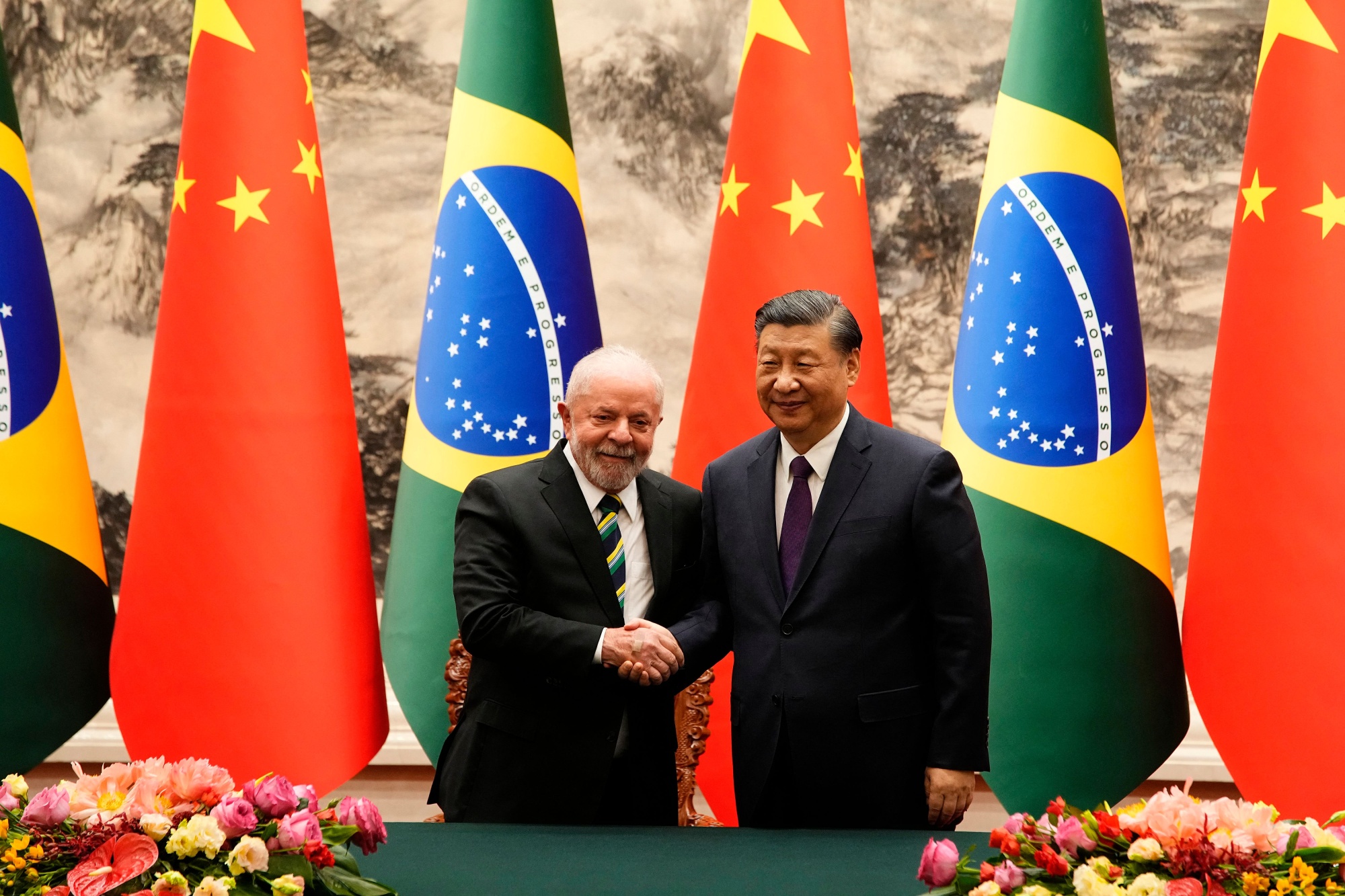

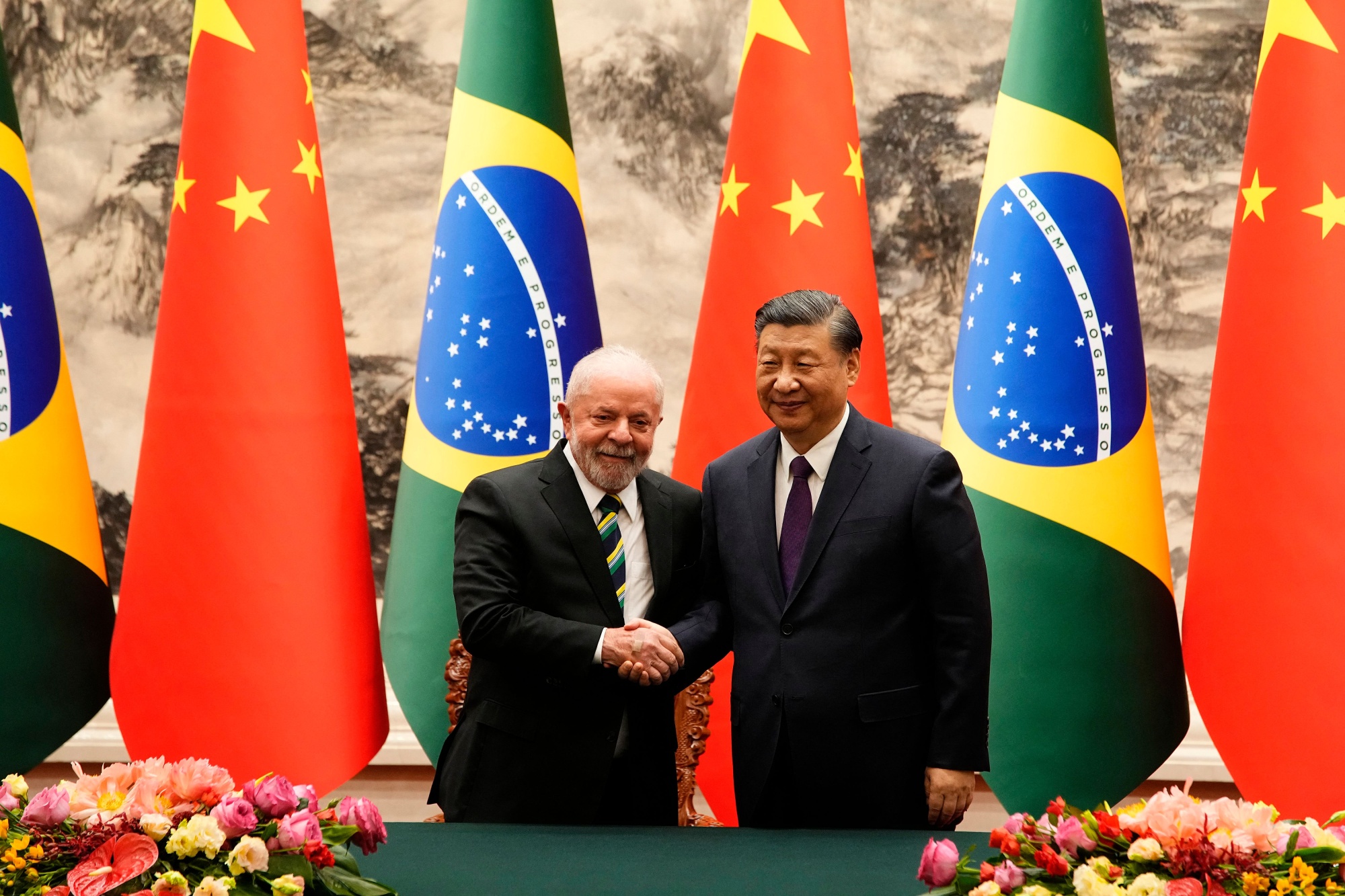

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Volkswagen's already contentious decision to plow billions of dollars into electric-vehicle maker Rivian just got $800 million more awkward. The German manufacturer upset its powerful works council earlier this year when it announced plans to invest up to $5 billion in Rivian. That ceiling has now been lifted to $5.8 billion, which is unlikely to sit well with labor representatives batting back potential plant closures, job cuts and pay reductions. Daniela Cavallo, Volkswagen's top labor leader, scolded management in September for splashing out on the US company, telling them that in Germany, "you want to rob us of our prospects." "Can we be sure that this isn't the next billion-euro grave?" she asked at a workers' assembly. While neither side has a crystal ball on how the cooperation will pan out, Volkswagen's bet does look risky. Rivian was, after all, valued at just $11.9 billion as of June 25, the day Volkswagen first announced its investment plans. That's a far cry from the more than $150 billion Rivian was worth at its peak three years ago, around the time of its blockbuster initial public offering. It's been all downhill since. What Volkswagen sees in Rivian is the cutting-edge software and electronics architecture that its initial EVs have been missing. An effort to develop software in-house has been an abject failure, first by holding up launches of its namesake brand's ID models, then by handicapping those vehicles' sales because of buggy features. Once those issues began to also set back important Porsche and Audi models, it cost former Volkswagen CEO Herbert Diess his job. Even if Volkswagen's joint venture with Rivian helps right those wrongs, the two are coming together at a time of immense uncertainty for the global EV market. Sales have slowed in Europe as countries including Germany pare back purchase incentives. China's domestic manufacturers are reaping virtually all the benefits of growth in its new-energy vehicle market, which has largely been driven by plug-in hybrids. In the US, President-elect Donald Trump has vowed to slash subsidies and weaken fuel-economy standards that were compelling companies to make more EVs.  Volkswagen's launch of the ID.3 was plagued by buggy software. Photographer: Liesa Johannssen-Koppitz/Bloomberg Volkswagen and Rivian's JV will employ around 1,000 people initially, with the majority coming from Rivian. The first VW model to use the venture's architecture is expected to launch as early as 2027, which would follow Rivian's R2 compact sport utility vehicle slated for production in 2026. The deal is good news for Rivian, as it alleviates concerns about all the cash the company has been burning through while struggling to ramp up output. Rivian shares jumped 14% on Wednesday. "We view the deal as a less expensive way for VW to finance its software-defined vehicle architecture goals and for Rivian to receive funding to get to its R2 launch," RBC Capital Markets analyst Tom Narayan said in a note. The question for Volkswagen is whether this increasingly pricey Rivian partnership will now hurt its position at the bargaining table. The automaker last month reported its least-profitable quarter in years, adding urgency to management's pursuit of drastic measures. Labor leaders last month said they would resist proposals including the 10% wage cut and the closing of at least three factories in Germany. A grace period in those tense negotiations runs out at the end of this month, with warning strikes expected for early December if no agreement can be reached before then. — By Monica Raymunt  China's President Xi Jinping and Brazil's Luiz Inacio Lula da Silva at the Great Hall of the People in Beijing in April 2023. Photographer: Ken Ishii/AFP Brazil's geography and colonial history meant that it's traditionally looked to the Atlantic for commerce. Under President Luiz Inacio Lula da Silva, it's deepening ties to the Asia Pacific, with China investing across Latin America in areas including electric vehicles, renewable energy, urban infrastructure and high-end manufacturing. It's a strategy that risks a run-in with US President-elect Donald Trump, considering the Biden administration already was cautioning Brazil against deeper engagement with China. |

No comments:

Post a Comment