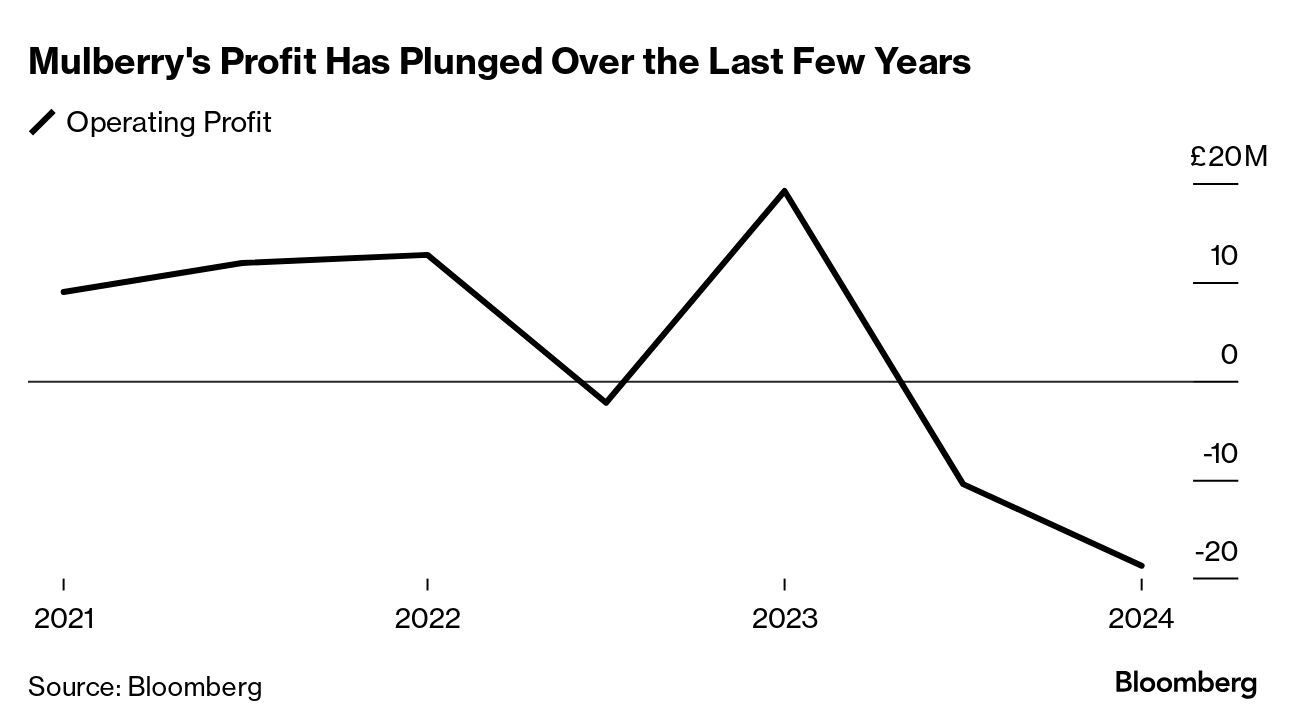

| Morning, I'm Louise Moon from Bloomberg UK's breaking news team, bringing you up to speed on today's top business stories. Mulberry is fighting a multitude of bush fires. Having managed to successfully fend off a takeover attempt by Mike Ashley's Frasers Group, the iconic British handbag maker is now reforming itself under new CEO Andrea Baldo. Chucked in at the deep end. A "challenging and volatile" macroeconomic environment means Mulberry will "streamline operations" and review its team structure to become "a leaner, more agile organisation" (read: job cuts?) It has also adjusted products, pricing and distribution strategies. First-half sales shed 19%, dragged by a 31% drop in Asia. To its credit, Asia isn't a siloed problem – a cutback in spending by Chinese consumers is weighing on luxury across the board. Swiss watch exports, for instance, fell again last month due to a fall in shipments to China, which was sharp enough to offset growth across the pond in America. Plus, in Mulberry's home market, there is the budget to contend with. Scores (79) of retailers, including Tesco, Next and M&S, came out overnight with a letter warning Rachel Reeves of a £7 billion annual hit to the sector, according to reports. Faced with these headwinds, the question is — will a rejig get Mulberry back into fashion? What's your take? Ping me on X, LinkedIn or drop me an email at lmoon13@bloomberg.net. Oh, and do subscribe to Bloomberg.com for unlimited access to trusted business journalism on the UK, and beyond. |

No comments:

Post a Comment