How Hindsight Capital Dealt With a World in Turmoil | Welcome back to our annual rundown of the trades put on at the beginning of the year by Hindsight Capital LLC, an imaginary hedge fund that has the gift of knowing how the year would work out in advance. This is not a totally serious exercise, and you can find all the assumptions we made here. However, it's always interesting to look at the wins that could have been had with hindsight, and examine whether it would've been possible to identify them in real time. Nobody should ever expect to make as much money as the bold risktakers at Hindsight. They have no need to hedge against the risk that they might be wrong. The rest of us have to recognize our own fallibility and hedge our bets. With that said, here are the remaining trades they entered into in 2024, most of which are not directly tied to US politics, but did very much benefit from turmoil the world over. Boosting the Immaterial World

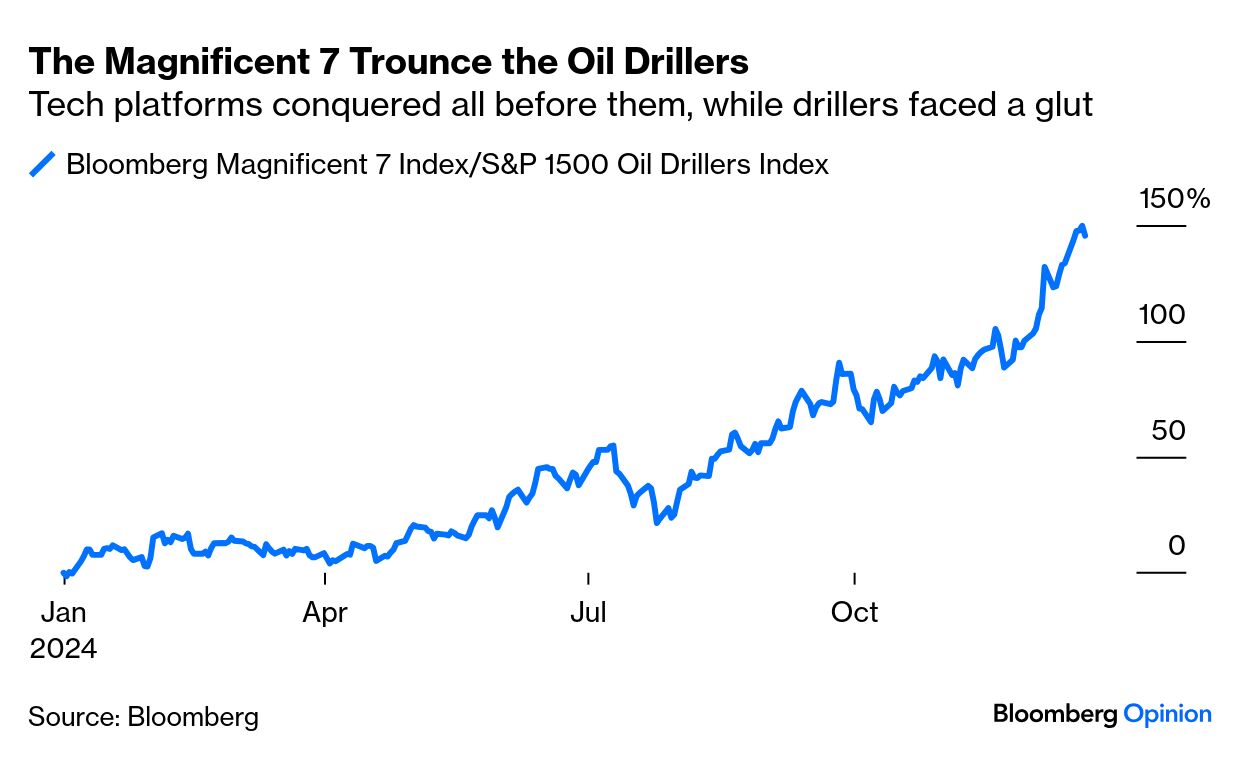

Buy the Magnificent 7/Short Oil Drillers (Up 148.5%) The Magnificent 7 were already a phenomenon as the year started. The giant tech companies — Apple Inc., Amazon.com Inc., Alphabet Inc., Meta Platforms Inc., Microsoft Corp., Nvidia Corp., and Tesla Inc. — are all in growth markets, and have built dominant platforms that have allowed them to sell more products and do so globally. Optimism about artificial intelligence combined with hopes that Trump 2.0 would lessen the regulatory attention on them to drive another massive year of returns. There is money in entrenched monopolies with low fixed costs, and the Magnificent 7 made 70.1%. Meanwhile, geopolitical turmoil failed to dent the supply of oil, at the same time that demand grew ever more anemic. The firms that effectively have the most leveraged exposure to the oil price are the drillers; they have big costs, and if supply isn't increased, they have no business. The excitement over "Drill, baby drill!" under Trump 2.0 is overdone, and pushing down the oil price by boosting supply seems as though it should be a low priority. That at least might be the message from the S&P 1500 oil drillers' index, which fell 29.3%. Put the two trades together, and Hindsight made 140.6%: Europe's Fracturing Core

Buy 5-Year Insurance Against French Default/Sell 5-Year Insurance Against a German Default (Up 101%) Entering the year, right-wing populist movements were growing ever stronger across Europe, and the center-left leaders of France and Germany, the nations at the heart of the continent, were palpably weak. They also had diverging fiscal issues. France's deficit had grown infeasibly deep, even ahead of putting on the Paris Olympics. Germany had written a "debt brake" into its constitution in 2009 in an attempt to thwart future crises, but that left it with little way to spur growth. Therefore, the trade was to buy protection against a French default through credit default swaps, while selling protection against German default. Once French President Emmanuel Macron made the disastrous call for legislative elections in July, which resulted in a parliament hopelessly hamstrung and divided between three roughly equal blocs, market angst went through the roof. Setting the budget looked an insuperable obstacle, and indeed when Michel Barnier, Macron's first appointment as prime minister, tried to negotiate a budget, he swiftly lost his job in a vote of no confidence. Not surprisingly, the cost of French default insurance rose 62% on the year. Meanwhile Germany, whose greatest problem seems to be fiscal tentativeness, is much cheaper to insure. The price of insurance dropped by more than 50% at one point, and ended the year down 17% as worries about the political situation set in. Up more than 150% at one point, the trade was still ahead 94.7% at year's end:  Brazilian Money Illusion

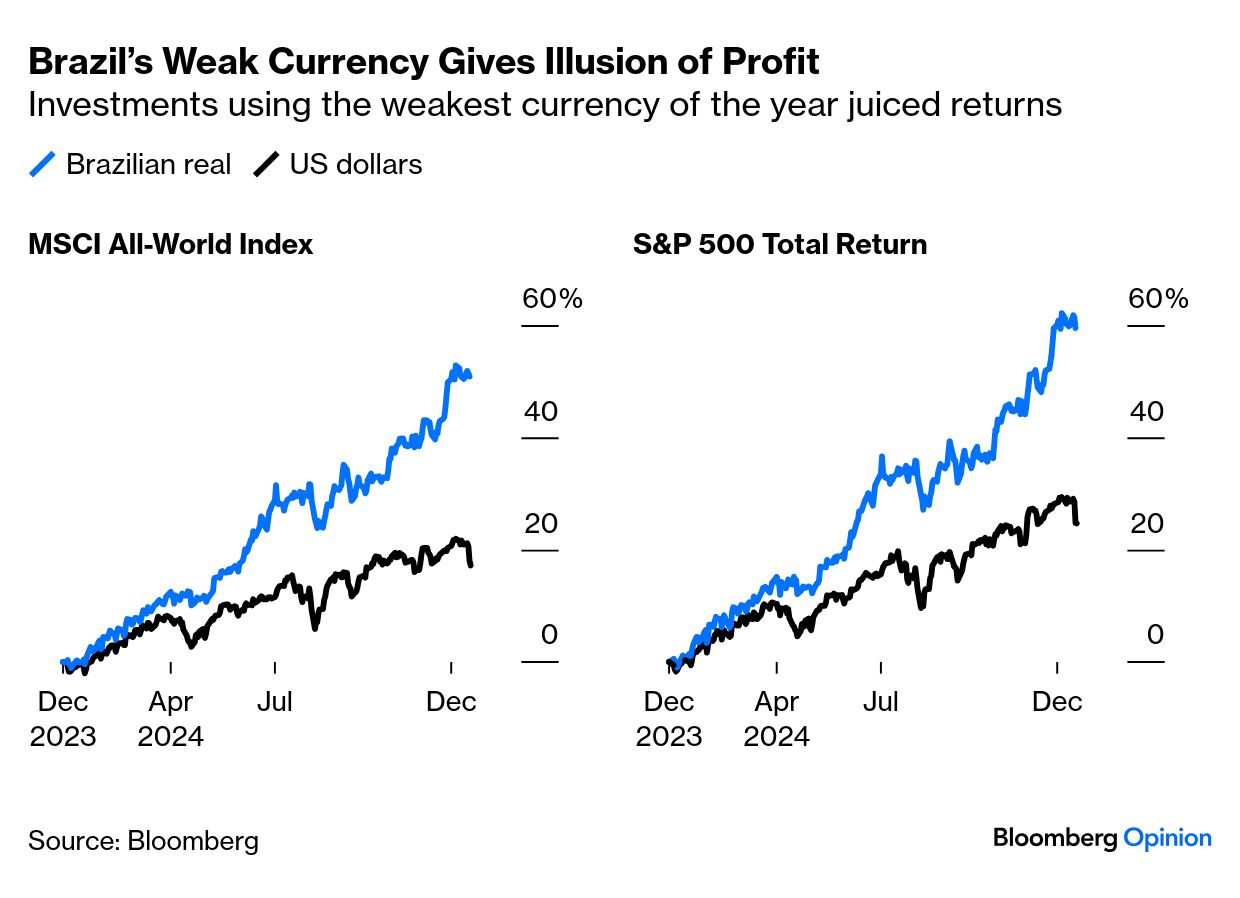

Relocate to Brazil: World Stocks Up 51% in Reais, S&P 500 Up 60% Hindsight's money managers are well traveled, as they grasp the power of money illusion. Denominate your returns in a weak currency, and you automatically make them look much better. In 2024, that meant they headed to Rio de Janeiro. Brazil's real had for years enjoyed excessive returns thanks to the carry trade — the practice of borrowing in low-rate currencies like the yen, parking it in jurisdictions with higher rates, and pocketing the difference. During 2022 and 2023, Bloomberg's index of the yen/real carry trade more than doubled, leaving Brazil's currency hopelessly overvalued and ready for a fall. Hindsight also noted that the country's deficit had risen sharply during 2023, left-wing president Luiz Inacio Lula da Silva's first year back in power, and that this also spelled trouble, while the central bank was already cutting rates. Betting against the real was an obvious call, and it worked spectacularly as Brazil's currency and bond markets drifted into crisis at the end of the year. It fell 20% against the dollar, meaning that the S&P 500 in real terms made a total return of 59.4%. In dollars, this was just 24.7%. For global stocks, the effect was similarly dramatic, with the gain increasing from less than 20% in dollars to more than 50%: The Beans Bonanza

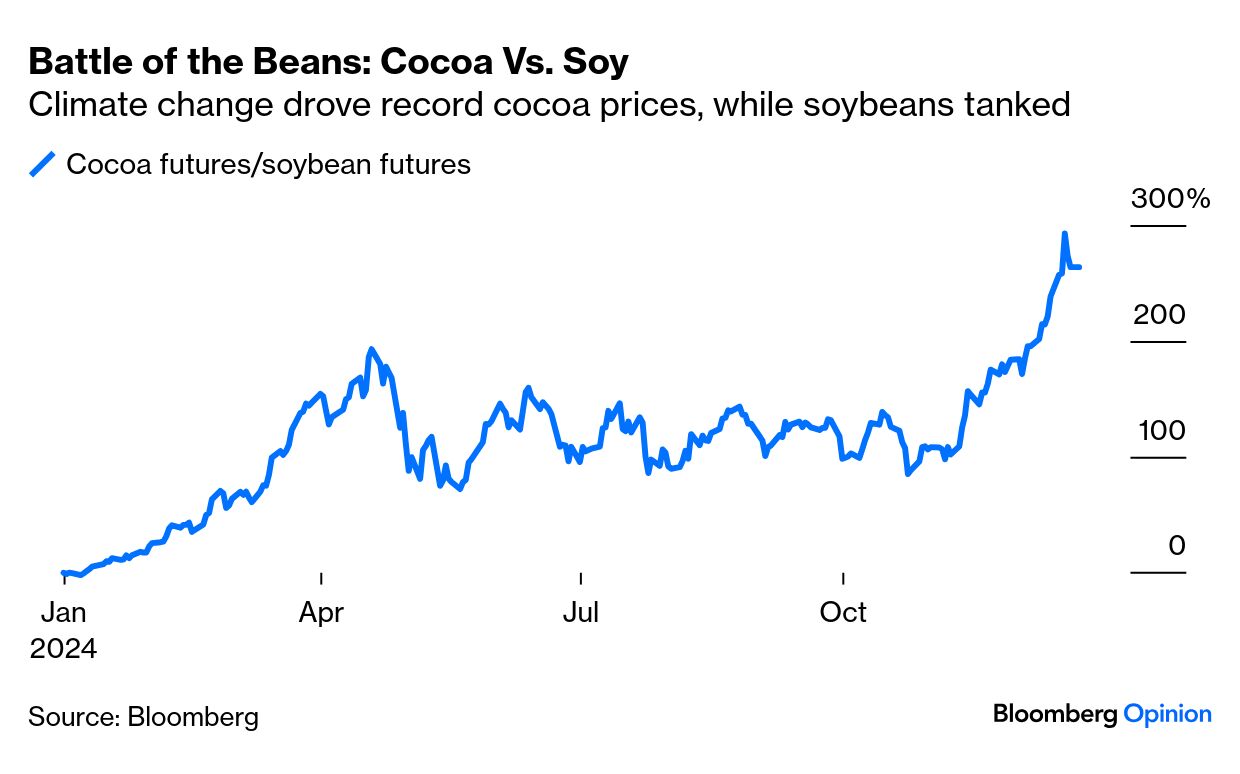

Buy Cocoa Futures and Short Soybeans (Up 242%) In agricultural commodities, climate change created a great opportunity. Global warming doesn't have the same effect on all crops. In the world's breadbaskets, such as the US heartland, a long and warm summer helped create a bumper crop in a range of agricultural staples, led by soybeans. That's bad news for anyone betting on their price, as it increases supply without altering demand. The Chicago Board of Trade's benchmark soybean contract dropped 25.7% for the year. The story for cocoa was the polar opposite. Most world production comes from the West African nations of Cote d'Ivoire and Ghana, where higher temperatures and lack of rain contributed to a very bad harvest. That was meteorologically predictable, and compounded by spreading crop diseases. Equally predictable, at least to Hindsight, was that commodity traders would be able to exploit the situation. Producers had hedged themselves by shorting cocoa futures (betting that they would fall), and were forced to buy back those positions, forcing the price ever higher. The futures gained 176% for the year. Putting the trades together, and funding cocoa beans by shorting soybeans, made Hindsight 278%:

The Southern Core

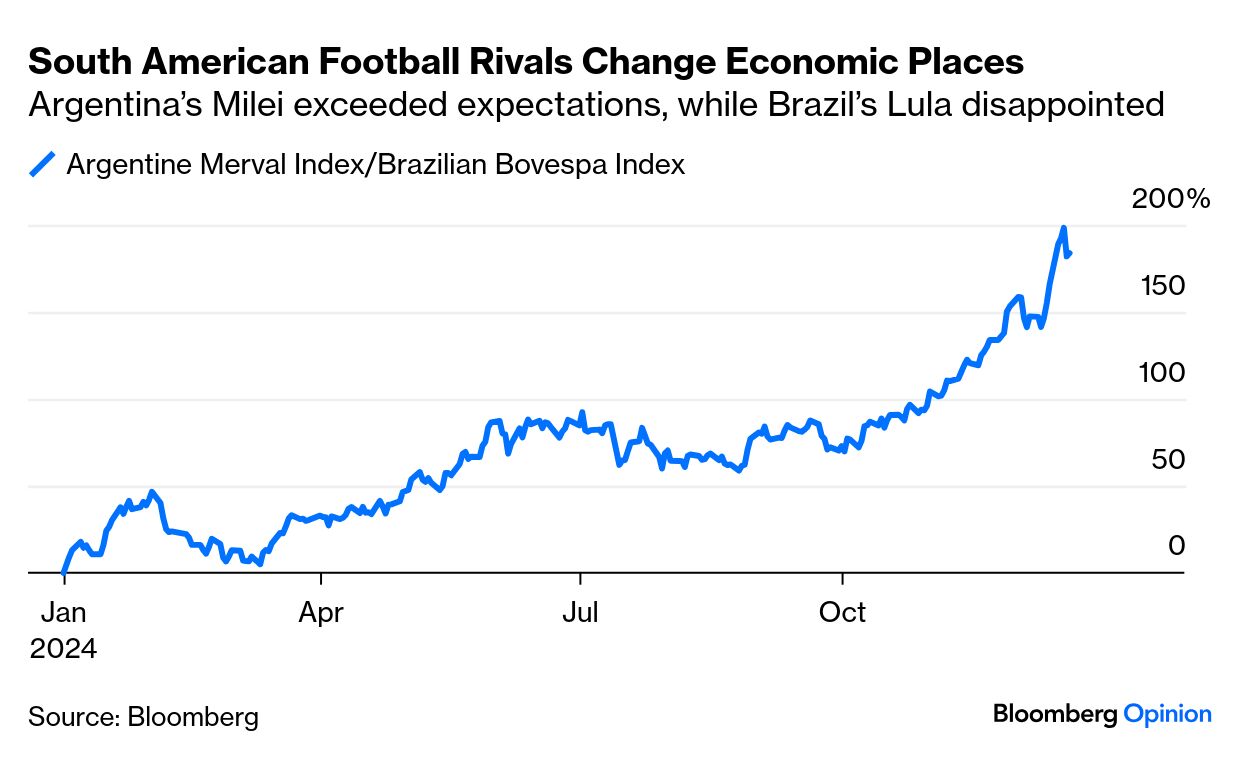

Buy Argentina Merval Index/Short Brazil Bovespa Index (Up 182%)

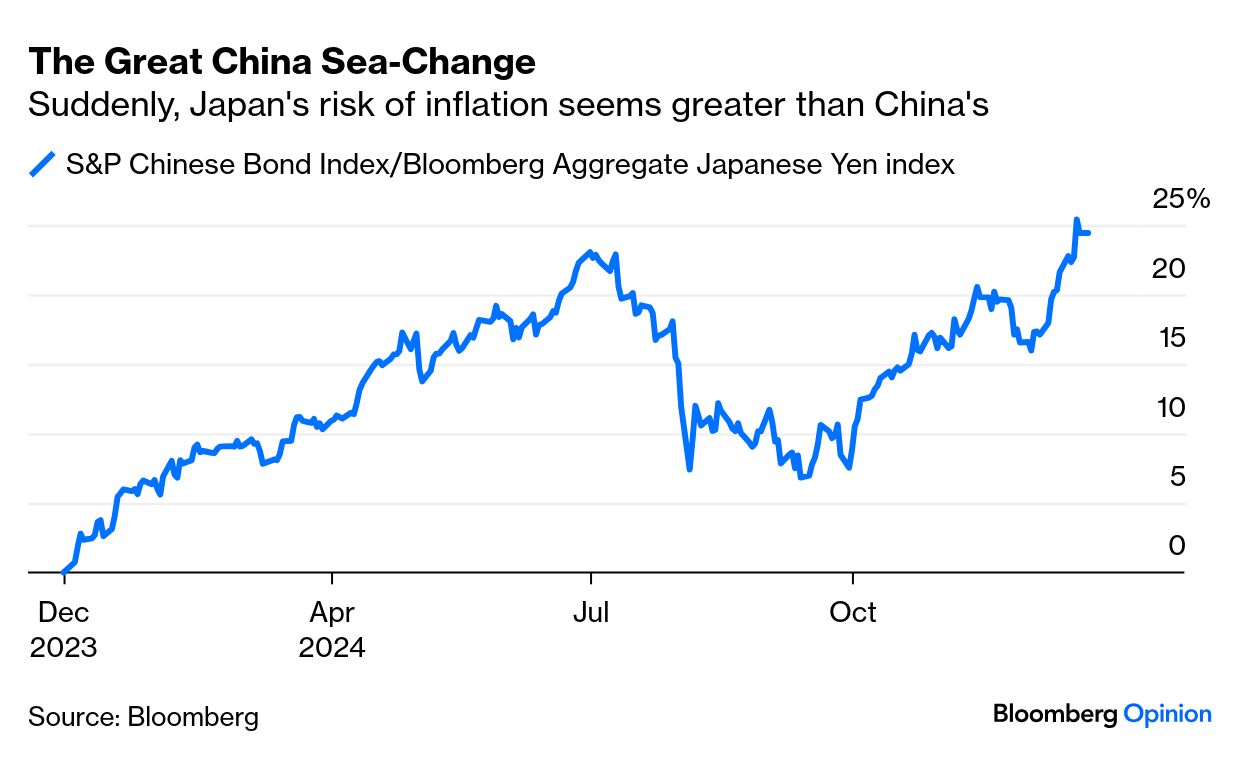

The rivalry between Argentina and Brazil goes far beyond soccer. And just as the Argentines have the upper hand in their footballing rivalry, so circumstances have helped their financial markets to also enjoy a bonanza. Rather than Lionel Messi, they can thank Javier Milei, the outspoken anarcho-capitalist who took office at the end of last year. One of his first acts was to devalue the Argentine peso in an attempt to create a floor. Markets had panicked about Milei in advance. His hard-core libertarian ideas seemed impractical while some of his personal weirdness (he has a number of pet cloned dogs, and campaigned brandishing a chainsaw) was off-putting. That set the scene for an epic rebound. In dollar terms, Argentina's benchmark Merval stock index gained 106.5% this year. Brazil once reaped those type of gains, in 2003 and 2004, when there was a similar rebound in confidence after markets sold off in panic at the advent of Lula. His first term in office proved him far more of a pragmatist than feared. This time, it turns out, is different. Investors didn't panic ahead of Lula's return, but the country's structural fiscal difficulties have intensified, and the man seems unaware of how serious the situation has become. Also, as we've seen, the currency was riding for a fall. In dollar terms, the iBovespa benchmark stock index dropped 27% in 2024. Put the two trades together, and Hindsight made 182%: Ominous Trade, If Only Hindsight Was Allowed to Lever Up: Long Chinese Government Bonds/Short JGBs (Up 20%) Possibly the most important shift in the financial world is that China and Japan are changing places. For decades, Japan has been locked into low or even negative interest rates, and effectively offering cheap finance to anyone who wants to borrow in yen through the carry trade. China, in the midst of a historic economic transformation, has instead churned out cheap exports that allowed the rest of the world to keep inflation under control, albeit at high social costs, and has come with interest rates to match a growth environment. This year, with China's imports to the US already declining under pressure from the Biden administration and far worse in prospect, and with the country still battling to find its way out from a huge overhang of debt taken out to finance its property, Chinese government bond yields have fallen. In Japan, however, it really begins to look like the deflationary psychology has been licked, and Japanese government bond yields have started to rise. Ten-year JGB yields were held at zero for years. They are now at 1.04%. Equivalent Chinese government bonds yielded 2.56% in January, but they have now dropped below 1.7%. Short Chinese bonds/long Japanese bonds would have yielded 20%. That's not enough to excite Hindsight in a year like this, but it's stunning that there was this much money to be made on a shift in power of this magnitude: Buy When There's Blood in the Street: A Tragic Way to Profit from War in the Middle East

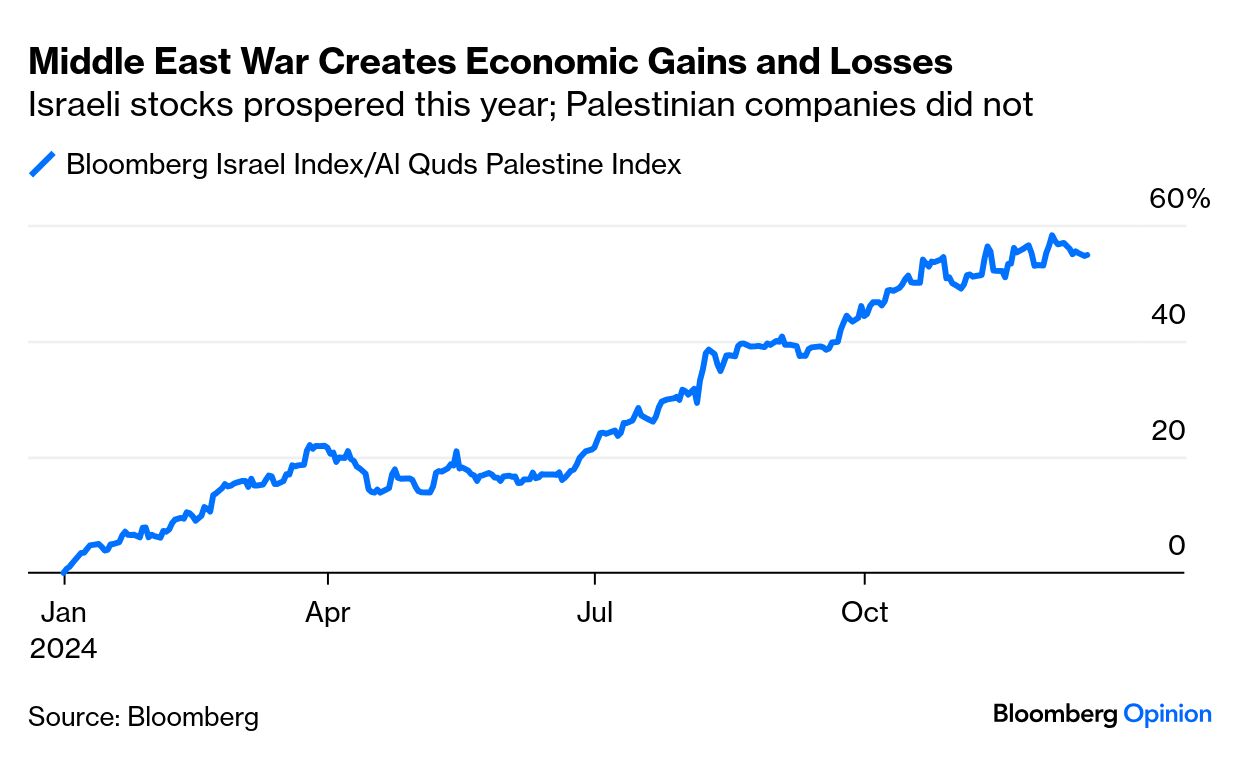

Long Bloomberg Israel Index/Short Al Quds Palestine Index (Up 58.2%) Perfect foresight was not necessary to work out that Palestinians would have much the worst of any confrontation with Israel's powerful military forces. After Hamas decided to provoke a war with the terrorist attacks of October 2023, it was always predictable that Israel would respond with far greater force, and would prevail. The debate over that concerns far more important things than money. But Hindsight just needed to see that Palestinian businesses were bound to suffer, while a wartime economy would support stocks in Israel. So it proved. The Al Quds Palestine index includes 15 stocks in the West Bank, and has gained 5.25% annually since inception in 1998. It's really too small an index for Hindsight to be allowed to include in a bet, as the whole market is much tinier than many US stocks. It had a very bad year, for obvious and wholly predictable reasons, and dropped 16%. Meanwhile, Bloomberg's Israel Large and Medium Cap index gained 31.4%. Put these two trades together and they made 58.2%. There's always a way to profit from a war: That concludes Hindsight Capital's trades for 2024. It was a great year, like every other. But unfortunately, its managers still refuse to tell me about their trades for 2025. Have a great and prosperous new year, everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment