| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Asia's auto industry underwent some seismic changes in 2024, with China again at the epicenter. There was the unstoppable rise of electric car powerhouse BYD. Europe imposed punishing tariffs on Chinese EVs to protect the continent's carmakers, including the embattled Volkswagen Group. Legacy manufacturers like General Motors and Stellantis continued to go backward in China, while December saw Japan's Honda and Nissan begin talks to combine in a direct response to the existential threat posed by the rise of China's new breed of EV makers. So what does 2025 have in store? Here are five key things to watch:

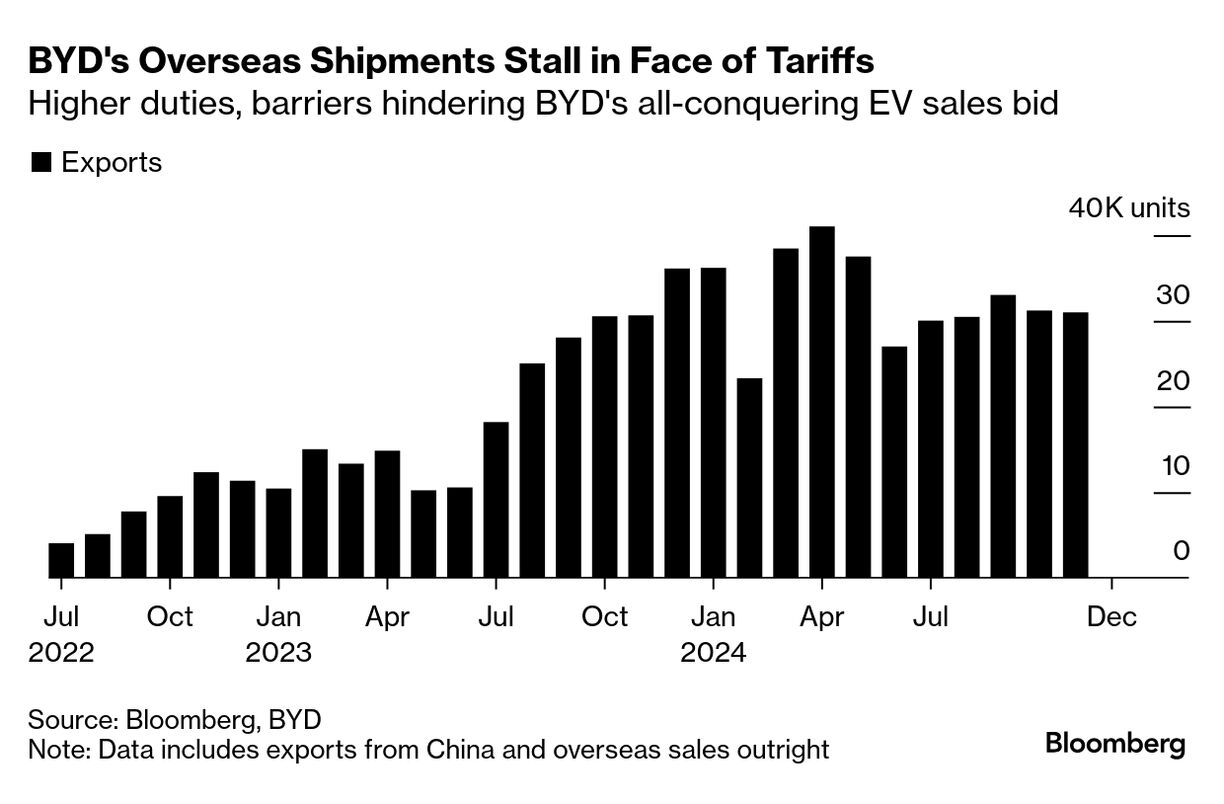

Can BYD Keep Going? China's EV king sold a record 4.25 million cars last year, easily topping the previous high of 3 million in 2023 and narrowing the gap to global leader Tesla. But headwinds are growing, particularly in the overseas markets BYD is counting on to fuel its next growth spurt. According to Citibank, BYD is targeting sales of 5 million to 6 million vehicles in 2025, including a doubling of overseas deliveries, which would translate into roughly 1 million cars. The full impact of European tariffs (set at an additional 17% for BYD) will start to be fully felt in 2025, while demand for EVs is showing signs of slowing in places like Southeast Asia, where the company has made a big push in countries such as Thailand. In Brazil, tens of thousands of Chinese EVs are piling up in ports, while on Christmas Eve, BYD was forced to sever ties with a building firm after authorities halted construction of a new EV plant where workers were found working and living in "slave"-like conditions. If some of BYD's biggest overseas markets — Brazil, Thailand, Israel, Australia and Indonesia — are to be a barometer, it is finding some success but the outlook is mixed and overall sales remain small relative to gasoline competitors. Hands Off While nothing Elon Musk does should come as a surprise, his lightning trip to Beijing in April to gain government support for the advanced driver-assistance technology that Tesla markets as Full Self-Driving was certainly unexpected. The visit paid immediate dividends, with Tesla receiving in-principle approval to deploy its driver-assistance system and cutting a mapping and navigation deal with tech giant Baidu, FSD still hasn't launched in China.  A Tesla Cybercab prototype. Photographer: David Paul Morris/Bloomberg Musk has staked Tesla's future on autonomous driving, launching the Cybercab amid great fanfare in October. Deploying FSD in China would be a step forward for a technology that still requires constant human supervision and is subject to several investigations in the US. With a small and little-changed range of cars, Tesla needs transformative features such as properly autonomous driving to keep people buying its EVs, especially in China where a wave of tech-savvy competitors are rolling out their own assisted- driving systems. Tesla is confident of starting FSD trials in China in the first quarter of this year, and claims to be ready to ramp up production of autonomous vehicles. "Once the entire automotive industry transitions to full autonomous driving, the real competition will center on how efficiently vehicles can be produced," Tom Zhu, one of Musk's top lieutenants, posted on Christmas Day. "We will be ready." OEM China Woes The outlook for legacy foreign automakers in China has never been this bleak. Take GM, which early in December took more than $5 billion in charges and writedowns tied to its troubled operations in the world's biggest car market. VW, until recently the top-selling car brand in China, is being left in the dust by domestic EV makers, while their dire situation in China is one reason behind the potential Nissan-Honda tie-up. "2025 will be the year where investors and shareholders fully realize how deep and wide the hole each legacy automaker is in relative to China," said Tu Le, founder of Detroit-based advisory firm Sino Auto Insights. Part of the problem is that younger Chinese drivers prefer EVs packed with advanced tech, an area where legacy automakers are now far behind. In an attempt to bridge the gap, VW is charting a new course in a potential model for others, giving its local operations more autonomy in its "In China, For China" strategy. Expect to see VW deepen its ties with Chinese partner Xpeng, and potentially more deals such as Stellantis's move to offer Leapmotor vehicles in nine European countries. However, another year of onslaught from Chinese EVs means foreign rivals have few options. "The only viable rescue plan? Great, affordable products, and, likely for many OEMs, new management," said Tu.

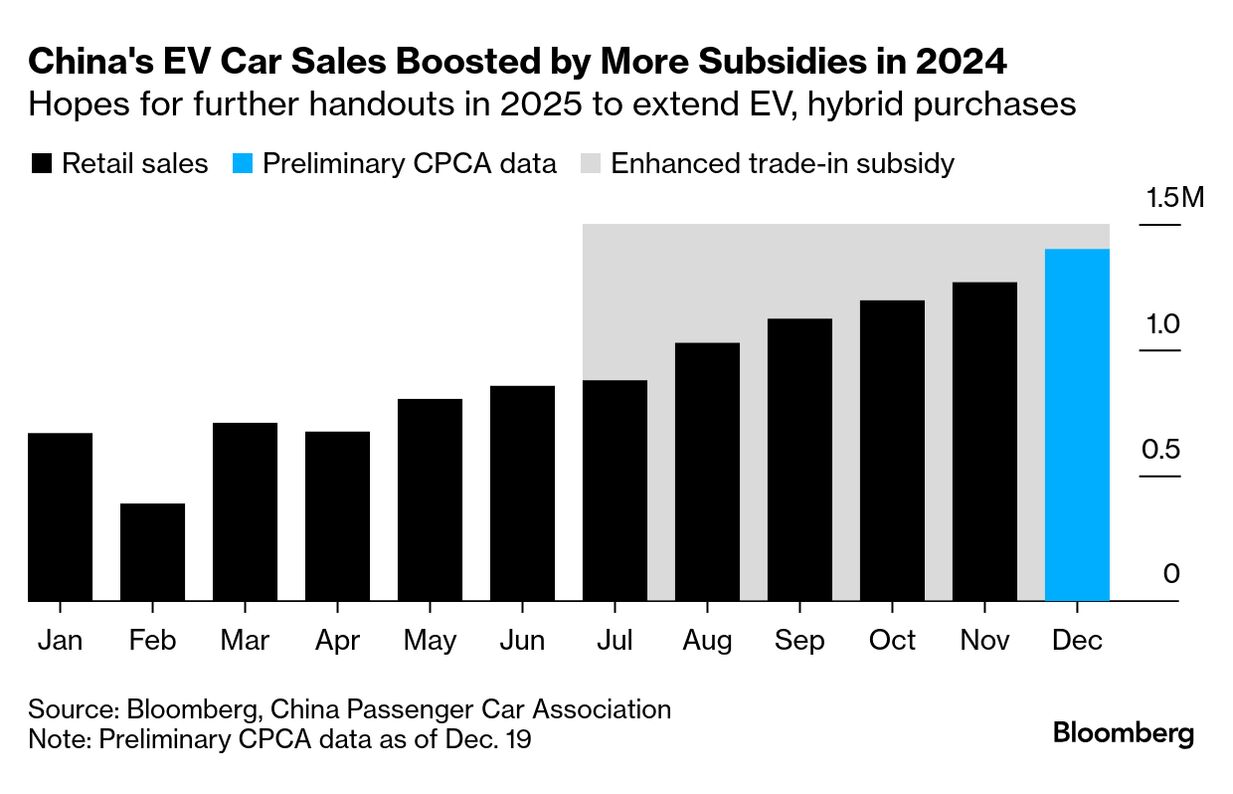

More Yuan for Clunkers China's car industry is keenly watching policymakers in the hope for another sales sugar hit. Manufacturers such as BYD and Geely saw sales jump in the second half of last year as buyers took advantage of a doubling in subsidies to trade in older gasoline cars for new fuel-efficient vehicles to 20,000 yuan ($2,748). Cui Dongshu, secretary general of China's Passenger Car Association, last month said that he expects car sales to grow in 2025, but the outlook remains uncertain. People are waiting to see if the government renews the cash-for-clunkers subsidy, which expired Dec. 31. The hope is the handout could be reintroduced by March during the closely watched National People's Congress legislative gathering. That could mean sluggish sales in January and February.

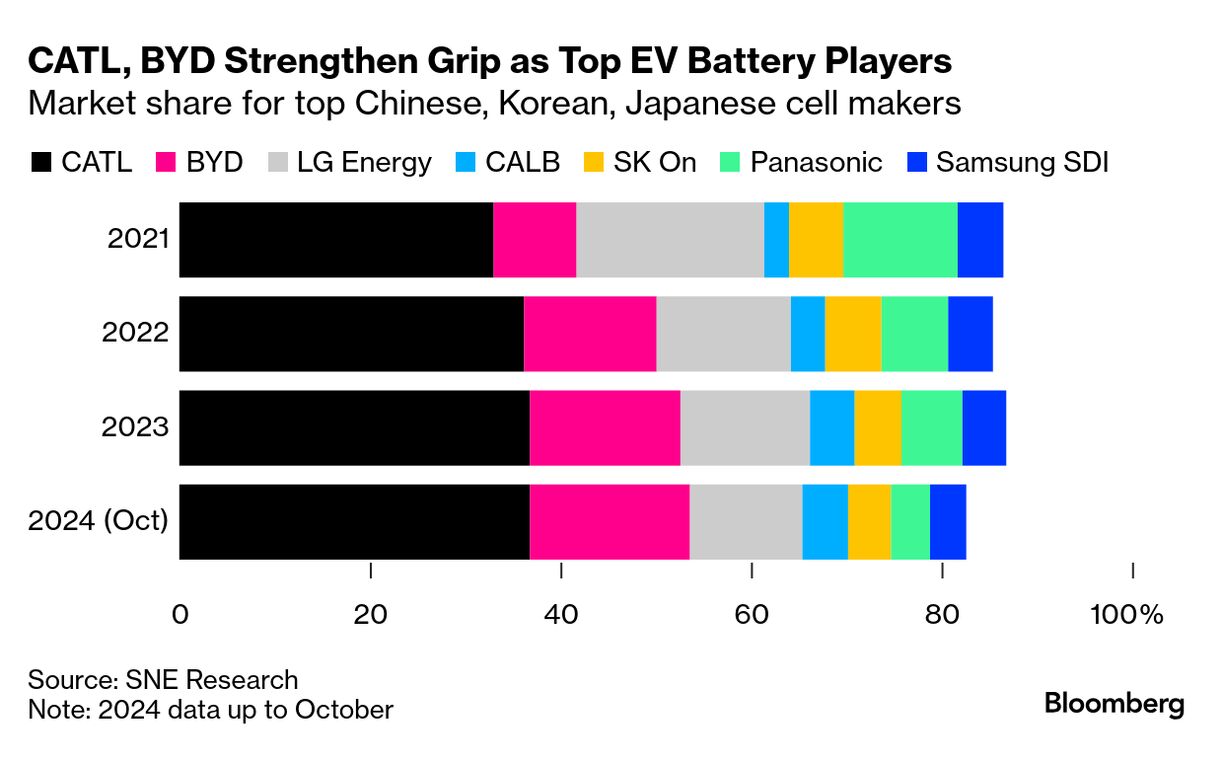

Longer, Faster, Cheaper Not a year goes by without another innovation from CATL in the push for batteries that offer more range, charge faster, and cost less. Just last month, CATL, the world's biggest EV battery maker, unveiled a new car chassis with an integrated battery strong enough to withstand fires or explosions from high-impact collisions. BYD, also the world's No. 2 battery maker, is expected to unveil the successor to its Blade battery — the low-cost lithium-iron-phosphate cell that has helped propel it into a top-selling plug-in hybrid and EV champion. Last May, it launched a new hybrid powertrain capable of traveling more than 2,000 kilometers (1,250 miles) without recharging or refueling as it pushes the boundaries of just how much range one charge can provide. - Tesla's stock surge runs up against potential annual sales drop.

- China automaker Chery adds JPMorgan for $1 billion Hong Kong IPO.

- BYD chalks up new sales record to narrow EV gap with Tesla.

Nio's Firefly compact car. Photographer: Nio It's a wonder three little headlights can stir up such debate. But that's what many Chinese netizens have been driven to comment on following the launch of Nio's latest sub-brand, Firefly. The compact car will start from 148,800 yuan ($20,400) and features a rather plain design punctuated by three little round lights at the front and rear, which look more cutesy than chic. Many online posters derided the car, saying it undermines Nio's premium eponymous brand and the automaker's positioning of itself as a luxury marque. |

No comments:

Post a Comment