| It's that time again. Trading is almost over after another hectic 12 months, and we are paying our annual visit to the offices of Hindsight Capital LLC. For the uninitiated, I've been going for years. They use a strategy that beats all others, every year, guaranteed: hindsight. All of the trades it makes at the start of January are with the full knowledge of how things will turn out. The rewards for seeing the future are potentially infinite, so I impose some rules on its managers. There is no investing in individual stocks, or in trivially small frontier markets, and no trading within the year. Positions taken at the outset must be maintained until the end of December. There is no use of leverage. And they have to show that there was a rationale for what they did on Jan. 1. Investing on the basis that an earthquake would hit on a specific day, for example, is out; investing on the geopolitical balance of probabilities is fine. They are, however, allowed to sell short, and therefore can benefit when securities go down rather than up. And as this isn't the most serious exercise (just to be clear, this hedge fund doesn't exist), we assume that Hindsight negotiates such great terms that its trading costs are zero. Broadly, this was the year of the Trump Trade, and a key to getting it right was to predict that Donald Trump would win back the presidency. That was a strong probability at the outset, but far short of a certainty. Markets hadn't priced it in, and so there was money to be made. Shifting balances in the US, and the perception of what Trump might do back in office, drove global markets throughout the year. So this download from Hindsight will be in two parts. Today, we will look at the series of lucrative Trump trades that relied directly on the US election. We will be back tomorrow with a variety of investments that weren't quite so contingent on US politics. With all that settled, here are the Trump Trades that Hindsight made on Jan. 1, in dollars (unless otherwise indicated). The charts, drawn up by Elaine He, show the percentage return on each trade, and have been updated to the close of play on Dec. 20. Bet on Trump Himself

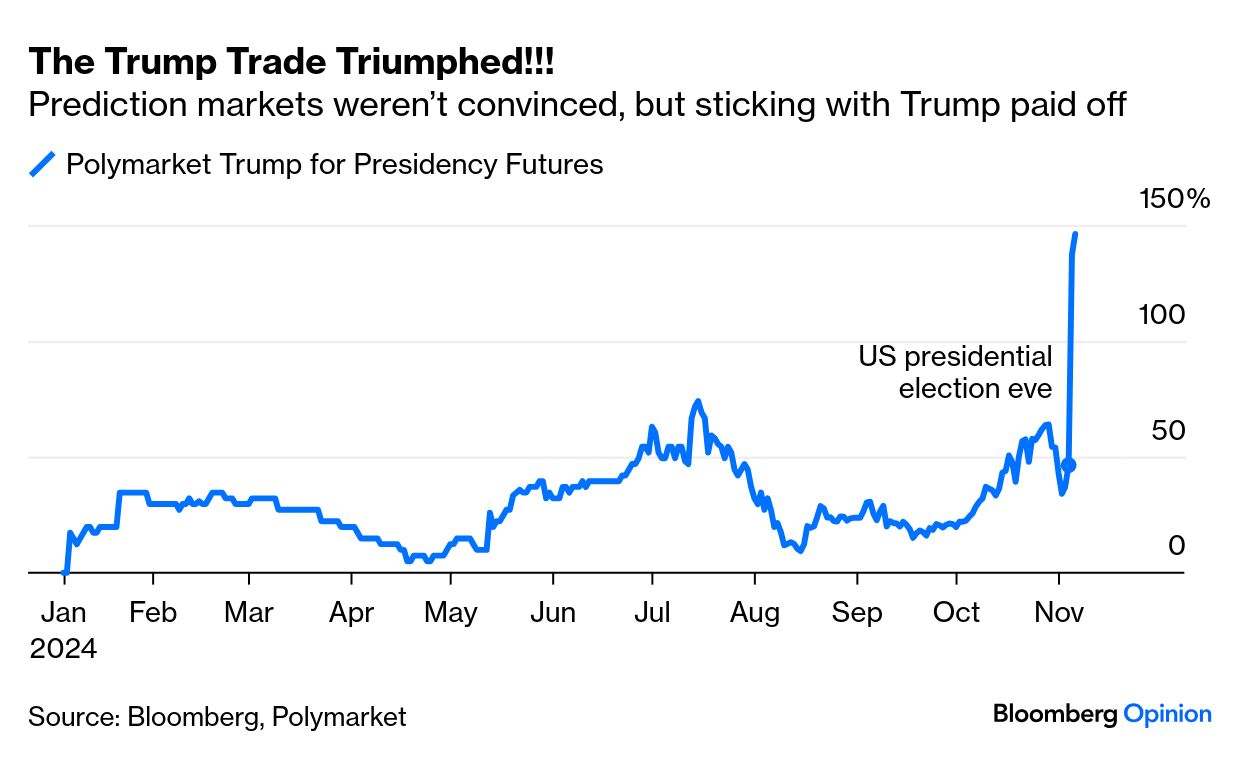

Buy Polymarket Donald Trump for President Futures (Up 146%) As the year dawned, there was a widespread assumption that Trump was on course for the White House, but it wasn't a done deal. He still had to navigate the Republican primaries, where he faced serious opposition from Ron DeSantis and Nikki Haley. Then, of course, he would need to win a general election. As he had lost the popular vote in both his previous presidential campaigns, this wasn't a given. Hindsight's managers, however, saw that inflation had inflicted mortal damage on the Democrats' hopes, and that Trump's legal fights had served only to strengthen him with his base of supporters. Hindsight also grasped that the incumbent, Joe Biden, was unequal to a second term. Replacing him would be a messy job for the Democrats, improving Trump's chances still further. Prediction markets allowed a pure way to bet on Trump's chances. On Jan. 1, Polymarket put the odds of a Trump victory at only 40% (40 cents for a payoff of $1 if he won). After fluctuations throughout the year, this was still only at 54.6% on the weekend before the election. That meant there was plenty of money for confident bettors ( other prediction markets put Trump's chances even lower, but were less liquid, so it would have been difficult to place the trade). Hindsight made 146%. It also returned 250% from the bet that Trump would win the popular vote, an event scarcely anyone saw coming: POSTSCRIPT: The Kamalamentum Trade That Might Have Been

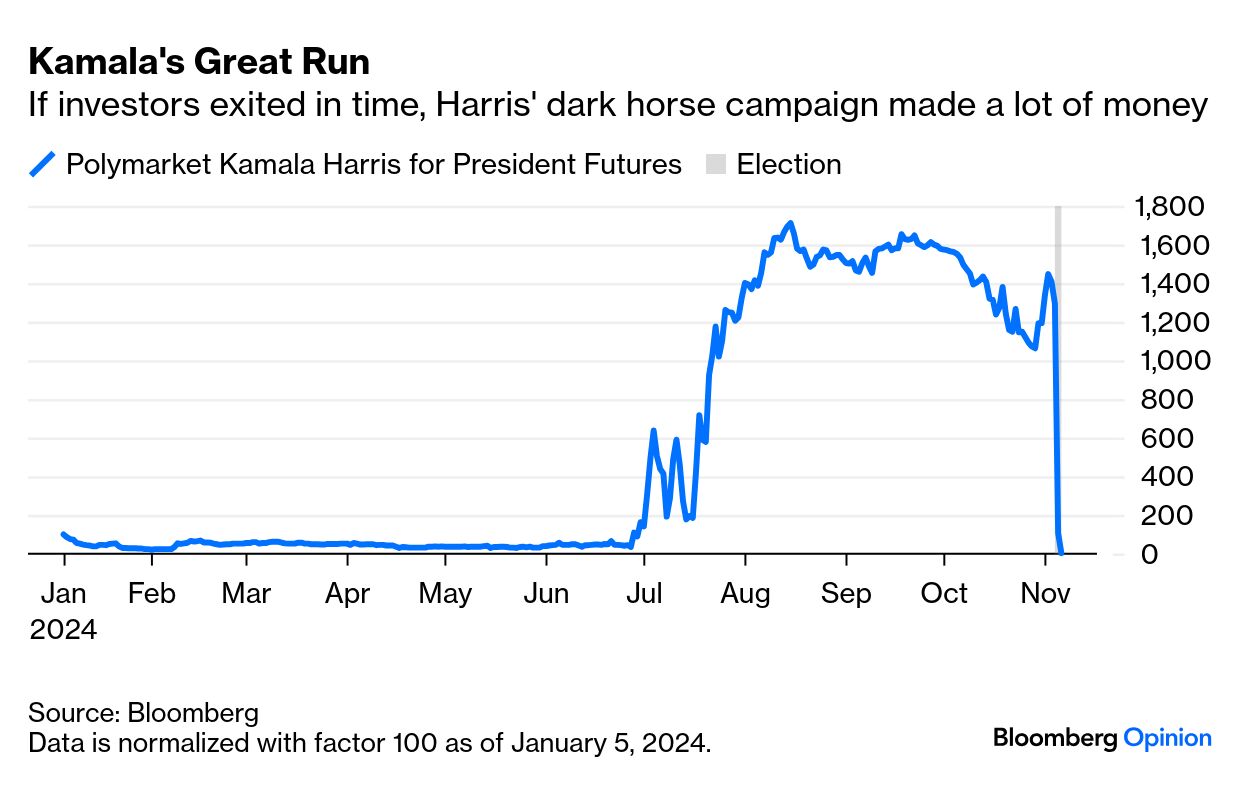

Buy Polymarket Kamala Harris for President Futures and Sell Before the Election (Up 1,600% in August, 1,350% on Election Day) If there was one trade that Hindsight would love to have made, if only they were allowed to sell before the year was out, it was to bet on Kamala Harris. She wouldn't beat Trump, of course. But Joe Biden's infirmities were already painfully obvious as the year began, and Minnesota Democratic congressman Dean Phillips launched a quixotic presidential campaign, solely on the basis that Biden was too old. As he was unopposed in the primaries, however, Democrats would find it politically impossible to replace him with anyone other than the sitting vice-president. Ergo, if Biden did have to pull out, the odds overwhelmingly favored Harris. With roughly half the country implacably opposed to Trump, and with the benefit of novelty, bettors would have to acknowledge that she had a chance once she got into the race. That was Hindsight's reasoning, and it was pretty straightforward, relying on no inside information. And yet Polymarket opened the year with Harris' chances of winning the presidency at 3.2%. With hindsight, that was way too low. They would peak at 54%, and were still as high as 49% on the Saturday before the election — after which, of course, they dropped to zero. Had Hindsight only been allowed to sell at the top they could have made 1,700%: Bet on Crypto

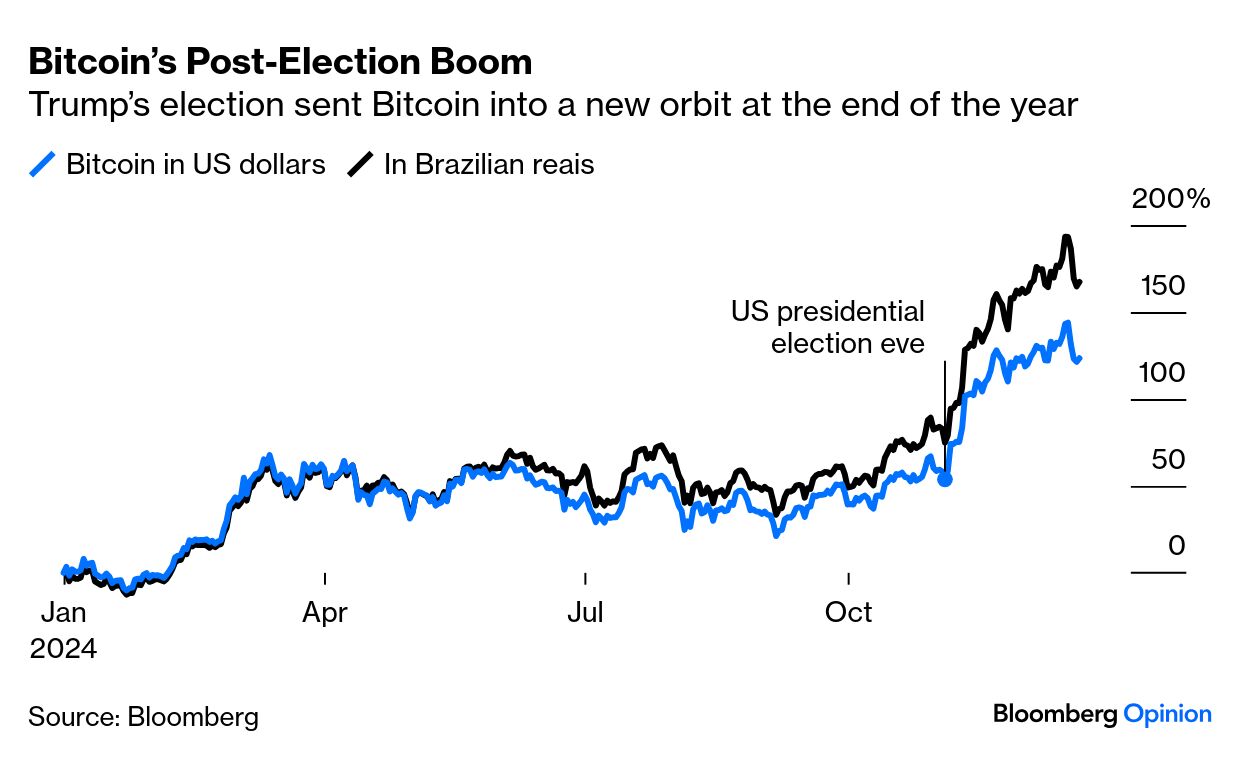

Buy Bitcoin (Up 144% in Dollars, 192% in Brazilian reais) Bitcoin has always been hugely volatile. Almost every year for the last decade, it's featured in Hindsight's winning trades, almost as often on the short side as on the long. This year dawned with crypto reeling from the collapse of FTX and the industry at loggerheads with the Securities and Exchange Commission. But it then won the right to offer Bitcoin exchange-traded funds, opening crypto to new investors, and continuing the steady institutionalization of what was originally supposed to be an asset that could cut out the traditional financial infrastructure. The point was to grasp that Trump was growing tightly enmeshed with the crypto bros, and that this would have a galvanizing effect once he won. The promise of looser regulation, and his plan for a governmental Bitcoin reserve (also antithetical to the original design of the project) would take crypto into the stratosphere once he got reelected. At the time of writing, Hindsight's Bitcoin holding has rallied by 118% for the year — and 161% when they juiced the trade by buying the cryptocurrency with the weak Brazilian real: The Border Wall Trade

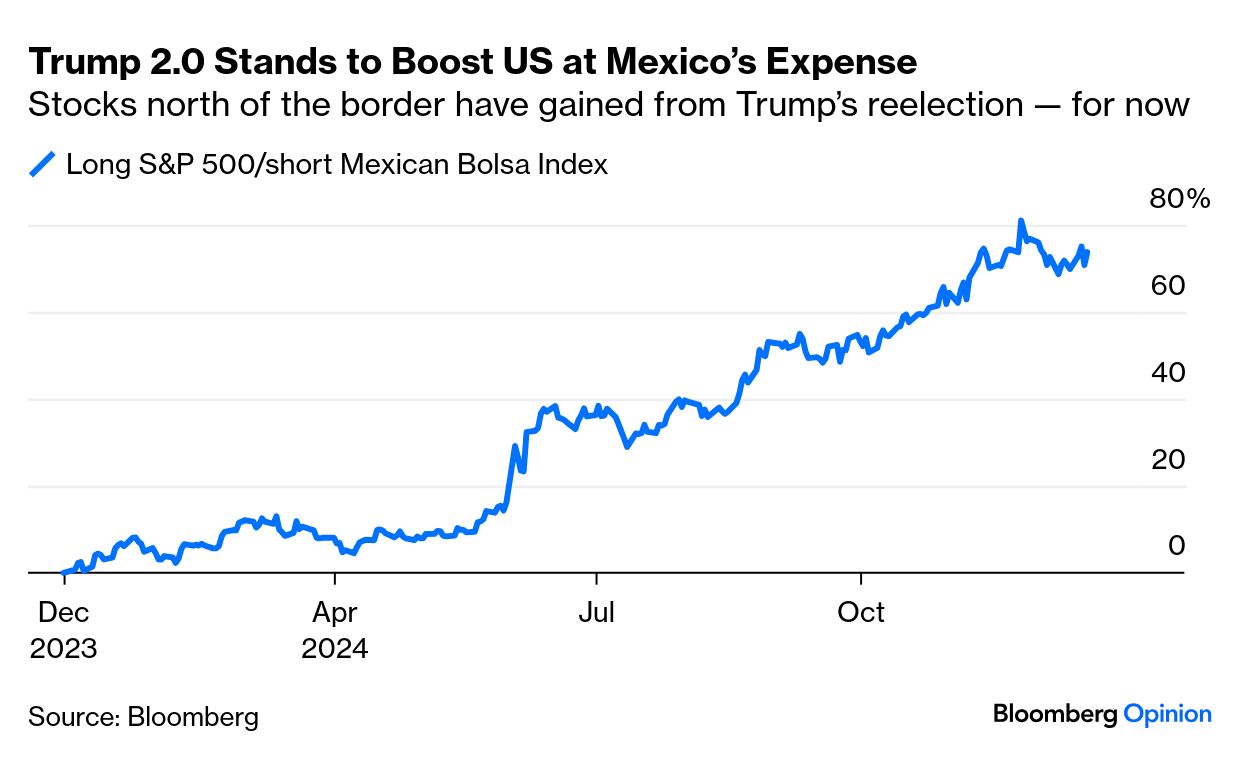

Buy US Stocks/Short Mexico Stocks (Up 64%) If you knew Trump was coming back then it made absolute sense to buy US stocks, bound to rally at the prospect of deregulation and corporate tax cuts. His key policy of tariffs dictated selling Mexican stocks. That intensified as Trump made clear that he wanted to stamp out "near-shoring" — moving production from China to Mexico — in favor of forcing companies to come to the US. The prospect that trade hostilities with China would prompt more businesses to bring manufacturing to Mexico had been a big reason for bullishness about the country, so this was very bad news. In addition, the Mexican peso entered the year wildly overvalued thanks to heavy speculation by traders looking to benefit from its high interest rates. And an election didn't help. Alone among incumbents in 2024, Mexico's ruling Morena party emerged with an even stronger mandate, including a supermajority in Congress, which was soon converted into constitutional changes that weakened the role of the courts. That scared investors (although it didn't surprise Hindsight). In dollar terms, the Mexican Bolsa index fell 26.9% for the year, while the S&P 500 gained 24.3%. Put them together and the trade returned 71%: Elon Shifts the Balance of Trade

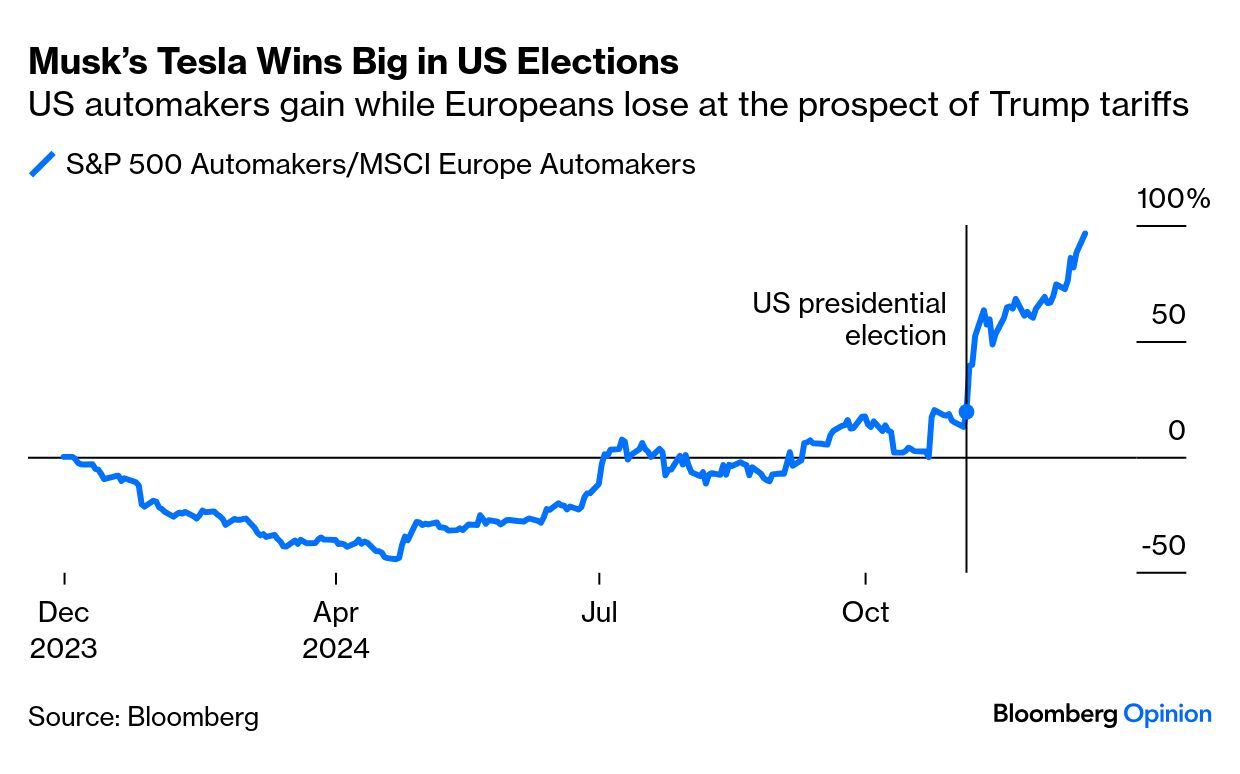

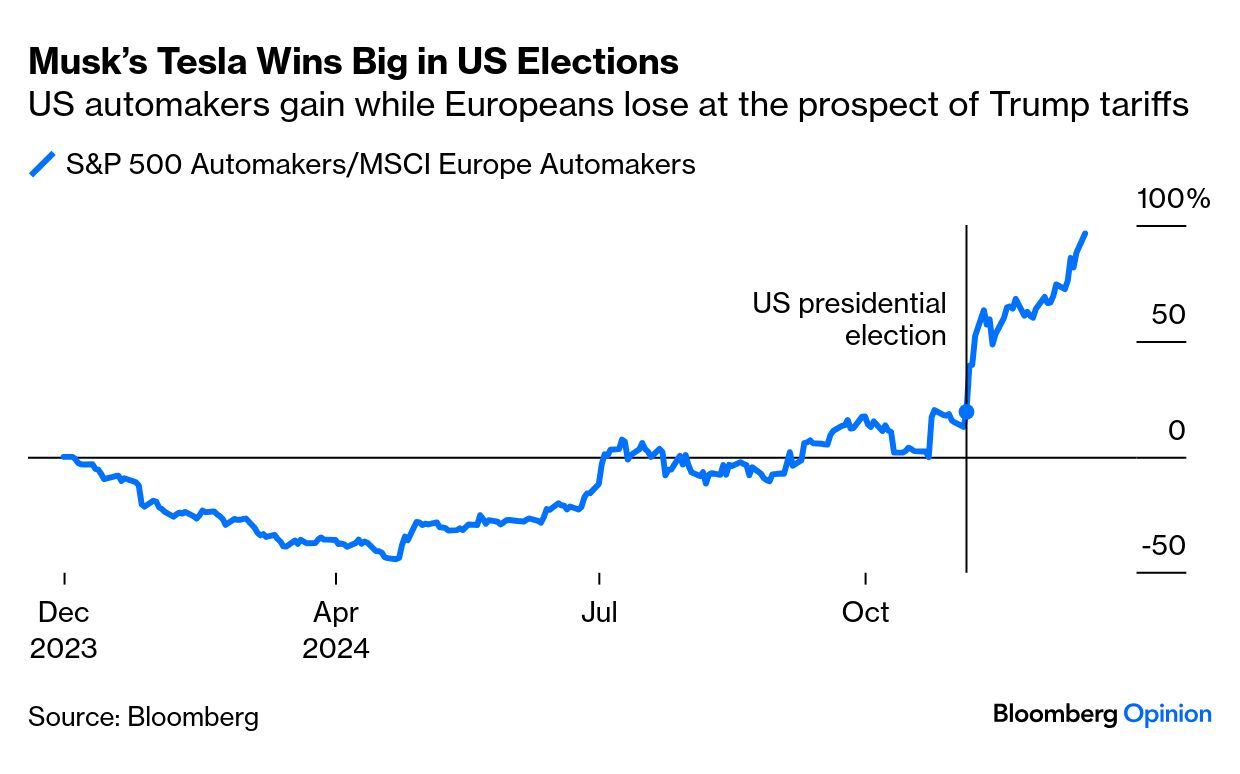

Long S&P 500 US Carmakers/Short MSCI Europe European Carmakers (Up 95%) Trump dislikes Europe, and is particularly concerned to protect the US car industry. He's also increasingly fond of Elon Musk, chief executive officer of what is now by far the largest US automaker by market capitalization, Tesla Inc. European manufacturers also had to contend with a sluggish economy at home, and difficulties selling their products to China. So an obvious trade on the Trump effect was to buy the S&P 500 Automakers index, of which Tesla now accounts for 97% (yes, you could argue that this was Hindsight finding a way around the prohibition on single stocks, but it was vital in 2024 to identify a route to profit from the phenomenon of Elon Musk), while shorting the MSCI Europe Automakers index. The US index rose 69%, while European carmakers were down 14%. Incredibly, all the gains from this trade came after the election, reflecting just how important a Trump victory was perceived to be. Hindsight's return was 95%:  China's Problems Drive the Metals Market

Buy Gold/Short Qingdao Chinese Iron Ore Futures (Up 76.3%) China has for the last quarter-century represented the critical marginal demand for industrial metals. When its economy is rolling, copper and iron ore prices rise. And vice versa. At the beginning of the year, China was in evident difficulty, as it tried to battle excessive debt from its property binge at home, and increasing hostility from the US that dampened its export business. In this environment, demand for iron ore was bound to suffer, and its price as set by its Qingdao benchmark dropped by 11%. Meanwhile, gold appears ever more attractive as a haven to wealthy Chinese, and to its central bank. Official gold reserves have risen 17% over the last two years, and have quintupled since the start of the century as the economy went into overdrive. Global geopolitical uncertainty, with the US-Chinese relationship at its center, boosted demand all year long. It's perceived as a way to hedge against what could be the very negative economic effects of an all-out trade war, and it gained a massive 57.7%, bringing the shiny metal to new highs. Put the trades together, and Hindsight made more than 75%: So you could have become extremely rich this year if only you had predicted US politics and its impact on everything else. But other things were happening. We'll explain how Hindsight Capital would have profited from them tomorrow. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment