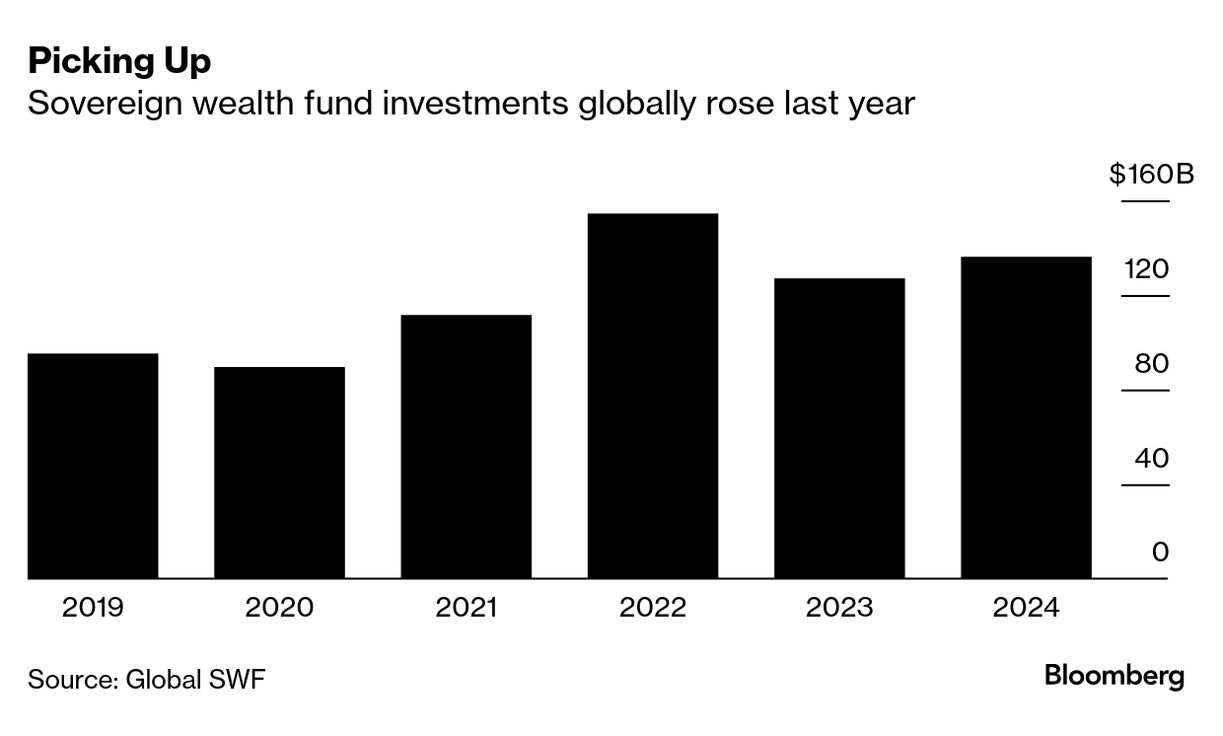

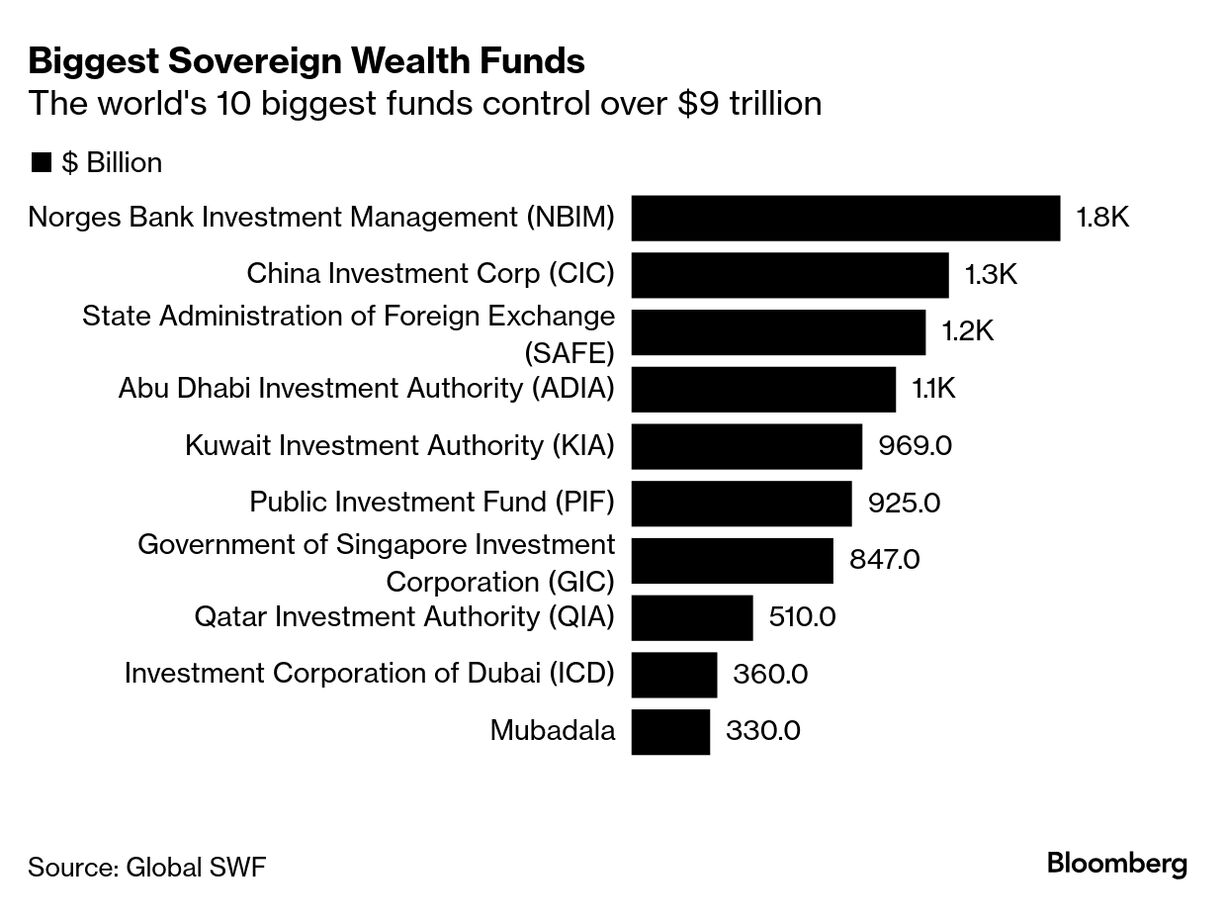

| Welcome to the Mideast Money newsletter, where we chronicle the intersection of money and power in a region that's become one of the most influential in global finance. I'm Matthew Martin, Bloomberg News' chief correspondent for Gulf sovereign wealth funds, filling in for Adveith Nair. This week, we look at Saudi Arabia's 2025 fund raising spree, Qatar Airways' private-jet boost and Donald Trump's impossible promise. But first, let's dive into how wealth funds in the region are poised to extend their influence. That the Gulf's various sovereign wealth funds have become some of the most dominant players in global dealmaking has rarely been in doubt in the past few years. Figures for 2024's deal activity demonstrate it beyond all doubt. Collectively, five wealth funds controlled by Abu Dhabi, Qatar and Saudi Arabia deployed $82 billion last year, accounting for more than 60% of all sovereign wealth fund investments, according to Global SWF. These entities regularly feature in the top 10 global sovereign dealmakers. The bigger question is how much these funds are driven by the quest for returns, and how much by their nations' domestic and foreign policy priorities. That may become even more acute as Gulf states look to use their oil wealth to position themselves at the center of industries like artificial intelligence. Traditionally tasked with turning oil revenue into long-term assets, these funds are increasingly prioritizing investments that align with their national interests, going beyond mere financial returns. Returns are clearly still important, but recent investments in building digital infrastructure, advancing artificial intelligence capabilities and fostering regional semiconductor manufacturing reveal a broader agenda: These funds are investing in projects that will make their nations relevant in a world beyond oil, and in a way that will also be of strategic importance for their partners both in the West, and the East. The deep pools of capital that Gulf rulers can put to work — just the top five regional funds control around $4 trillion in assets — will give them a significant advantage, along with the power to shape the priorities of those who benefit from their investments. For instance, Gulf entities' backing of new trade corridors linking India, the Middle East and Europe, or their support for Egypt's economy, highlights how economic initiatives often overlap with geopolitical strategies. Meanwhile, Gulf funds are increasingly optimistic that the addition of Elon Musk to President-Elect Donald Trump's inner circle will help them win even more deals in the US, particularly in tech and AI, people familiar with the matter told Bloomberg News in November. A key reason is their links to Musk, with Saudi Arabia's Public Investment Fund, the Qatar Investment Authority and an Abu Dhabi-based entity having previously invested in the billionaire's firms.

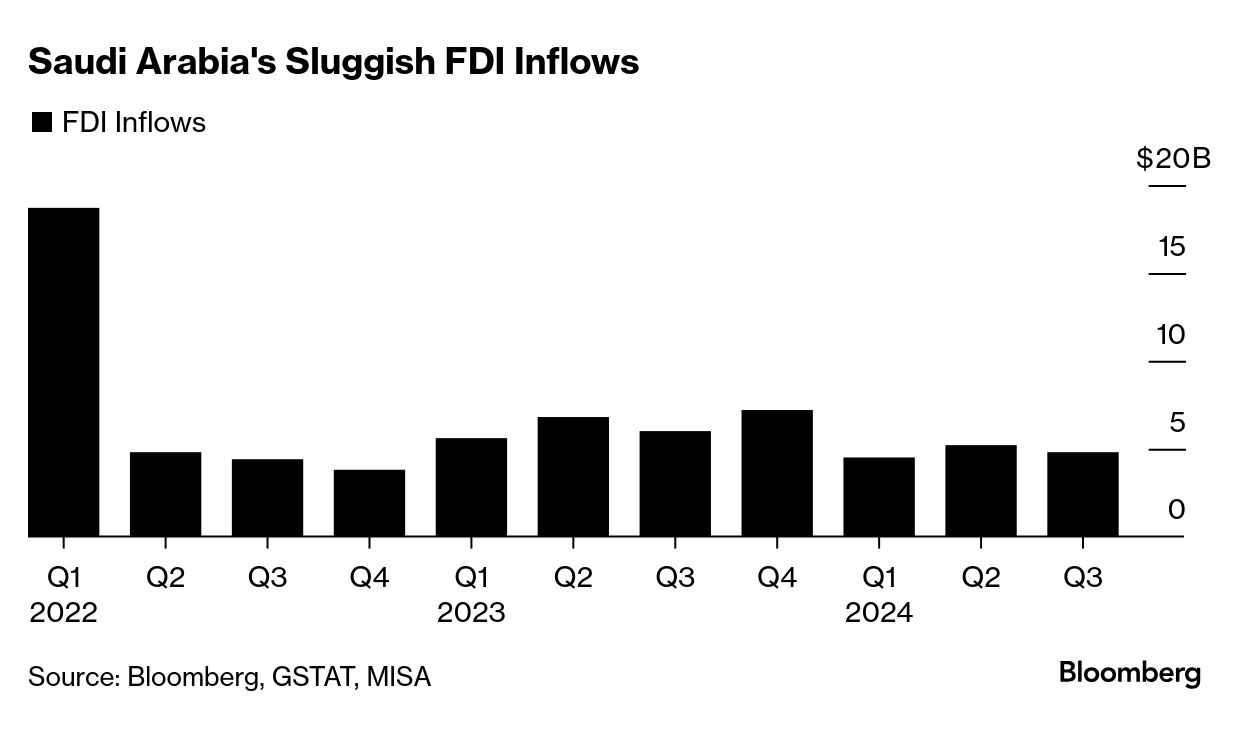

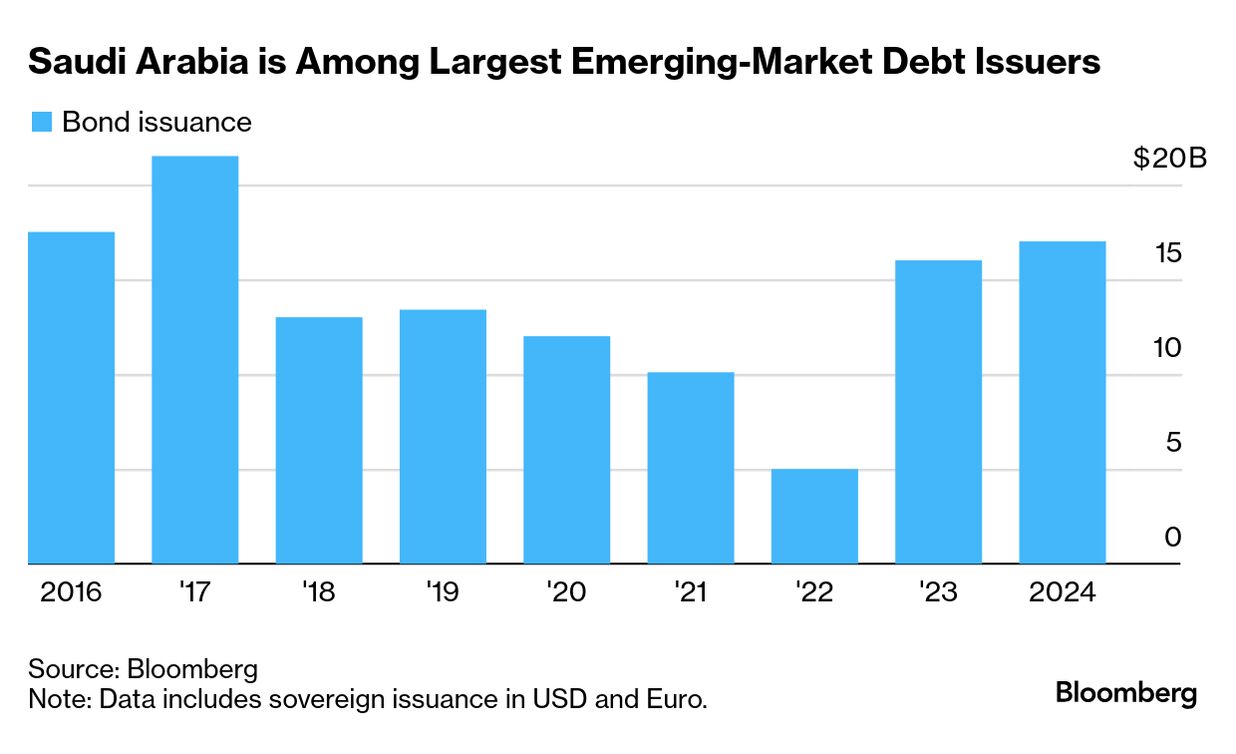

Related Coverage Even Saudi Arabia's domestic spending can be seen through the prism of boosting Crown Prince Mohammed Bin Salman's soft power projection internationally. As he prepares to host global cultural and sporting events in the decade to come, he's spending hundreds of billions of dollars repositioning the kingdom on the global stage. While the funds themselves would argue all of their investments are done on a commercial basis, they look like they are becoming increasingly intertwined with wider policy priorities of their owners. Also Read: The $4 Trillion Gulf Funds and the Power Brokers Who Run Them Must-read Mideast stories | Turkey's inflation rate fell more than expected last month, potentially making it easier for the central bank to cut interests rate again. Saudi Arabia raised oil prices for buyers in Asia next month, in a sign the world's largest crude exporter sees tighter supply in its largest market. Hossein Shamkhani used citizenship-for-investment programs in the Caribbean and Europe to gain access to the international banking system. Read the latest installment of Bloomberg's investigation into the Iranian oil tycoon. Israelis face a $11-billion war bill in 2025, which will likely deepen social and political divides. Qatar Airways said revenue at its private-jet subsidiary rose 26% last year, as more affluent families and business groups choose the flexibility of the smaller aircraft. Meantime, the Doha-based carrier also ranked among the top five most punctual global airlines of 2024.  A Gulfstream G500 executive jet operated by Qatar Airways. Photographer: Simon Dawson/Bloomberg Here're a few other stories that caught my eye: | Wall Street's expectations for 2025 are anything but dull. Here're the potential perils and golden opportunities that lie ahead. From D.E. Shaw to ExodusPoint, multistrategy hedge funds produced mostly double-digit gains in 2024. The net worth of the world's 500 richest people surpassed $10 trillion in 2024, but for France's biggest billionaires, it was a year to forget. Meantime, Nvidia's banner year supercharged its chief executive's net worth to new heights — and boosted three of the chipmaker's longest-serving board members into the billionaire ranks, in a virtually unheard-of feat of wealth creation.  Jensen Huang, co-founder and chief executive officer of Nvidia. Photographer: Valeria Mongelli/Bloomberg Donald Trump's vow to ensure that all remaining Bitcoin is "made in the USA" may prove to be one of his most challenging campaign promises to keep. Italy is in advanced talks with Elon Musk's SpaceX for a deal to provide secure telecommunications for the nation's government — the largest such project in Europe. Rolex raised prices on some of its most popular watch models after gold values surged in 2024.  A Rolex GMT-Master II luxury watch. Source: Rolex SA Saudi Arabia's inflows of foreign direct investment slumped in the third quarter to $4.8 billion. The tally brings inflows to $14.5 billion for the first nine months of 2024, according to data from the Saudi General Authority for Statistics. That's below year-ago levels and just half way to reaching the government's target of $29 billion in 2024. To meet that goal, Saudi Arabia would need one of its biggest quarterly hauls ever for foreign investment. Staying with Saudi Arabia. The kingdom, which was among largest bond issuers in emerging markets last year, has kickstarted 2025 with a debt spree. The kingdom's sovereign wealth fund closed a $7 billion Islamic loan with a group of 20 international and regional banks, it said in a statement Monday. That announcement came hours after the country's finance ministry kicked off a bond sale and days after it raised $2.5 billion from three banks. The kingdom's funding needs for 2025 are estimated to be 139 billion riyals ($37 billion), with 100 billion riyals covering the budget deficit and the rest repaying maturing debt. If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment