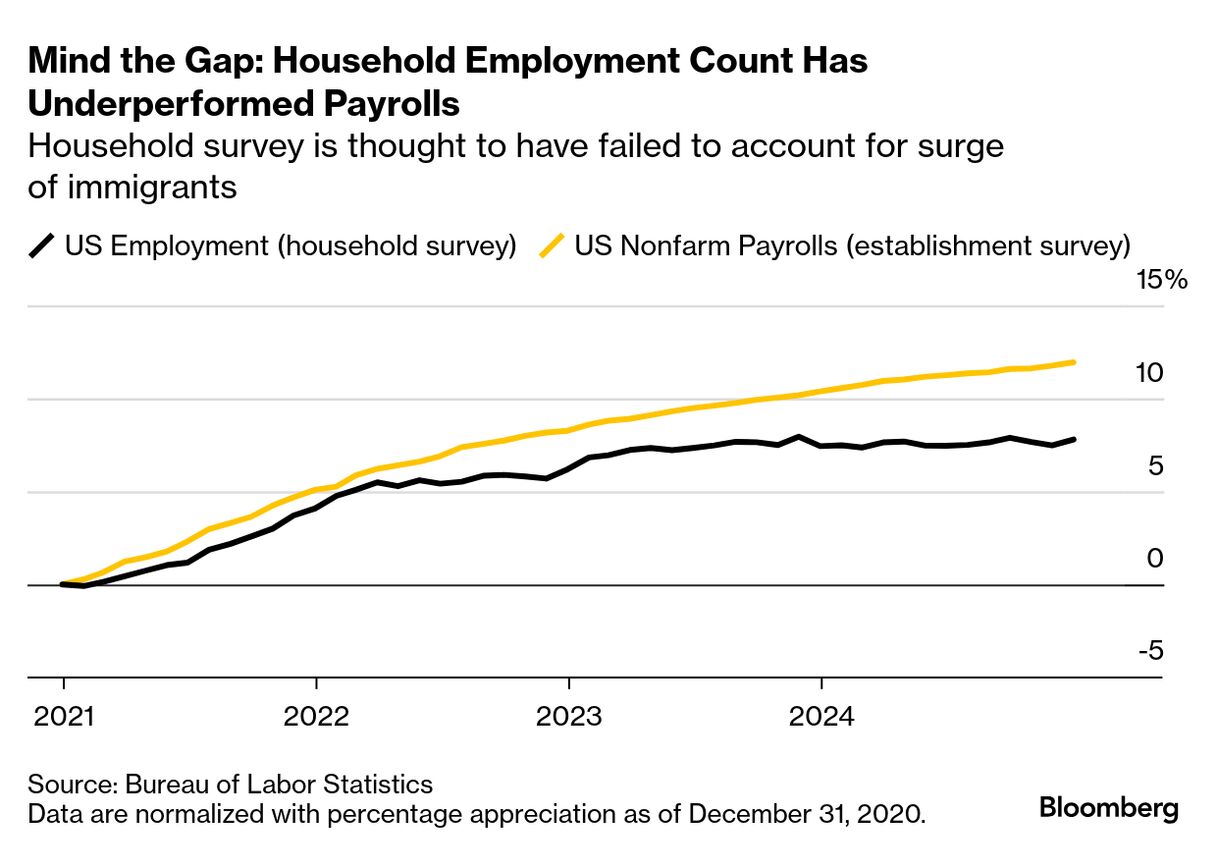

A number of times in recent years, the two main surveys on the US job market have appeared hugely out of sync, with a blowout gain in payrolls in a given month accompanied by a slide in the number of people employed as far as the Bureau of Labor Statistics household survey was concerned. That gap is set to be narrowed in favor of payrolls, thanks to Census Bureau population figures updated last month, according to Goldman Sachs economists. The problem was that the household survey, unlike the so-called establishment survey, wasn't capturing the big influx of immigrants — so employment growth was "severely understated," Goldman's Elsie Peng wrote Tuesday. "We expect that when the new data are incorporated in the January employment report," household employment will jump by some 2.3 million — the largest such revision in history, Peng wrote. That should close about three-quarters of the cumulative gap between payroll and household job growth since the migrant surge began in early 2022. |

No comments:

Post a Comment