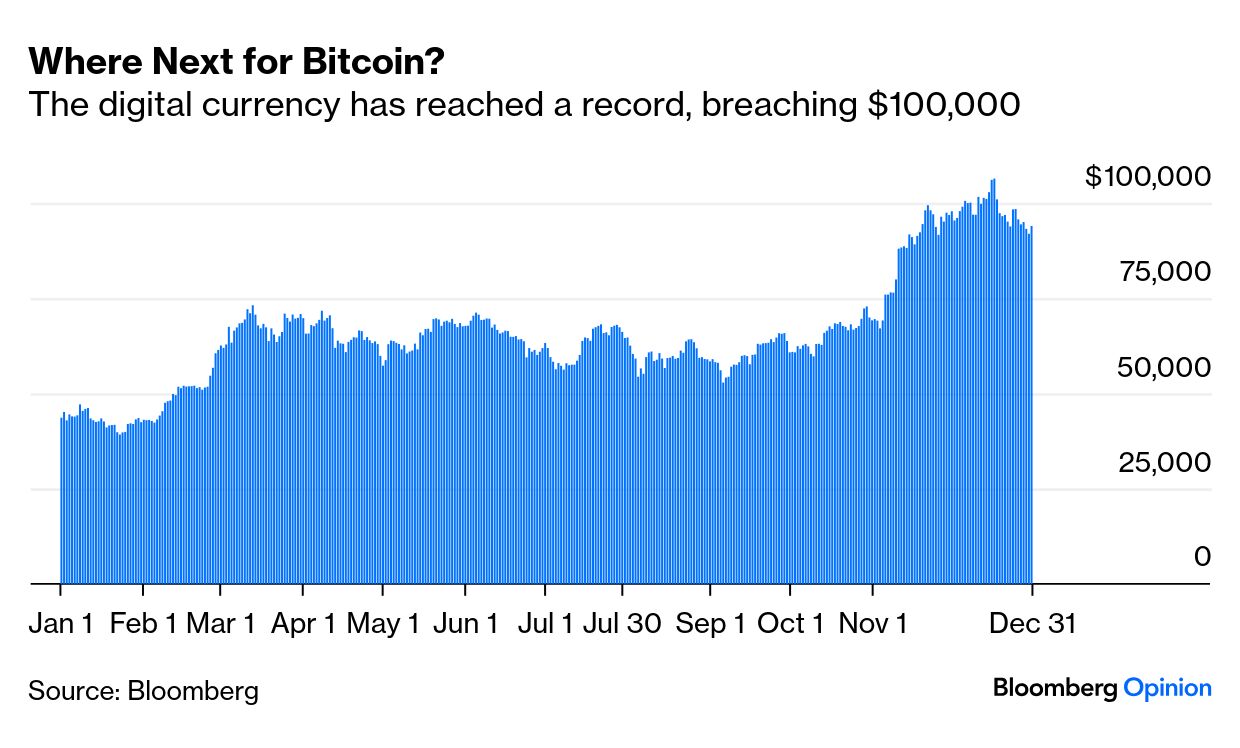

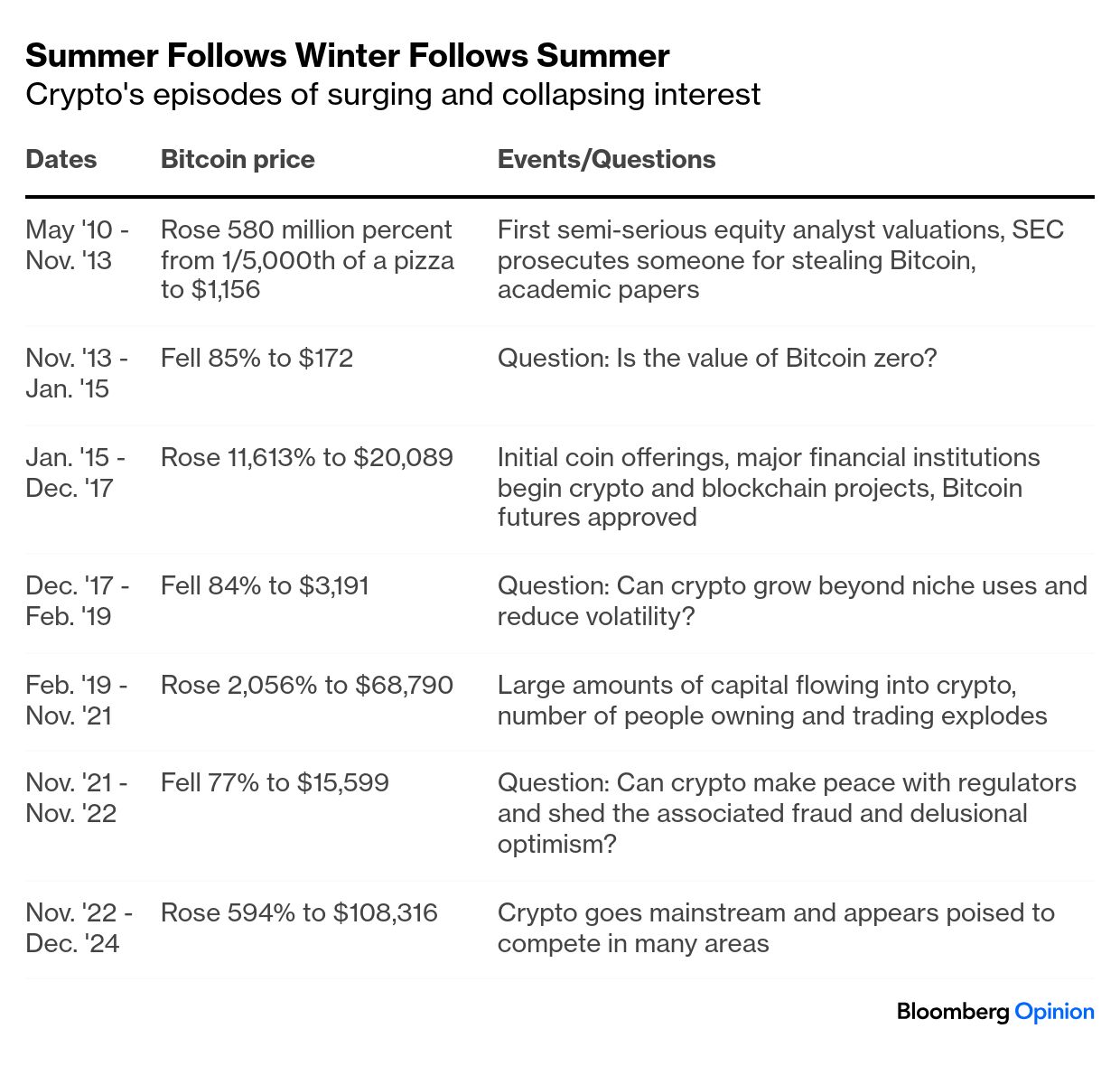

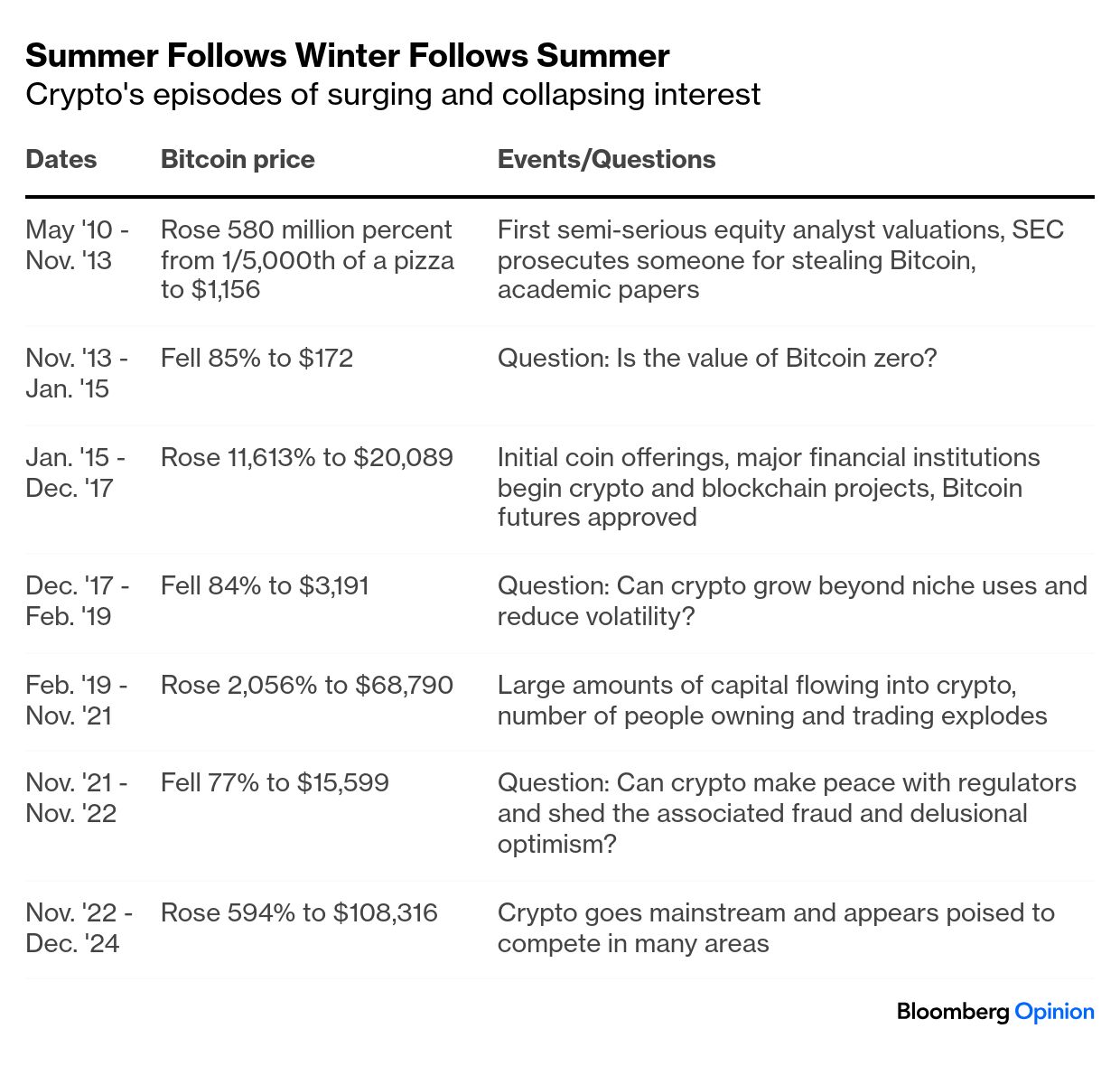

| This is Bloomberg Opinion Today, a jumping consensus estimate of Bloomberg Opinion's opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here.  Would you buy a memecoin, or even a car, from this man? Photographer: Paul Yeung/Bloomberg I am tempted to blame my job for my failure to buy crypto; for a (fake-ish) financial journalist that sort of speculation is out of bounds. But the truth is, I never would have bought Bitcoin anyway. Because I am dumb. A decade ago, when my more financially literate friends were taking flyers on crypto, I thought they were foolish. I assumed that you'd never be able to actually buy anything with it. When that proved wrong, I assumed virtual currency was hugely overvalued. When that proved wrong, the crypto winters hit, and I assumed Bitcoin was toast. Now, with it dancing close to $100,000 a pop, I have to admit I am not just dumb, but dumb again and again. This despite the repeated reminders from of my former colleague Niall Ferguson, who is not dumb, that winter is invariably followed by spring. Even I could have predicted this latest boom, however, because when politics hits markets, I'm on more comfortable ground. With a crypto convert taking the oath of office this month, a crypto bro (and once again richest man in the world) at his right elbow, and crypto fanboys set to head the Treasury, the Securities and Exchange Commission, the Commerce Department, etc., even I could have foreseen this enduring spike, right? Or maybe I am dumb yet again. "Crypto bros are heading into 2025 with great expectations," writes Andy Mukherjee. "For the $135 million they have donated to President-elect Donald Trump and dozens of successful congressional campaigns, they want unhindered access to the global banking system and an end to lawsuits against the industry by the Securities and Exchange Commission. A strategic US reserve dedicated to Bitcoin will be the icing on their cake. Don't be surprised, however, if the actual outcome turns out to be less than a libertarian feast." Marcus Ashworth and Mark Gilbert help explain why. "The election of Donald Trump introduces an unwelcome capriciousness to US policymaking, with everything from trade to regulation to cryptocurrencies looking decidedly less predictable," they write. "And while the US consumer continues to defy expectations by keeping the world's largest economy rolling along just fine, the rest of the world is a lot less robust. Our key message for 2025: Buckle up, it's gonna be a roller coaster."  Crypto will likely experience many ups and downs in the new year. "Hopes that the Trump administration will be more accommodating to crypto's various bids for official recognition as a viable store of value are likely to be realized under Paul Atkins, the incoming head of the Securities & Exchange Commission who's perceived to be warmer to the market than his predecessor, Gary Gensler," Marcus and Mark explain. "And even though the US is unlikely to stockpile a Bitcoin reserve — an idea floated by the president-elect during his campaign, and described in this Bloomberg editorial as possibly 'The Biggest Crypto Scam Yet' — the regulatory environment is almost certain to be less hostile. But the links between digital currencies and anything even remotely resembling the fundamentals that typically drive the values of their reality-based counterparts remain tenuous at best, nonexistent at worst — which makes any effort to predict where Bitcoin will trade an exercise in futility." The Biggest Crypto Scam Yet? It looks like the Editorial Board may have found and even bigger one: Tether. "Tether has survived various cataclysms to become the crypto world's stablecoin of choice. It has done so despite practices that would trigger a run on a traditional bank — such as effectively lending holders' dollars to an affiliated, insolvent crypto exchange," the editors write. "What could go wrong? Much already has. An almost comical cast of villains — including Russian arms dealers, Irish gangsters, North Korean hackers and Hamas — have used the stablecoin to move billions of dollars." Enter the man who sold $99 digital trading cards to his voters last year. "Trump's victory has radically changed Tether's outlook," says the board. "This combination — Trump and Tether — presents quite a few potential problems. Two in particular stand out. First, the more Tether grows, takes on risks and becomes interconnected with Wall Street firms like Cantor, the greater the chance that crises in crypto will infect the broader financial system. Second, a resurgent Tether could vastly expand opportunities for illicit activity, undermining governments' ability to fight crime, counter terrorism and enforce sanctions." Aaron Brown is a crypto-optimist, but even he sees the glass as only about half full. "The industry has made substantial progress," he notes. "In 2014, many people thought Bitcoin and other cryptocurrencies would not survive, and that the underlying blockchains would never be more than a minor technology for niche applications. In 2018, most assumed crypto would not disappear, but that it would never deliver a social revolution comparable to the internet. In 2022, the question was whether the sector could integrate with existing regulation and financial markets or survive as an outlaw alternative similar to the dark web."  So, will crypto be a team player or an outlaw? "2025 will go a long way toward answering that last question," says Aaron. "There are reasons to think the Cold War between crypto innovators and governments will end, allowing capital to move more freely between traditional and crypto sectors. Bitcoin and the 'respectable' crytpo projects, backed by major venture capital firms and traditional financial institutions, could emerge into full sunlight, with projects developed by 'two gals in a garage' and shadowy groups of hackers, anarchists and libertarians still in the shadows but perhaps out of the crosshairs of law enforcement. This would lead to further Bitcoin appreciation." On the subject of libertarians, here's Tyler Cowen's take: "Stablecoins will continue to grow in US payments systems as well as foreign ones, as more institutions will want access to dollar-based transactions. While the Federal Reserve will worry that monetary institutions are evolving beyond the scope of its control, Donald Trump's pro-crypto administration will celebrate the innovation. The role of the dollar as a reserve currency will strengthen." So there you have it. Crypto is going mainstream in 2025, unless it infects the entire financial system. It's going to find an accommodation with regulators, unless it goes all dark web. The US will create a Bitcoin strategic reserve, unless it doesn't. Trump will bring Tether to new heights, unless a comical cast of villains brings it down. Given all these unanswered questions headed into a pivotal year for crypto, and Nir Kaissar's advice to stick with stocks, maybe my decade of caution wasn't so dumb after all. Bonus How to Be Dumb Reading: - Stock Bears Are Going Extinct. Time to Worry? — Jonathan Levin

- A 'Made in China' Crisis Awaits Big Auto — Liam Denning

- AI, Musk and Trump Add Up to a Turbulent 2025 for Tech — Dave Lee

What's the World Got in Store? - Fed minutes released, Jan. 8: The Fed Has to Fix Its Communication Problem — Clive Crook

- US jobs report, Jan. 10: Don't Believe the Hype on These 3 Workplace Trends — Sarah Green Carmichael

- Supreme Court argument on TikTok ban, Jan. 10: Asia's 2025 Tech Race: TikTok, Trade Wars and AI Hype — Catherine Thorbecke

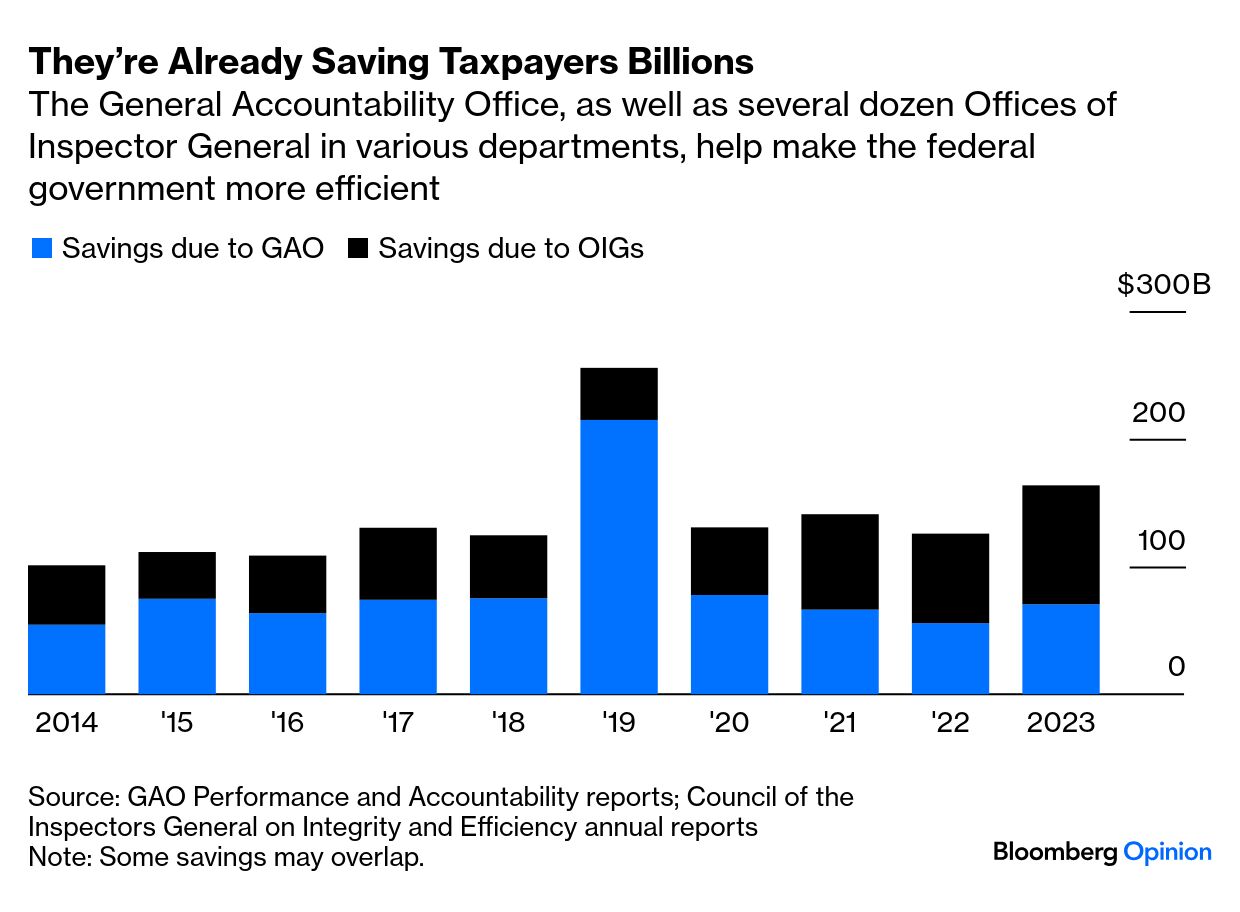

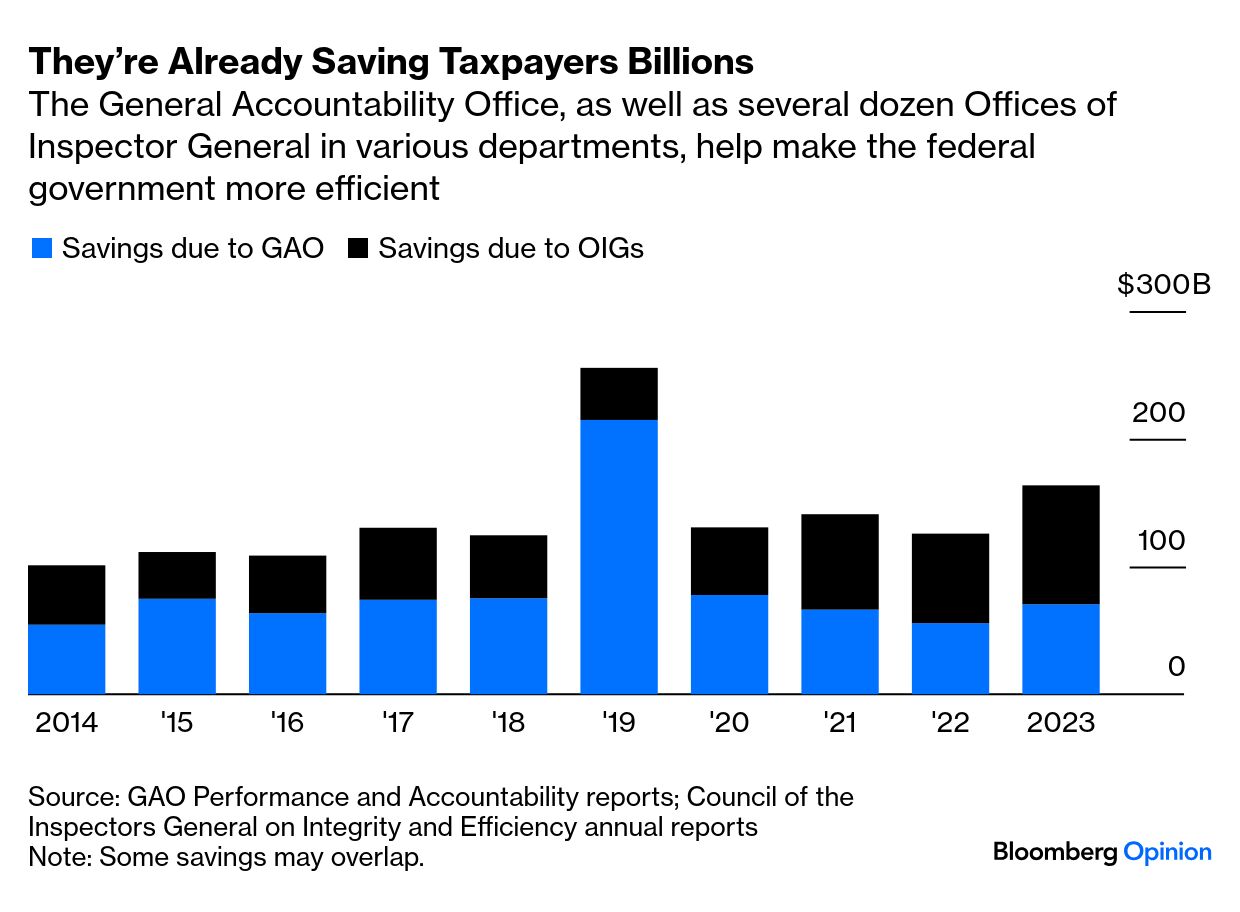

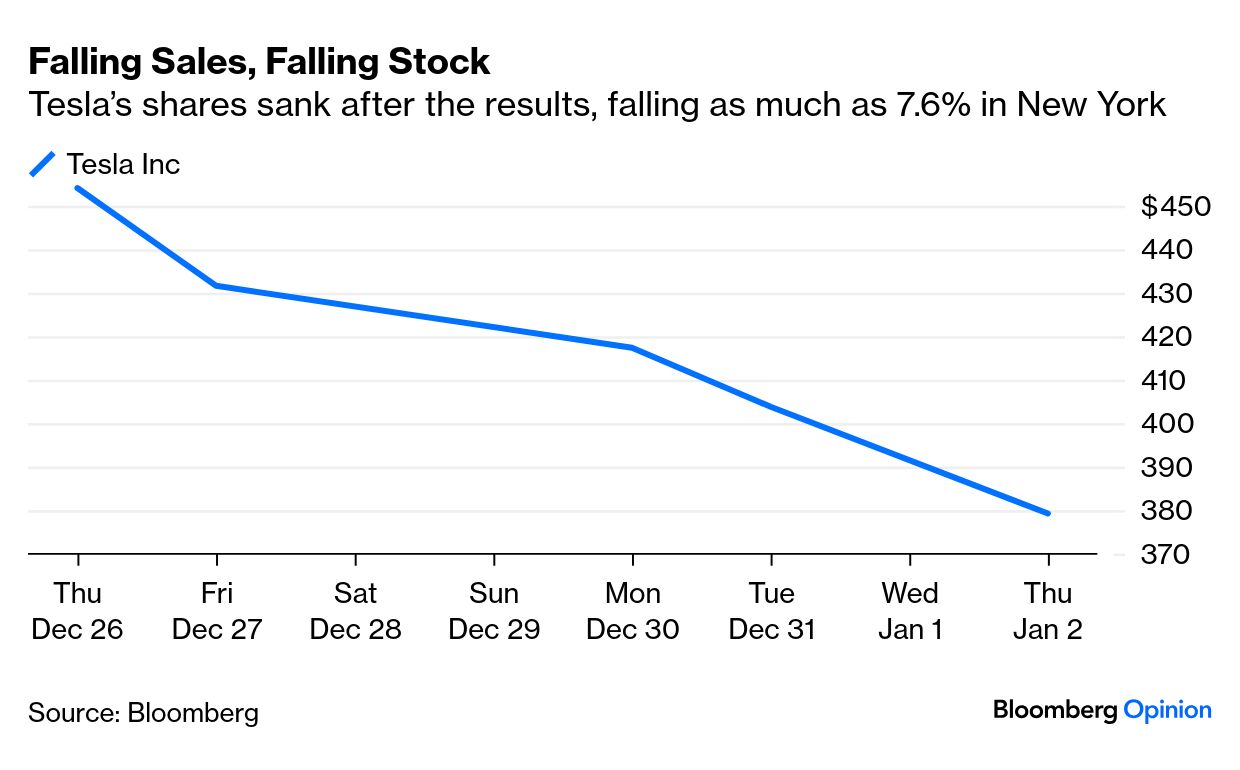

Back to Elon. First, let's look at DOGE, [1] his plan to run the government like a business. Sounds maybe like a good idea, but according to Max Stier of the of the Partnership for Public Service, there's a problem. "Business-world principles have an important place in government reform. But running the government like a business — especially a technology startup — simply won't work," Max argues. "Proposals to arbitrarily fire huge portions of the workforce or eliminate vital agencies such as the FBI would put essential public services and national security at risk." Besides, our bloated and inefficient bureaucracy may not be as bloated or inefficient as Musk and his partner in efficiency, Vivek Ramaswamy, think:  Elsewhere in Musk-land, you'll find Tesla's falling fourth-quarter sales. "The strange thing about Tesla Inc.'s latest results, released Thursday morning, is that a company touting leadership in artificial intelligence and self-driving cars struggles to predict where its own sales will be in a couple of months," writes Liam Denning. "In late October, Tesla surprised markets by announcing it expected a 'slight increase' in annual vehicle sales in 2024, implying the company would move around 515,000 in the fourth quarter. Wall Street analysts, who had been slashing their forecasts for fourth-quarter sales for the best part of a year, duly reversed course and the consensus estimate jumped to almost that number. As it turns out, sales came in at about 496,000. Companies do miss guidance, of course. But in this case, Tesla had pointedly challenged the prevailing view on the street about one of the easiest figures for any enterprise to predict, let alone one that has rebranded itself as an AI giant." Markets wasted no time reacting: But plenty of froth remains. "Tesla's stock duly fell a little on Thursday morning and it is now down by almost a fifth from its post-election peak," Liam notes. "It still sports a forward earnings multiple that is, at about 120 times, more than three times that of Nvidia Corp., to pick a useful benchmark. Tesla may have trouble seeing the future, even just months out, but remains priced to own it nonetheless." Elon owning the future? Well, better him than Tether I guess. Notes: Please send icing on the cake and feedback to Tobin Harshaw at tharshaw@bloomberg.net. |

.png)

No comments:

Post a Comment