"We'll make so much money from that, from energy. We are blessed with something. You will hear numbers in a little while. We will make so much money that we'll start to pay down our $19 trillion in debt."

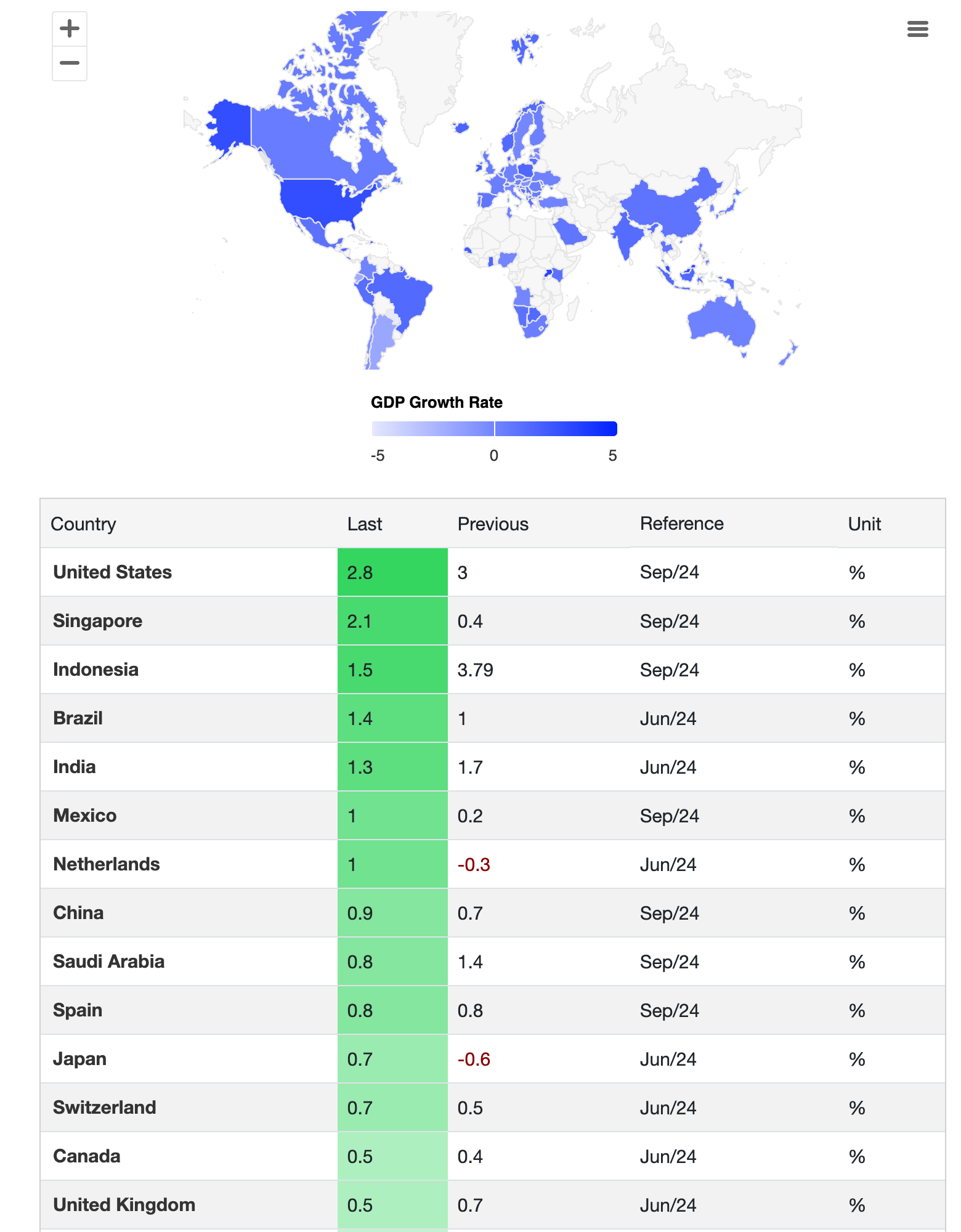

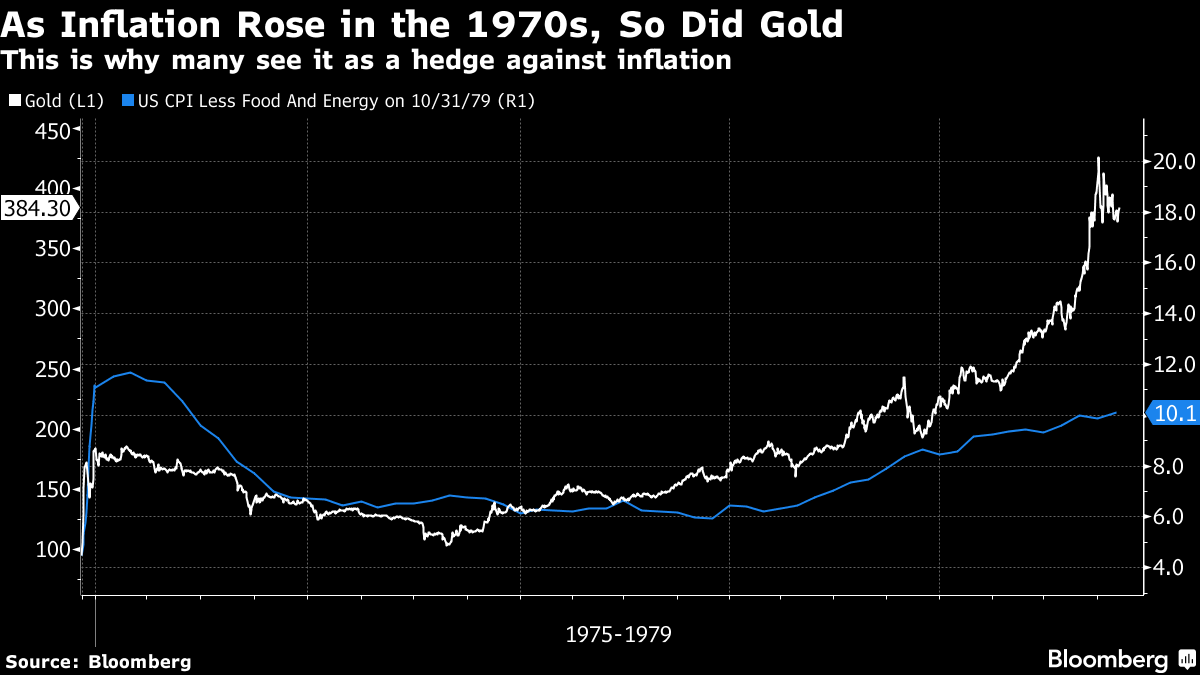

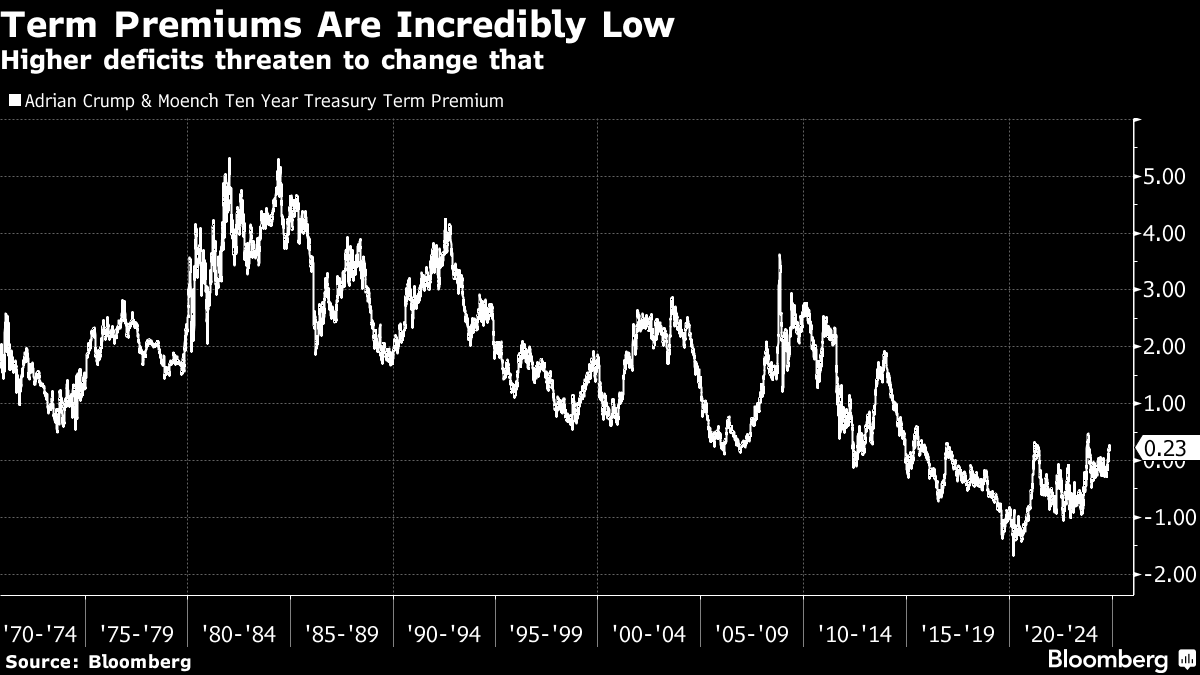

That's what Presidential candidate Donald Trump predicted in 2016. His plan was to eliminate regulations on oil drilling and usher in a production boom that would not only make oil companies rich but fill the coffers of the US government with tax collections. If you look at the price of oil price under Trump's first term in office, it pretty much round-tripped, with a barrel of West Texas Intermediate oil costing around $53 when he came to office and when he left. To be sure, there was considerable fluctuation along the way, with oil prices rising almost through the 2018 midterms and plummeting during the Covid epidemic. Still the lion's share of Trump's time in office saw oil prices in a comfortable $40-65 range. Was that good for energy companies? No. Here's a chart showing sector performance from 2009 to 2023. it's pretty busy, so I want you to focus on the lite green from 2017-2020. What you'll notice is that energy companies did the worst of any sector. Nothing about the price of oil or Trump's plans ahead of the election would have led you to expect that. Meanwhile the bitter feud between Trump and Big Tech leading up to the election quieted down, they mended fences by December 2016, and information technology ended up the big winner of Trump's term in office, even before the pandemic supercharged that run. The moral of the story? You can't trade shares based on politics. All of this "Trump Trade" stuff is pure speculation. And we need to be cautious about making equity sector or individual stock predictions in a very uncertain macro world. The story of a booming energy sector's dwindling the US government's debt in 2016 that never came to pass has become one of tariffs dong that same job in 2024. In fact, President-elect Trump even mused to podcaster Joe Rogan that the US could make so much money in tariffs, it might be able to eliminate personal income taxes. The bond market isn't having it. By the time presidential election was called for Trump early Wednesday morning, Treasury yields were already rising sharply in anticipation. Yields on all maturities beyond 10 years rose in excess of 20 basis points by the time equity market trading began. Equities then blasted higher. But that's a trade that I find much less compelling than the Treasury market one. Why? In a world where the US is growing the most of any of the G20 countries, with the unemployment rate near 4%, and promises that will worsen the deficit, the biggest tail risk is overheating. When the world is falling apart — as it was after Covid hit or when the 2007-2009 recession scarred the world economy — deficits fill a hole that a loss of private sector demand create. But when demand is already high and you add more deficits on top, the result — as we saw in 2021 and 2022 — is inflation. The difference now is that the potentially inflationary economic policy is coming when core consumer price inflation, at 3.3%, is almost a full percentage point higher than it was on the eve of the pandemic and two percentage points higher than it was before inflation took off in 2021. That's better than the 1970s. But it's still reminiscent of that time. Back then, core CPI excluding volatile food and energy prices crested at 11.7% in 1975 and only got back to about 6% before it started rising again in 1977. So the same pattern we see today — albeit with numbers roughly half of those from back then. |

No comments:

Post a Comment