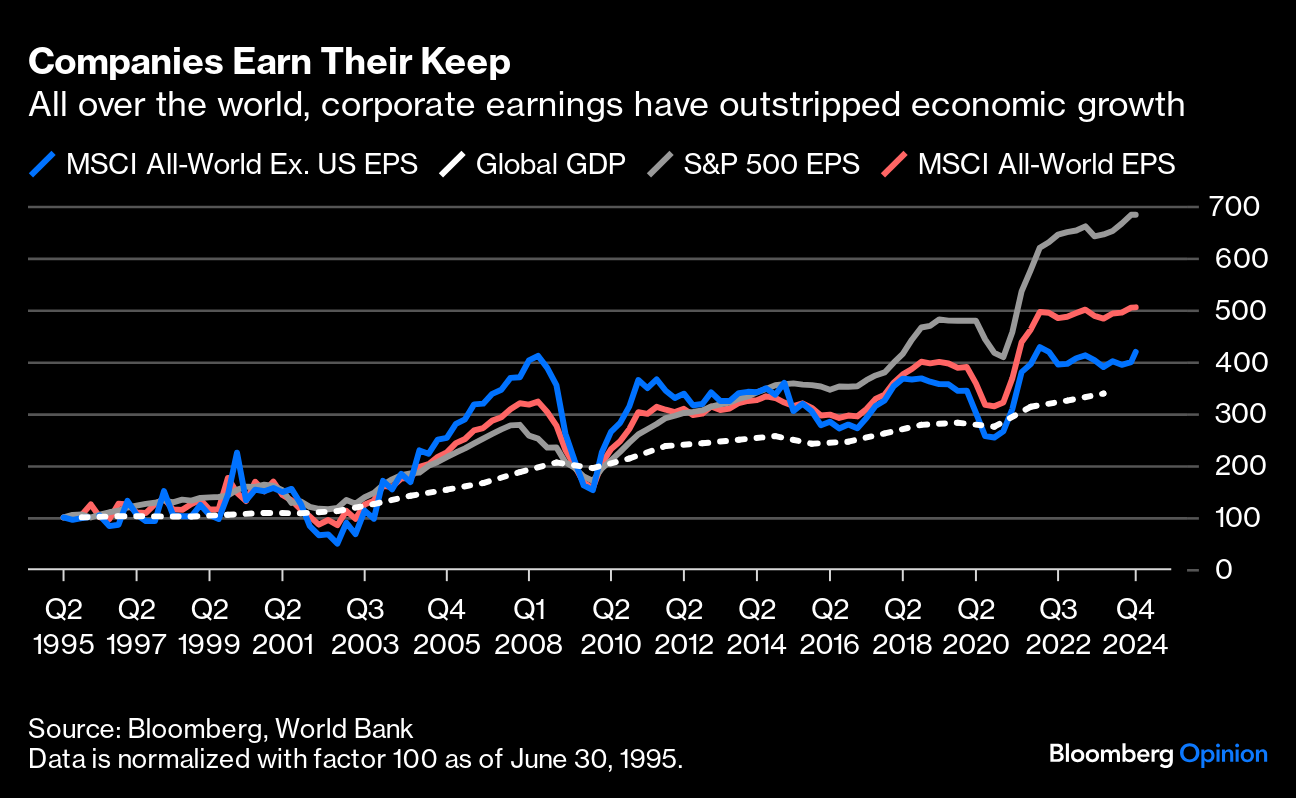

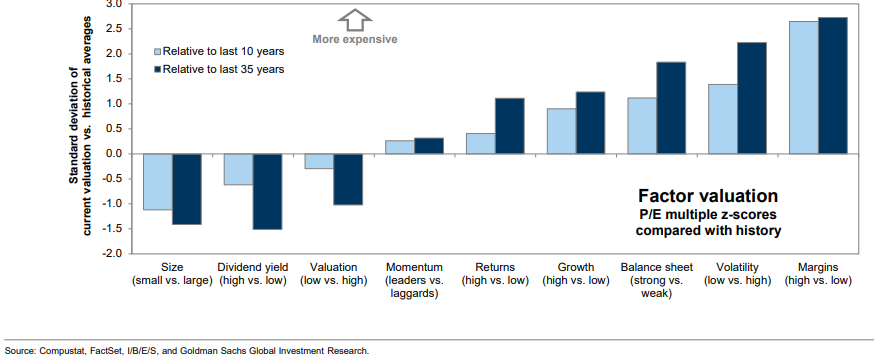

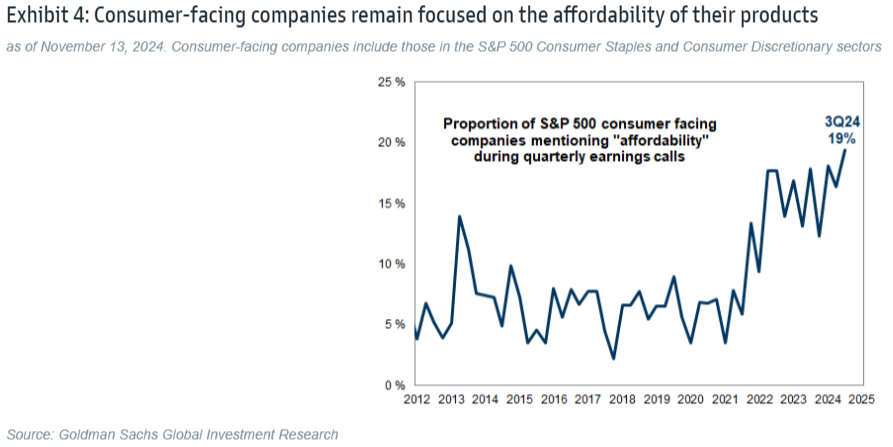

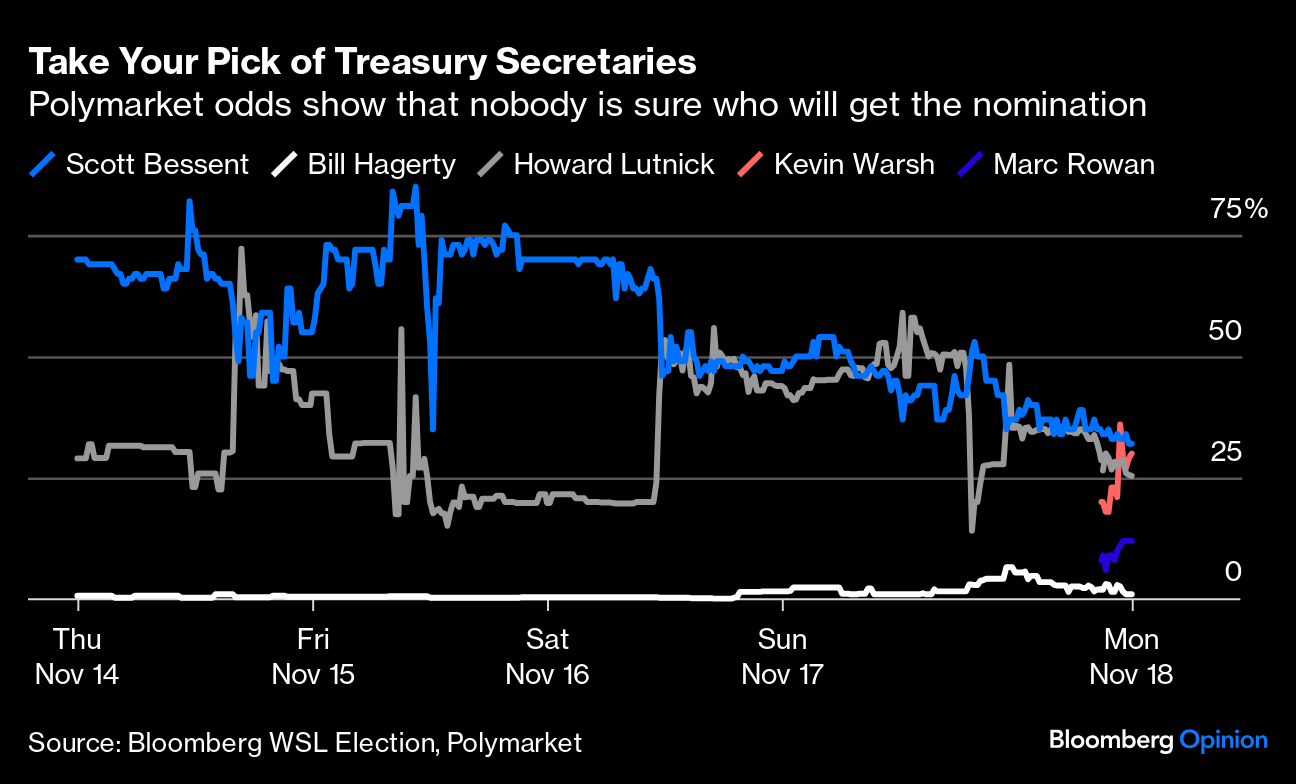

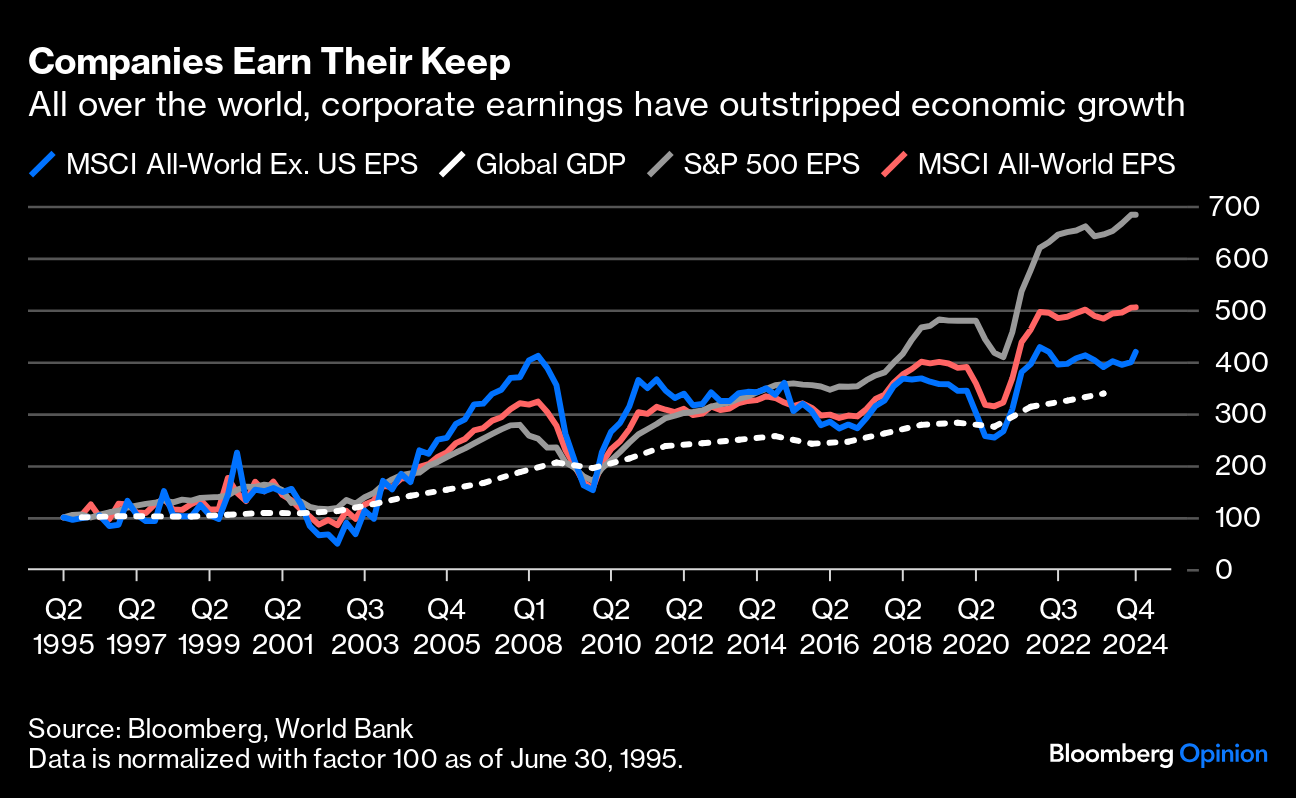

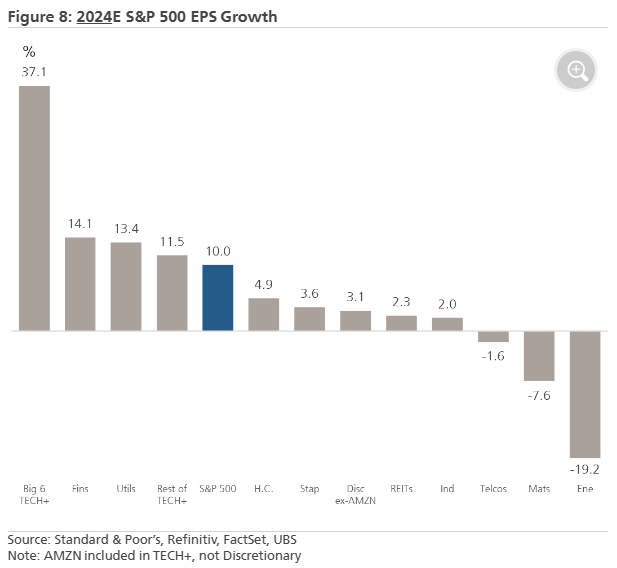

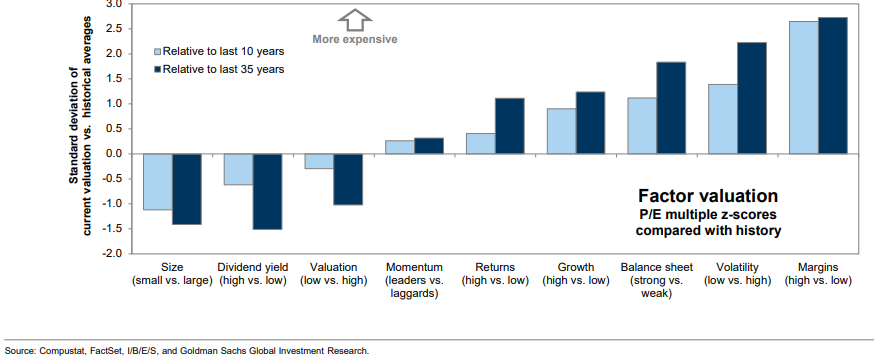

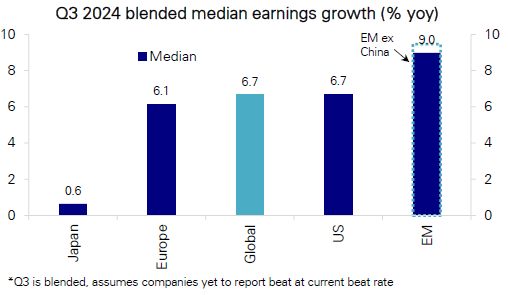

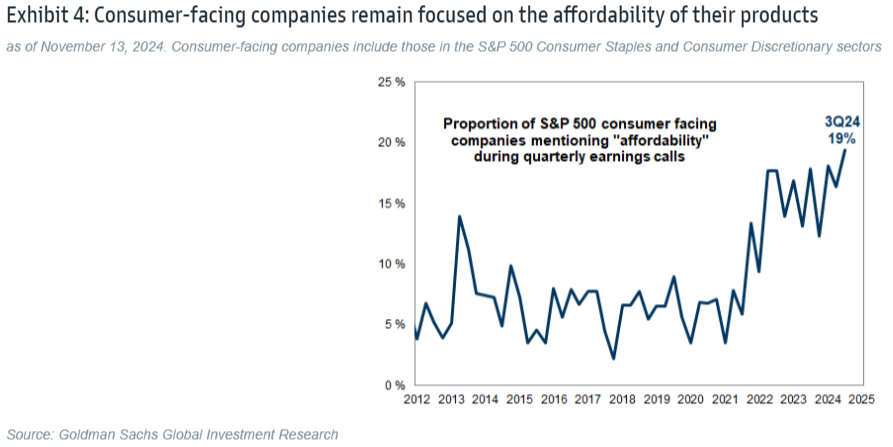

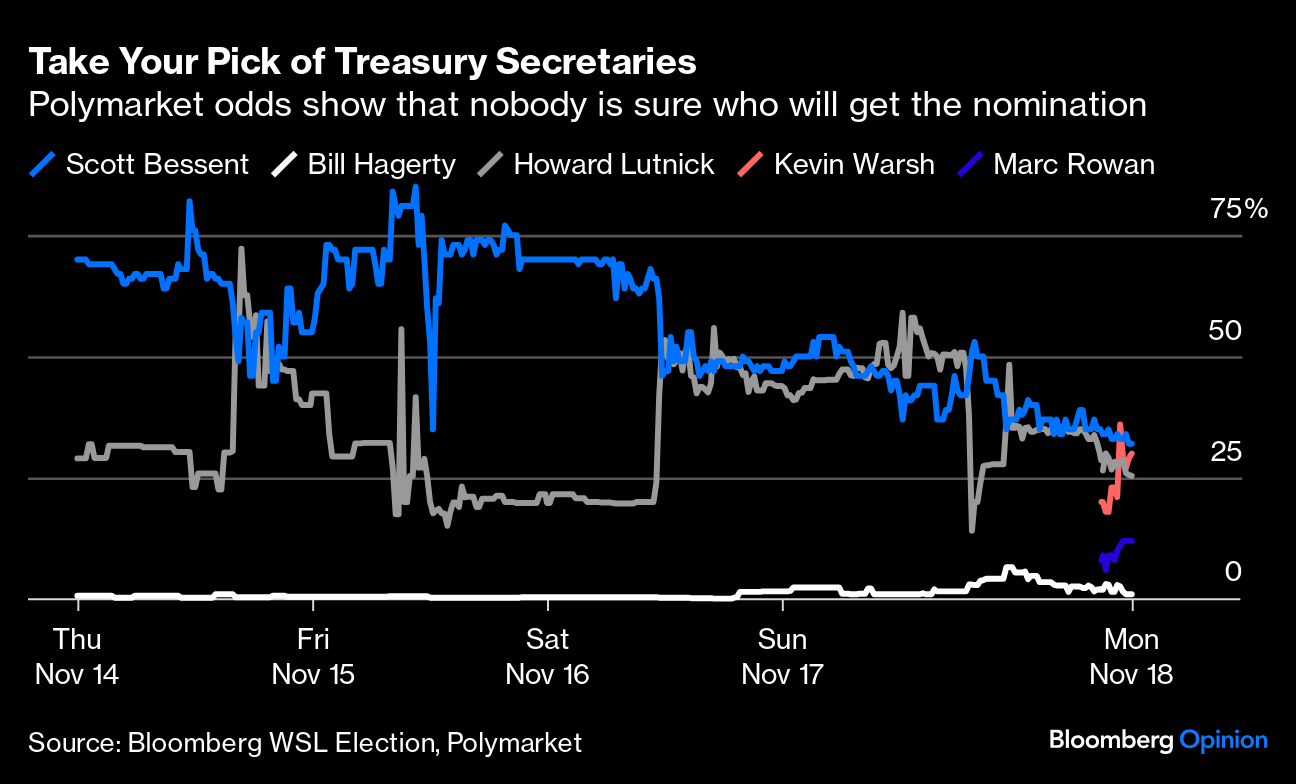

| It's simpler to take aim at a stationary target than a moving one. Thus, with global politics in flux, it's worth examining data that won't be changed by the election result — corporate earnings for the third quarter. More than 90% of companies have reported now, and the only significant name still to come — admittedly a very big one — is Nvidia Corp., which lands Wednesday. Corporate America told us, while attention was turned to the ballot boxes, that it remains healthy. Earnings were comfortably ahead of expectation, which is largely a facet of the low bar of expectations coming in to earnings season. In broader context, however, the most important message is that company profits are a great protection against disappointing economic growth, even if they provide a much bumpier ride. This chart shows trailing 12-month earnings per share since 1995 for the US, the world, and the world outside the US compared to the World Bank's estimate of global GDP. The corporate sector continues to take a greater share everywhere. Recent US dominance, when the country has just decided to embrace "America First," is awe-inspiring:  Does this have to do with the US tech sector? Yes. The US market would look very different without its dominant tech platform groups. To illustrate, Jonathan Golub of UBS Group AG shows expected earnings growth by sector for this year. Their "Big Six TECH+" sector includes Amazon.com Inc., technically a consumer discretionary company, but omits Tesla Inc., from the standard Magnificent Seven. It's quite a picture: We know that the Magnificent Seven are growing gangbusters, but margins appear to be their real secret sauce. While profit margins accounted for 12.3 percentage points, or roughly half, of the Big Six's 24.5% earnings growth, according to UBS, they took three percentage points off the growth of the rest of the S&P 500's overall expansion of 0.9%. To make the argument that the Big Six are monopolies, these numbers are a good place to start. David Kostin, chief equity strategist at Goldman Sachs Group Inc., illustrates in the following chart how much the market is moving toward companies with high margins. It measures the current disparity in valuation according to a range of metrics. Small caps and companies that pay a high dividend yield are currently 1.5 standard deviations cheaper than their average for the last 35 years. Meanwhile, high-margin companies receive a far higher valuation than they have historically, some 2.5 standard deviations above the 35-year norm. As these companies are continuing to surprise on the upside and widen their margins, the money invested in them so far has been well rewarded. It's a little hard to imagine this continuing:  Similar arguments apply in reverse if the energy and materials sectors, hammered by weaker commodity prices, are excluded. Globally, the equity strategy team at Deutsche Bank AG estimates that if these two sectors are removed, then earnings growth for everyone else improved slightly, to 11.9% from 11.2%, over the quarter. The market is over-excited about companies whose profitability looks hard to sustain, but earnings season definitely gives reasons for confidence about both the global economy and the stock market. The global picture justifies more optimism than the mood might indicate. The team at Deutsche took median rather than mean growth to help control for the Magnificent effect, and that revealed growth in emerging markets actually outstripping that of the US. That at least in part suggests that Chinese growth in particular, and the broader global economy in general, is in better shape than many tend to realize. Corporate Japan has had a problem with the sudden strengthening of the yen, which didn't flatter overseas earnings in yen terms: The consensus sees double-digit earnings growth in the US, Japan and EM, in both 2024 and in 2025 (these numbers will not yet take full account of the US election). Europe is seen as much more problematic, but not cataclysmic, with the consensus expecting a contraction of -1.5% this year to be followed by 7% growth in 2025. At a more impressionistic level, it's noticeable that the word "tariff" and its derivatives appeared in more earnings call transcripts in the latest quarter — 1,969 globally according to Bloomberg Document Search — than at any time since the eve of the pandemic in the first quarter of 2020. This is far below the peak of more than 6,000 CEOs who wanted to talk about tariffs in the third quarter of 2019, when the Trump 1.0 measures were having their effect, so companies are not fully prepared for another trade war. Meanwhile, Goldman's Kostin continues his regular quarterly Beige Book, culling quotes and anecdotes from earnings calls and releases to come up with a subjective version of what worries CEOS, analogous to the Federal Reserve's anecdotal exercise. The best news, at least for policymakers, is that consumer-facing companies remain very worried about making their products affordable for customers. They share in the desire to bring inflation under control. By Goldman's count, mentions of affordability in earnings calls have reached a new high in this quarter:  Kostin also showed that executives, like the rest of us, were bothered by political uncertainty. The US election, widely called as a dead heat at the end of September when these results were wrapped up, was having a deadening effect both on companies' own investments, and on customers' willingness to buy. With a Republican clean sweep now locked up, a decision on the appointments to the Trump economic team is the last obstacle to bringing uncertainty back down to normal levels. That moment is getting closer, but it hasn't arrived yet. If you want real uncertainty, look at the evolving race to be Donald Trump's Treasury secretary. A lot is riding on this for markets; it's fair to say that the consensus view is that Trump policies should be good for growth, but involve risks that could require the Treasury to move nimbly, particularly when it comes to the dollar. Until the weekend, Scott Bessent of Key Square Group, best known for his role in George Soros's audacious 1992 move that forced the British pound out of the European Union's exchange rate mechanism, was regarded as the clear favorite. As whoever gets the job will need a good grasp of the behavior of foreign exchange markets in general, and people like Soros in particular, there is an obvious logic to appointing him. After a dizzy weekend of briefing and counter-briefing, Bessent is no longer the clear favorite. Given a 75% chance by Polymarket on Thursday last week, he is now in a virtual tie with Howard Lutnick, CEO of Cantor Fitzgerald, and a new name, former Fed Governor Kevin Warsh, who is best known for his role as the Fed's firefighter during the worst of the Global Financial Crisis. None is better than a one-in-three shot:  Uncertainty like this will mess with markets until it's resolved. And we need to know more than the identity of the winner. Trump also has to dole out positions for his chief economic adviser and the US Trade Representative, either of which could make a big difference to the direction of policy. And it's possible the winner will only take their position after making some specific commitments. At the time of writing, after midnight in London, there is no resolution. It's unwise to take too big a position in any financial trade for the next few days; there'll be plenty of analysis in this space once we know what we have to analyze. Bitcoin's remarkable rise has an obvious explanation. It's all down to Trump and the GOP's impressive triumph. As the largest crypto asset has topped $93,000, the question now is whether the surge is merited or merely over-enthusiasm as crypto bros assume a reversal in antagonism from regulators. This is another issue where the forthcoming economic appointments really matter. It's what happens when an asset class that has faced constant regulatory scrutiny suddenly gets let off the leash: Political pressure from pro-crypto groups like Stand With Crypto is doubtless having an effect, but Bitcoin's history of extreme volatility means that it will run into air pockets at some point. Corrections in the past have been brutal. Notable instances include 2018, 2021, 2022, and to some degree this year. But for now, Miller Tabak + Co.'s Matt Maley argues that any potential correction may have to wait at least until the outcome of the Treasury secretary drama: If Howard Lutnick gets the nod for Treasury secretary, it should help Bitcoin and others even more. As for the demand, I'd just say that in today's marketplace, momentum feeds on itself. So, as Bitcoin has seen such a strong breakout of its old highs, it has attracted a huge influx of money flow. We're seeing a similar situation in the software stocks as they have broken out.

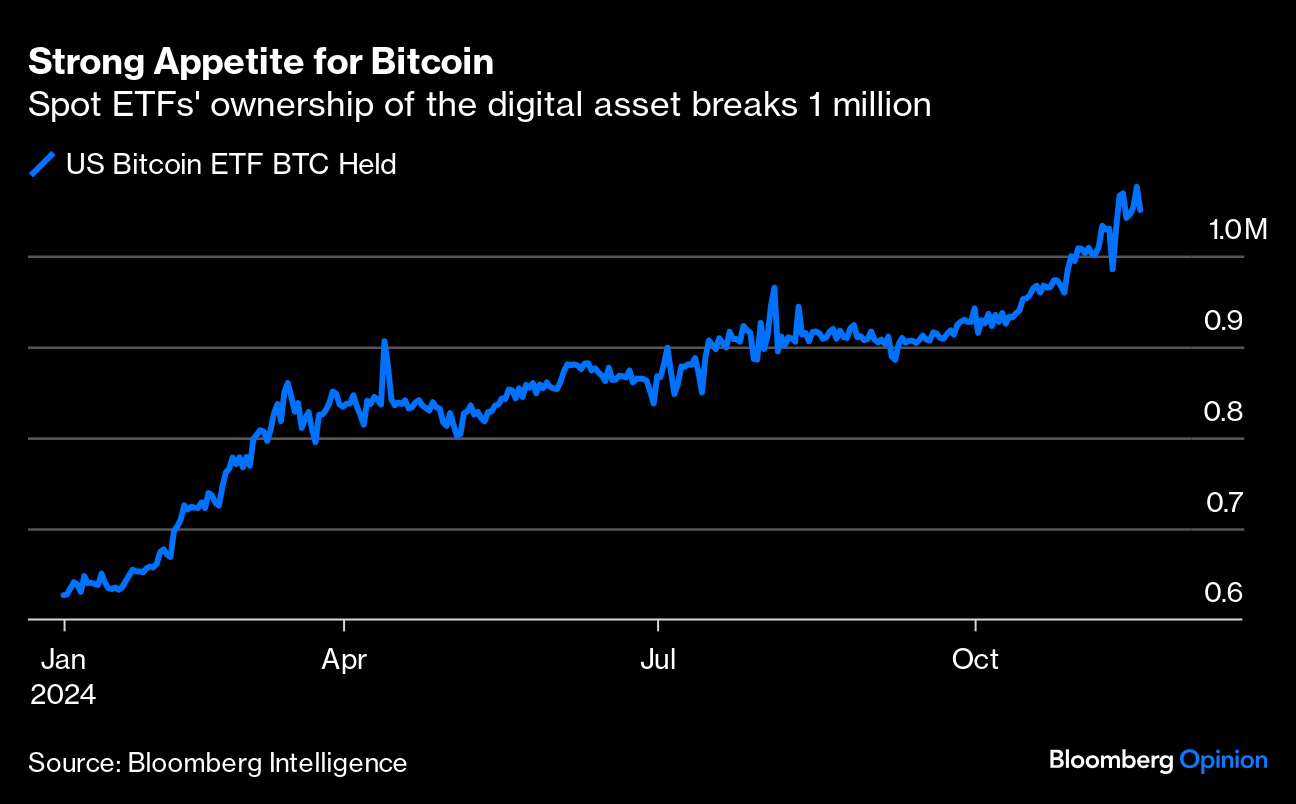

Bitcoin exchange-traded funds, which debuted earlier this year, have led the inflow. In a six-day, post-election window from Nov. 6 to 13, the funds recorded a net inflow of $4.7 billion, and US Bitcoin ETFs' ownership of Bitcoins recently broke the 1 million ceiling: The choice to head the Securities and Exchange Commission is also a big deal. More or less anyone would be more supportive than the incumbent Gary Gensler. However, it's premature to assume that a crypto ally would mean favorable regulations. Bloomberg Intelligence's James Seyffart argues that the base case is an appointee who abandons the tight scrutiny of crpyto, which would be a win. Still, JPMorgan strategists led by Nikolaos Panigirtzoglou suggest favorable regulations would foster strong engagement between banks and digital assets beyond Bitcoin and Ether. They see regulatory clarity as a tailwind for venture capital, M&A, and initial public offerings — although the mooted US Bitcoin reserve is a "low-probability event." Crypto's fate could also be guided by monetary policy. Fewer rate cuts could leave interest rates that limit speculative demand for digital tokens. A Bloomberg Economics model suggests that a possibly more cautious central bank underscores the risks for Bitcoin in the months ahead. —Richard Abbey Roberto Carlos scored some amazing free kicks in his time; here are a top 10 and a top 25. On Sunday, I witnessed him score another. It wasn't as spectacular as any of the top 25 goals, and he was playing in a charity match on a non-league ground in southern England (which happens to be next door to my old high school). And yet Carlos, now 52, and his teammate from Brazil's 2002 World Cup-winning team Gilberto Silva both decided it was worth their time to raise money for an anti-suicide charity called CALM (Campaign Against Living Miserably). Carlos seemed utterly delighted when he hit in a free kick from outside the area, celebrating as vigorously as any of the goals he scored for Brazil and Real Madrid while about a thousand of us cheered. Good for him. In more way than one, he struck a blow against living miserably.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Lionel Laurent: Crypto Prediction Markets Have a Cloudy Future

- Daniel Moss: China Will Send a Weaker Yuan to the Trump Front

- Liam Denning: Musk Is Short-Circuiting the EV Revolution He Sparked

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment