| Welcome to the Mideast Money newsletter, where we chronicle the intersection of money and power in a region that's become one of the most influential in global finance. I'm Zainab Fattah, Bloomberg News' Middle East finance reporter, filling in for Adveith Nair.

This week, Donald Trump's $13 billion man in Dubai draws skeptics, Saudi wealth fund eyes a stake in a streaming service and the UAE's largest lender sells distressed debt. But first, let's dive into the outlook for real estate in Dubai and beyond.

Dubai property market's record-breaking rally over the last few years has culminated in a new milestone: Nearly 20% of homes in the city are now worth $1 million, according to Knight Frank. The comparable figure for New York, one of the most expensive real estate markets in the world, is around 30%. Prices in the luxury end of the emirate's market — known for its glitzy towers and sea-front villas — are expected to rise 5% this year, topping London's 2% and New York's 3%. But, some cracks are starting to appear in the red-hot market. Knight Frank predicts that residential prices will rise an average 8% in 2025, moderating from the eye-popping 20% jump of the previous year. Meanwhile, some — including Dubai's largest developer Emaar Properties — are starting to see the need for more caution. The firm, best known for building the world's tallest tower, is growing wary of raising prices too much because it could " kill the golden goose," its founder and Managing Director Mohamed Alabbar, said in a recent interview. Brokers say sales are starting to slow especially in the off-plan market, where much of the new supply is sold via installments ahead of construction. Dubai's property developers launched a record number of new housing developments in 2024, according to REIDIN, with a total of nearly 140,000 homes having been either started or announced. That steady supply also has the potential to limit prices.  Residential skyscraper buildings beyond luxury villas on the waterfront of the Palm Jumeirah in Dubai. Photographer: Christopher Pike/Bloomberg Other parts of the Gulf are also seeing a rise in demand for property, even as they face their own challenges. In Saudi Arabia, housing supply has been under pressure as many global companies relocated staff to Riyadh and opened regional headquarters. In addition, the Saudi government wants homeownership to reach 70% by 2030 from 63.7% at the end of 2023. Also Read: Saudi Arabia Needs to Build 115,000 Homes A Year to Hit Demand "The average price of villas in Riyadh has increased around 5% during the last 12 months. The prices of apartments have increased by around 4%. We think this is also going to continue in 2025 as well," Elias Bou Habib, the head of consulting for CBRE Saudi Arabia, said in an interview with my Bloomberg TV colleague Joumanna Bercetche. The demand remains strong and prices in Riyadh are likely to grow in the "high single digits or low double digits" this year, said Taimur Khan, the head of research in Middle East and Africa for real estate services firm JLL. "We're starting to see a pick up in the completion of the type of homes sought after by buyers — like apartments or townhouses within communities that include amenities like pools, gyms, retail and other facilities." Then, there's the prospect of global investor interest in the market. Long closed to outside investors, the Gulf's largest economy is slowly opening its property sector to foreign buyers. Saudi Arabia started granting foreigners who buy property worth 4 million riyals long-term residency, though prospective buyers are yet to get easy access to the market. Also Read: Dubai-Based Stake Offers $134 Entry Into Saudi Property Market Qatar too has been taking steps to welcome foreign buyers, increasing the number of locations where foreigners are allowed to buy property and offering temporary residency to buyers. The residential property market has been stable for the past 12 months with rents remaining relatively high in new and sought-after locations, according to Johnny Archer, head of consulting and research at Cushman & Wakefield, in Qatar. "While the market has been flat, occupancy rates have increased in prime locations after becoming more affordable since the end of the World Cup," he said, referring to the football spectacle that the country hosted in 2022. "Qatar's focus is now on increasing its population and putting in structures that help bring foreign investors into the market." Related Coverage Must-read Mideast stories | Saudi Arabia's sovereign wealth fund is in advanced talks to invest at least $1 billion in Dazn Group, which holds the broadcasting rights of some of Europe's top-tier football leagues. Abu Dhabi sovereign fund ADQ offered to take full control of Aramex in a deal that would value the courier services company at about $1.2 billion. Deutsche Bank is set to acquire a portfolio of soured loans worth around $800 million from the United Arab Emirates' largest lender in a rare large deal in the Gulf for distressed debt.

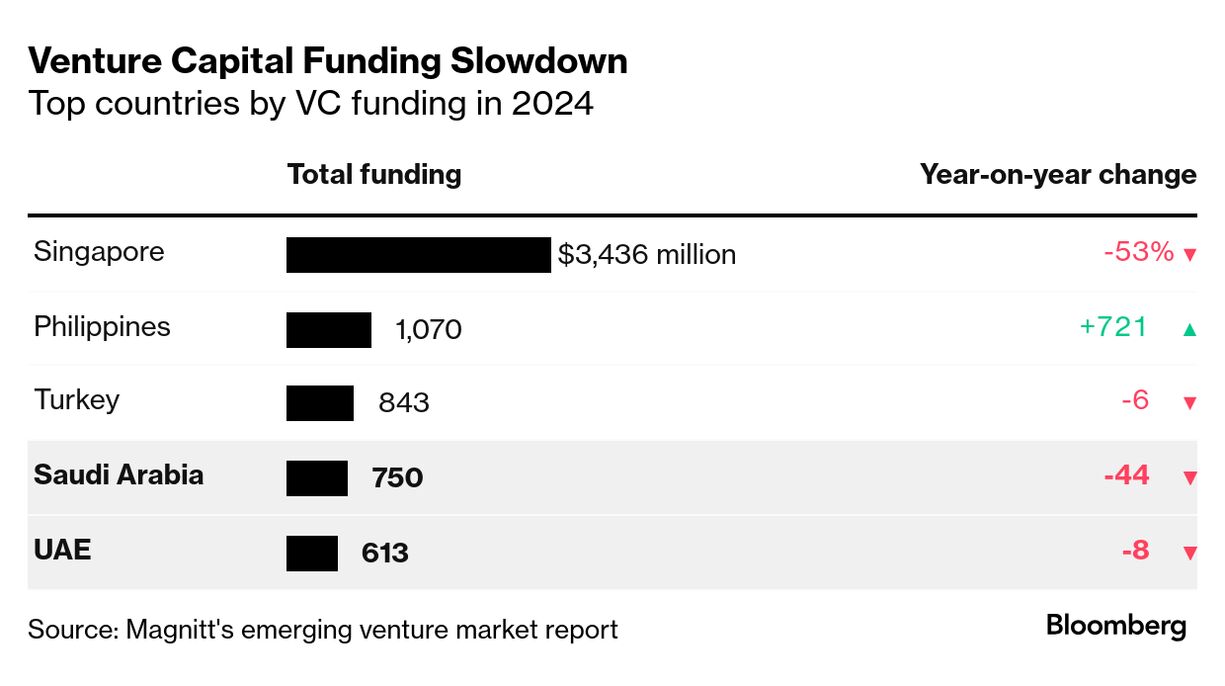

A Saudi district cooling firm, backed by the the kingdom's wealth fund, is working with Citigroup and SNB Capital for a potential initial public offering. Nice One and Almoosa Health both surged in their trading debuts as Saudi firms continued to see strong first-day gains after IPOs. Saudi Arabia's Maaden called off talks to swap two units for shares in its Bahraini rival that would have created one of the world's biggest aluminum producers. Two Hong Kong-based hedge funds are expanding to Dubai, part of a growing trend of Asian investment outfits looking to join their western peers in the emirate. Egyptian billionaire Nassef Sawiris, who owns the Aston Villa Football Club, is considering leaving Britain and relocating due to tax changes.  Nassef Sawiris Photographer: Zac Goodwin/PA Images/Getty Images Here're a few other stories that caught my eye: | A blowout US jobs report on Friday prompted traders to slash their wagers on Fed rate cuts to less than 30 basis points for the whole of 2025. Global stock and bond markets extended losses on Monday. Ken Griffin's Citadel extended its non-compete agreements for some portfolio managers to 21 months, underscoring the hiring war among multistrategy hedge funds.  Ken Griffin Photographer: Saul Martinez/Bloomberg Bridgewater dismissed 7% of its workforce as the world's biggest hedge fund seeks to remain "nimble." Wall Street may cut 200,000 jobs in the next three to five years as artificial intelligence replaces roles, according to Bloomberg Intelligence. Also Read: Wall Street Bonuses to Jump by Double Digits at Big Banks As the Los Angeles wildfires rage on, millions of residents are packing go-bags with vital documents and irreplaceable mementos as they brace for evacuation orders.  Smoke over destroyed homes in the aftermath of the Eaton Fire in Altadena on Jan. 11. Photographer: Kyle Grillot/Bloomberg Venture capital funding in the Middle East slumped in 2024, even as the number of deals increased, as investors shifted toward early-stage investments. Startups in the region raised $1.5 billion, a decline of 29% compared to the previous year, according to a report from venture capital data platform Magnitt. Saudi Arabia, which accounted for almost half of that funding, experienced a 44% drop. Still, the kingdom retained its position as the top destination for venture capital funding in the Middle East for the second consecutive year. Also Read: Aramco's Venture Arm Joins $30 Million Round for Saudi Startup Trump's $13 billion man in Dubai | Even in the emirate of Dubai — renowned for embracing ambitious projects — many were taken aback when local tycoon Hussain Sajwani stood beside Donald Trump to pledge a $20 billion investment in US data centers.  Hussain Sajwani Photographer: Stefan Wermuth/Bloomberg In the city's property circles, the 71-year-old founder of Damac Group and longtime Trump business partner has a reputation as a hard-charging businessman who has survived sharp market downturns over the years. More recently, a five-year-long property boom in Dubai has pushed his net worth above $13 billion, according to the Bloomberg Billionaires Index. Still, people familiar with his business say he isn't seen wielding major national influence or maintaining a tight relationship with Abu Dhabi's oil-rich state funds. That's left industry insiders and others in the emirate questioning how successful he's likely to be in bankrolling and pulling off his ambitious plans in the US. Sajwani, for his part, is taking any skepticism in stride. If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment