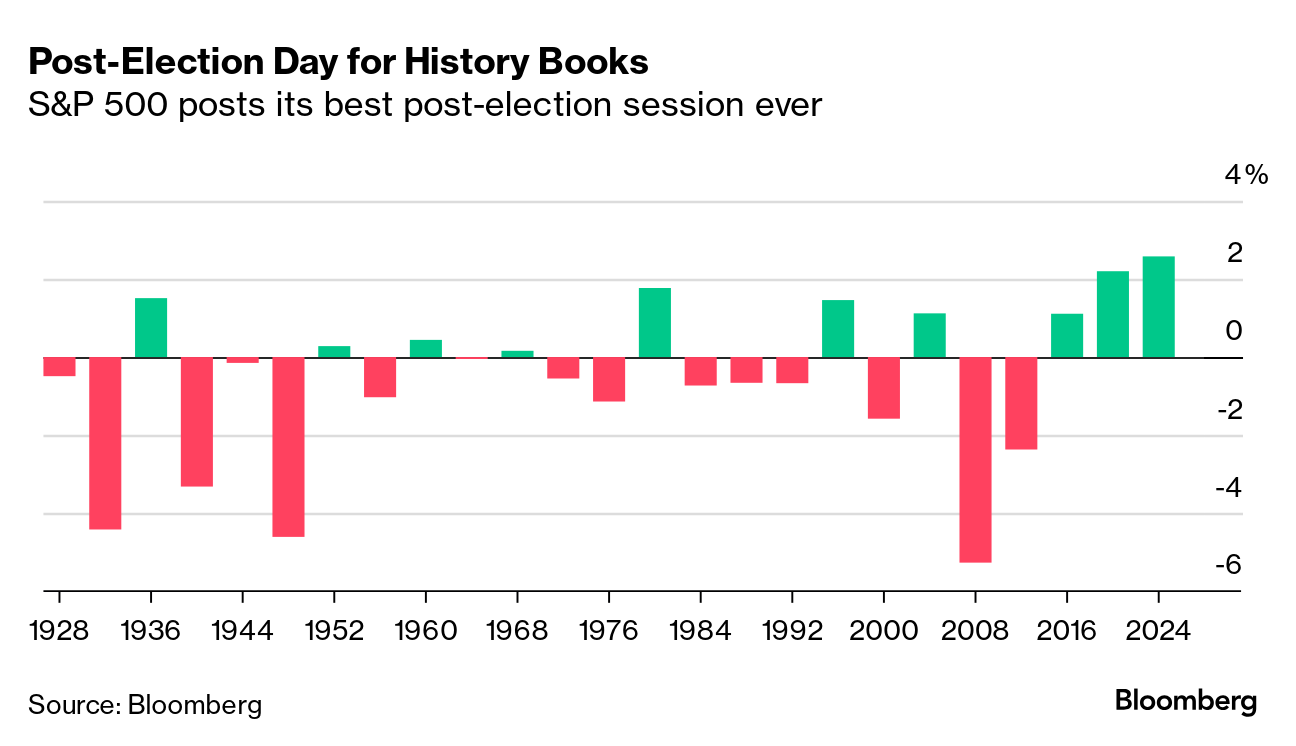

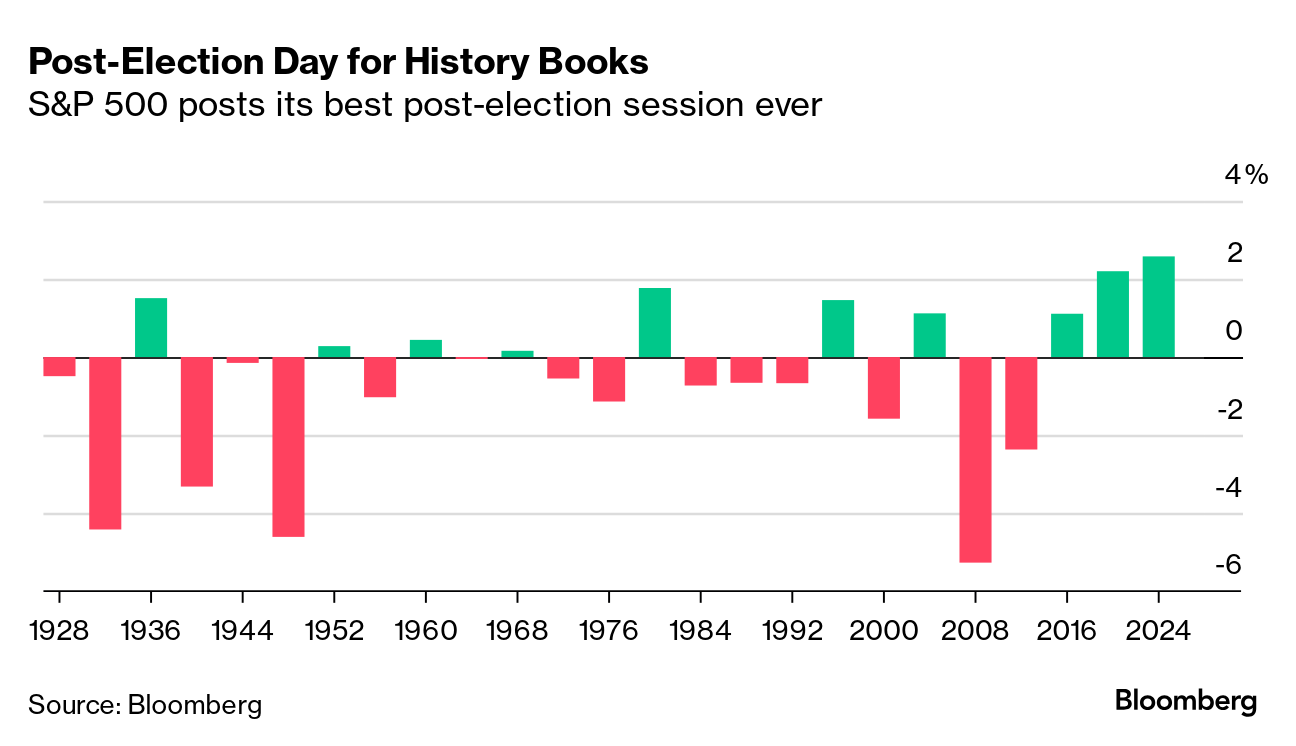

| Stocks hit all-time highs following early-morning news that former President Donald Trump is once again President-elect Donald Trump. US yields jumped and the dollar saw its best day since 2022 as investors cheered the Republican's return to the presidency and the potential for what increasingly looks like his party's control of both houses of Congress. The last time that happened, the GOP and Trump pushed through a multitrillion-dollar tax cut largely benefitting corporations and the rich. Trump has pledged to have Congress renew portions of the law, along with a whole host of other proposals. On Wednesday, the S&P 500 climbed 2.5% on bets the 78-year-old, the oldest incoming president in American history, will spend the next four years attempting to push through a slate of legislation sought by corporate America. The benchmark had its best post-Election Day in history, with a gauge of small caps rallying 5.8% while wagers on lower taxes and reduced regulation lifted banks.  Meanwhile, Wall Street's "fear gauge" tumbled the most since August, and almost 19 billion shares changed hands on US exchanges, 63% above the daily average in the past three months. Even the Dow Jones Transportation Average jumped to a fresh high after a three-year drought of records. "The biggest takeaway from last night is that we received certainty that the market craves," said Ryan Grabinski at Strategas. "This will allow both business and consumer confidence to improve. Attention now should shift to the Federal Reserve meeting tomorrow." —David E. Rovella |

No comments:

Post a Comment