| Wall Street and the Federal Reserve haven't exactly been in lockstep in recent years.

Investors mostly failed to forecast how high interest rates would go after the pandemic and then thought they would be cut much faster than they were.

But those paid to predict the bond market may be taking their cues from the central bank into 2025.

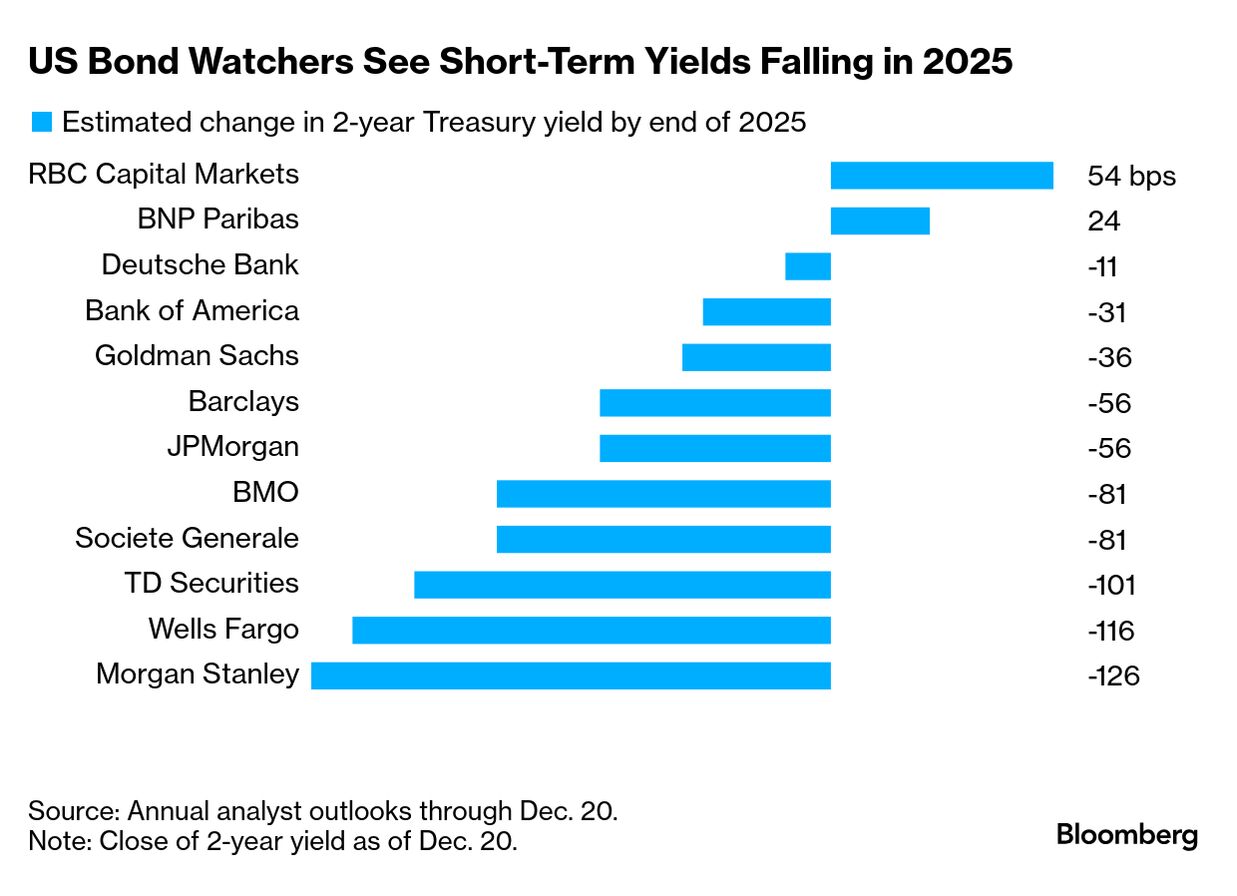

Strategists at major banks envisage short-term US Treasury yields dropping over the year, despite the risk President-elect Donald Trump's trade and tax policies play havoc with such predictions by reigniting inflation.

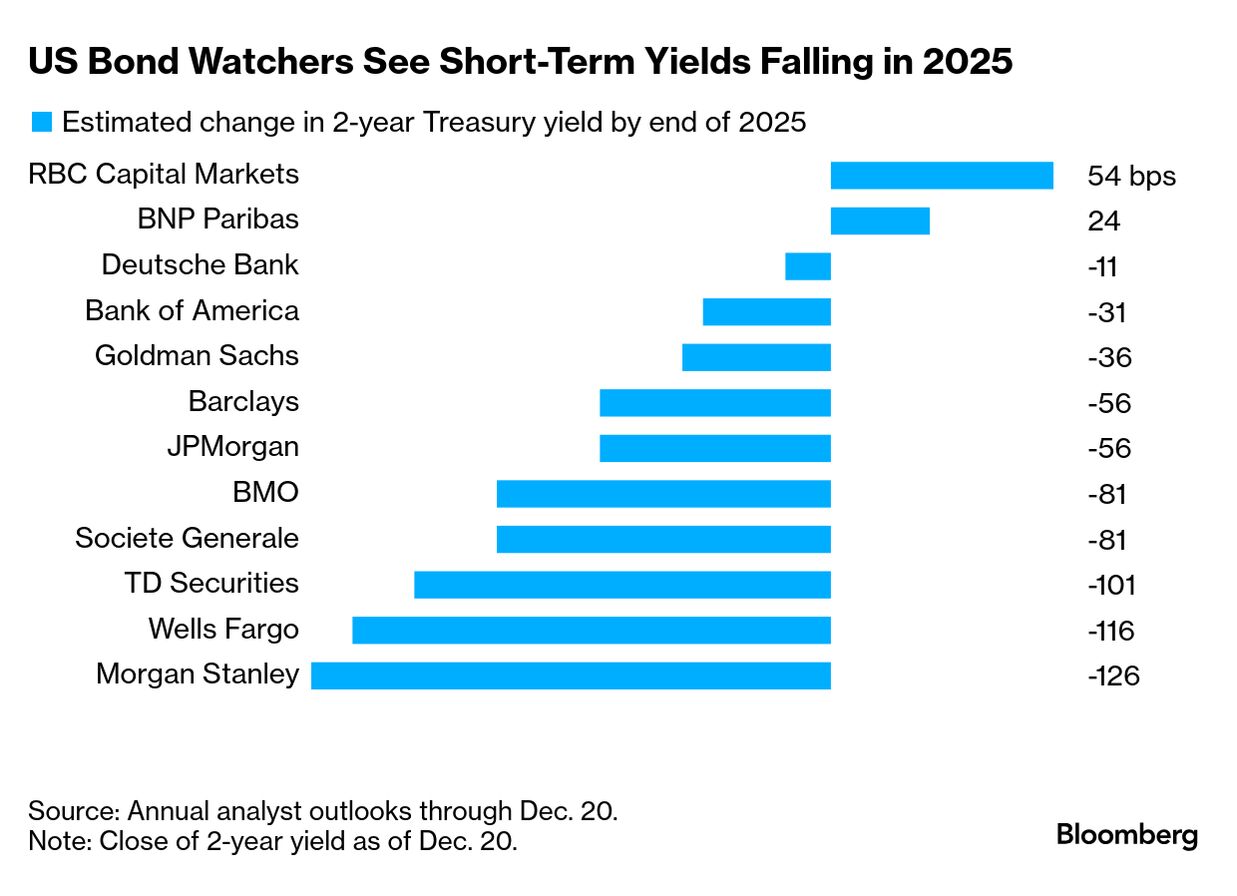

Market-watchers are readying for a drop in the two-year Treasury note's yield, which is more sensitive to the Fed's interest-rate policy. They see a decline of at least half a percentage point from the current level 12 months from now.  "While investors are likely to be myopically focused on the pace and magnitude of rate cuts next year, investors should take a step back and recognize that the Fed is still in cutting mode in 2025," a JPMorgan Asset Management team led by David Kelly said in the firm's annual outlook. Still, the Fed signaled fewer rate reductions next year at its meeting this month which could still complicate the path for yields. Estimating how long-term borrowing costs will fare in the year ahead is perhaps even trickier. "Even as the Fed is likely to continue lowering the policy rate, pulling front-end yields lower, many of the forces that argue for longer-term yields to remain elevated are still in place: a high neutral rate, elevated rate volatility, the inflation risk premium, and large net issuance amid price-sensitive demand," a Barclays team led by Anshul Pradhan wrote in a note. For now, Morgan Stanley and Deutsche Bank are among the most bullish and bearish, respectively, on the bond market. Morgan Stanley sees "downside risks to growth" and an "unexpected bull market" for investors.

Anticipating a speedier pace of Fed rate cuts than other banks, the firm expects the 10-year yield to fall to 3.55% next December. At Deutsche Bank, which forecasts no Fed cuts in 2025, the team led by Matthew Raskin is looking for the 10-year yield to rise to 4.65% on strong growth, low employment and stickier inflation. — Carter Johnson |

No comments:

Post a Comment