| Bloomberg Evening Briefing Americas |

| |

| As sophisticated scams increasingly target the life savings of Americans, a more mundane effort is underway to steal from you. It's part of a little-noticed pattern popping up all across US banking—from towers in Manhattan to hubs in Florida and even suburban Louisiana. It seems the financial industry's lowest-paid employees keep getting caught selling sensitive customer information—your information—right out from under their boss's noses. This kind of 20th century scamming (even fake checks are involved) is fast emerging as a critical area of weakness in bank risk controls, which is kind of ironic given the traditional (and continuing) messaging from the bank lobby. The industry has long sought to remind the public that the customers themselves (and certainly not the banks) are the ones primarily responsible for ensuring they don't get ripped off. —David E. Rovella | |

What You Need to Know Today | |

| BlackRock's iShares unit offers more than 1,400 exchange-traded funds around the world, yet none of them have performed quite like this. The iShares Bitcoin Trust (IBIT) smashed industry records in its launch this year. In just 11 months, it grew to a behemoth with more than $50 billion in assets. No ETF has ever had a better debut. One industry expert notes that its size swelled to the equivalent of the combined assets under management of more than 50 European market-focused ETFs. Nate Geraci, president of advisory firm The ETF Store, called it "the greatest launch in ETF history." Yet IBIT's success was about more than just racking up big numbers for BlackRock. It proved to be a turning point for Bitcoin itself. | |

|

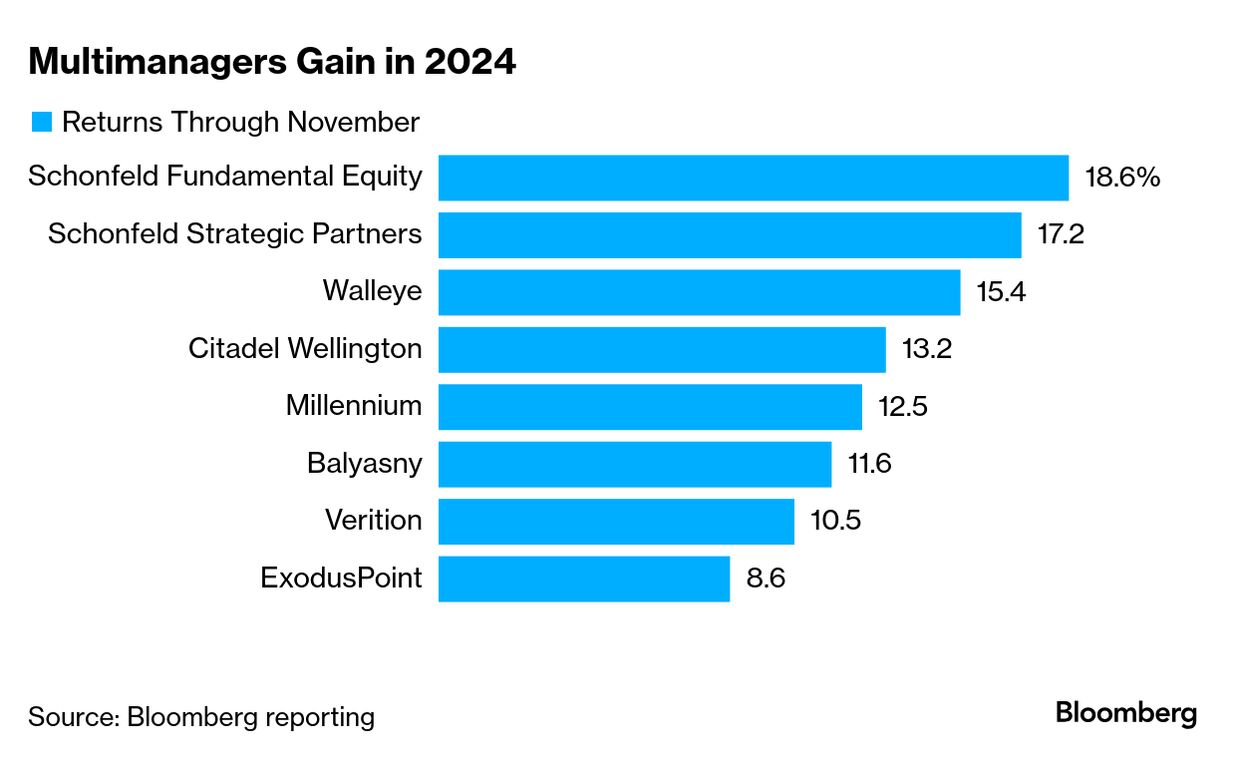

| Citadel founder Ken Griffin was only half right when he said the multistrategy hedge fund boom had "come and gone." Yes, the amount of money these multimanager funds oversee has dipped from last year—partly because some (including Citadel) have returned billions of dollars of profits to clients. But the firms, also known as "pod shops," are actually still in their heyday—and several rank among the world's largest hedge funds. Demand for the biggest among them is strong, performance improved this year and the war for talent to trade their billions of dollars continues to rage. | |

|

| For a crushed commercial real estate market, 2024 was actually a year of diverging fortunes. Some office landlords in the US, facing plunging valuations, struck deals to sell properties they no longer wanted—often at steep price cuts—while scoring new equity investments on high-quality towers. Overall, office sales volume for the year through November jumped 17% from the same period a year earlier. But insight can be drawn from the top deals of the year—from a stake sale in a trophy Manhattan office tower to a distressed offloading of Pacific Corporate Towers in California. With $300 billion of debt in need of refinancing in the next 12 months, landlords can use all the lessons they can get. | |

|

| A Chinese state-sponsored actor hacked the US Treasury, the agency told Congress Monday, saying a third-party software service provider was used as a conduit. "On Dec. 8, 2024, Treasury was notified by a third-party software service provider, BeyondTrust, that a threat actor had gained access to a key used by the vendor to secure a cloud-based service used to remotely provide technical support for Treasury Departmental Offices (DO) end users," according to the letter seen by Bloomberg News. "Based on available indicators, the incident has been attributed to a China state-sponsored Advanced Persistent Threat (APT) actor." The news comes just days after AT&T and Verizon acknowledged that they'd been hit by the China-linked Salt Typhoon hacking operation. | |

|

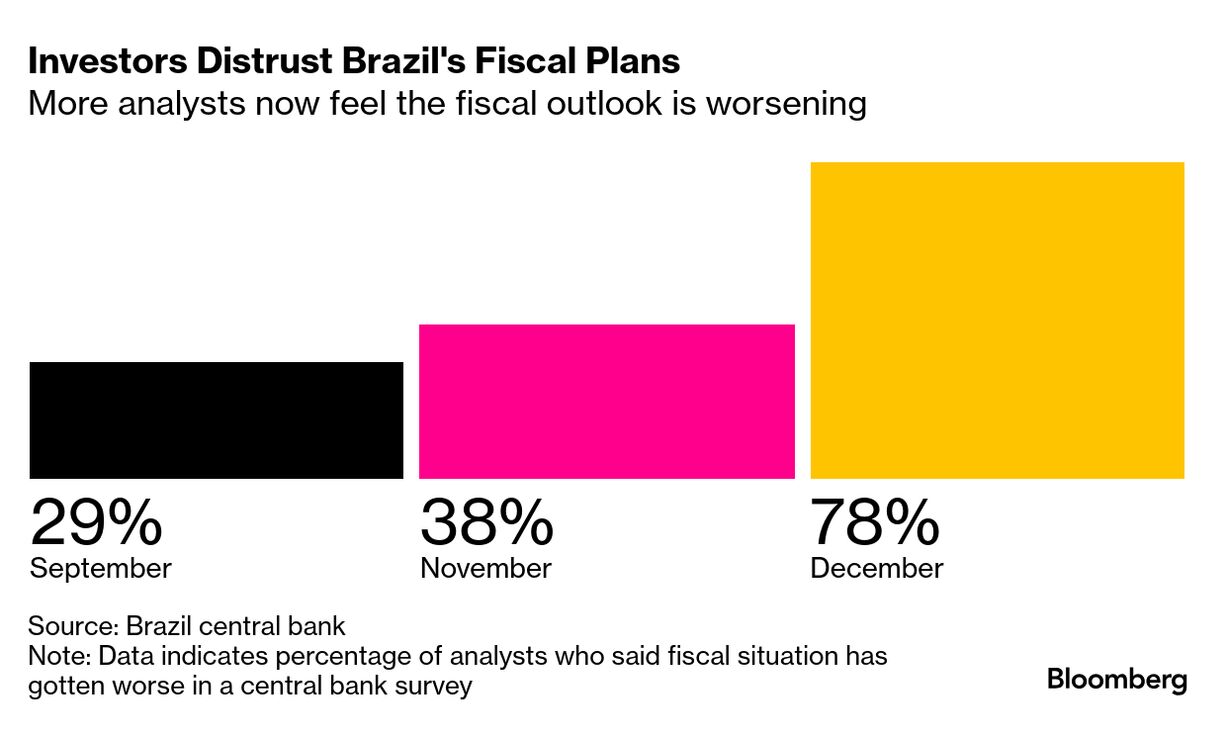

| Brazilian assets finished the year lagging all major peers, with the real posting its biggest slump since the pandemic shock of 2020. The real weakened 21% against the US dollar this year, the worst among 31 major currencies alongside Argentina's tightly controlled peso. Losses accelerated in November after a long-awaited government fiscal package failed to earn investor support. Not even a historic intervention by the central bank—spending some $20 billion in reserves in two weeks—has been able to reverse the rout. The monetary authority stepped in again on Monday, the last trading session of the year for local assets, selling about $1.8 billion in the spot market. | |

|

| The Adani Group will exit its 44% holding in consumer joint-venture Adani Wilmar and use the cash to bolster its main businesses. The sale comes amid legal challenges facing the Indian conglomerate's indicted billionaire founder, Gautam Adani. The US alleges he played a part in a bribery scheme to win contracts in India. Ratings companies have cited the allegations as a potential risk to fundraising for the group. But the prosecution hasn't just renewed scrutiny on Adani Group's corporate governance, it's also made it trickier for it to tap markets, and that could lead to asset sales. | |

|

| In 2006, Jimmy Carter published a best-selling book on Palestine with the word "apartheid" in the title. Then he went on a whirlwind book tour, captured on film by Jonathan Demme, to promote it. Carter spoke, signed books and calmly rebutted criticism and attacks with his trademark Sunday-school demeanor. Allies, including Nancy Pelosi, then on the verge of becoming Speaker of the House, were annoyed. Enemies were livid. As for Carter, Francis Wilkinson writes in Bloomberg Opinion, he was 82 years old and itching for a fight that mattered.  Former US President Jimmy Carter died on Sunday at the age of 100. Photographer: Photograph: AP Photo/AP | |

What You'll Need to Know Tomorrow | |

| |

| |

| In the 2010s, US nuclear plants were struggling to compete against cheap natural gas and renewable energy sources. But the intensifying threat of climate change and the rise of energy-hungry artificial intelligence have changed the conversation. To bridge the gap to a carbon-free future, America is considering building out its atomic power industry. Bloomberg Originals explores how the US nuclear power sector, like a huge battleship slow to turn, may be about to steam ahead.  Why Nuclear Energy is Making a Comeback by Bloomberg Originals | |

| Bloomberg House at Davos: Against the backdrop of the World Economic Forum on Jan. 20-23, Bloomberg House will be an unparalleled hub where global leaders converge to chart a path forward. Join us for breakfast, afternoon tea or a cocktail. Meet thought leaders, listen to newsmakers, sit in on a podcast taping, have a candid conversation with our journalists and help us identify the trends that will impact the year ahead. Request an invite here. | |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment