- In one of the ultimate Trump Trades, Bitcoin topped $80,000 for the first time — more analysis on that as the week goes on.

- ESG is about to be buried; in the US, at least, it's fair to say it was already dead.

- China still hasn't nailed how it digs out from its real estate debt crisis, or responds to Trump 2.0 tariffs.

- AND: Rest in Peace, Quincy Jones, a songwriter and producer who was not at all bad.

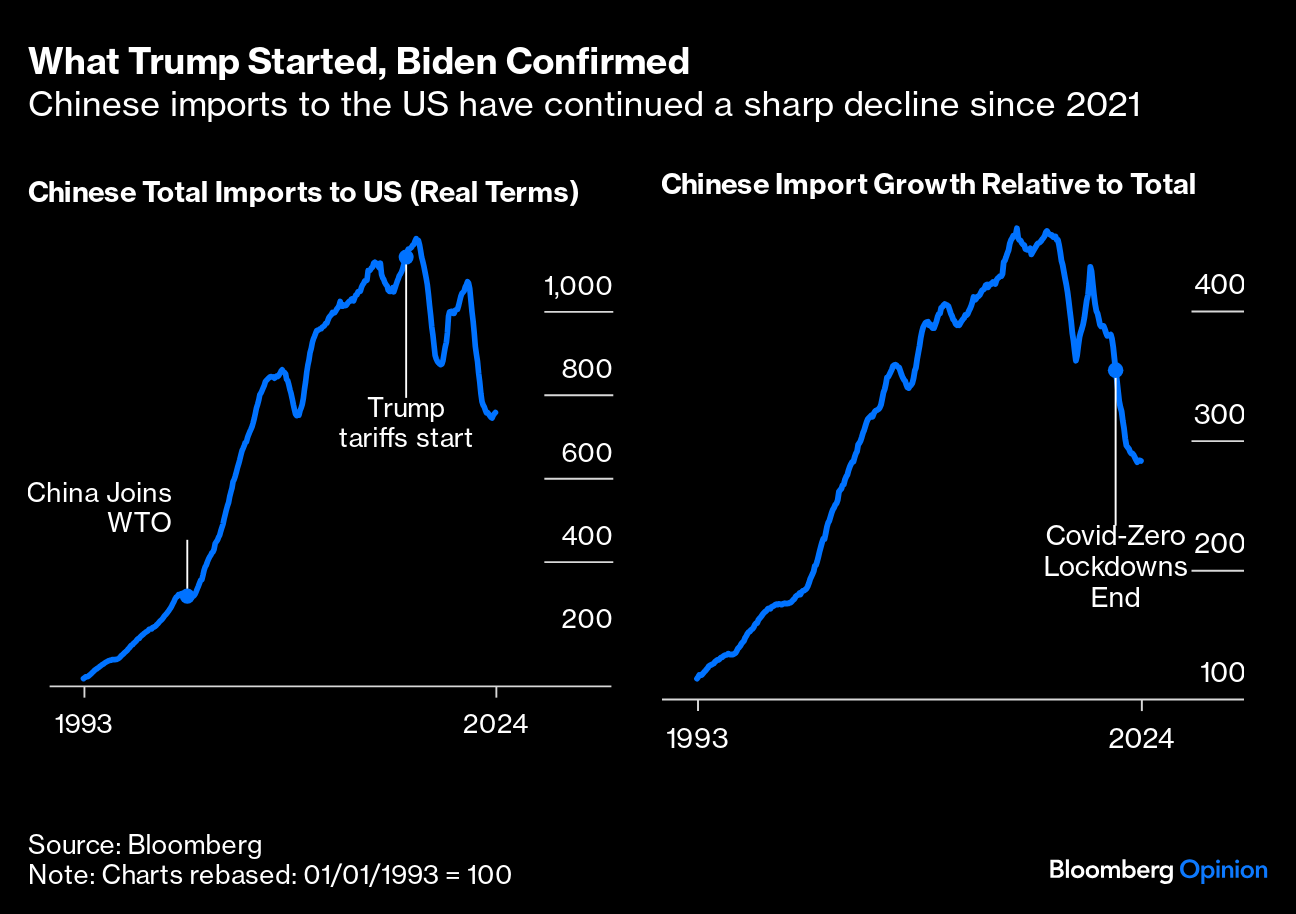

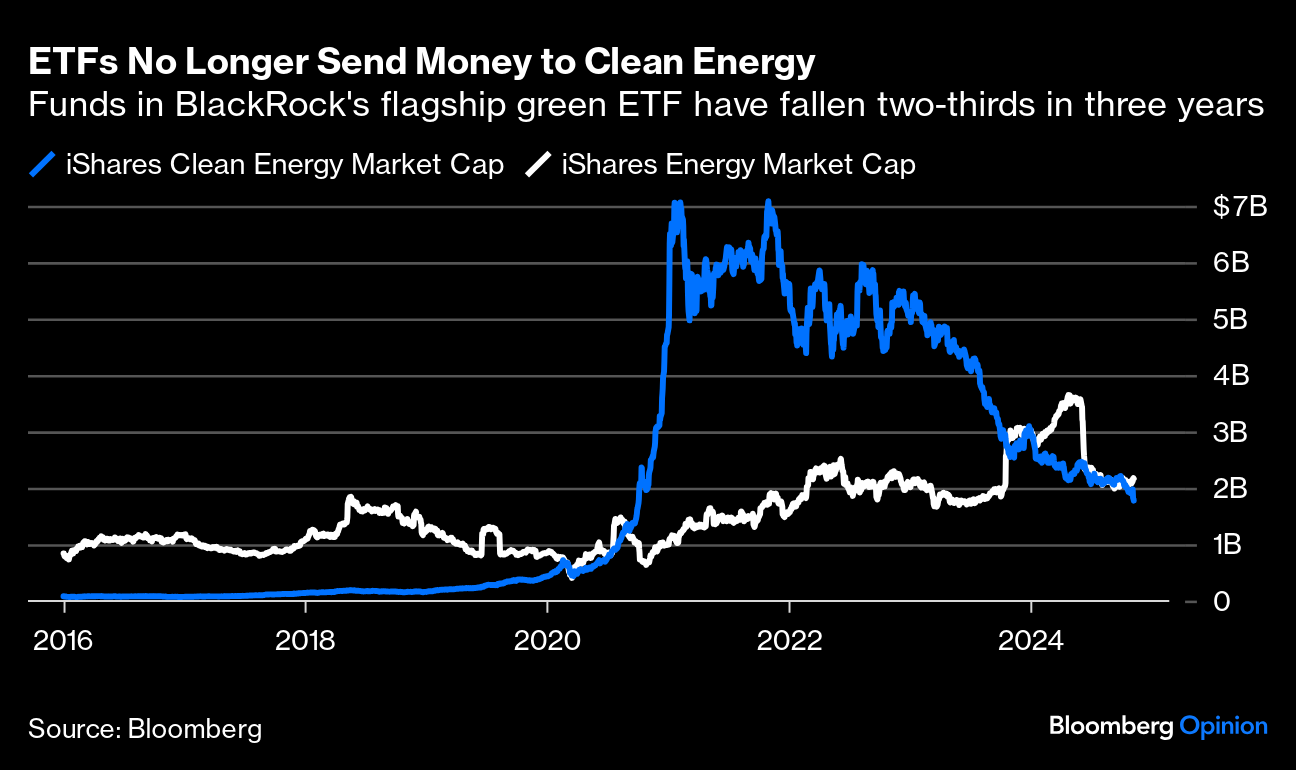

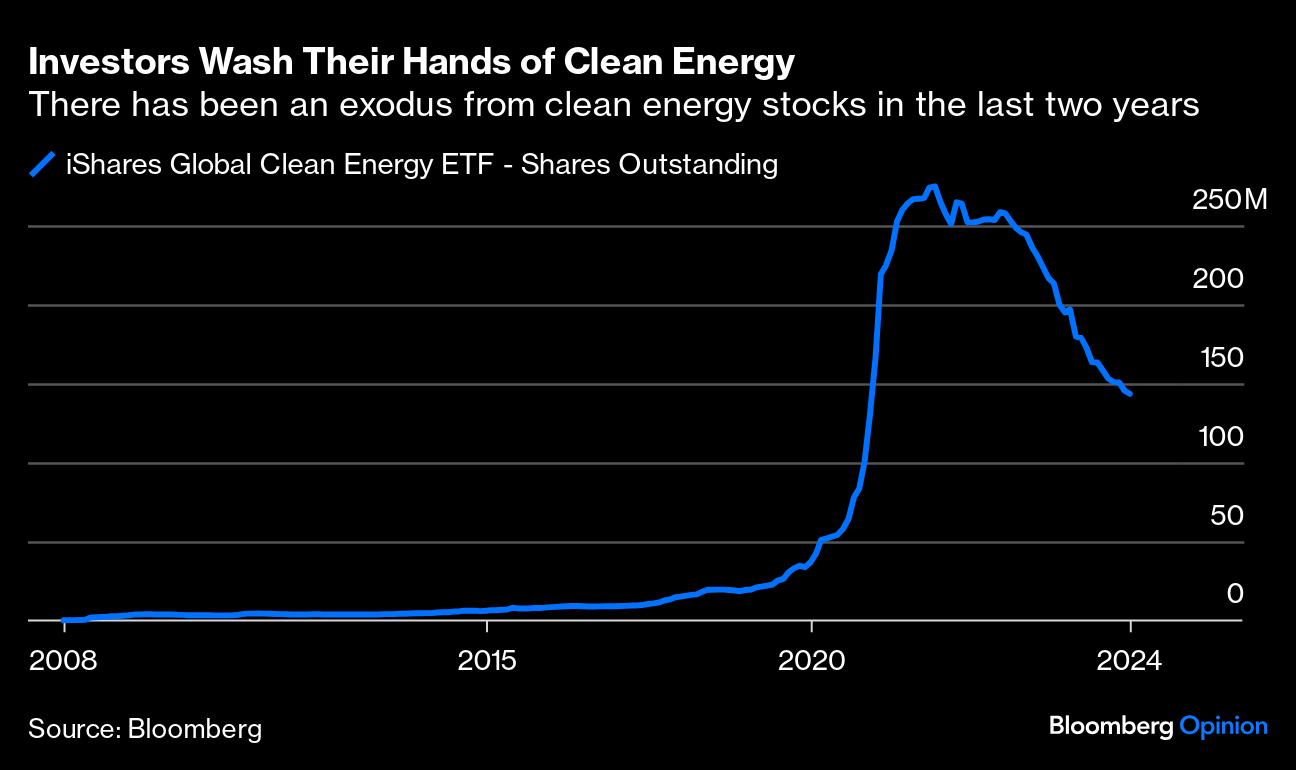

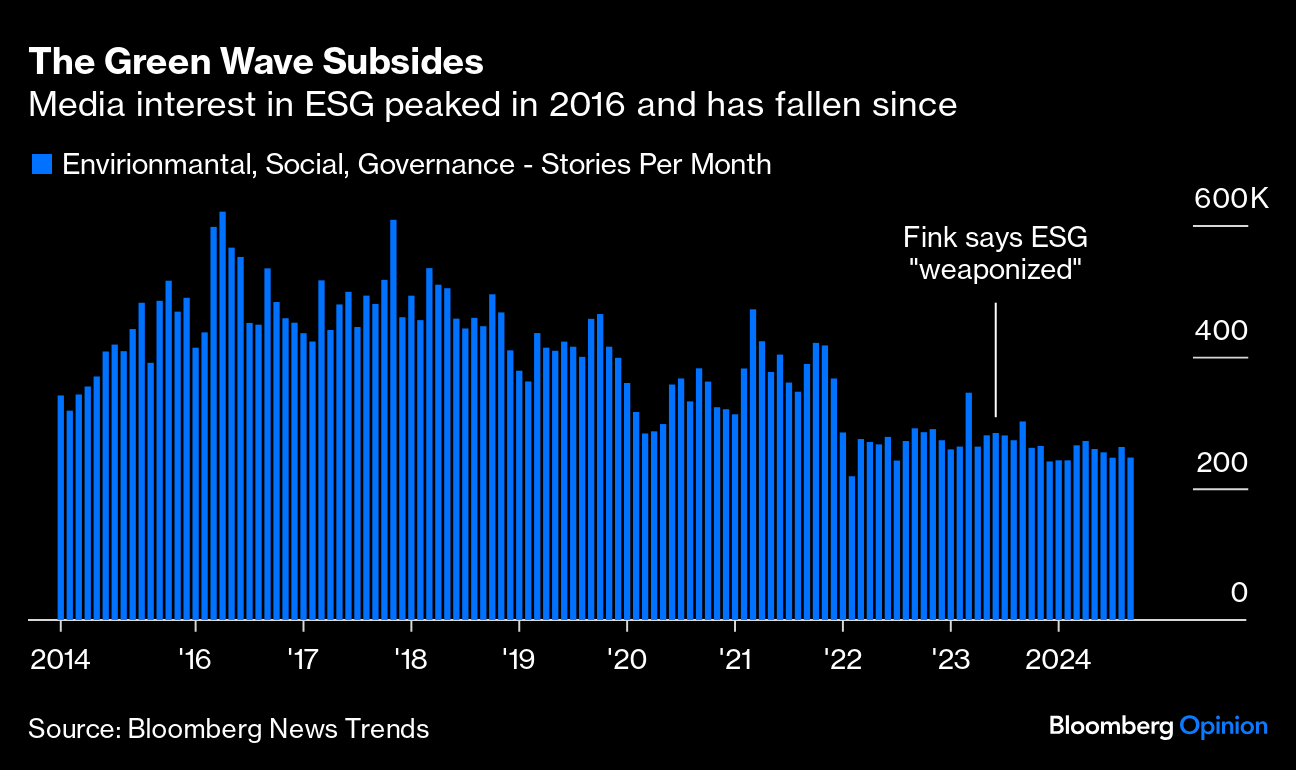

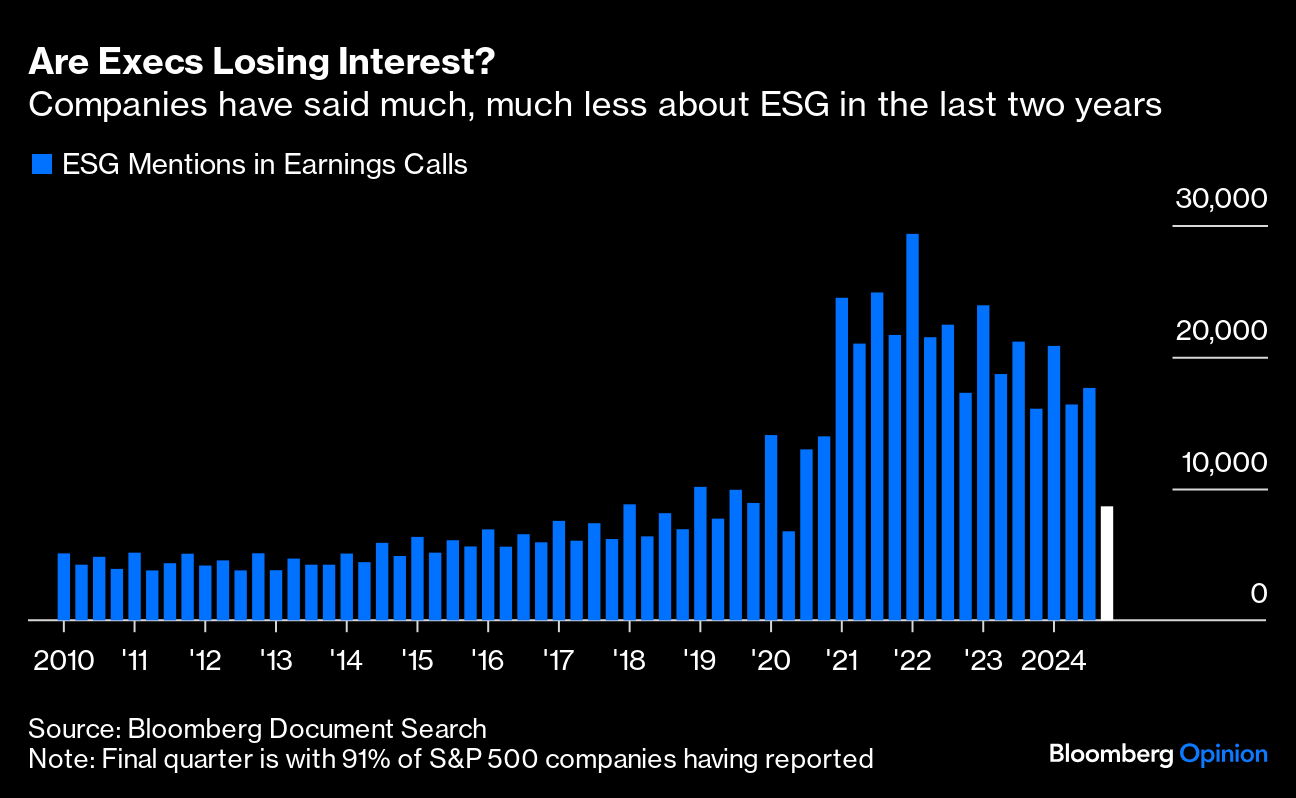

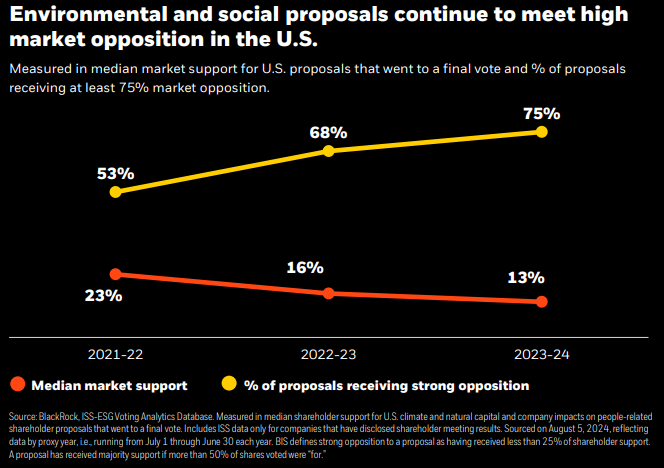

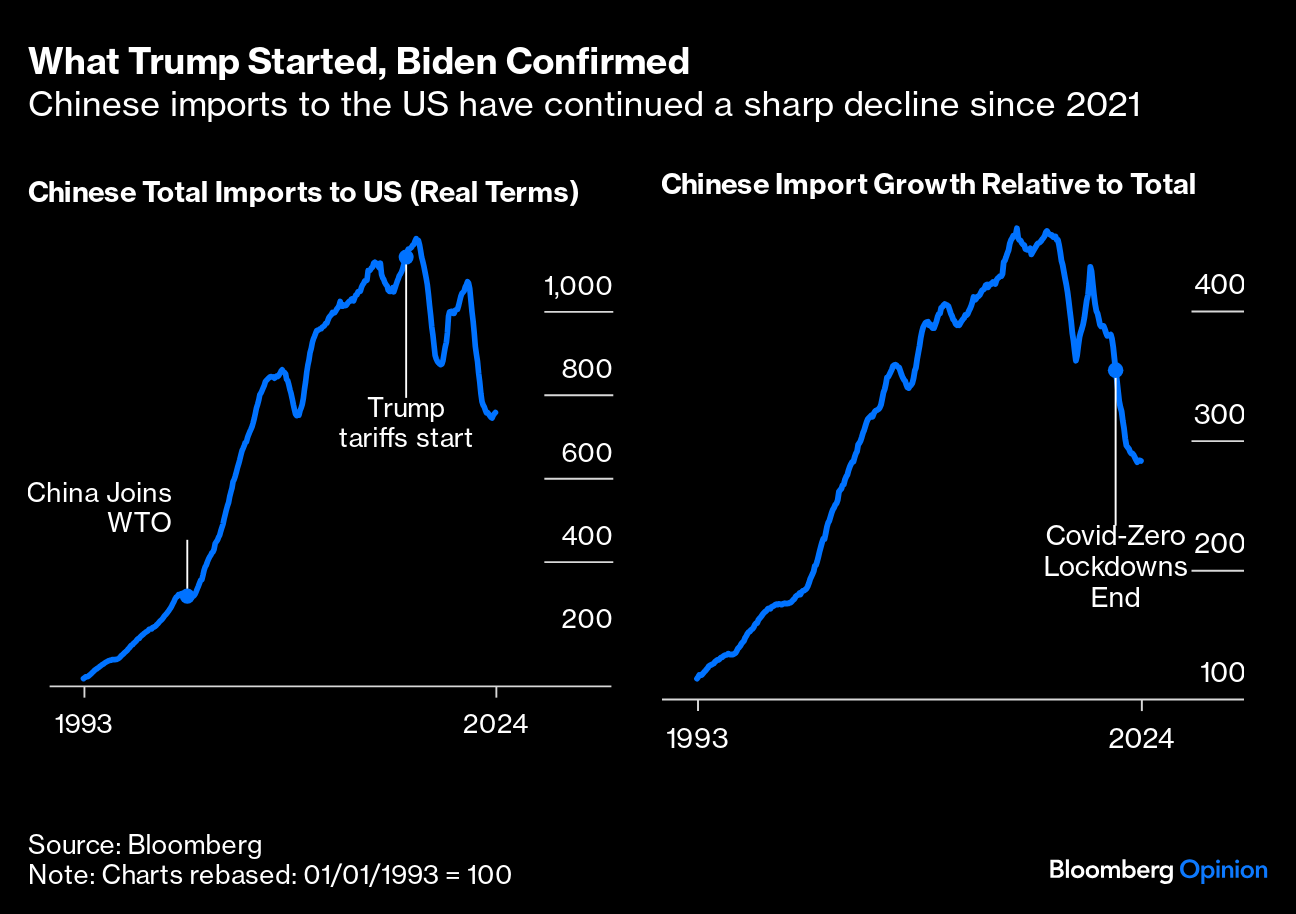

As was obvious even before voters went to the polls, ESG was already a decisive loser in the US. The concept of Environmental, Social and Governance investing became hopelessly entangled with the culture war agenda, failed to deliver on its promises, and went into retreat. Rather than attempt a technocratic, clean, green way of changing capitalism, America has opted for something more nationalist, even mercantilist. ESG as a term has been demonized by politicians on the right, to the point that BlackRock's Larry Fink said that it had been "weaponized" and should no longer be used. Because of Fink's stand on ESG issues, BlackRock has become a lightning rod for conservative attacks lumped in with identity politics. Startlingly, the company shows up in a list of "decadent and rootless" institutions that should be burned to the ground in a new book by Kevin Roberts, the head of the Heritage Foundation, a distinction it bizarrely shares with the Boy Scouts of America and the Chinese Communist Party. Supporters of the concept were already disillusioned that ESG had become little more than a marketing wheeze, and several big fund managers, including WisdomTree and Invesco, have faced fines in the US for "greenwashing" (claiming their products were greener than they really were). In France, BlackRock is under fire over allegations that 18 of its funds sold as sustainable are in fact investing in fossil fuels. Regulator attitudes differ starkly across the Atlantic. In Europe, regulators have raised the ante by telling fund managers that they must reach minimum thresholds for environmental impact before they can use the ESG label — a move that makes it hard for them to keep investing in the US, where the best returns are, and requires them to become more active than is currently the case for many. In the US, the Securities and Exchange Commision has watered down its requirements on companies to disclose ESG statistics — and the whole concept is close to unworkable unless everyone has to disclose standardized statistics. In September, it quietly disbanded its task force on ESG enforcement. Now, the Trump administration is likely to make dismantling such rules one of its first acts in office. That will complete a retreat that has largely already taken place. A look at the total market cap of BlackRock's flagship ETFs covering the global energy and clean energy sectors shows that after a boom in 2021, the clean energy fund has steadily dwindled, and is now worth slightly less than the main energy fund: Much of this is driven by the declining share prices of clean energy stocks. However, if we look at the number of shares in the ETF, it's clear that there were huge inflows during the pandemic, and much of that money has now been withdrawn. Investors are losing interest in the concept (and claims that ESG would reduce global warming, or starve fossil fuel groups of capital, look overblown): Interest among the public has waned in the US — although not elsewhere. Google Trends shows that US searches for ESG and its synonyms tanked over the last two years, while continuing at much the same level elsewhere. The rest of the world still seems happy to give it a try, but America is no longer going along for the ride: The pattern recurs in the news media. Counting stories published on the Bloomberg terminal from all sources shows interest peaking in 2016, when Donald Trump was first elected, and long before the flow of money went into reverse. By the time that Fink said ESG had been "weaponized," interest was barely a third its 2016 level and has continued to dwindle: Critically from the point of view of how capitalism is operating, the same pattern shows up in earnings call transcripts. Bloomberg's Document Search function shows that executives — not just Larry Fink — no longer want to talk about it. This is our quarter-by-quarter measure of mentions of ESG and its various synonyms since 2010. Mentions exploded after the pandemic, and have tumbled since 2022. With this earning season roughly 90% over, interest from executives in ESG looks to be right back to pre-pandemic levels: This is at least in part because fund managers are no longer forcing the issue. BlackRock is admirably transparent about the way it votes its shares, and produces regular reports; here is the latest. As this chart from the report (which is worth a read) demonstrates, the amount of support from shareholders for environmental and social proposals has declined markedly over the last three years: BlackRock itself upped its support for corporate governance proposals, but only backed 4% of social and environmental proposals (down from 20% two years earlier). It also declined to support any of the various anti-ESG proposals that were put forward, and complained that many of them were duplicative or poorly drafted. But the notion that ESG was going to change the way companies operate seems to be in retreat. Once Trump is back in the White House in January, we'll learn much more about how his economic nationalism will work. Fine-tuning capitalism to make it more long-termist and take into account more than the narrowly defined interests of shareholders — the big ESG idea — has been comprehensively defeated. Now we wait to see what version of mercantilism comes in its stead. For another sphere where the US election ratified a change that had already happened, look to China. Its exports to the US surged for many years, briefly interrupted by recessions. The Trump tariffs brought the biggest overall decline in imports from China since Beijing joined the World Trade Organization. Less recognized is that after a recovery, they have suffered just as big a decline in the last two years under Joe Biden. That's true whether we look at total imports from China, or in their share of all the goods entering the US. The end of Covid-Zero lockdowns two years ago had no impact on the decline.  So while Trump's return is plainly bad news for China's policymakers, they already knew they faced the most difficult environment in a generation. That being so, it's surprising that their response remains unclear. China's National People's Congress held a five-day marathon meeting last week, and became the latest government body to attempt to bring clarity to economic recovery efforts. Like previous efforts, it hasn't really succeeded. The messaging around China's "whatever it takes" moment in late September sounded at first like a bold return to capitalism, but what's followed has been the usual bureaucratic and multiple-layered decision-making proces, testing investor resolve. The NPC is addressing local governments' humongous "hidden debt" — exacerbated by the housing sector's collapse. But the International Monetary Fund estimates it to be over 60 trillion yuan, far in excess of the 10 trillion yuan, or $1.4 trillion, the NPC announced on Friday. Absorbing the debt onto public balance sheets will occur through 2028 — clarifying the size and timeline of the government bailout. Excitement ahead of the NPC's briefing fizzled once investors realized that a comprehensive stimulus packaged wasn't happening. The disappointment was visible in the CSI 300 index of mainland stocks and in the offshore Hang Seng China Enterprises Index:  Still, it's premature to dismiss the usefulness of the debt plan, which Bloomberg Intelligence's Nicole Gorton-Caratelli suggests will reduce pressures from near-term debt repayment while cutting debt-servicing costs — creating more room for the spending needed to reach this year's 5% growth target: Local debt resolution is a critical aspect of policy support. But it's only part of a broader push that's required to revive the economy. With this package, local officials may be able to start catching up on spending allocated in this year's budget.

China is better prepared for a fight this time. Photographer: Na Bian/Bloomberg Generally, investors' reaction to the lack of broader fiscal support could have been a lot worse, as China faces a potential existential threat from Trump 2.0 tariffs. How did they remain this calm? It's possible that Finance Minister Lan Fo'an's promise of a "more forceful" fiscal policy next year did enough to assuage fears. With Trump's inaguration looming, investors want a response to mitigate the promised 60% tariffs on Chinese goods. That could load a punch for China, given its already fragile economy, notes Gavekal Research's Arthur Kroeber: We should not assume that it will simply cave to US pressure and seek terms. Many Chinese foreign policy thinkers believe that a second Trump presidency is a short-term headache and a long-term benefit for Beijing because a gratuitous trade war with China and bullying of allies will accelerate global economic fragmentation and make it impossible for the US to forge an effective anti-China coalition. And Beijing has spent the last several years investing heavily in domestic substitutes for imports from the US and its allies. In some ways, it is better placed to withstand US economic pressure than it was six years ago.

There's growing evidence of foreign companies pulling out money. The latest direct investment liabilities in the balance of payments dropped $8.1 billion in the third quarter, the State Administration of Foreign Exchange shows. Cumulatively, China's FDI slumped by nearly $13 billion in the first nine months of this year:  It's difficult to imagine a sudden reversal of this trend with Trump back in the White House. For now, the finance minister's assurance of a counter-policy is only buying time. Luckily, policymakers can count on their Trump 1.0 experience, with déjà vu easing the sense of uncertainty. Still, it is difficult to tell how China will respond to the tariffs once they appear. If history is a guide, Gorton-Caratelli suggests Beijing will turn to import restrictions targeting agricultural goods where it doesn't rely heavily on the targeted country as a source. "But if Chinese leaders believe the US is all in on containment or can be pressured to back down, export controls could be in their arsenal." Next month provides another window for bigger fiscal measures when the 24-member Politburo will discuss the economy. Clearly, they're in no rush. As much as they can, China's leadership is following its own timelines. Slowly, investors are getting that message. —Richard Abbey Much was going on last week, so we never said goodbye to Quincy Jones in this space. Even though he described the Beatles to New York magazine as the worst musicians in the world, a questionable judgment to say the least, his legacy is extraordinary. Lists of his greatest works as a songwriter, producer and performer are proliferating, but let me suggest the version of It's My Party he made with Amy Winehouse, his version of Golden Years by David Bowie, his live performance at Montreux with Miles Davis in 1991, only a matter of weeks before Davis' death, and, OK, Thriller by Michael Jackson. It's as good a pop album as there has ever been and it's still great listening. Enjoy the week ahead everyone.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment