| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. This week, Saudi Arabia's $100 billion salvo for AI supremacy, Wall Street's delicate balancing act, and the UAE's second-richest private individual. But first, it's over to my colleagues Zainab Fattah and Matthew Martin for the implications of Donald Trump's victory on the Middle East. Gulf officials are always careful talking about US presidential elections, not wanting to be seen as favoring any one candidate or party. Still, in the days leading up to election last week, it was pretty clear who most people preferred: Donald Trump.  Donald Trump, right, Melania Trump, second right, King Salman bin Abdulaziz al-Saud, center, and Abdel Fattah al-Sisi in 2017. Source: Saudi Press Agency via Getty Images Expectations that Trump's second term will see him renewing pressure on Iran over its nuclear program, push for an end to regional conflicts and Russia's invasion of Ukraine will be welcomed in Gulf capitals. Trump's already indicated that one of his priorities would be to expand the Abraham Accords to include normalization of relations between Israel and Saudi Arabia. His transactional approach to foreign policy, the return of familiar faces from his previous administration, and expectations that pressure over human rights will come to an end will also be well received. But in other areas, the new administration's goals may clash with the interests of Gulf rulers. Plans for American 'energy dominance' could weigh on oil prices at a time when OPEC members are already constraining supply and losing market share. Also Read: Saudi Crown Prince Reached Out to Trump in Late Night Phone Call

AI and the China Question In his first term, the Republican cultivated strong ties with regional governments but many Gulf countries have since drawn closer to China. That raised concerns in the Biden administration and will also require deft navigation under Trump, who started a trade war with Beijing in 2018.

Here, the Middle East's aspirations in artificial intelligence will be in focus. For the United Arab Emirates and Saudi Arabia, which both aspire to be the regional hub for the technology, a more hawkish US administration presents difficult choices. "Trump clearly wants to clamp down on Chinese networks across the world," said Andreas Krieg, a lecturer in Middle Eastern security issues at King's College in London. "The Emiratis are the ones that have pivoted the furthest away from the west by having diversified the most in this respect with exposure to China's tech." To be sure, Abu Dhabi has pared back its ties to China and pledged investments in key Western markets. But already under pressure to choose sides, Trump may add to the headaches of UAE President Mohammed bin Zayed and Saudi Arabia's Crown Prince Mohammed bin Salman in how they balance ties to the world's largest and most innovative economy in the West with their biggest trading partner in the East. Tariffs and Fed Rates The Gulf will also keep a close eye on Trump's plans to impose tariffs. That could be inflationary and prompt the Federal Reserve to keep interest rates elevated, according to Khalij Economics's Justin Alexander. Saudi Arabia, which is in the middle of multitrillion-dollar investment plan, will hope the Fed continues on its path of easing, especially with oil prices trading well below levels needed to balance its budget. The Bargaining Chips

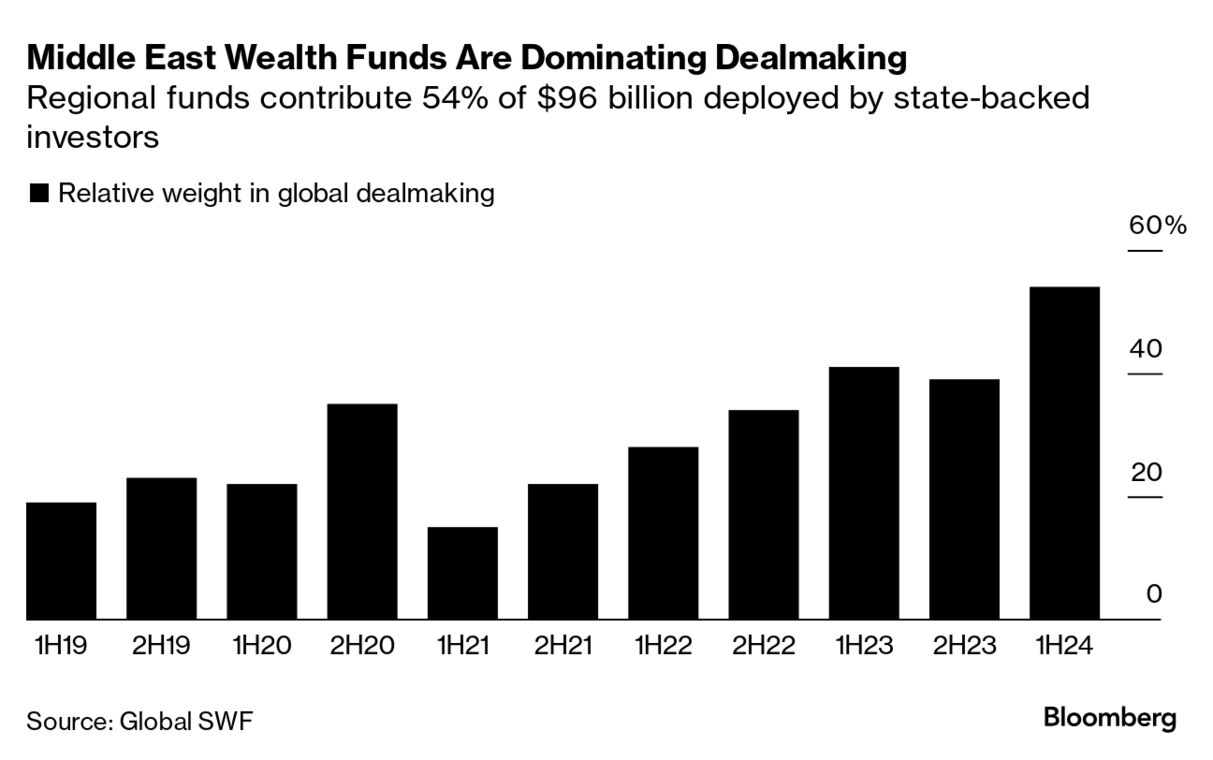

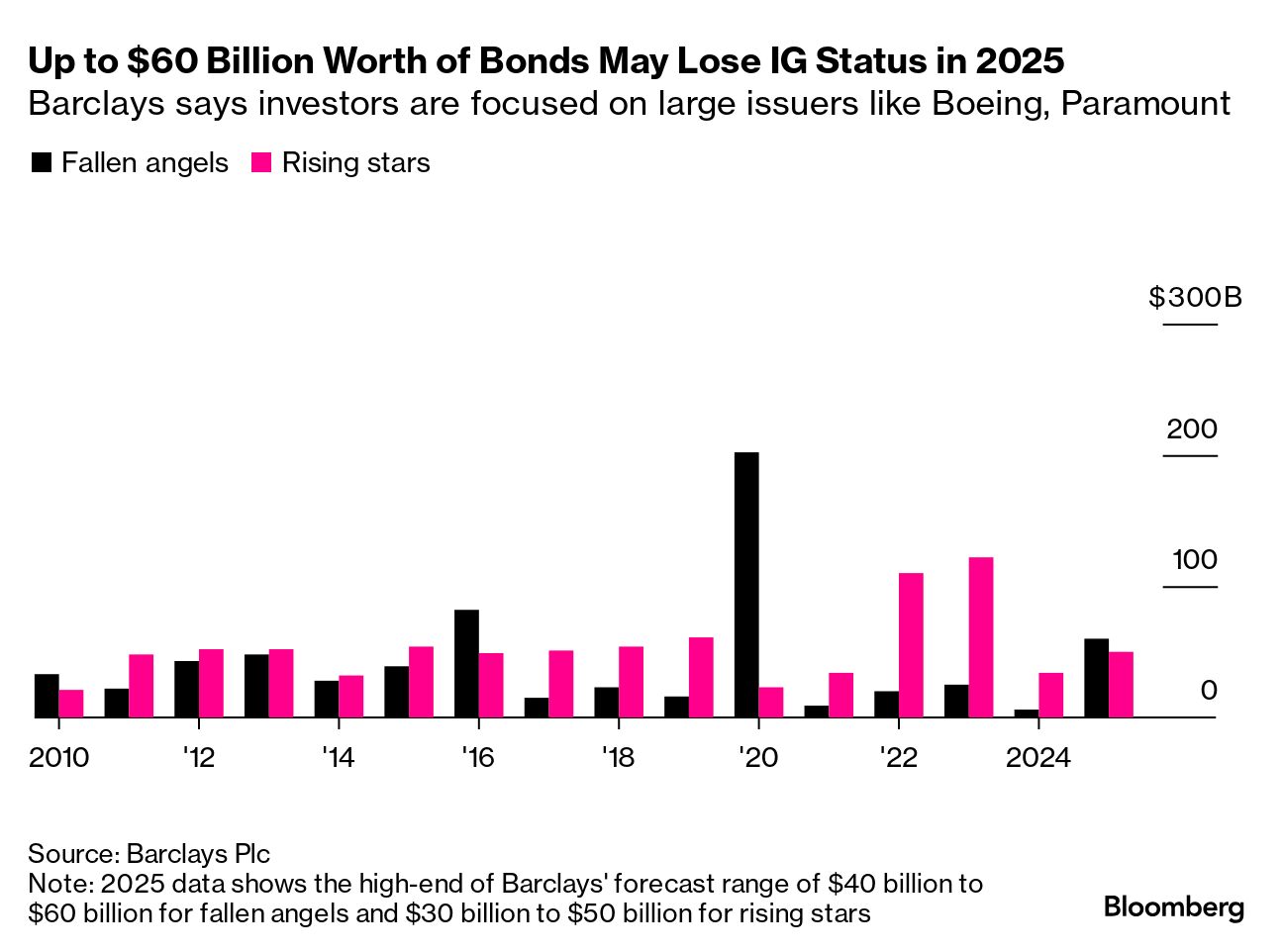

Still, the past four years has seen the Middle East emerge as an economic and finance powerhouse. Regional wealth funds are splashing out record amounts on deals, much of it in the US, and firms around the world continue to see state-backed entities in the Gulf as bankers to the world. "The Gulf is in a much stronger position on all accounts, economically and geopolitically. They're much more independent and they have the money," said Krieg. "Western countries need growth and need cash injections and the Gulf is willing to provide it, particularly when it comes to AI research and data centers which it can run on cheap energy." That could provide Gulf rulers with the leverage they need to minimize some of the negative impacts of Trump's foreign and economic policy in talks with the self-styled 'dealmaker' in the White House. The region could use those bargaining chips to convince the US administration to "cut them some slack," Krieg said. Also Read: Musk Is About to Find What $130 Million for Trump Gets Him Let's dig a little deeper into Saudi Arabia and the UAE's AI push that Zainab and Matthew referred to, which is now turning into an all-out race for regional supremacy. In the latest example, Bloomberg News reported last week that Riyadh is planning a new AI project backed by up to $100 billion. "Project Transcendence" will invest in data centers, startups and other infrastructure to develop AI, while also focusing on recruiting new talent to the kingdom, developing the local ecosystem and encouraging tech companies to put resources in the country. An AI hub being built by Saudi Arabia's wealth fund and Alphabet's Google may serve as the starting point for a broader initiative.  Server room at a data center. Photographer: Dhiraj Singh/Bloomberg That builds on the government's previous attempts to make inroads into high-end technology. The Public Investment Fund this year said it would back a firm called Alat that could, over the years, plow $100 billion into everything from technology to semiconductors and capital goods. The PIF was also reported to have been in early talks to partner with Andreessen Horowitz on another fund, which may grow to as large as $40 billion in commitments, to target AI investments. All of this puts Riyadh in direct competition with Abu Dhabi. The emirate's main AI vehicle, G42, this year set up a technology investment firm targeting deals in AI and semiconductors that could surpass $100 billion in assets under management in a few years, Bloomberg News has reported. That came weeks after Saudi Arabia's similarly-sized Alat was set up. Meanwhile, MGX is teaming up with BlackRock and Microsoft on one of the largest efforts to date to bankroll the build-out of data warehouses and energy infrastructure behind the boom in AI. The companies will seek $30 billion of private equity capital over time for the strategy, which will then leverage the money to as much as $100 billion in potential investments. AI is part of Saudi Arabia's Vision 2030 strategy, which aims to identify new revenue sources as the Gulf state diversifies away from fossil fuels. It's also one of the key planks of Abu Dhabi's own attempts to reshape its economy for a post-oil world. To aid their efforts to build AI capabilities — and as they vie to become the regional tech superpower — both countries are also rushing to build data centers to support the technology. Of course, AI isn't the only area where Riyadh and Abu Dhabi's ambitions collide. Both cities, home to over $1 trillion in sovereign wealth, are making a concerted attempt to draw the biggest names of finance. Many of those executives were in attendance at Saudi Arabia's flagship Future Investment Initiative last month and a number of them flew to Abu Dhabi soon after. Some will return to the region in December for the emirate's own confab — Abu Dhabi Finance Week. Also Read: Abu Dhabi Heavy Hitters Skip FII, Showing Riyadh Competition Abu Dhabi's M42 is planning to build an AI-powered healthcare champion and is eyeing dozens of potential deals in Europe, Latin America and Asia.  M42 CEO Hasan Jasem Al Nowais Source: M42 Talabat's Dubai IPO could value the company higher than its German parent firm, Delivery Hero. Saudi Arabia's stock exchange operator is eying mergers and acquisitions as a means to broaden the kingdom's capital markets. Electric-vehicle maker Lucid — majority owned by the Saudi wealth fund — posted a better-than-expected third-quarter loss. A Turkish gas trader is starting a currency exchange business to ease unsanctioned trade between Russia and Turkey. Dubai's family-run conglomerate Majid Al Futtaim shuttered stores it operated in Jordan under the Carrefour brand. China handed local governments a $1.4 trillion lifeline, but stopped short of unleashing new stimulus, preserving room to respond to a potential trade war when Donald Trump takes office next year. Skill is hard to measure in the shadowy world of private markets. A small band of quants wants investors to give it a go. Goldman Sachs added 95 executives to its partnership, the biggest addition since CEO David Solomon took over leadership of the firm. LVMH's empty Chinese megastore signals the $250 billion luxury crash is only the beginning.  Louis Vuitton's flagship store in Beijing has yet to open. Photographer: Na Bian/Bloomberg Credit markets face the risk of a $60 billion wave of 'fallen angels.' Bitcoin rallied past $81,000 for the first time, boosted by Trump's embrace of digital assets and the prospect of a Congress featuring pro-crypto lawmakers

Also Read: Trump Wins Arizona in Clean Sweep of Swing States in US Election

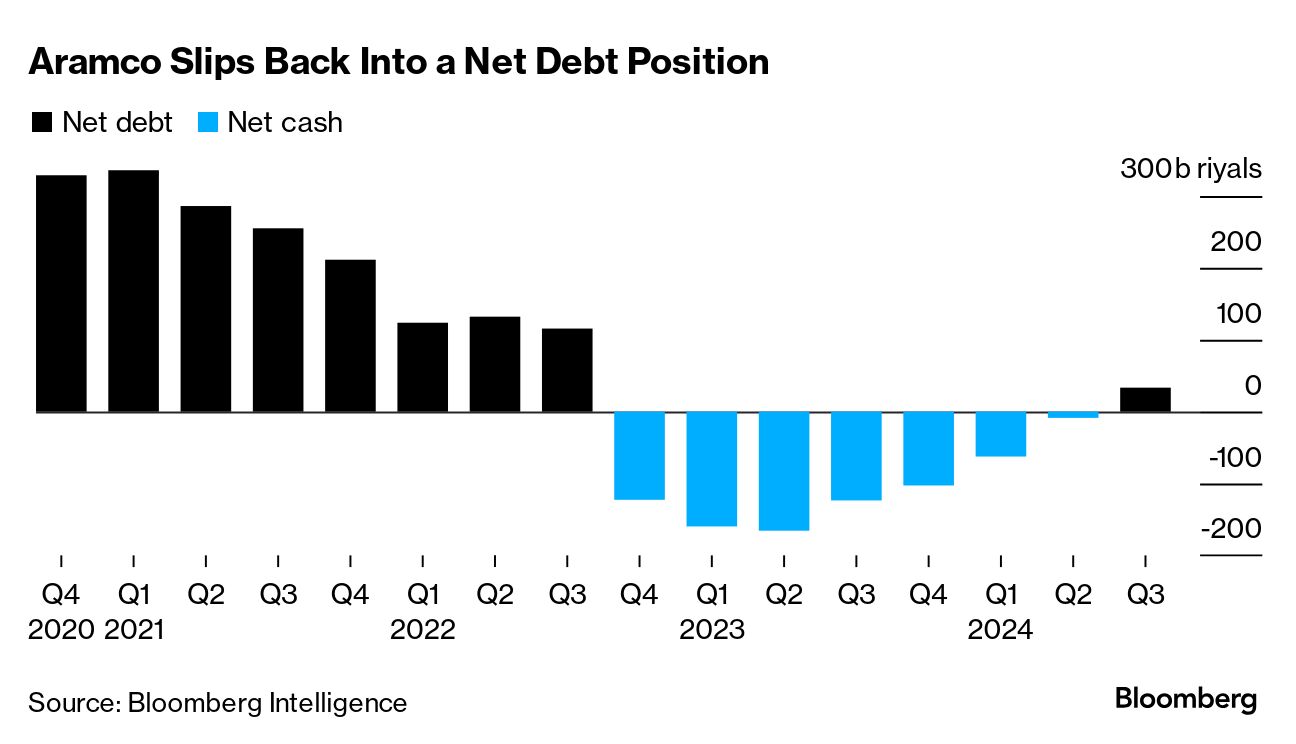

Floating armories are a key component of Russia's ability to profit enormously from its oil trade despite widespread sanctions. Billionaire Tom Ford has bought a mansion in London for $104 million. The property is in the same neighborhood where UAE's president bought an $82 million home. Saudi Aramco will have a crucial decision to make early next year: Cut its $31 billion quarterly dividend and risk worsening the kingdom's budget deficit, or keep borrowing to maintain the payout. The world's biggest oil exporter is distributing more than it's earning, flipping the company into a net debt position in the third quarter. It's a sharp turnaround for the firm that had over $27 billion in net cash just a year ago. Also Read: Saudi Aramco Is Burning Cash – It Needs to Stop (Opinion) Lulu Retail's $1.72 billion IPO has cemented Yusuff Ali's position as the UAE's second-richest private individual. Ali, now worth $7.1 billion, is part of a cohort of tycoons from India who spotted pockets of opportunity in the UAE in sectors from real estate to health care and education. That includes the likes of Aster DM Healthcare's Azad Moopen, infrastructure conglomerate RP Group's Ravi Pillai and Danube Properties' Rizwan Sajan.  Yusuff Ali, left, Sheikh Mohammed bin Zayed Al Nahyan, center, and Narendra Modi. Photographer: Lulu Group "They were all first-generation entrepreneurs who moved here to make their fortunes," said Viswanathan Shankar, a former top executive at Standard Chartered and founder of Gateway Partners. "Adept at networking, and exceptional at identifying and resolving basic consumer demand." Their ascent mirrors the rise of the UAE, which is now home to over 10 million people — a third of them from India, with the biggest portion hailing from Ali's home state of Kerala.

Also Read: Expats Paying $33,000 School Fees Fuel Rise of Dubai Billionaire If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment