| Bloomberg Evening Briefing Americas |

| |

| Recurring applications for US unemployment benefits rose to the highest in more than three years as it takes longer for out-of-work Americans to find a job. Continuing applications serve as a proxy for the number of people receiving benefits. Federal Reserve Chair Jerome Powell said last week that the labor market remains "in solid shape," though policymakers are keeping a close eye for any sign of deterioration. The labor market is cooling, but not in a way that would raise concerns, Powell said. Here's your market wrap. —David E. Rovella | |

What You Need to Know Today | |

| Russia was the focal point of much news this Christmas. Vladimir Putin launched a massive volley of missiles and drones at Ukraine as part of what's become an annual winter onslaught aimed at destroying the latter's energy infrastructure. Russia's holiday attack came as the war on Ukraine approaches its three-year anniversary. Aviation experts say the Russian military likely fired on a civilian airliner that subsequently crashed yesterday near the Caspian Sea, killing 38 people on board. If confirmed, the mid-air strike would bear similarities to the downing of Malaysia Airlines Flight 17 over Ukraine in 2014 that killed all 298 people aboard. Investigators established that a Russian missile was fired at the Boeing 777. And in the Baltic Sea, Finnish authorities boarded a Russia-linked foreign oil tanker, the Eagle S, after disruptions on a subsea power link and several data cables. On Christmas, a 170-kilometer (105-mile) subsea electricity line connecting Finland and Estonia reportedly went offline. Since then, four underwater data cables have also been experiencing disruptions. Eagle S is part of the Kremlin's shadow fleet, which transports Russian oil in violation of international sanctions. It's the third such incident in just over a year. Russia has denied any role in the attacks.  Emergency service workers at the site of a Russian attack in Ukraine on Christmas Day. Source: State Emergency Service of Ukraine | |

|

| Key rates tied to the US overnight bank funding market are rising despite a recent effort by the Federal Reserve to quash volatility. The Secured Overnight Financing Rate—an important one-day lending benchmark—jumped to 4.40% from 4.31%. Bank year-end balance-sheet constraints may be starting drive up the cost of overnight funding. The increased rates come at a critical moment, as Wall Street watches for signs of whether volatility in funding markets is extending beyond typical monthly or quarterly surges. | |

|

| Asked what makes Nissan a strong business partner, Honda Chief Executive Officer Toshihiro Mibe struggled to find the right words. "That's a difficult one," he said after announcing plans to bring the two automakers together. His reticence arguably speaks to lingering questions over why Honda would ever agree to a deal with Nissan, and what it could gain by folding the flailing Japanese carmaker into its business. The rapid rise of electric vehicles in China and in parts of Europe, coupled with a resurgence in the popularity of hybrids, is pushing legacy brands to band together. At the very least, by assuming Nissan's resources such as factories, manpower and intellectual property, Honda may gain access to the heft it needs to keep its own head above water. | |

|

| The US higher education industry appears to be responding to the intensifying backlash against exorbitant tuition costs. A handful of top US colleges are taking steps to boost financial aid for low and middle-income families as the soaring cost of attendance turbocharges anger with the sector. The University of Pennsylvania recently announced it will stop including a family's home equity when determining financial aid eligibility while at the Massachusetts Institute of Technology, undergraduates with families earning less than $100,000 can expect to get a full ride starting next fall. | |

|

| |

| Argentina's central bank on Thursday sold the most foreign reserves in one day since October 2019 after officials eliminated a key tax on imports, igniting corporate demand for dollars. The country sold $599 million in foreign exchange reserves, monetary authorities said in a social media post. The sale exposes some faults in President Javier Milei's attempt to rebuild the country's foreign reserves, which are essential to eventually lifting capital and currency controls next year. The buffer is money he can ill afford to lose, with payments on international bonds set to jump to some $9 billion in 2025—half of which come due next month. | |

|

| Alibaba Group Holding agreed to form a $4 billion joint venture for its South Korean operations with E-Mart's e-commerce platform to better compete in the country's online retail sector. AliExpress International and Gmarket are creating a 50-50 operation which will own 100% of Gmarket. Alibaba has been seeking to expand its international footprint to make up for slower growth in its core Chinese e-commerce business. The internet pioneer's domestic e-commerce operations reported anemic growth in the September quarter. | |

|

| Xi Jinping is fond of invoking stormy seas to describe the dangers China will confront in the years ahead, Minxin Pei writes in Bloomberg Opinion. Luckily for him, he has yet to encounter such extreme scenarios. A two-year economic slump may have stalled his goal of transforming his country into a superpower equal to the US. Still, he's managed to navigate a darkening geopolitical landscape without suffering a true calamity. But now, with Donald Trump reentering the White House, the Chinese leader's luck threatens to run out. He could face five simultaneous challenges that will determine China's trajectory for the remainder of the decade.  Xi Jinping Photographer: Ton Molina/Bloomberg | |

What You'll Need to Know Tomorrow | |

| |

| |

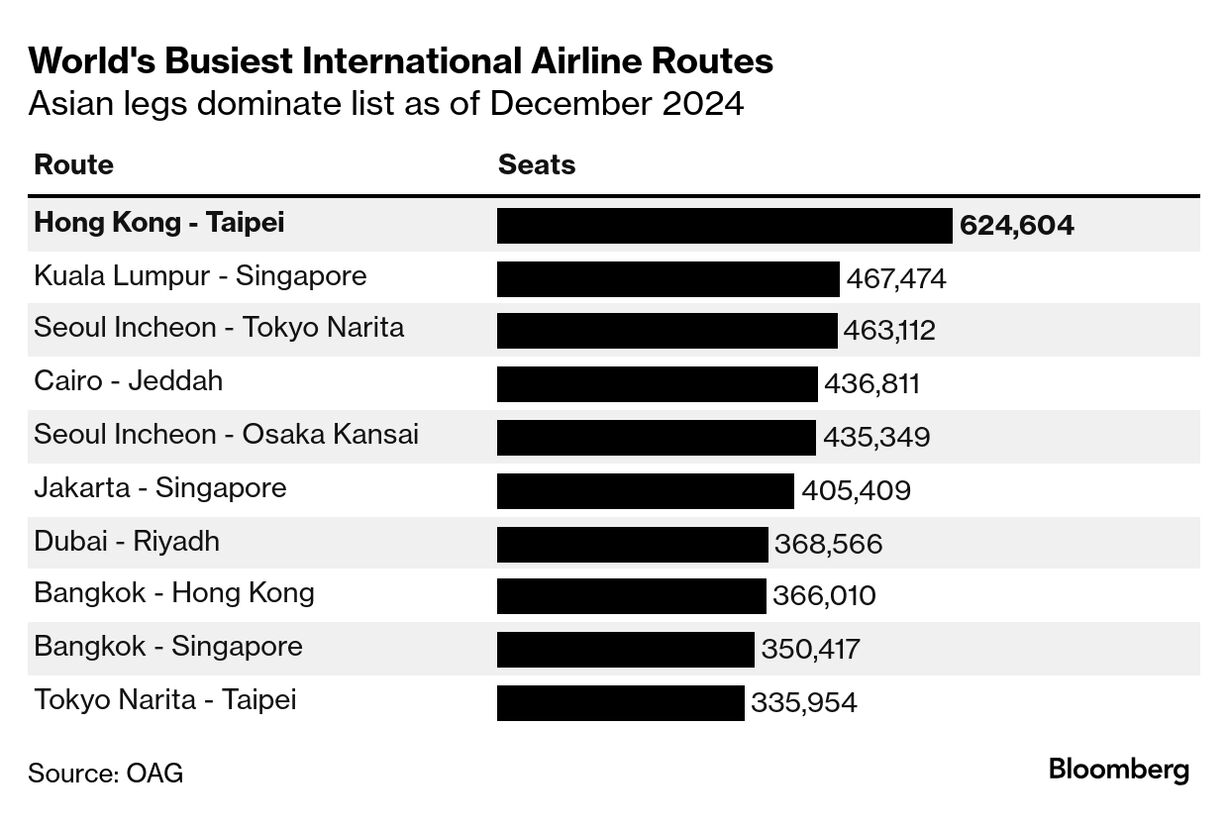

| International flights into Shanghai, Beijing and Hong Kong are set to jump in 2025, almost completing the cities' recoveries to pre-pandemic totals. It's a different story in the rest of the world as the industry navigates cost-of-living crises, broken supply chains and regional conflicts. Here's where you'll be flying in 2025. | |

| Bloomberg House at Davos: Against the backdrop of the World Economic Forum on Jan. 20-23, Bloomberg House will be an unparalleled hub where global leaders converge to chart a path forward. Join us for breakfast, afternoon tea or a cocktail. Meet thought leaders, listen to newsmakers, sit in on a podcast taping, have a candid conversation with our journalists and help us identify the trends that will impact the year ahead. Request an invite here. | |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment