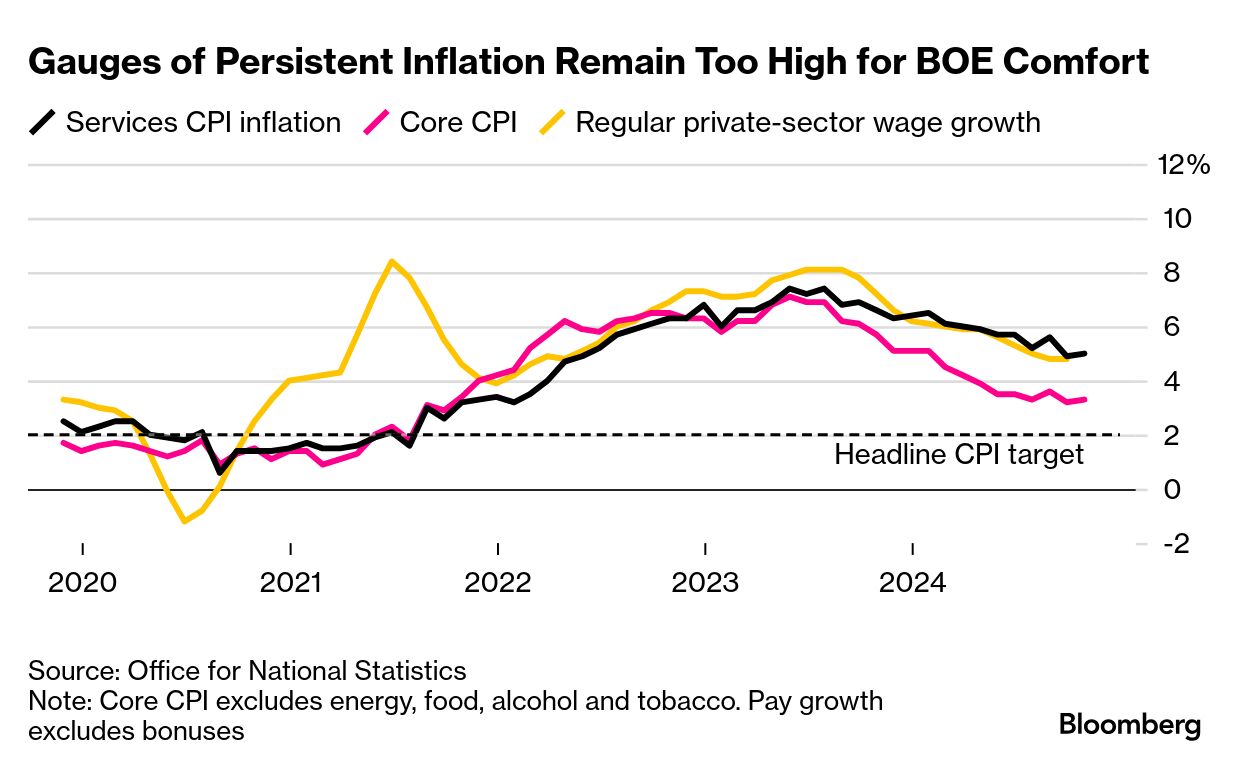

| Morning, I'm Louise Moon from Bloomberg UK's breaking news team, bringing you up to speed on today's top business stories. Just when companies thought they were out of the high inflation and high interest rate woods, the economy had other ideas. Inflation in the UK accelerated (slightly) more than forecast in October to 2.3% from 1.7% in September, nudged higher by more expensive energy bills. The Bank of England and economists had expected 2.2%. While the rise may seem small, it's the biggest inflation pickup between months since October 2022. Plus, the sentiment and implications matter. Crucially for companies, this morning's stats keep Andrew Bailey and his rate-setting gang on their path of cautiously cutting interest rates. More on that from Markets Today's Dave Goodman below. That's just as things seemed to be looking up. A host of firms this morning pointed to better times ahead as the economy simmers, not least Severn Trent. The water company described a period characterised by unprecedented energy prices and other cost increases, but said lower inflation during the first half was helping. Perhaps it spoke too soon. Plus, the BOE also thinks Rachel Reeves' budget could add fuel to the flames. So as costs increase and taxes rise, companies still have a whole lot to contend with. What's your take? Ping me on X, LinkedIn or drop me an email at lmoon13@bloomberg.net. Oh, and do subscribe to Bloomberg.com for unlimited access to trusted business journalism on the UK, and beyond. |

No comments:

Post a Comment