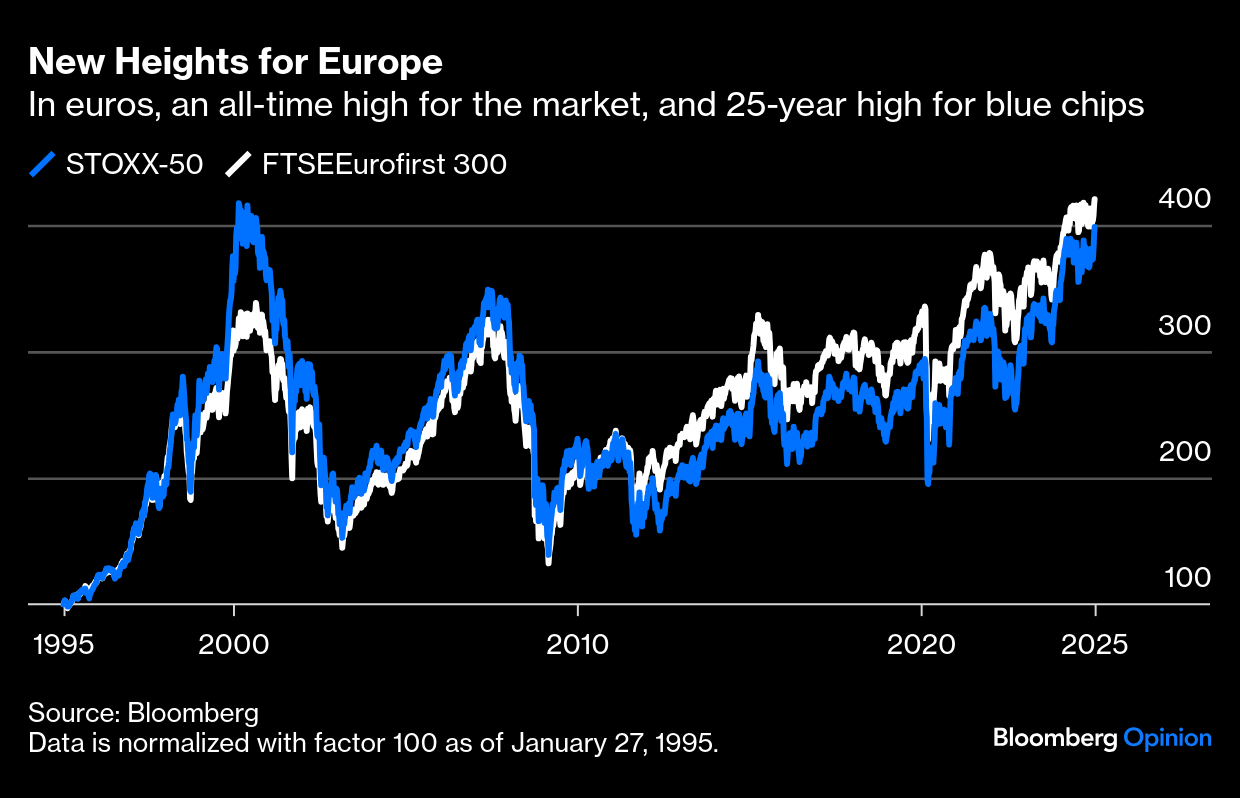

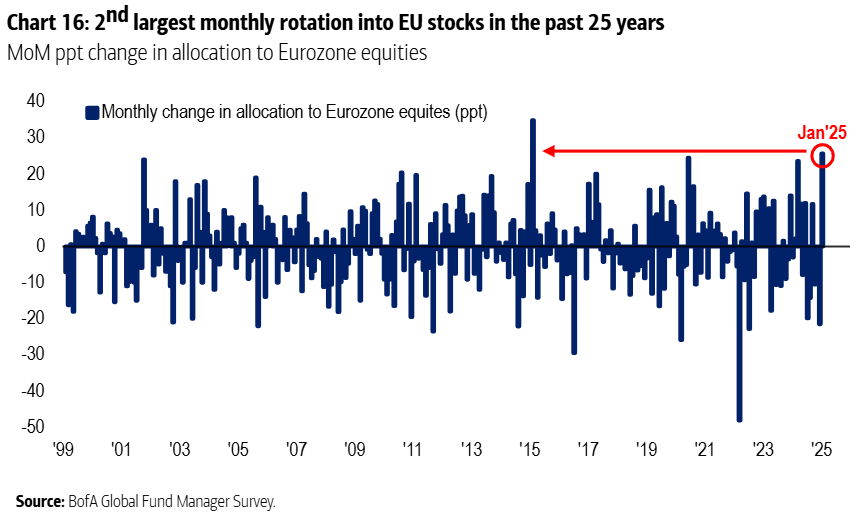

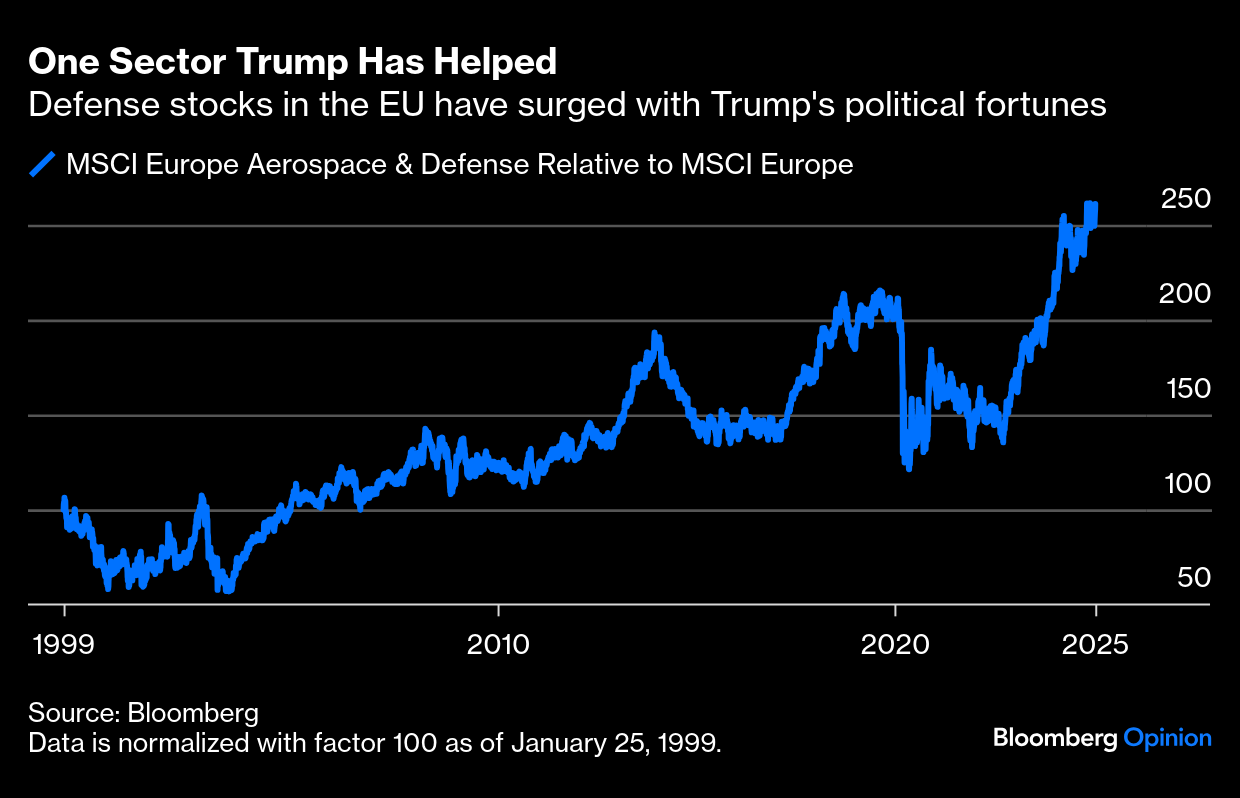

| It's hard to avert your gaze from the US at present. And yet, in financial markets, there's more excitement in Europe. Shares in the euro zone have underperformed the US for 17 years, in a trend accelerated by Donald Trump's return to power. But in the last few weeks, the STOXX 50 index of European blue chips has enjoyed a bounce. It's way too soon to say that a new trend is underway, but there are embers of enthusiasm for European equities out there: Taking away the cruel comparison with the US, in absolute terms and denominated in euros the STOXX 50 is now its highest since the early weeks of 2000, while the broader FTSE Eurofirst 300 is at an all-time high — a distinction the S&P 500 didn't quite reach in US trading: Compared to mid-2024, the latest monthly survey of global fund managers by Bank of America Corp. revealed a startling swing toward the region. Respondents' European weighting has risen by the most in any month since 2015, and by the second most ever. This survey was conducted before Trump took office and predates the optimism generated by his initial failure to impose new tariffs on the European Union: There's no discernible hype about the region, whose issues range from the rise of the hard right to a potential split over fiscal policy at its core between France and Germany. Anxiety about extra defense spending under Trump 2.0 shows up in a rally for arms manufacturers: Optimism is on the floor, especially in Germany, where both the IFO and ZEW surveys of business sentiment suggest that companies are sliding deeper into pessimism: Robin Winkler of Deutsche Bank AG offered a suitably gloomy upsumming, saying it's "hard to detect any fresh animal spirits in the German economy." Trump 2.0 has much to do with this: The uncertainty about the new Trump administration is palpable. There is a broad range of views on the US outlook under Trump 2.0, from concerns over a superior US economy siphoning off European investment to gloomier predictions of the US leveraging itself to breaking point. Either way, the implications for the German economy inspire nobody. There is a strong consensus that Germany's competitiveness issues will be exacerbated following Trump's inauguration. Notably, the prospect of US deregulation is considered as important a competitive threat in certain sectors as potential tariffs.

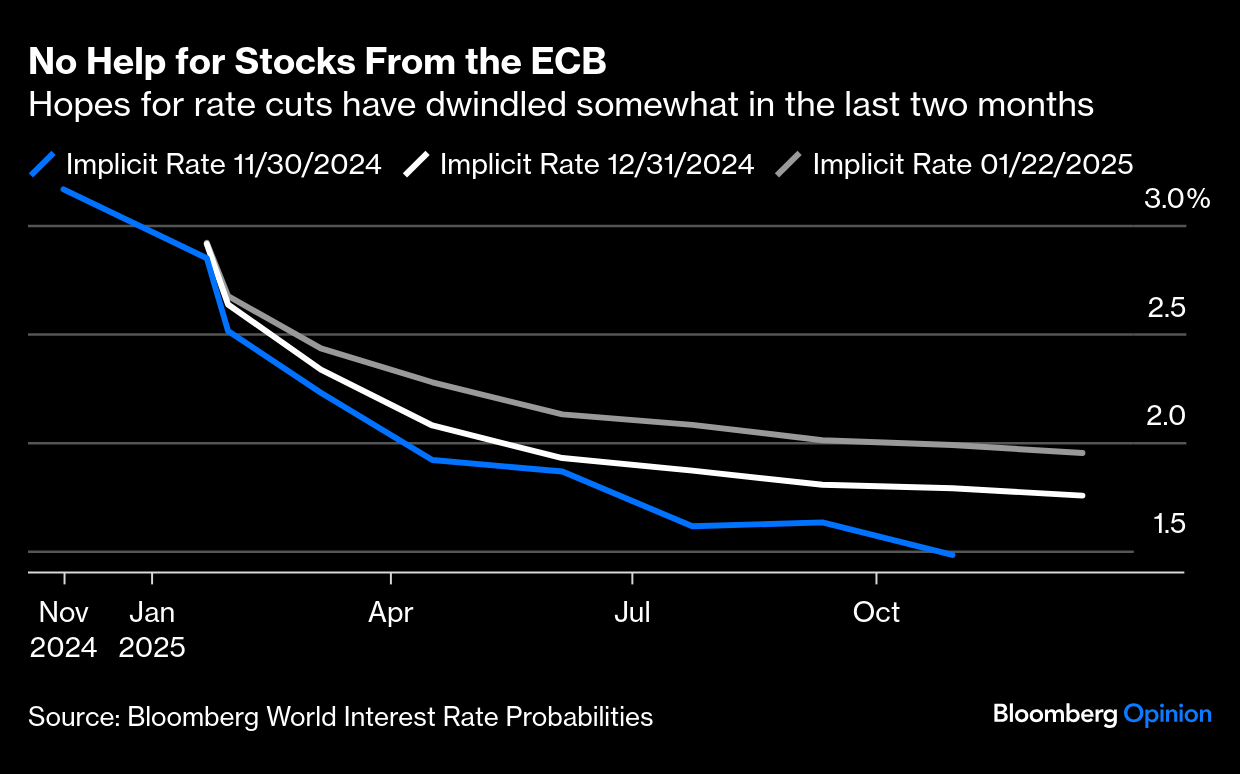

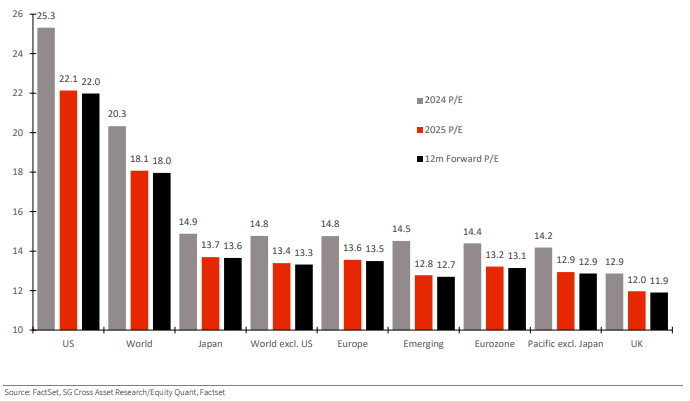

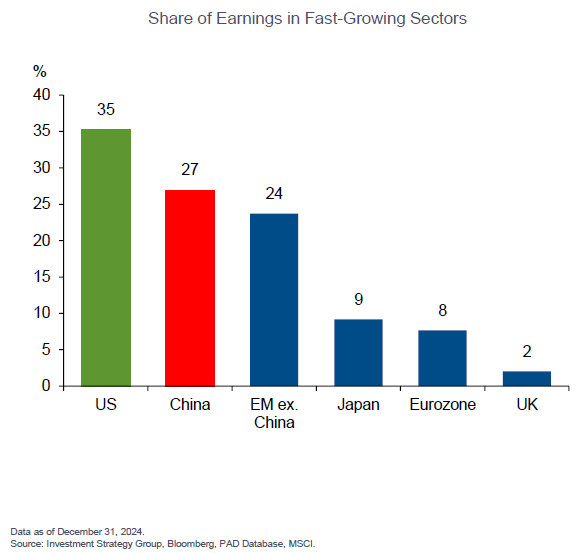

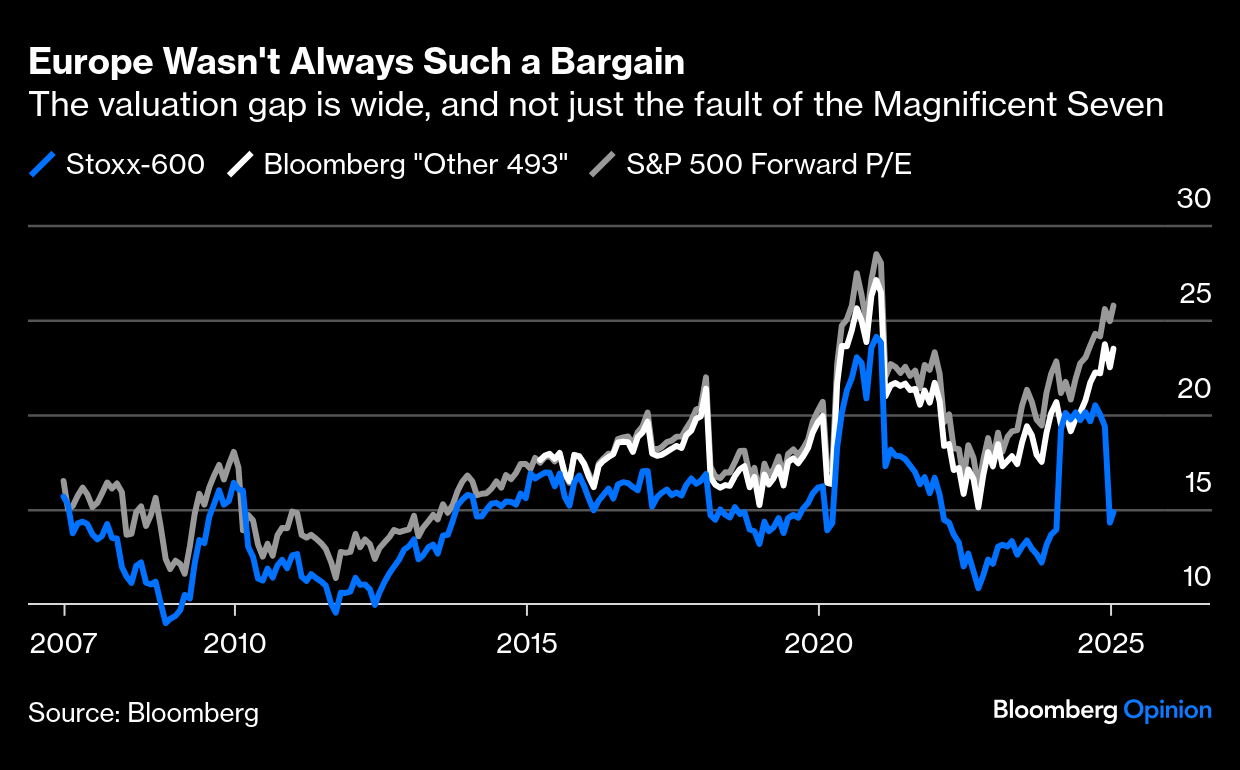

Trump might just administer the jolt to the solar plexus that Europe — particularly Germany — needs. Next month's elections offer a chance to change direction, and release the "debt brake" introduced after the Global Financial Crisis and embark on expansive fiscal spending. But that will require a clear majority that excludes Alternative für Deutschland (which is opposed to ending the brake). That's not a given, and the election is not creating any great cheer. Meanwhile, expectations for rate cuts have also been pegged back as the Federal Reserve looks likely to stay higher for longer, making it harder for the European Central Bank to move. The implicit rate expected for the end of this year has edged up by about 50 basis points over the last two months, according to the Bloomberg World Interest Rate Probabilities function: So why the recovery and the sudden interest from fund managers? In large part, it's because European stock markets are notoriously cheap. This chart from Societe Generale SA comparing price/earnings ratios reveals that Europe is much, much cheaper: This can be overstated, however. Europe must contend with its dearth of big, competitive companies in the sectors that are currently leading global economic growth. This chart from the Goldman Sachs Investment Strategy Group shows that the share of such companies in the euro zone is tiny compared to China or the US — although at least the bloc has far more players in fast-growing sectors than the UK. It's natural that overall earnings multiples for the market would look cheap: But there's more to this than the Magnificent Seven. If we compare the Stoxx 600's forward p/e with that of the S&P 500 and of Bloomberg's index of the "other 493" (excluding the Magnificents), then the gap is wide, and only slightly narrowed by excluding the most fashionable stocks of the moment. Europe is meaningfully cheap: The loss of confidence in Europe is obvious, and it showed up last year in an extreme collapse in stock market valuations. Andrew Lapthorne, SocGen's chief quantitative strategist, summarizes as follows: In 2024, MSCI Europe underperformed the US by the greatest amount since 1975 in US dollar terms, leaving Europe on aggregate, trading at a record 40% forward P/E valuation discount. Individual stock valuations have evolved over time and the valuation discrepancy is not simply down to some very high US mega-cap valuations. There is a long list of explanations for the current gap, but it is also clear that the contrast in valuations has never been as stark as it is today.

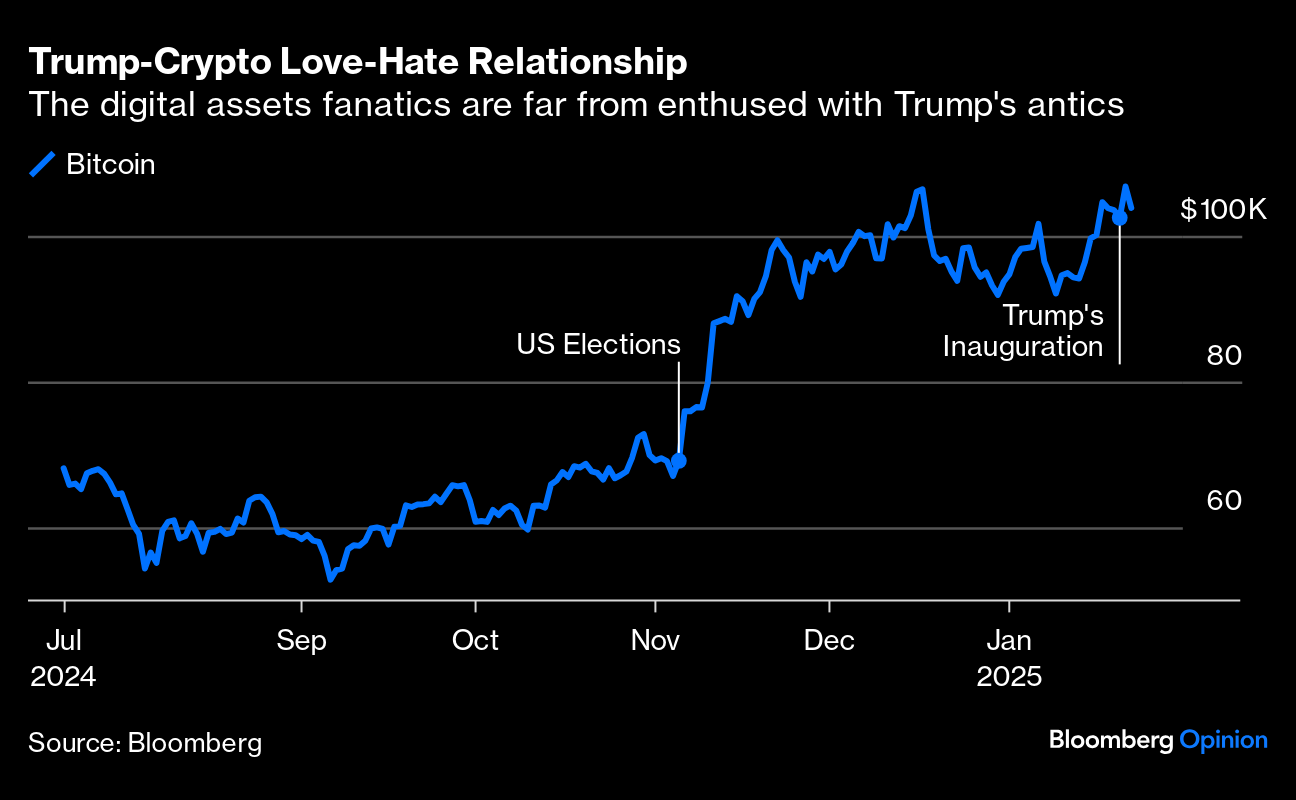

Germany is the heart of the problem. The last time tech stocks were surging, 25 years ago, the cyclically adjusted p/e ratio (CAPE) — comparing prices to average earnings over a decade — shows that Germany was briefly even more expensive than the US. In this latest boom, the CAPE indexes kept by Barclays Plc show that Germany has missed out completely: So Europe in general and Germany in particular may be cheap for a reason, but it sure is cheap. With the risks represented by Trump already heavily discounted, there is more of a margin of safety for those prepared to dive in. And if the next year pans out better than many fear — for example, with a peace in Ukraine that the continent can live with, and a return to more stable government in France and Germany — Europe will indeed prove to be a bargain. Some good news is needed first, however, before the recent sudden enthusiasm can be validated.  | | | In crypto's genesis story, Bitcoin's mythical creator, Satoshi Nakamoto, envisaged a currency beyond the central government's remit. Technically, the foremost cryptocurrency has stayed true to that cause, as far as its supply is concerned. The government can't mint any new Bitcoin. But the founding libertarian ideals have long blurred out of the pricing and regulatory framework. Arguably, the recent symbiotic relationship formed between Trump and crypto's legion of followers is yet another step away from its founding ideology. Such is the strong belief that the digital asset's fanatics had in Trump's pro-crypto regulatory regime that his "silence" on Inauguration Day sent prices tumbling. As Trump and his wife, Melania, had launched their own memecoins a few hours earlier, the omission was hard to accept. The highly volatile tokens have no underlying assets to back up their value and no obvious practical purpose. The spike after their debut, earning billions of dollars for the first family, fueled accusations of money grabbing. The Trump coin rose to a market capitalization of as much as $15 billion, but has now fallen to roughly $7.3 billion, according to CoinMarketCap data. The Melania coin has lost over half its market capitalization, now at around $600 million. Bitcoin's muted response to the unveiling of the Crypto Task Force led by Commissioner Hester Peirce to come up with a "comprehensive and clear" regulatory framework on Trump's second day is striking, though not surprising, as the post-election excitement had brought the asset to record levels: For what it's worth, Bitcoin has surged more than 160% in a year, lagging only cocoa among traded commodities, and is still trading near its all-time high. It's hard to see how crypto fanatics' recent discontent with Trump's antics will derail it. His promise to make the US the crypto capital of the world speaks of his favorable view of the asset class. And his coin gives him skin in the game — even if critics question the legality of this move. And the US is able to move regulators across the world. In typical fear-of-missing-out fashion, regulatory regimes elsewhere that were previously agnostic toward crypto are having their own "Come to Jesus" moment, Bloomberg News reports. As Bitcoin entrenches itself as a mainstream asset class, questions on the rationale behind its allocations in portfolio management remain inconclusive. A new study by Wilshire Indexes Research goes beyond the often quoted 3% to 5% digital asset allocation, probing whether it is underpinned more by hoped-for returns rather than risk. It questions conventional allocation models by examining the integration of Bitcoin into traditional equity and fixed-income portfolios, concluding that an allocation of 2% to 7% enhances risk-adjusted returns; even small allocations of 1% to 2% significantly shift portfolio risk concentration to Bitcoin: In many of the portfolios, the addition of Bitcoin has not provided any risk diversification but has merely shifted the concentration of risk from one asset class (equities) to another (digital assets). Given a risk concentration exists with or without a digital asset allocation, our results imply that from a risk management viewpoint, traditional asset allocation is not an optimal approach.

If conventional asset allocation can't keep a lid on risk, portfolio managers need a new, suitable risk control mechanism. Among various approaches, Wilshire concludes that a combination of risk parity and volatility targeting is ideal when building a portfolio. Of the two approaches, risk parity addresses the concentration of risk directly by controlling the maximum risk contribution from each asset class, while volatility targeting involves leveraging or deleveraging a portfolio using cash to control the overall risk.  Not what Satoshi Nakamoto had in mind. Source: Bloomberg Wherever Satoshi Nakamoto may be, he must be proud that his legacy lives on. But he might well be uncomfortable with the lack of other use cases for Bitcoin beyond the world of investment. For now, it is being used as an asset that can help institutions, but not so much as an actual currency that people use to transact. Further, Nakamoto would surely have a thing or two to say about governments' increasing influence over crypto. It might help make a few people rich, but it could potentially spell doom for those who originally wanted to get out of government monetary policy control in the first place. —Richard Abbey Western Europe utterly dominated the world of classical music, but the Anglo-Saxons turned the tables when pop music took over. Not that the German-speaking world hasn't produced anything of interest since Elvis and the Beatles showed up. You could listen to Nena, Tangerine Dream, Kraftwerk, Peter Schilling, Falco, Andreas Bourani, Einstürzende Neubauten or Die Toten Hosen. If you'd prefer something from the classic German repertoire, try this work by Brahms, or this song by Schubert. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Bill Dudley: Trump's Economics Are Anybody's Guess. Here's Mine.

- Marcus Ashworth: No, Ray Dalio, There's Not a UK Debt Death Spiral

- Marc Champion: Trump Inherited a Strong America. That's a Weak Europe's Problem

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment