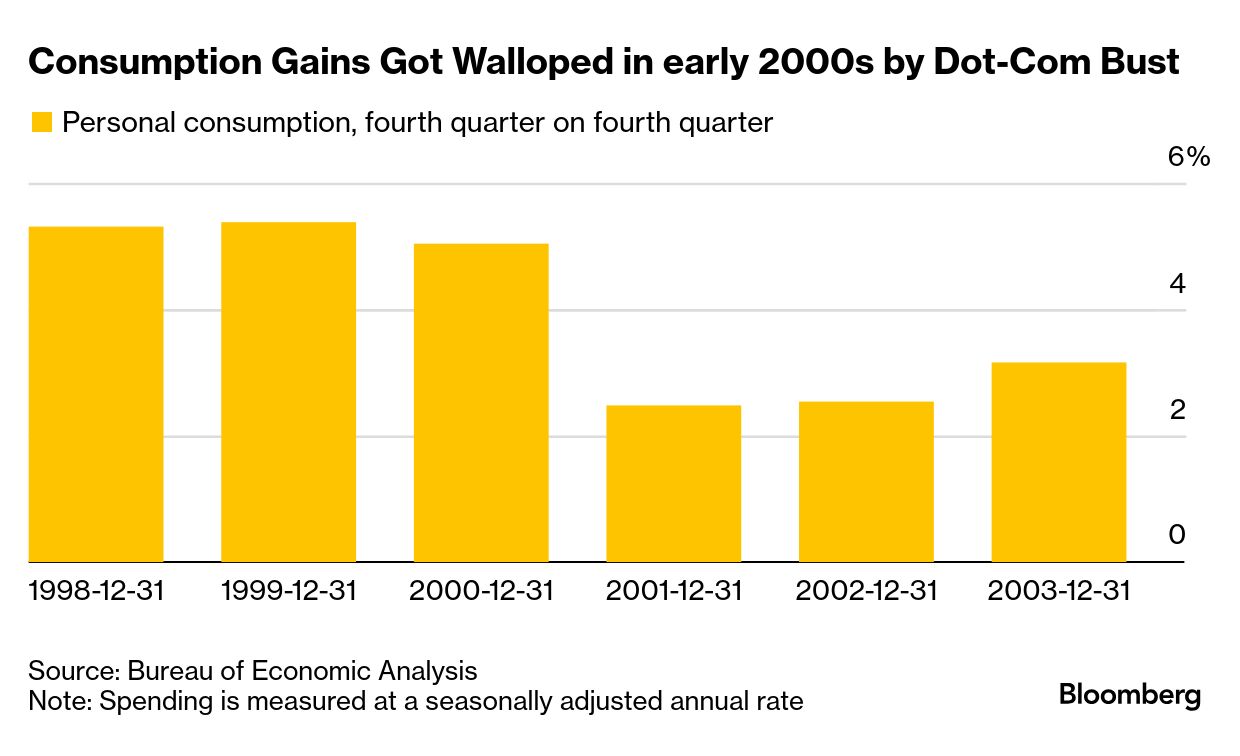

| I'm Chris Anstey, an economics editor in Boston. Today we're looking at whether the US tech stock slump might affect the economic outlook. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. A half-trillion dollar plus equity wipeout — in a single stock — is difficult to fathom. But that's what happened with chipmaker Nvidia's market capitalization on Monday. For some, it instantly reminded of the 2000-01 dot-com bust, when the Nasdaq Composite index tumbled some 72% from peak to trough. That early 2000s crash not only hammered a whole lot of investors' portfolios, it had broader economic ramifications as well. Business investment and consumer spending growth both tanked. Today, just like back then, stocks had been on a tear and valuations had soared. The trigger for the selloff in Nvidia was news from Chinese artificial intelligence startup DeepSeek that it had developed an AI model at a fraction of the cost of rivals without meaningfully sacrificing performance. That appeared to invalidate the widespread belief the future of AI will require ever-increasing amounts of power and energy to develop. And if that's the case, US tech giant shares may be less valuable than previously thought. The market turmoil was serious enough for Deutsche Bank's US economists, led by Matthew Luzzetti, to write a note to clients, acknowledging a scenario where a tech-driven selloff hits American household wealth and ultimately slows down the up-to-now irrepressible consumer. Indeed, looking backwards, a Deutsche Bank economic model showed that US consumer spending growth, if not for the 2024 rally in equities, would have come in around 2% for last year, rather the 3% estimate. (Fourth-quarter GDP data are due out on Thursday, and most economists see annualized fourth-quarter consumption growth of at least 3%.) "In short, the model suggests that there could be meaningful downside to consumer spending if equity markets were to reverse the gains," Luzzetti and his colleagues wrote. Nevertheless, there are upside risks as well for 2025, they said — including the need to be mindful that President Trump and his team "could be focused on the stock market as a barometer of economic success," and therefore unveil measures that limit the downside to equities. For now, they "continue to anticipate that growth will exceed consensus expectations this year." The Best of Bloomberg Economics | - Bank of Japan is likely to wait for summer to raise interest rates again, economists say. It may soon have two women on its board for the first time ever.

- Euro-area banks tightened credit standards for companies by the most since 2023.

- World Bank President Ajay Banga said boosting access to electricity in Africa is key to unlocking the demographic dividend in the world's youngest continent.

- The Reserve Bank of India is injecting $18 billion of liquidity into the banking system, fueling hopes of a rate cut.

- Inflation data in Australia will help steer when the central bank embarks on an easing path, and the timing of an election.

- Coming up, Hungarian officials may keep its rate on hold, their peers in Chile are likely to pause easing, and Sweden's Riksbank may cut again early tomorrow.

Set aside Trump's wave of tariff threats for a moment. It's immigration policy that's arguably more important for the immediate economic outlook, according to Morgan Stanley economists. The bank's US economists, led by Michael Gapen, estimate that some 2.7 million immigrants came to the country last year, after 3.3 million in 2023. That pushed US population growth to about double the pre-pandemic pace, boosting the economy's potential, they wrote in a recent note. That bump is set to fade as the crackdown on migrants unfolds. While the potential GDP expansion rate currently stands at 2.5% in Morgan Stanley's estimation, they see just 1.9% growth this year, easing to 1.4% in 2026. "Our outlook for immigration remains an important input" into that expected slowdown, the team wrote. They see immigration flows of about 800,000 for 2025, and 600,000 in 2026. |

No comments:

Post a Comment