| Wednesday's earnings from the Magnificent Three — Microsoft Corp., Tesla Inc. and Meta Platforms Inc. — were always going to be a big deal. A rather bland meeting by the Federal Reserve helped confirm that. Then the asteroid hit of DeepSeek's shoestring-budget artificial intelligence chatbot, which has inflicted massive damage on some US tech stocks, raised the stakes even further. The tech megacaps have sky-high multiples; that's nothing new. Can they really justify them? The market's initial judgment is that they can — but that seems questionable. Microsoft and Tesla were first out of the blocks, and both reported mixed earnings. Microsoft's Satya Nadella offered a reassuring assessment of the impact DeepSeek will have on its business model: We are going to see that all get commoditized and it's going to get broadly used. And the big beneficiaries of any software cycle like that is the customer. AI will be much more ubiquitous, and so for a hyper-scaler like us, a PC platform provider like us, this is all good news, as far as I'm concerned.

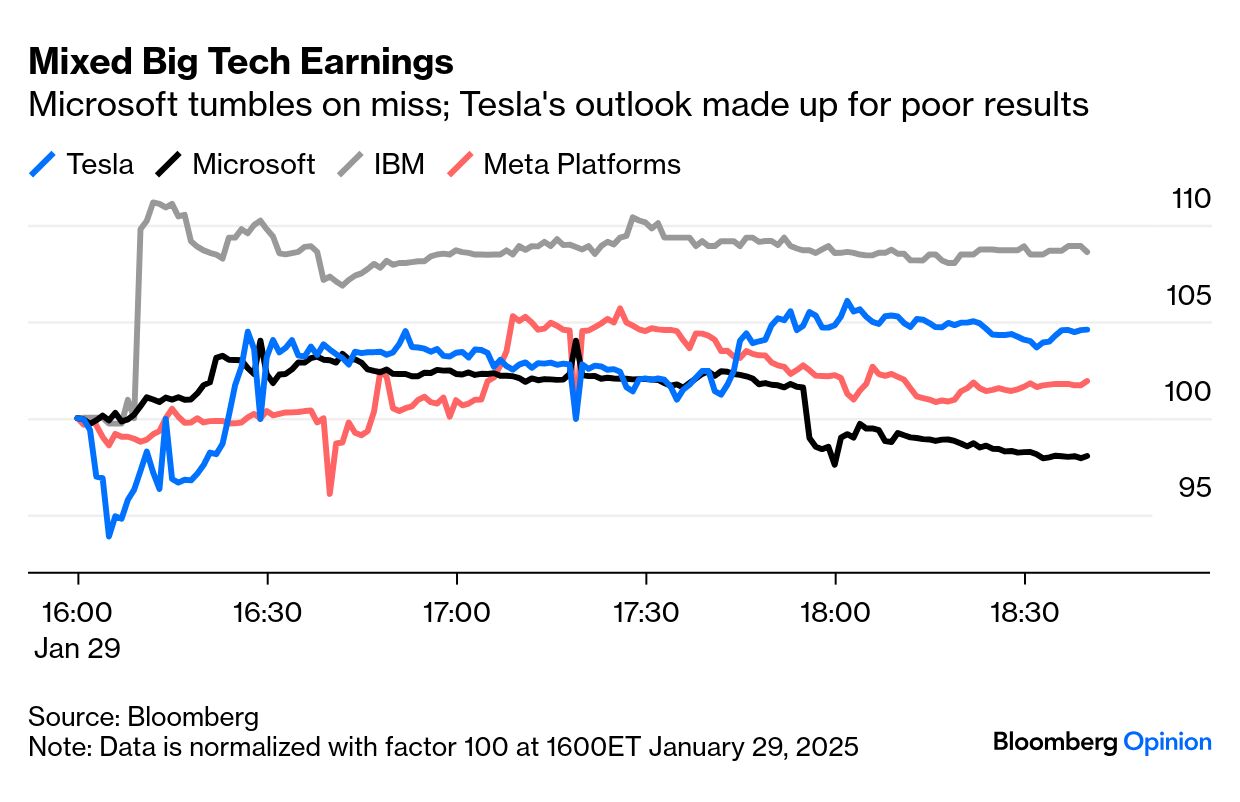

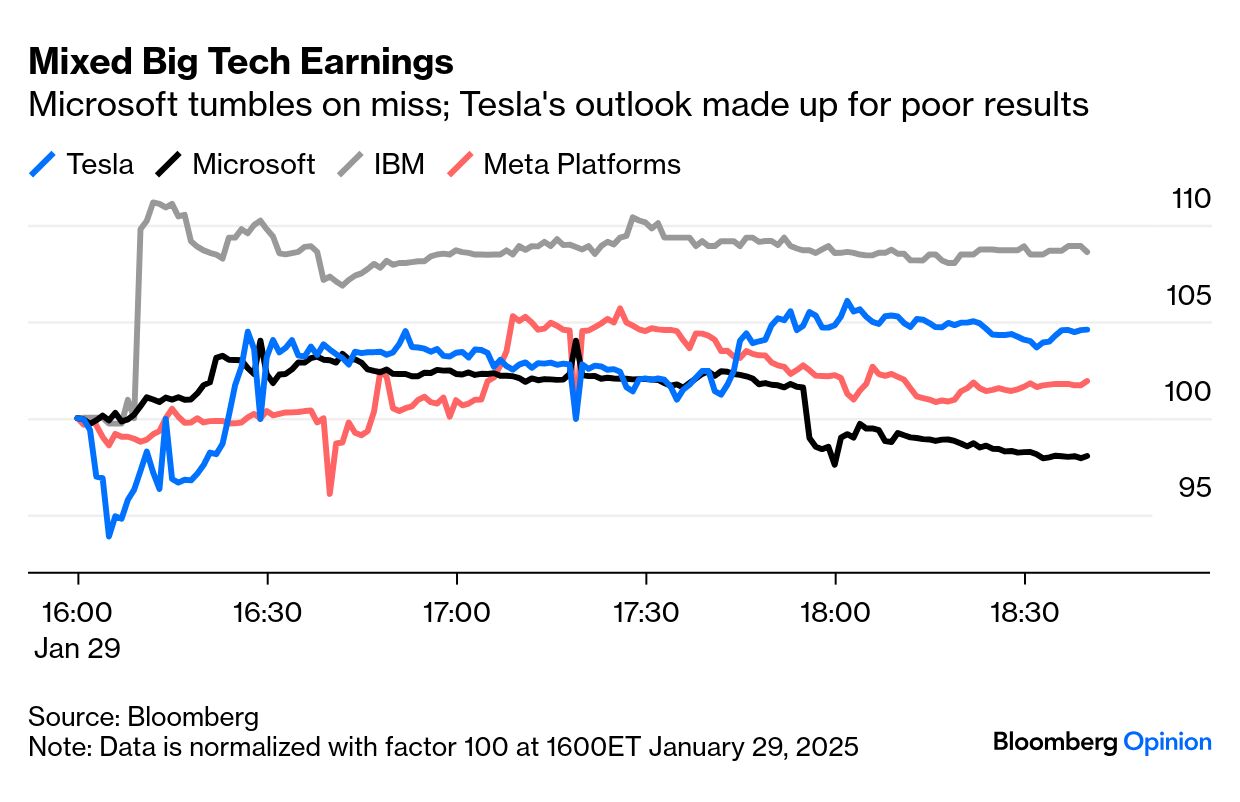

These may be valid points, but they didn't compensate for slow growth in Microsoft's Azure cloud computing business in the last quarter, which contrasted with continuous massive infrastructure spending to back its AI products. Profits from such huge investments will not be instant, but the expectations baked into the company's valuations leave little room for disappointment; the shares took a hit after hours. Meanwhile, Tesla and Meta Platforms, also reporting after the bell, traded higher as investors viewed their results favorably. Outside the current dominant Magnificents group, the strong earnings of IBM Corp., which for many years was the world's largest tech company, made it one of the top gainers in after-hours trading. This is how the stock of these four companies moved as their results came out:  Tesla's earnings were far from stellar. Arguably, they were downright bad. Various fundamental measures — operating income, profit, and earnings per share, or EPS — fell short of analysts' estimates. Elon Musk's prediction at his last earnings call of a 20% to 30% growth target set the expectations bar far higher. That explains the shares' immediate plunge in post-market trading. But the nosedive was fleeting, with a rebound turning into an outright gain as the earnings call got underway, and Musk and his head of investor relations, Travis Axelrod, took turns to talk up the company's outlook (all while ditching the 20% growth target, and never even mentioning CyberTrucks). Apparently, if you are Elon Musk, it's possible to talk your way out of such a weak performance. The hypothesis that Tesla's share-price surge since US President Donald Trump's reelection had more to do with Musk than his core business looks ever stronger. Among the highlights, he sees a path for Tesla to be the world's biggest company by market cap, and as big as the next five combined; self-driving cars will start a pilot run in Austin in June; and the great new trump card is robots, which have hands so dexterous that they can thread a needle. Trump's threats of tariffs and his anti-green policies are least helpful to Tesla's electric-vehicle business, which Musk himself concedes. Add these headwinds to disappointing earnings and the share price should have tanked. Musk's talk about an expansive deployment of full self-driving cars and robotaxis as central to Tesla's outlook was all very exciting, but nothing new. Nevertheless, the Tesla chief made it compelling for investors to overlook past performance, embracing a so-called "epic" power of automated vehicles supercharged by AI. It's understandable that not everyone is convinced by Musk's playbook. Ross Gerber, of Gerber Kawasaki, told Bloomberg TV there was little to show for Tesla's expensive other businesses: No question it is a tech company. It focuses on software and developing software for robots and autonomous vehicles. Their core business is selling cars and energy storage and charging. The mission is to advance sustainable transportation and energy. They were doing a wonderful job before they pivoted into these businesses. We are not sure how they will be, but we are sure there will be robotics and cyber cabs. That is not coming anytime soon. Where does growth come from the next several years until these technologies work?

Meanwhile, the reaction to Microsoft's miss is telling of the standards the company is held to. The stakes are high as investors want to see signs that AI is helping businesses make money. Rishi Jaluria of RBC Capital Markets puts this succinctly: Microsoft, which is underappreciated by the investor community, but the customer understands, drives the adoption of adjacent services, even Office, that allows them to be shared gainers in the space. They feed well into each other. AI can be crossed into the existing Microsoft... It's s so well-positioned. It's a giant portfolio company with weapons in every area.

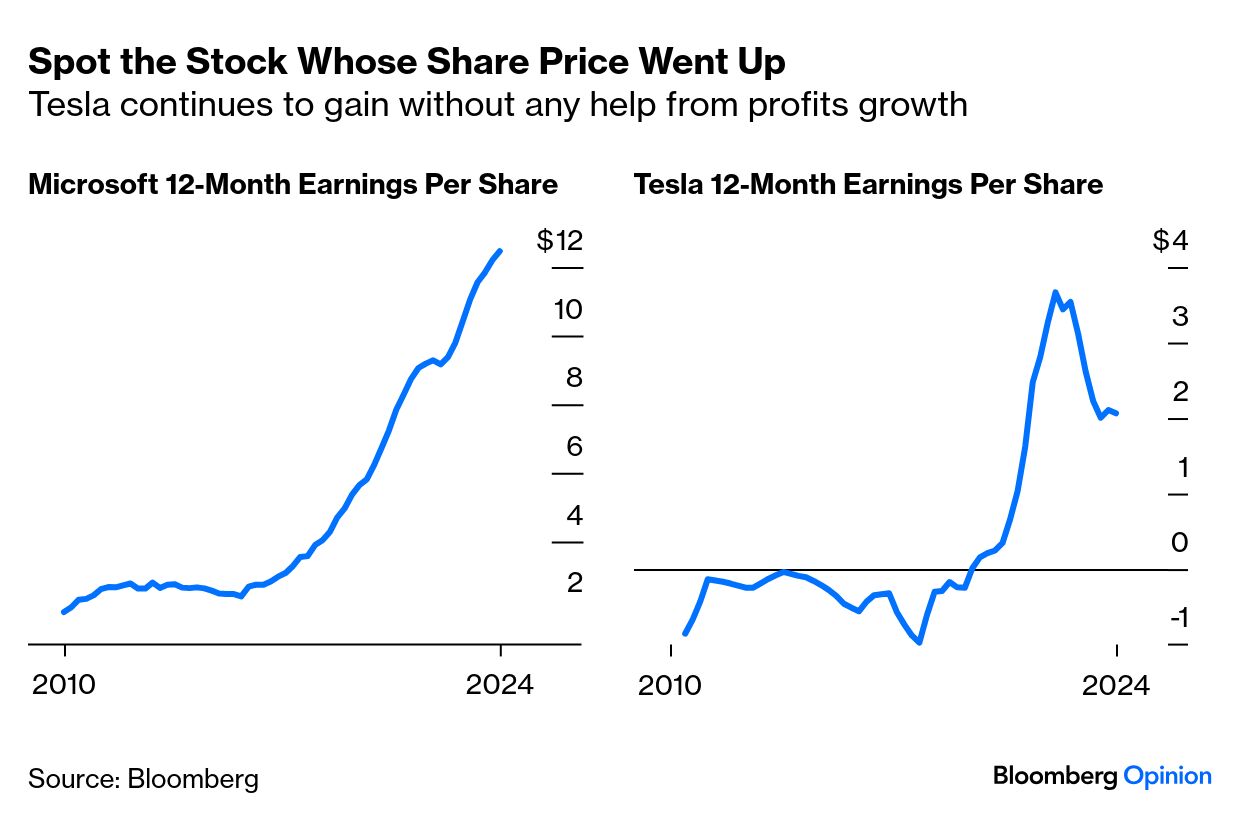

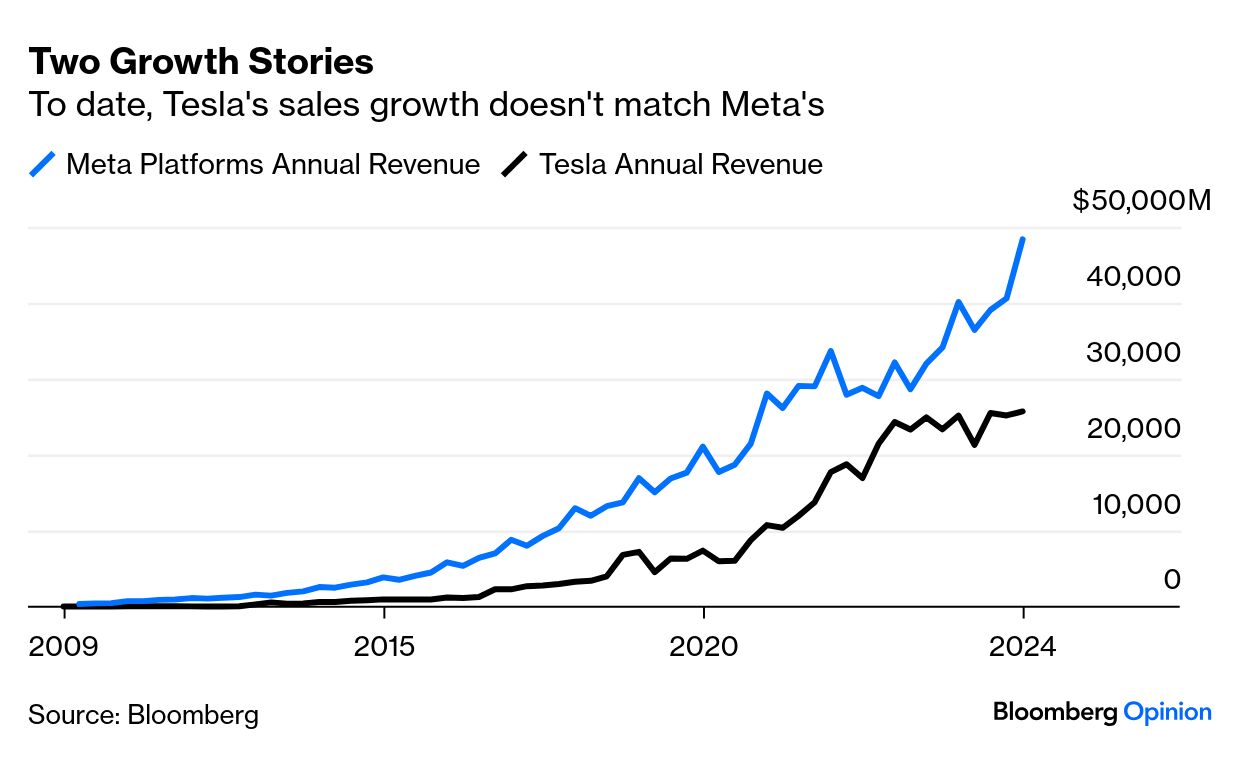

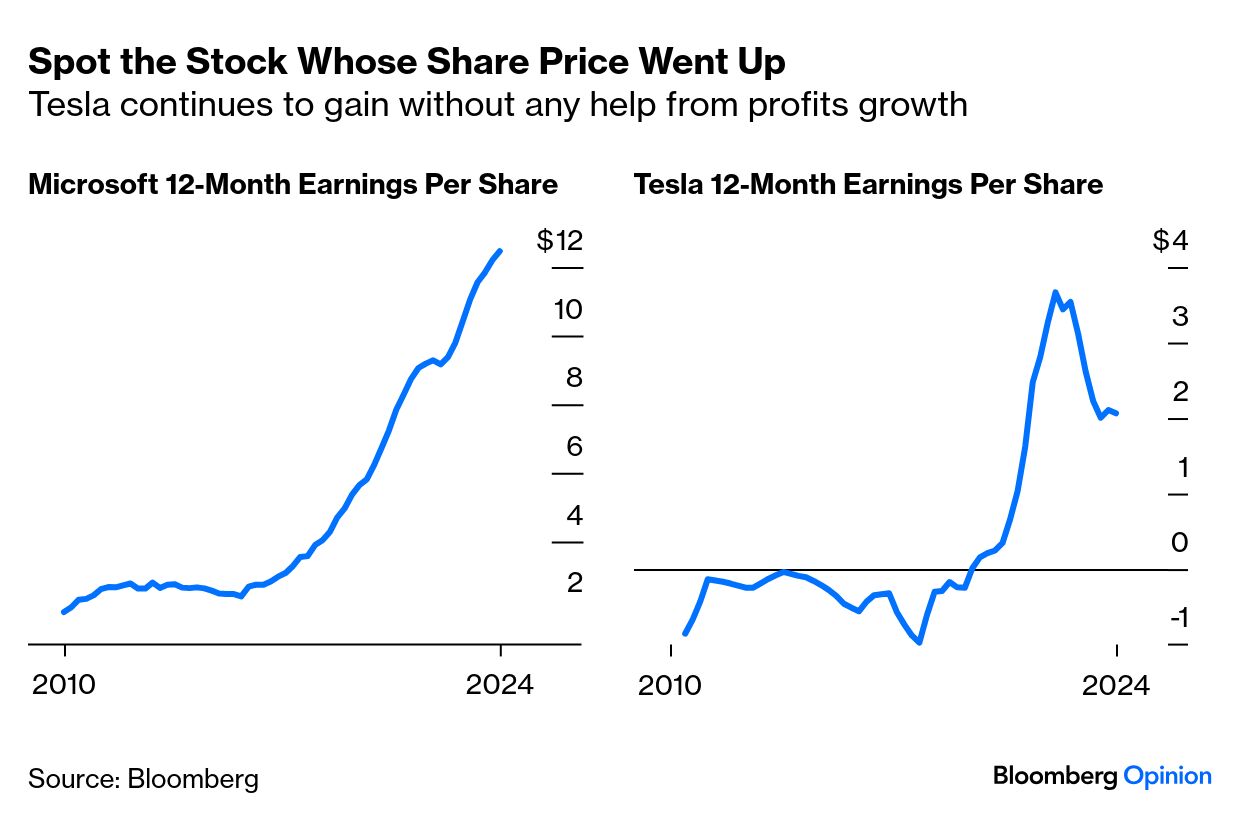

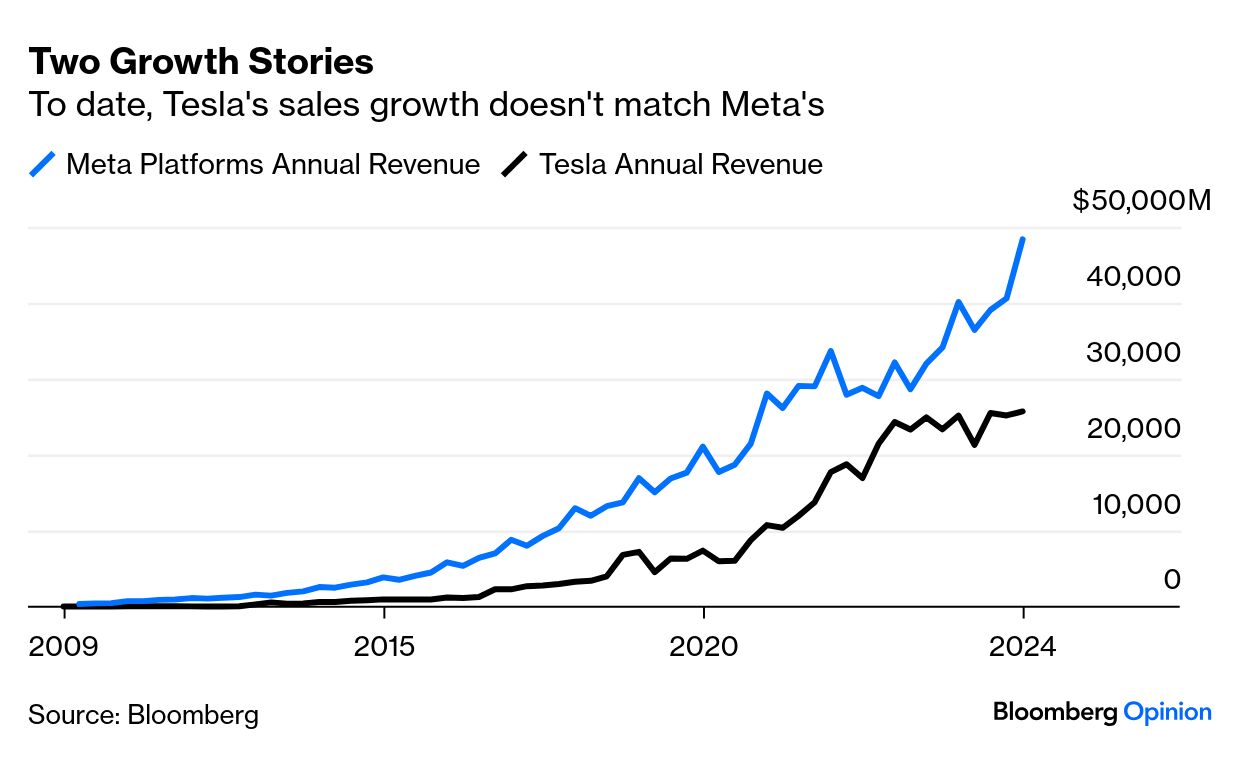

And yet Microsoft, in a renewed phase of dramatic growth, was punished, while Tesla was given a pass for a total failure to raise profits. There is more to a company's share price than the last year's earnings, of course. But putting the two side by side is remarkable:  The reaction to Meta's performance was slightly better than Microsoft's. Admittedly, Meta's earnings were decent, which was impressive given that it was carrying grandiose projects that are yet to make money, like its Reality Labs, which had losses of close to $5 billion on a paltry revenue of about $100 million. But Mark Zuckerberg, the company's CEO, had an exciting tale of how he is planning to develop an AI engineer that could write code and deploy it. He also admitted that he didn't know whether it would make any money. It's a prospect, and the company is not even sure of its timeline. But somehow, investors prefer Big Tech to talk big on AI, even if their projects appear more fanciful than reality. When it comes to actual revenue growth, Tesla — whose shares have surged about 90% since its third-quarter earnings — is no match for Meta:  It's true that you buy a company's future earnings when you buy its stock. But it's amazing that so much can be taken on trust. Somehow, even after the almighty DeepSeek shock, investors still seem prepared to give Big Tech the benefit of the doubt. — Richard Abbey Central bankers don't, as a rule, want to make news. Occasionally, they might try to generate a response by deliberately engineering a surprise, but that's generally when the stakes are high. Most of the time, their aim is to merge into the background. That was Fed Chair Jerome Powell's target ahead of Wednesday's meeting of the Federal Open Market Committe, and he hit the bull's eye. Amid surging political waves in Washington, and just minutes before the tech titans would take the stage, he offered a placid and torpid Sargasso Sea. Everyone knew that the Fed wouldn't change interest rates. They also did nothing to change their policy of gradually reducing the balance sheet. Instead, the greatest excitement in its communique came from a slight alteration in language about inflation and unemployment. Last month, the FOMC statement said: Labor market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee's 2 percent objective but remains somewhat elevated.

This month that changed to: The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.

So if the labor market is solid rather than easing, and the Fed no longer says it's making progress toward the 2% target, that sounds like a distinct shift toward hawkishness — a propensity to make the next move a hike. Then Powell was asked about what appeared to be a critical signal in his Q&A. His response: If you just look at the first paragraph, we did a little language cleanup there… We just chose to shorten that sentence.

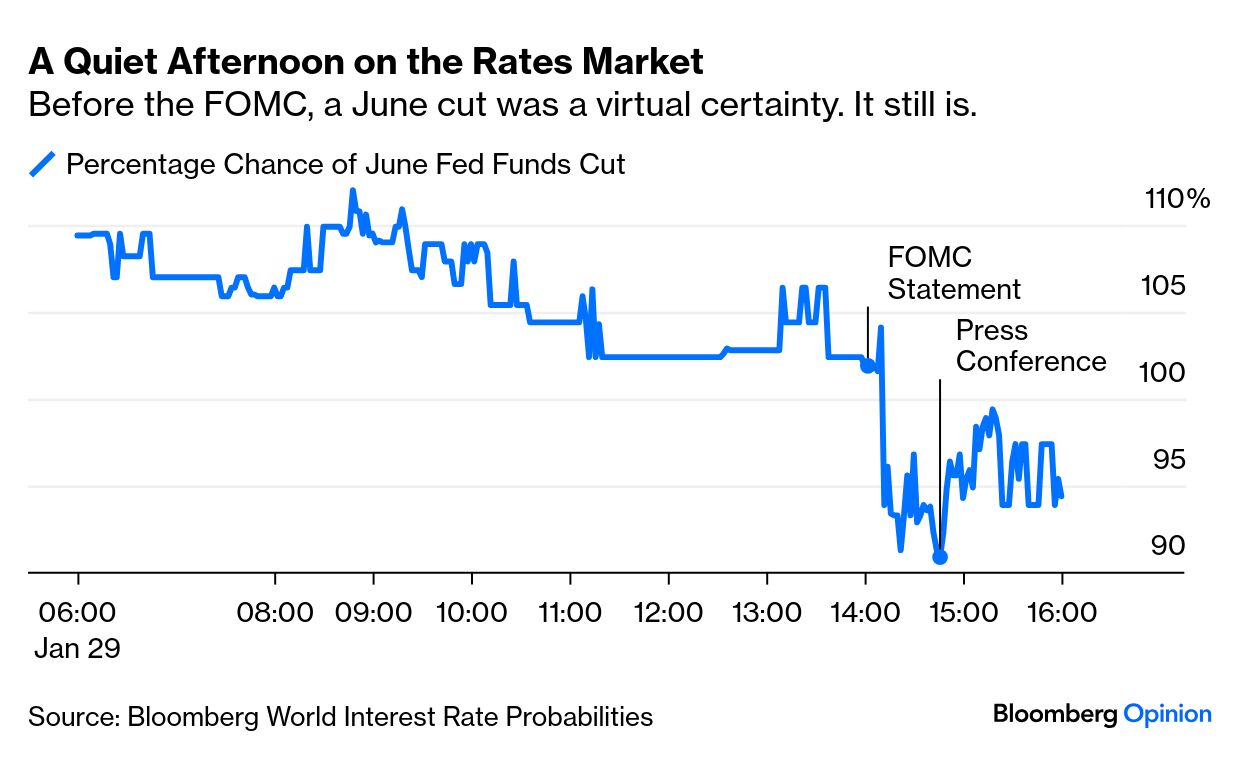

For fed funds rate futures, the outcome by the end of the day was to reduce very slightly the chance that the Fed will cut at its June meeting or before. The odds of this moved from 110% to 95%, however, meaning that it's still perceived as a virtual certainty: The effect of the Fed's language cleanup — and Powell's subsequent attempt to clean up how people had interpreted it — was clearly visible across broader financial markets. The dollar, the gold price, the 10-year Treasury yield, and the S&P 500 all moved sharply. Those moves were completely reversed on Powell's clarification. In the final analysis, the Fed did a good job of convincing people that it wanted to cut rates, but was in no hurry to do so: His invitation to side with the hawks thus rebuffed, Powell went on to refuse to answer questions about the Trump administration. Tariffs could affect the battle against inflation, and the Fed is not going to say anything until it knows what they are. Such strictures don't apply to the Bank of Canada, which announced a 25-basis-points cut earlier in the day, and then declined to give any guidance on where rates might go for the rest of the year, thanks to the political uncertainty over US tariffs (there's also considerable political uncertainty at home). Tiff Macklem, the bank's governor, said: We don't know what the US is going to do. And even when we do, we're going to have to do some more work to figure out exactly how that is going to play out through the economy… If broad-based and significant tariffs were imposed, the resilience of Canada's economy would be tested.

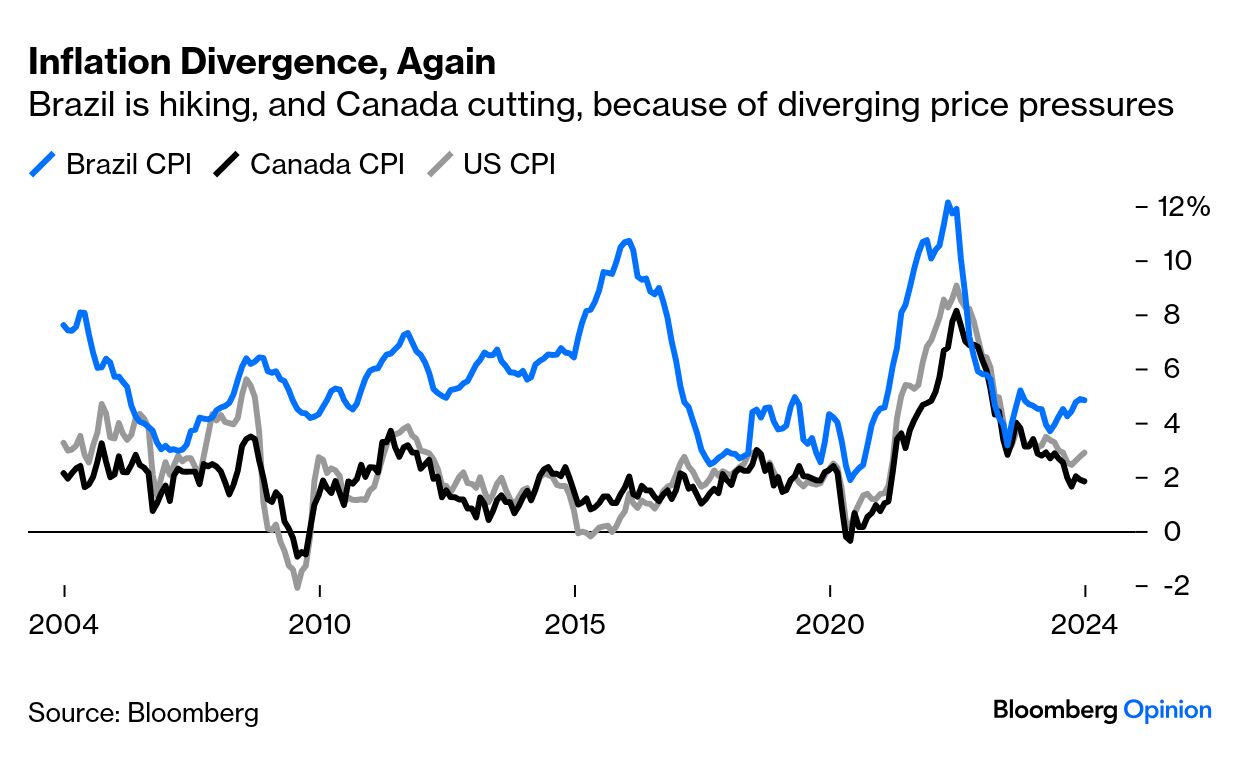

Canadian inflation is falling, but the strong US dollar is a risk, while the possibility of Trump 2.0 protectionism, to which Ottawa would presumably have to respond, raises the risks considerably. Thus, the central bank can't tell us where it's heading next. In Brazil, it's simpler. Inflation is rising, and so the central bank has just hiked its benchmark Selic rate by a full percentage point. The problem is the woeful fiscal position, but the strong dollar and uncertainties over trade don't help. We can expect the central bank to increase again at the next meeting in March. And a brief period of global convergence, in which the emerging world stole a march by fighting inflation earlier and more effectively than its developed-market peers, appears to be over: Next up, Frankfurt. For once, this section lives up to its name. On New Year's Eve, Joseph Lynskey was pushed on to the New York subway tracks, in front of an oncoming train. The odds against survival were minuscule. He survived. And now he has told the tale in a fascinating piece of reportage in The New York Times, which you can read here. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Dave Lee: DeepSeek Calls for Deep Breaths From Big Tech Over Earnings

- Catherine Thorbecke: DeepSeek Is No Chat(Xi)PT. For Now

- Andreas Kluth: Trump Is Like Putin and Xi: an Imperialist

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment