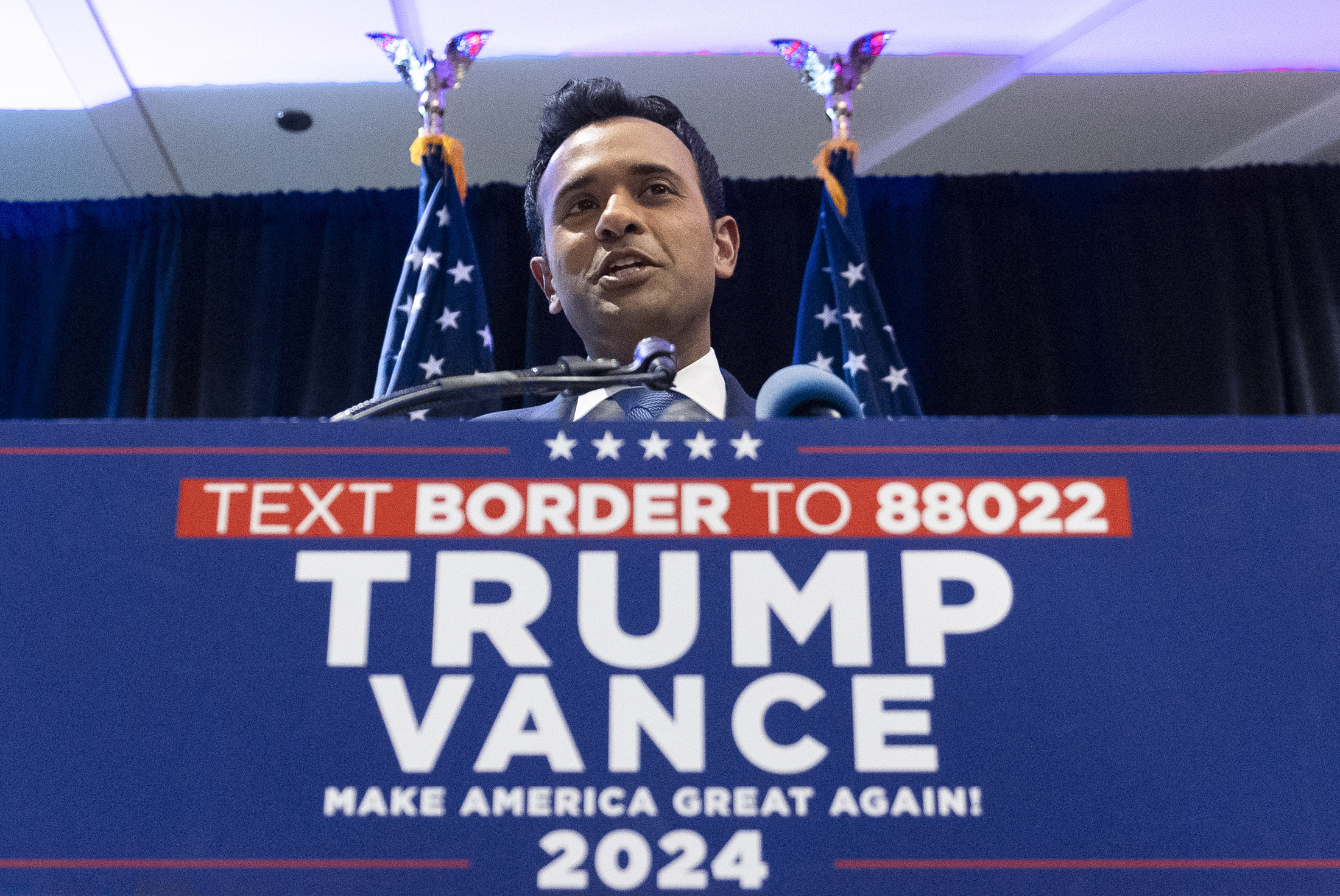

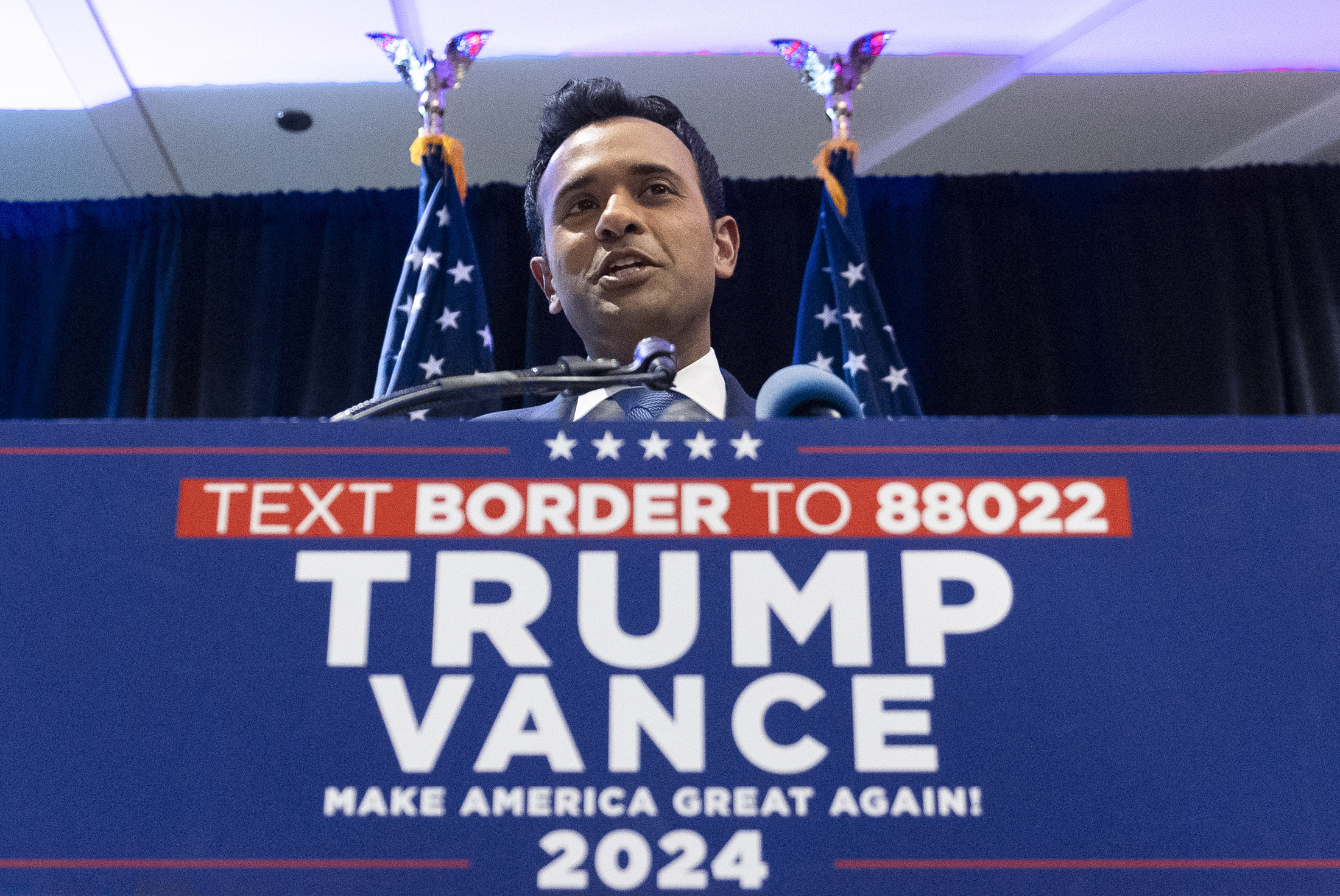

| Inflation data from October, released this morning, shows there's still work to be done to bring price pressures under control. Enda Curran writes in today's newsletter how President-elect Donald Trump might affect that effort. Plus: how the world's richest man got influence in the White House, the US's new age of irony and the challenges ahead for Europe. If this email was forwarded to you, click here to sign up. Just when it seemed the US economy was returning to a more predictable path after years of upheaval, the reelection of Donald Trump promises another round of shock therapy. A global trade war, mass deportation and an Elon Musk-led swing at finding trillions of dollars in government spending cuts are just some of the big-ticket policies now facing the world's largest economy. Voters made clear that policymaking needs a new direction and gave the Trump administration the legislative backing to make those changes. Less clear, however, is how those changes will play out. Take the plan for Musk and Vivek Ramaswamy to lead a "Department of Government Efficiency," a new entity aimed at drastically overhauling the government. Skeptics say if making major spending cuts were so easy, it would've been done a long time ago. Instead, lawmakers are routinely deadlocked in talks on where to find savings.  Ramaswamy will join Musk in a government cost-cutting effort. Photographer: Alex Brandon/AP Then there's the promise to carry out the biggest deportation of immigrants lacking permanent legal status on record. Economists say such a move would inevitably hit the labor supply for construction, restaurants and retail sectors, compounding complaints of worker shortages. But perhaps the biggest question is, how far can Trump push up tariffs on imported goods without triggering another round of inflation? The Republican has called for minimum tariffs from 10% to 20% on all imported goods, rising to 60% or higher on those from China. October's inflation numbers, released this morning, show why that may be risky. The core consumer price index—which excludes food and energy costs—increased 0.3% for a third month. Over that span it rose at a 3.6% annualized rate, marking the fastest pace since April, according to Bloomberg calculations. The headline measure in October rose 0.2% for a fourth month and 2.6% from a year earlier, marking the first acceleration on an annual basis since March. The details of the report highlighted the risk that disinflation will continue to be a slog. Goods prices excluding food and energy, meanwhile, rose for a second month (they'd fallen over much of the past year). Prices of used cars rose 2.7%, the most in over a year, and hotel rates climbed 0.4%. Airfares continued to rise, and health insurance costs jumped 0.5%. Apparel prices fell by the most since the onset of the pandemic — raising the question of what would happen to those prices if tariffs were jacked up. Trump says his trade policies will support manufacturing jobs and drive economic growth, a policy that clearly resonated with voters. But the ultimate impact of this policy mix will take years to become clear, long after the final votes of the 2024 election have been counted. |

No comments:

Post a Comment