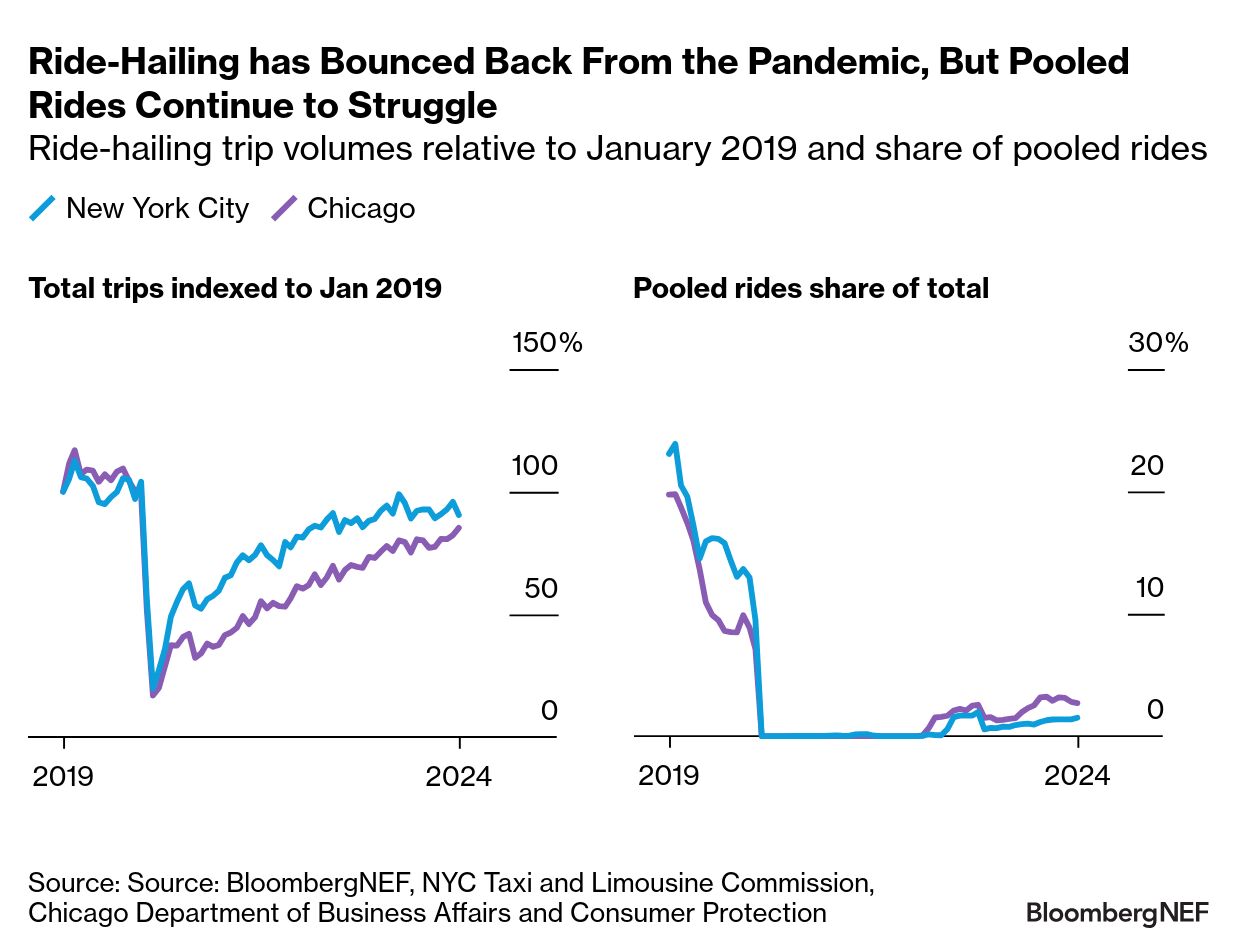

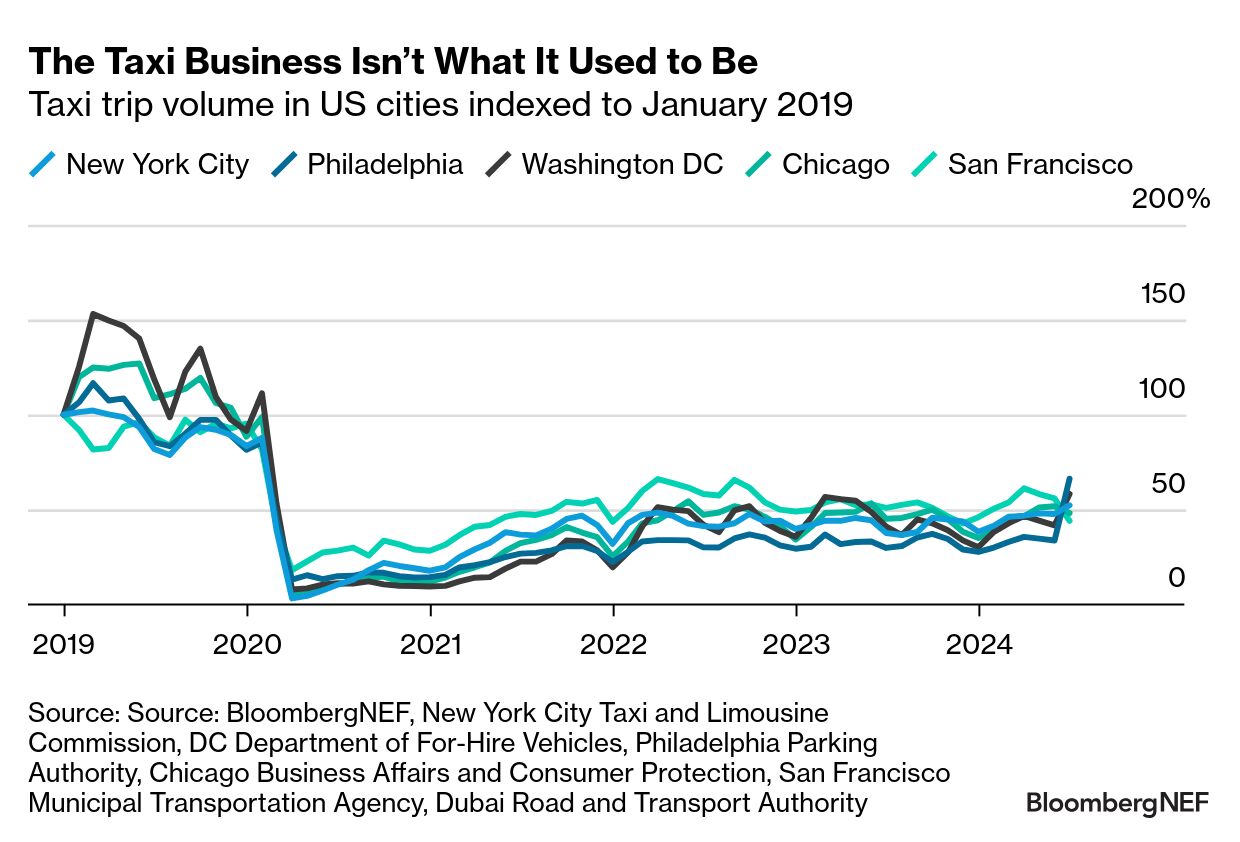

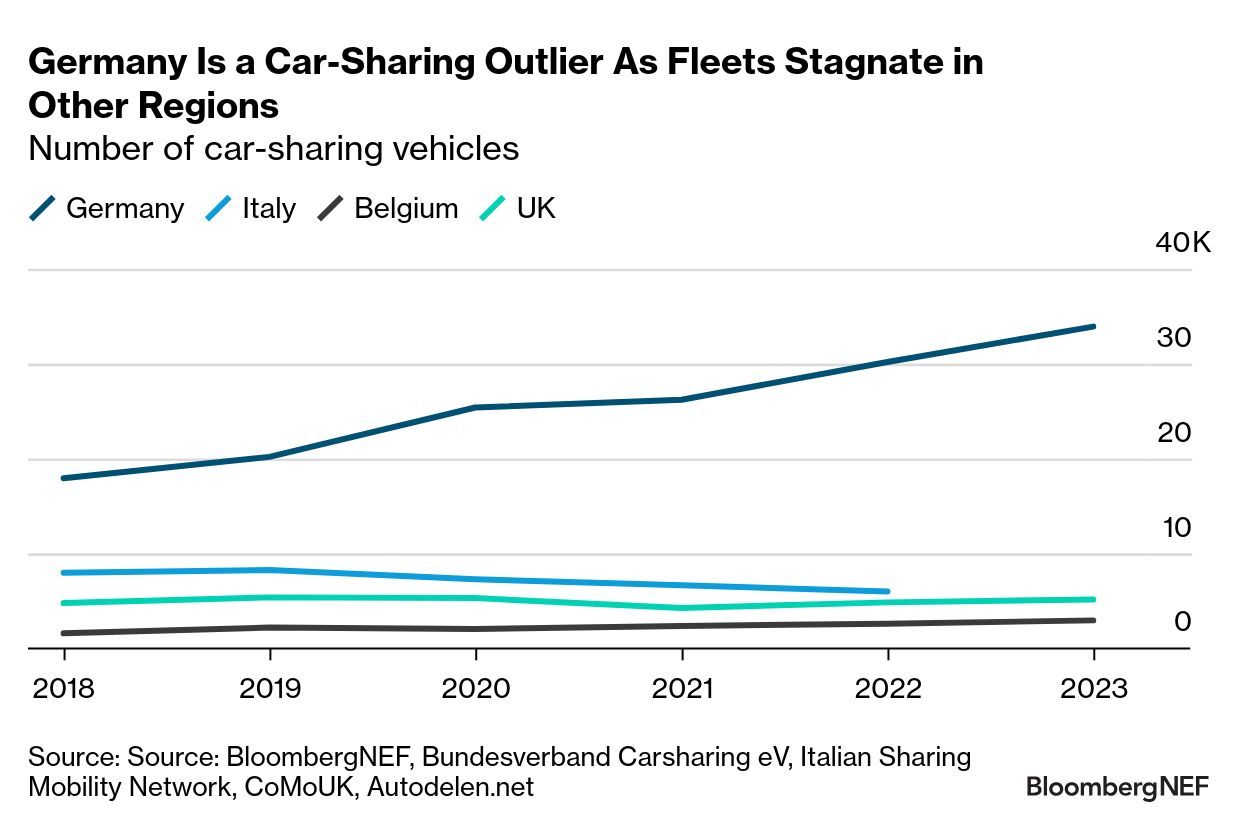

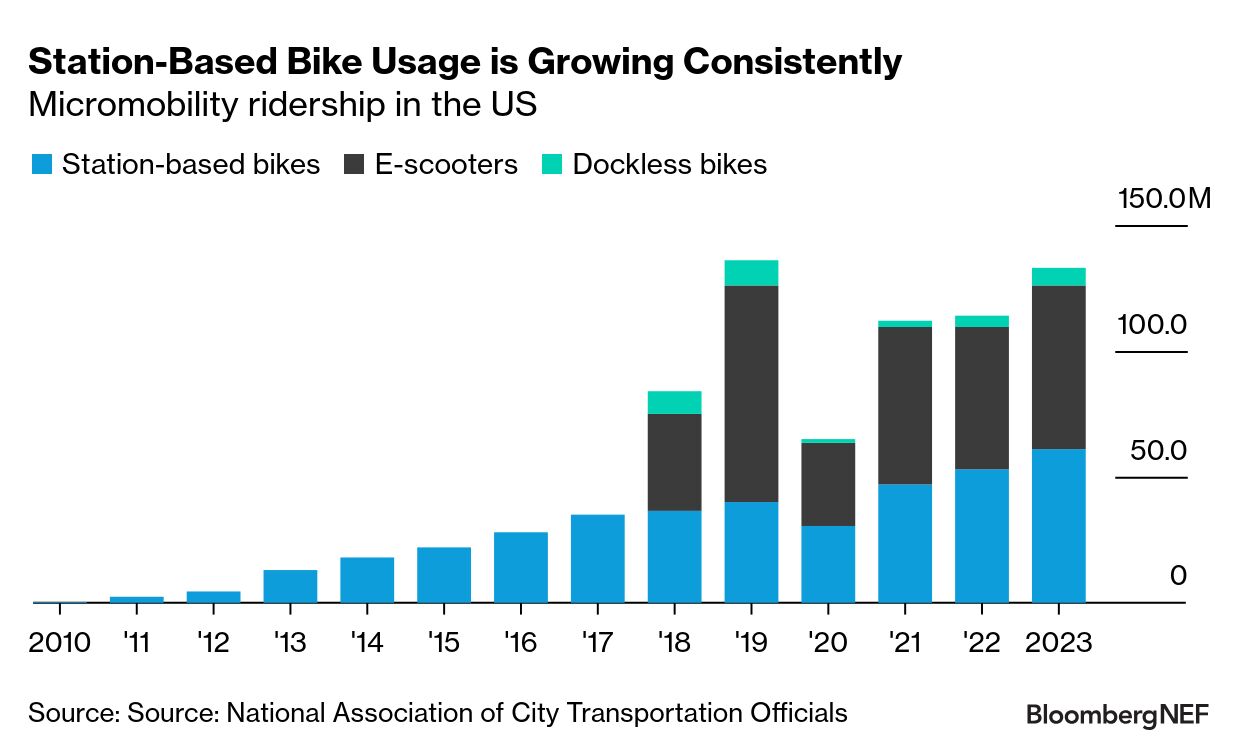

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Venture capitalists have in the past decade plowed about $120 billion into shared mobility service businesses ranging from ride-hailing platforms like Uber and Lyft, to scooter and bike-sharing companies including Lime and Bird, to car-sharing firms such as Turo and Zoomcar. Some forms of mobility services are now fully entrenched in cities' transit landscapes. Others haven't lived up to the hype or have been displaced by competing technologies. A few years removed from a global health pandemic, there are some clear winners and losers: Winner: Ride-Hailing Ride-hailing is by virtually every metric the largest and most impactful type of mobility service. Of the top 10 venture and private equity-backed mobility service companies in history, eight are ride-hailing firms. In major urban hubs, ride-hailing companies like Uber, Lyft, Didi, Grab and Bolt have higher user counts and more vehicles on their platforms than other forms of mobility services. In New York City, for example, there are two ride-hailing vehicles for every shared station-based bike, and nearly 10 ride-hailing vehicles for every taxi. Usage of ride-hailing has mostly recovered from the Covid-19 pandemic. As of July 2024, daily trip volumes in New York City and Chicago stand at 91% and 85% of pre-pandemic levels, respectively. The pandemic did change the business model of the ride-hailing, moving quite decidedly away from from pooled rides, which were as high as 24% of total trips in New York, pre-pandemic, and haven't returned to above 4% since. As a result of this trend, Lyft discontinued its pooled ride offering in May of last year. Loser: Taxis Taxis were already losing trips to ride-hailing businesses prior to the pandemic, but the lockdown era seems to have sealed their fate. Traditional taxi services have experienced a more prolonged decline in ridership compared to ride-hailing services. At the onset of the pandemic, taxi ridership plummeted by 80% to 95%. By July 2024, trip volumes in these cities were still 44% to 66% lower compared to January 2019 in cities like New York City, Washington, Philadelphia, Chicago and San Francisco. Taxi companies have been forced to embrace digital hailing options in order to compete with ride-hailing services. While some taxi companies have developed their own apps, it's more common for taxis to be matched with riders by an independent marketplace service, either in the form of a taxi-specific app or by taxis being an option within ride-hailing apps. Uber has partnered with taxi companies in 33 countries, and the company aims to include every taxi in the world on its app by 2025. Loser: Car-Sharing Managing a fleet of depreciating assets is a tricky business, and car-sharing is no exception. Fleet-based car-sharing businesses have struggled to scale up their operations outside a few specific markets. Automakers have previously experimented with the fleet-based carsharing business models, but outside of a few offerings such as Stellantis' Free2Move and Renault's Zity, most have largely moved on from trying to both manufacture and own cars. The total number of car-sharing vehicles have flatlined across many cities in Europe outside of Germany. Germany's growth in car-sharing can largely be attributed to favorable government policies that include dedicated car-sharing parking spaces and integration of car-sharing with public transportation systems. Winner: Micromobility Those familiar with the high-profile bankruptcies and rampant consolidation among bike and scooter-sharing companies may be surprised to see micromobility labeled as a winner, but the sector is seeing rising usage across the US and Europe. However, it's station-based bike systems that are growing the quickest, rather than the dockless bike and electric scooters that garnered high levels of investor enthusiasm in the late 2010s. Station-based bike sharing saw a 53% increase in ridership in the US between 2019 and 2023. Micromobility ridership in the US rose from 114 million trips in 2022 to 133 million in 2023, near the pre-pandemic peak of 136 million. The distribution between bikes and e-scooters is nearly even, with bikes representing 51% of all trips and e-scooters accounting for 49% in 2023. From 2022 to 2023, dockless bike ridership saw the highest growth, at 56%, compared to a 15% increase for station-based bikes and e-scooters. BloombergNEF's full report on the state of the shared mobility service industry can be found on the Bloomberg terminal and our website. — By Andrew Grant and Siong-Hu Wong - Nissan shares surge on activist fund buying stake.

- Trump picks ex-congressman Lee Zeldin to lead EPA.

- VinFast's billionaire owner pledges another $2 billion.

A Jaguar I-Pace electric SUV. Photographer: Krisztian Bocsi/Bloomberg Monday came and went without much fuss about a major bit of British automotive history: Jaguar, the go-to car marque for prime ministers and members of the royal family, stopped selling any new vehicles in the UK for the first time since World War II. The storied British brand is going dormant until 2026, when it will reemerge selling only higher-end EVs. Until then, Jaguar Land Rover won't ship any new Jaguars to UK dealers. All Jags still left in inventory are now classified as pre-owned, no matter the number on the odometer, according to a spokesperson. |

No comments:

Post a Comment