| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Programming note: We'll break for New Year's Eve and New Year's Day, and be back in your inbox Thursday, Jan. 2. Many Frowns to Turn Upside-Down | Stellantis Chairman John Elkann began the month by parting ways with Carlos Tavares, the automaker's first and only chief executive officer. As December wore on, Elkann may well have made the second CEO's job all the more difficult. The Agnelli family scion spent the weeks after Tavares' resignation attempting to patch things up with some of Stellantis' most important constituents: - On Dec. 16, Elkann was in Paris to reassure French President Emmanuel Macron about the Peugeot and Citroën maker's future.

- The next day, it was Italy's turn — Stellantis vowed to replenish each of its factories in the country with new Fiat, Alfa Romeo and Lancia models to make within the next few years.

- Then, it was on to Germany, where Elkann reaffirmed the company's commitment to Rüsselsheim, which has been manufacturing Opel automobiles for 125 years.

- By week's end, Stellantis announced a reprieve for roughly 1,100 workers at a Jeep plant in Toledo, Ohio, who were poised to be laid off indefinitely early next month.

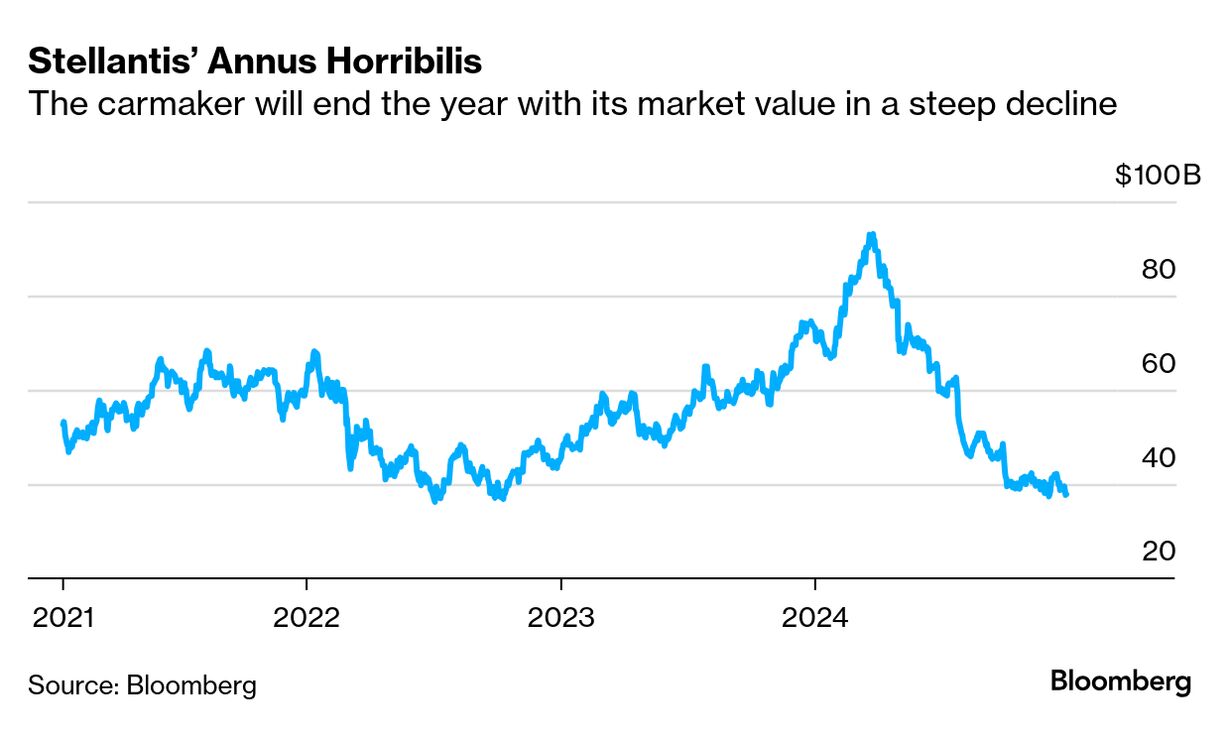

Elkann, left, and Tavares at the May 2023 inauguration of a battery factory in Douvrin, France. Photographer: Nathan Laine/Bloomberg Smoothing-over efforts were badly needed after Tavares clashed with politicians, dealers, suppliers and Stellantis employees in the months leading up to his exit. But for all his survival-of-the-fittest rhetoric, Tavares largely stopped short of some of the most difficult judgment calls expected of a CEO. With the notable exception of announcing plans in late November to close a Vauxhall factory in the UK, Stellantis has mostly avoided shutting down or selling off assets. While making such moves may be necessary in an increasingly competitive and challenging time for the industry — 14 brands is, after all, an awful lot of mouths to feed — Elkann's charm offensive would seem to take many options off the table. "The next CEO will have to win the support of different governments and of various other stakeholders while improving performance. It will be no easy task," says Alexandre Marian, partner and managing director at AlixPartners. "The countries where it has a presence will all push for local investments and the automotive environment is extremely difficult at the moment." The whole conceit behind combining Italian-American manufacturer Fiat Chrysler with French carmaker PSA Group was that bigger would be better at a time of transition for the auto industry — one where vehicles increasingly would be powered by batteries and software, rather than internal combustion engines. But almost four years after the megamerger, the theory that there would be strength in numbers and geographic diversity in the midst of immense change is running up against staunch national interests. In Italy, Elkann has been under pressure to stem a car-production plunge that has the group's roughly 40,000 local employees on edge. Even after Stellantis offered detailed plans for all Italian plants to remain active for years to come, Elkann will face further questioning next month at a parliamentary hearing in Rome. In the US, Bernie Moreno, the Ohio auto dealer elected to join the Senate in January, is urging Elkann to divest Jeep, Ram, Dodge and Chrysler, saying the brands belong back in the hands of American ownership. President-elect Donald Trump and his VP-to-be JD Vance, who also happens to hail from Ohio, are unlikely to be receptive to any further restructuring of US operations. And finally, in France, Macron is navigating a bitterly divided political landscape and can ill afford any paring back by a major job provider. "It's important that France doesn't get forgotten," the Force Ouvriere labor union wrote in a Dec. 18 letter distributed internally within Stellantis. "French plants must maintain a level of activity that can guarantee employments." For the time being, balancing these varied interests falls to a 10-person interim executive committee headed by Elkann. Whoever is tapped sometime in the first half of next year to be CEO will face the seemingly possible task of staying aligned with all these stakeholders, fresh off the chairman's tour to restore confidence. Good luck, bonne chance and buona fortuna. — By Albertina Torsoli  Container ships berthed at the Yangshan Deepwater Port in Shanghai on Oct. 10. Photographer: Qilai Shen/Bloomberg Across the world, businesses aren't waiting until Inauguration Day in the US to see which countries, products or tariff rates are announced in Donald Trump's widely telegraphed trade wars. The mere threat of his universal tariffs is sparking a scramble that's leaving the global trading system prone to bottlenecks, saddled with higher costs and vulnerable to disruptions should an economic shock come along. "We're still in the freakout period," said Robert Krieger, president of Los Angeles-based customs brokerage and logistics advisory firm Krieger Worldwide. "There's about to be a king tide in the supply chain." |

No comments:

Post a Comment