| Bloomberg Evening Briefing Americas |

| |

| The renewed threat of a dockworker strike paralyzing a chunk of America's seaborne shipping appeared on Tuesday when Maersk, the world's No. 2 container carrier, urged its customers to remove cargo from US ports along the East and Gulf coasts before a Jan. 15 deadline. "If no agreement is reached by that date, a coast-wide strike on Jan. 16 is possible," the Copenhagen-based company warned. For the past 2 ½ months, the 47,000-member International Longshoremen's Association, which represents cargo handlers at every major eastern and southern port, has been trying to negotiate a new contract with the United States Maritime Alliance, a group of shipping lines and terminal operators that employ them. In early October, with warnings of potential shortages from a work stoppage, American consumers began to panic. But the two sides reached a temporary deal, agreeing to a 62% wage increase over six years while leaving unresolved the more existential issue of automation. Well, a three-month delay is coming to an end, and the talks appear to have gone nowhere. —David E. Rovella | |

What You Need to Know Today | |

| European natural gas prices soared as an even earlier deadline arrives. Russian flows to the region via Ukraine could be cut as of this writing, given that a fuel transit deal inked before Russia's full-scale invasion is set to expire overnight. Initial orders for gas at the Sudzha intake station on the Russia-Ukraine border were set for zero as of the new year, according to data published by Ukraine's gas-transit network operator. The disintegration of the deal between the warring nations has highlighted Europe's continued reliance on Russian gas via pipelines and shipments of liquefied fuel, as well as the cracks in the bloc's approach to weaning itself off Russian supplies. | |

|

| Nearly all of Puerto Rico was without power Tuesday after its fragile electricity grid collapsed, triggering an island-wide blackout. The power outage started early in the morning and, by midday, about 85% of Puerto Rico's 1.4 million customers remained without electricity, according to Luma Energy, the private company that operates the system. Luma said power was being restored in some areas, including hospitals, but officials said it may take 24 to 48 hours to fully resume service.  Joggers on a dark street in San Juan, Puerto Rico, on Dec. 31. Photographer: Ricardo Arduengo/AFP/Getty Images | |

|

| Mazda Motor Corp. is wrapping up a banner year in an overall sluggish auto market, and its US sales chief expects that momentum to extend into 2025—all without offering an electric car. Buoyed by demand for its gasoline-powered compact crossovers and mid-size SUVs, the Japanese company is on track to deliver more than 420,000 vehicles in 2024, a 16% rise, said Tom Donnelly, president of Mazda's North American operations, breaking a record set in 1986. It aims to sell 450,000 vehicles in 2025, he said. | |

|

| It was the club every Wall Street institution wanted to join: the elite network of primary dealers who serve as gatekeepers to the world's biggest and most influential bond market: US Treasuries. Formed in 1960 to ensure the smooth functioning of a market that's since grown to almost $29 trillion and is a benchmark for setting borrowing costs across the world, the club was as rarified as it gets. But not so much anymore. Just as America's debt load is poised to balloon beyond already-record levels, a variety of forces has made membership in this club much less coveted. | |

|

| Dollar bonds from some of the world's weakest economies have emerged as the bright spot in what's otherwise been yet another lackluster year for emerging-market assets. While many developing-world assets are ending the year with gains, their returns pale in comparison to those on Wall Street. Among emerging currencies tracked by Bloomberg, only three have managed to strengthen in the face of a rising US dollar. | |

|

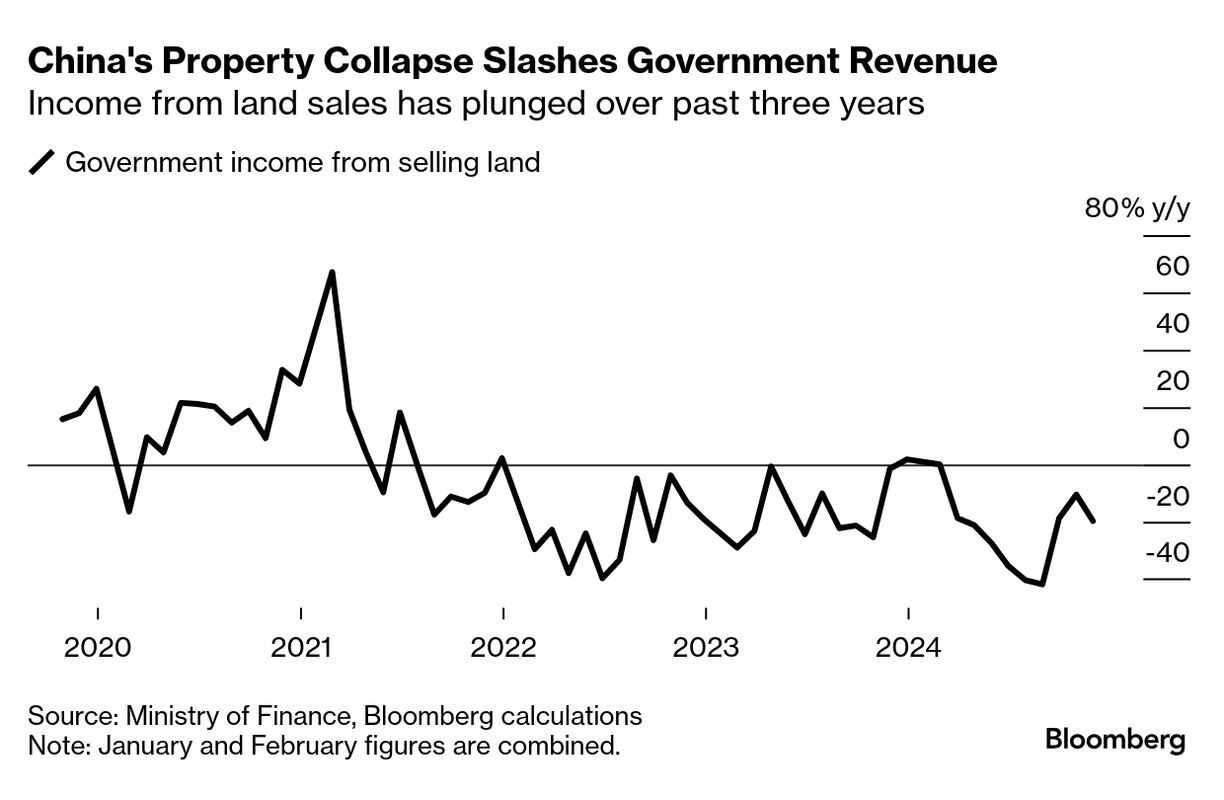

| China's gross domestic product is expected to expand around 5% for the full year of 2024, according to Xi Jinping, meeting its official target. While a precise figure won't be available until next month, the Chinese leader's pronouncement capped off a year of significant economic uncertainty for his country, with the goal initially seen as a "target without a plan." The outlook for 2024 improved however after policymakers rolled out a slew of stimulus steps beginning in late September. Economists now forecast an expansion of 4.8% this year. Still, China's economy remains burdened by weak domestic demand and an uncertain outlook for exports, which has been a key growth driver this year. Deflation is likely to persist well into next year, while the property market is still slumping. | |

|

| The US Federal Reserve has begun one of its reviews of "monetary policy strategy, tools and communications." December's rate cut and investor reaction to it underline why such a review is needed, Clive Crook writes in Bloomberg Opinion. First, the Fed cut 25 basis points from the policy rate. Second, it said progress in curbing inflation was going more slowly than expected. Third, it projected fewer rate cuts next year. Investors saw this combination as a "hawkish pivot," meaning a tightening of policy despite the rate cut, and predictably dumped shares. Though Crook volunteers that the Fed's "soft landing" strategy has been going well, the way the Fed signals and executes changes in policy is making a difficult job harder than it needs to be. | |

What You'll Need to Know Tomorrow | |

| |

| |

| Speaking of Miami, have you ever wondered why this Florida city has some of the most iconic architecture in America? Would it surprise you that one firm in particular is behind a lot of it? Some 200 projects by the architecture firm Arquitectonica—over a third of its portfolio—are located in Miami-Dade County or nearby. Fourteen of Miami's 50 tallest buildings also are among the firm's designs. It seems the architects at this one firm have been defining the image of this world famous cityfor four decades.  The Atlantis, the project that put Arquitectonica on the map. Photographer: Courtesy of Arquitectonica | |

| Bloomberg Evening Briefing Americas will return on Jan. 2. Bloomberg House at Davos: Against the backdrop of the World Economic Forum on Jan. 20-23, Bloomberg House will be an unparalleled hub where global leaders converge to chart a path forward. Join us for breakfast, afternoon tea or a cocktail. Meet thought leaders, listen to newsmakers, sit in on a podcast taping, have a candid conversation with our journalists and help us identify the trends that will impact the year ahead. Request an invite here. | |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment