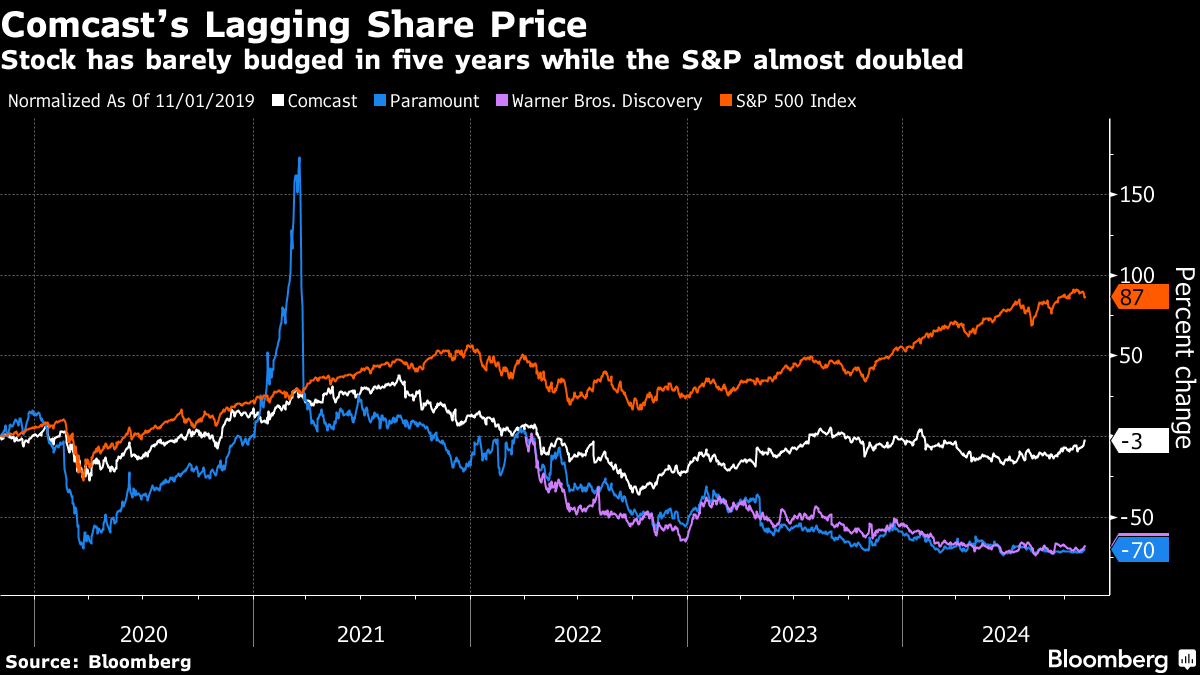

| Comcast Corp. will explore spinning off its cable networks into a separate company, in what may be the opening step in a wider restructuring of its NBCUniversal division, one of the world's largest media companies. No media company wants to own cable networks anymore. They are declining assets with no future. Walt Disney floated selling some networks. Paramount almost sold a couple before selling itself entirely. Warner Bros. Discovery has discussed breaking up its company into pieces. While cable networks are profitable, their limited future drags down the value of any company that owns them. That's one reason why Comcast is exploring a spinoff. Shares of the cable, media and theme-park company haven't budged over the last five years, while the S&P 500 is up almost 90%. Cable networks aren't the only reason for Comcast's performance. But investors don't love the company's exposure to such a struggling business, and spinning off the networks could boost its shares. Whether management spins off the networks into a separate public company owned by its shareholders remains to be seen. A spinoff would be very complicated and the company has cautioned that it's just exploring the idea. NBCUniversal's news resources are shared by MSNBC, a cable network, and NBC, a broadcast network that would likely remain part of Comcast. Bravo and E!, two cable networks, are prominent suppliers of programming to Peacock, a streaming service that will also likely remain part of Comcast. Management has made clear it's not going to part with NBC or Peacock. Some analysts and investors consider this week's announcement a trial balloon, suggesting the company has essentially hung a for-sale sign on its cable networks. It's inviting a private equity firm or another media company to bid on those networks. It's not clear who wants to buy a bunch of cable networks. Comcast said it would not load up the business with debt – a common tactic in spinoffs – but the resulting company still won't be in a particularly strong negotiating position with pay-TV distributors or advertisers. It would need to negotiate new deals without the support of NBC, the most powerful TV network in the NBCUniversal portfolio. "Spinning off NBCU's cable networks is challenging at this stage of their lifecycle," Rich Greenfield of LightShed Partners wrote in a note this past week. "Without NBC, those cable networks would be in an incredibly precarious position." Read More: Comcast Taps Morgan Stanley to Advise on Potential Spinoff It's also not clear Comcast wants to sell anything. Existing shareholders would own the new company, and the Roberts family, which holds a 33% voting stake in Comcast, would have similar control over the new entity. Despite constant rumors about a potential merger with Warner Bros., such a transaction has never materialized or come close. Comcast CEO Brian Roberts has been pretty consistent in dismissing talk of such a deal, while his top deputy, President Mike Cavanagh, stressed the company has a high bar for M&A. Comcast doesn't want more exposure to cable networks, so it has little reason to buy a company that makes almost all of its profit from them. Ergo, it's not buying Paramount or Warner Bros. Nor does Comcast want to get out of entertainment entirely. Roberts led the charge to acquire NBCUniversal over a decade ago and has built it into a media giant a little bigger in sales than both Warner Bros. Discovery and Netflix. He committed billions of dollars to its park business and more than $20 billion to broadcast rights to the NBA. Those games can appear on NBC, its broadcast network, and Peacock, its streaming service. "We're pretty excited about the company we've got," Roberts told me at Bloomberg Screentime earlier this year. While Comcast focuses on its studio, theme parks and broadcast network, the new company could become an aggregator of lower-growth and less-sexy media assets. With little debt and cash to spend, it would be able to buy some cable networks, local TV stations or other assets if they become available in the next couple of years. Most experts expect additional consolidation given the continued decline of the legacy cable and satellite TV business. Unlike some other media companies, Comcast hasn't felt the need to rush into any decisions. Given its size and family ownership, it is under less pressure from Wall Street than Paramount (down 72% since the reunion of Viacom and CBS) or Warner Bros. (almost 70% since its formation). Yet clearly Roberts and Cavanagh are tired of watching the stock trade at what they consider a discount and want to shake things up. While examining a proposed spinoff, management has also discussed restructuring NBCUniversal's executive ranks, handing more control to Donna Langley. Langley, the longtime head of the Universal film studio, was named NBCU's chief content officer last year. She added oversight of the TV studio but shares programming leadership with Mark Lazarus in some areas. Langley is expected to gain full control of those in any change. (I would recommend watching my interview with Langley at Screentime last year.) Lazarus, who led the charge on Comcast's NBA deals, is well-liked and should see his portfolio change as well. If Langley takes sole oversight of some areas under Lazarus, he will add to his duties elsewhere. He has a lot of experience running businesses like the potential new spinoff as well. If Comcast moves forward with its plans, the biggest question mark in what remains of NBCUniversal will be its strategy for Peacock. The streaming service lost $436 million last quarter – and that's before you factor in the cost of the upcoming NBA deal. The service accounts for more TV viewership than Paramount+ or Max, but is well behind Amazon and Disney (to say nothing of Netflix and YouTube). Comcast would like Peacock to be one of the few mass-market streaming services in the US, but has more limited ambitions abroad. The company is open to partnering with rivals, and has held talks with Paramount. But forming a proper joint venture is easier said than done, as we covered a few weeks ago. It requires compromise, sacrifice and a little desperation. Roberts and Cavanagh are nowhere near that. Netflix will replace Amazon as a new streaming home of Universal Pictures' live-action movies starting in 2027. Netflix already had the rights to Universal's animated films, a deal the two partners renewed for another five years. Universal has structured a deal it thinks is very clever. Its movies debut in theaters, after which they become available for home rental or purchase and then go to Peacock, the streaming service owned by its parent company, Comcast. This allows Peacock to offer the movies when demand is highest and the marketing is still fresh. The titles then go to Netflix, which will pay hundreds of millions of dollars a year and expose the films to an even larger audience before they return to Peacock (and later other places). Netflix won a bidding war that included Amazon, HBO and others. Universal has moved quickly to set the market for the next round of movie deals. Netflix, which is making fewer original movies, has a similar agreement with Sony. While the pact with Universal means the streaming company needs Sony less, the studio should have no problem getting a good deal. Sony is the only major movie studio not aligned with a streaming service and its product does very well on Netflix. Amazon may want to replace what it has lost with somebody. There are some in Hollywood who fear Universal is enabling Netflix to extend its advantage over everyone else. If it offers movies from two major studios, that is very compelling to customers. But Universal isn't going to forgo all that money (or the viewership) to make the movies exclusive to Peacock in perpetuity. YouTube's $50 billion yearYouTube went over the $50 billion mark in 12-month sales. The bulk of that money (about $36 billion) came from advertising. But that means the company now makes more than $10 billion from subscriptions like YouTube TV and YouTube Premium. At $50 billion in revenue, YouTube is about 30% larger than Netflix. But … we don't know if it makes any money. Most outside estimates put YouTube at about breakeven while Netflix is about to post around $9 billion in profit. A World Series spikeWorld Series TV ratings hit a seven-year high despite a short series. The event averaged 15.8 million viewers a game. That topped this year's NBA Finals by 4.5 million viewers. Deals, deals, dealsI saw Anora and Emilia Perez last week. Easily two of the best and most surprising movies of the year.

Top Dawg has done it again. Alligator Bites Never Heal, the third mixtape from the rapper Doechii, is a banger. |

No comments:

Post a Comment