| This is Bloomberg Opinion Today, a nepo baby moment for Bloomberg Opinion's opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. Scott Bessent, nominated by President-elect Donald Trump to head the US Treasury, has inherited a monumental task: getting the nation's massively indebted finances into some sort of order. Tobin Harshaw, mild-mannered newsletter writer at Bloomberg Opinion, faces nearly as tall an order: writing about successions without bringing up, well, Succession (I leave that to Jessica). There are plenty of other cultural touchstones of messed-up legacies — from King Lear to The Godfather to Arrested Development to the messiest of them all — but I am going to show my age. Here is the greatest, most vicious inheritance scene in TV finale history: Joan Collins. John Forsythe. Buried Nazi treasure! That fringe! For all its pent-up rage, "I'm the eldest boy!" doesn't hold a candle to the knife-twist of, "Aren't you going to walk me to the door?" Warren Buffett may be no Blake Carrington, but he understands that legacies are a dangerous business. Beth Kowitt read between the lines of the Oracle of Omaha's annual epistle, which announced a $1 billion benefaction: "Buffett put out a memo that was less about the nuts and bolts of the donation than the importance of getting your affairs in order at the end of your life. Close readers of Buffett know that this is his MO. Below the surface, his musings are often steeped with advice about leadership and management." His big piece advice (emphasis Beth's): Don't create dynasties (or nepo babies). "Buffett mentions more than once in his memo that he does not believe in dynastic wealth," writes Beth. "Two out of his three kids are on Berkshire's board, but none are in management — nor will any of them ever become CEO. Contrast this with the nepo baby moment we are seeing in other parts of the business world as a generational shift in power takes place at family-run companies … The result often is infighting, a la Estée Lauder Cos. and News Corp." Adrian Wooldridge takes on two blundering successions: one at the White House and the other at the Mouse House. "The Democratic Party's defeat in November was the result of, among other things, failed succession planning," Adrian writes. "Botched succession is a pervasive problem in human affairs: in autocracies as well as democracies (Vladimir Putin's eventual departure will doubtless lead to a bloody power struggle) but also in the private sector as well as the political world. The one 'known known' in the business world is that CEOs will eventually have to hand over to a successor. Yet companies repeatedly make a hash of it." Take Disney. In 2020, Bob Iger stunned us all by stepping down at CEO; nearly five years later, he is back in charge — what Adrian calls a "boomerang CEO" — because his hand-picked successor couldn't fix the hole in Scrooge McDuck's pool. "A more comprehensive solution is to buff up the machinery of succession planning," Adrian suggests. "Require boards to take succession planning much more seriously, for example, by appointing a lead director with responsibility for standing up to the CEO and looking for a successor. Build succession-planning into the core of the company so that there is always a deep bench of talent awaiting. And … encourage CEOs to think of their careers in terms of life cycles, with a beginning, a middle and an end." Yet thinking in life cycles is too rare, and nepo babies all too common: not just around the boardroom and ballot box, but also Hollywood, the NFL, literature, the Achaemenid court, and so on. Also, Indonesia. "Indonesia is plagued by dynastic politics, partly as a hangover of its dictatorial past," writes Karishma Vaswani. "With democracy increasingly entrenched in the last quarter-century, voters deserve a new generation of leaders who represent a break from the military and political elites that have typically run the country." So who can snip the family ties? "One female politician is winning the affection of citizens in Southeast Asia's largest economy, with a reputation for effective governance. Khofifah Indar Parawansa was elected governor of East Java in 2018, the archipelago's second-largest province," Karishma writes. "A pious reputation helped propel Khofifah to victory in the 2018 gubernatorial race after two failed attempts, defeating an opponent whose campaign strategy depended on powerful family connections. Being a woman also helped." Meanwhile, a family that spent $600 million on a wedding is finding its elaborate succession plan foiled by US prosecutors. "The US bribery case against Gautam Adani has become something of a suspense thriller in India," reports Andy Mukherjee. "Everyone is waiting to see if the scandal will halt the tycoon's frenzied pace of empire-building. Or if it will make the acquisitive, debt-fueled conglomerate double down and take a more confrontational approach to rivals. Adani's competitors know they can't be too sanguine about a permanent mellowing of the 62-year-old's competitive instincts." You know who else didn't mellow with age? King Lear. Yet in the end, he acknowledged himself a "foolish fond old man." Buffett seems to get it. Adani, Iger and the rest might want to brush up on their Shakespeare. Bonus Working and Waiting Reading: - Comcast Spinning Off MSNBC Was Inevitable — Paul Hardart

- Comcast's Spinoff Plan Is Too Good to Ditch for Quick Cash — Chris Bryant

- The Gap Is Back — Andrea Felsted

What's the World Got in Store? - NATO foreign ministers meet; Dec. 3: Trump Wants to Reshape NATO. He Mustn't Break It — The Editors

- US unemployment; Dec. 6: Economic Advice for Trump and Powell: First, Do No Harm — Claudia Sahm

- Euro area GDP; Dec. 6: Winter Is Coming for the Euro in More Ways Than One — Marcus Ashworth

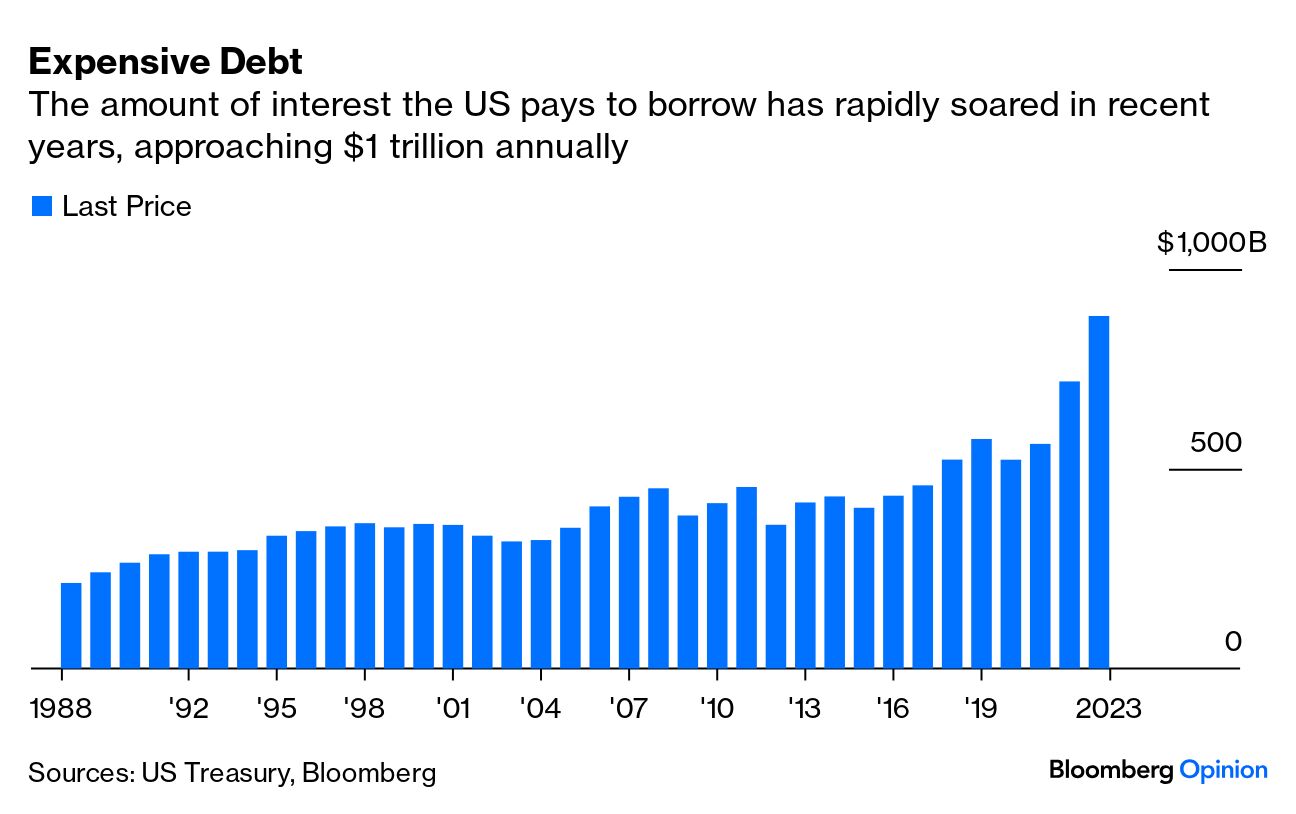

Imagine yourself after the funeral, waiting for the reading of the will, surrounded by other eager legatees — maybe, say, Howard Lutnick, Marc Rowan, Kevin Warsh. Then the announcement is made: It's all yours! The elation, the sense of triumph, the giddiness of being THE ELDEST BOY. And then you find you have inherited … negative $36 trillion. And then you wake up, and you are Scott Bessent, and the nightmare turns out to be real. Anyway, good luck to ya. "Bessent, President-elect Donald Trump's nominee for US Treasury Secretary, will face two big challenges if confirmed by the Senate: Ensuring that the world's largest government-debt market functions properly, and pursuing a fiscal policy that doesn't send the country's debt-service costs soaring," Bill Dudley writes. "Neither task will be as easy as stock and bond investors seem to believe." Bill, who knows a thing or two about fiscal policy from his nine years at the helm of the New York Fed, warns Bessent that there is one succession plan he shouldn't get behind. "Bessent would be wise to stop advocating for a shadow Fed chair to undercut Jerome Powell's authority before his term ends in May 2026. A shadow chair would likely be ineffective in influencing expectations about monetary policy, because the economy is operating near the Fed's employment and inflation objectives," Bill says. "I sincerely hope Bessent will be successful. Markets' exuberant response to his nomination certainly suggests this is what investors expect. Yet their optimism contrasts sharply with the difficulties he'll encounter in managing the Treasury market, the country's fiscal trajectory and the broader economy." The immediate difficulty is the one that helped power Trump to victory: rising prices. "Inflation has proved stickier than expected and the outlook for Fed rate cuts has been dialed back significantly. And Trump was reelected, raising the odds that he will inflict tariffs on China and our other major trading partners, perhaps pushing inflation rates even higher," Robert Burgess writes. "What all this means is higher borrowing costs for the government, companies and households." As Bob notes, Trump has called himself the "King of Debt" when boasting about how his business empire survived many hard times. Is that experience going to come in handy? Or are we doomed to another sort of king — a "foolish fond old man" wreaking havoc on a nation's posterity? Notes: Please send debt relief and feedback to Tobin Harshaw at tharshaw@bloomberg.net. |

No comments:

Post a Comment