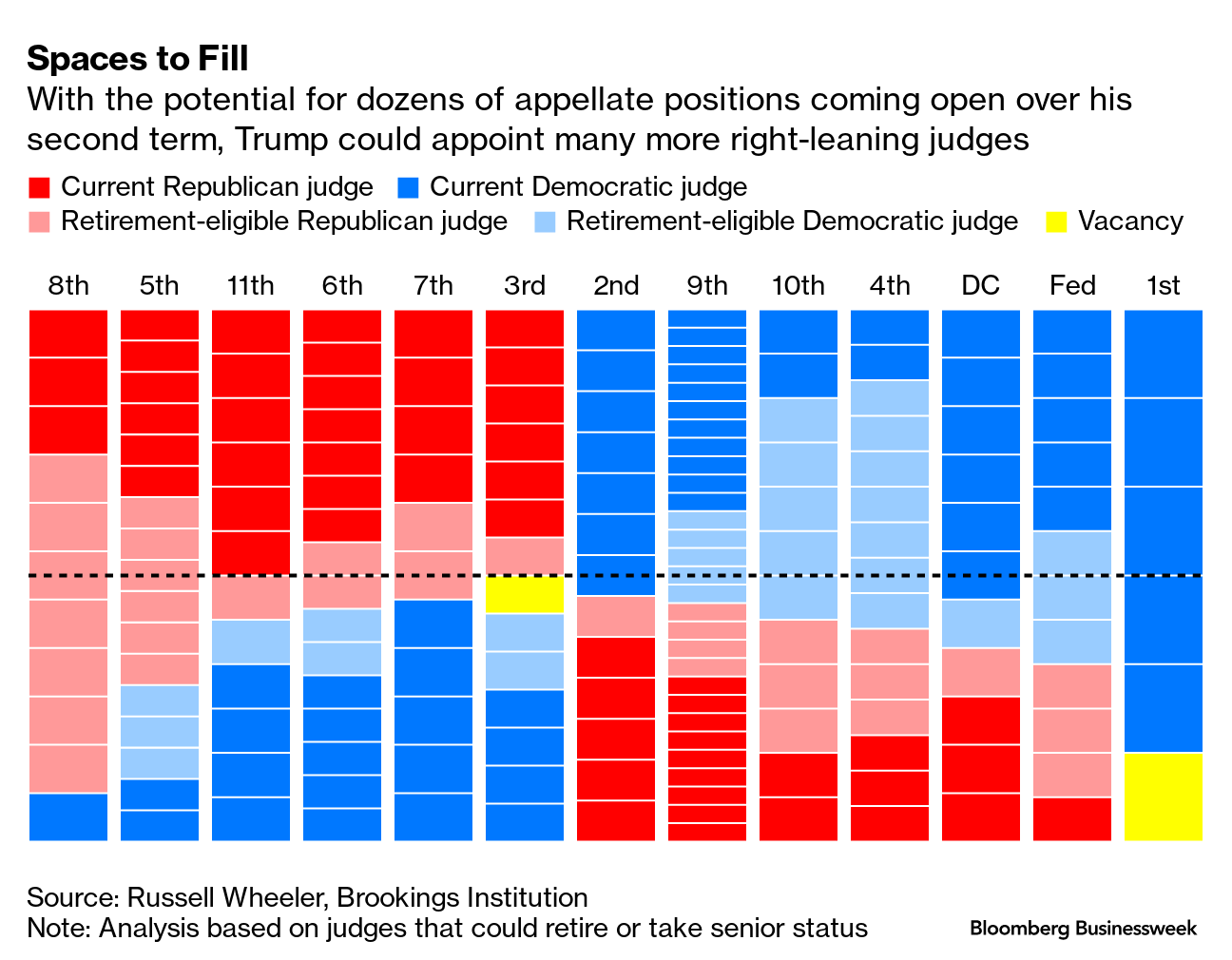

| Donald Trump rapidly filled a swath of vacancies in the US judiciary in his first term, dramatically reshaping the federal bench with right-leaning judges. Now he has a chance to cement his influence, particularly over the appeals courts that rule on some of the most important and divisive issues in American society. There are currently only two vacancies on those courts, known as circuits. But over the coming presidential term, out of 177 active circuit judges, 34 Republican-appointed and 29 Democratic-appointed appellate judges could retire, according to data gathered by Russell Wheeler, a nonresident senior fellow in the Brookings Institution's Governance Studies program. That should allow the president-elect to decisively shift the balance by replacing those who were appointed by Democrats, says Wheeler. "The judiciary is likely in for some turbulence." Appeals courts decide on pressing and far-reaching issues, from financial regulations to abortion. Sabrina Willmer, Madlin Mekelburg and Erik Larson write about the possible appointments: Trump Set to Move Courts Further Right, Deepening Judicial Clout Related: The Crypto World's Victory Lap Begins  Illustration: Nathan McKee for Bloomberg Businessweek It's a good time to be a football fan in Washington, DC. In 2022 the team went through a much-needed rebrand: The franchise is now known as the Commanders after spending decades as the Redskins. They're 7-2, which is the most wins they've had through nine games since 1996 and good enough for first place in their division. With the second selection in this year's draft, the Commanders picked quarterback Jayden Daniels from Louisiana State University, who's had one of the best NFL quarterback ratings and is a strong contender for rookie of the year. The man at the center of this turnaround is Josh Harris, a co-founder of private equity firm Apollo Global Management Inc.—and an owner of the NBA's Philadelphia 76ers and the NHL's New Jersey Devils and a general partner with the English Premier League's Crystal Palace. Harris bought the Commanders last year from Daniel Snyder, who was, to put it mildly, extremely disliked. Under Snyder, the team had two playoff wins in 24 seasons, which is the same number of NFL-led investigations into the organization. "The Snyder era was 20-plus years of constant mediocrity," says Eric Glazer, a Commanders fan whose family has had season tickets for 30 years. "It feels like Josh Harris owns the team for the fans as opposed to Dan Snyder owning the team for himself." Randall Williams writes in today's Field Day column how the new owner and a rookie quarterback playing like an All-Pro have transformed a moribund franchise: Why the Washington Commanders Are the Most Exciting Team in the NFL |

No comments:

Post a Comment