| In case no one has told you — and somebody will soon — the price of Bitcoin this week exceeded $93,000 for the first time. That's a jump of some 20% from a week ago, 150% from a year ago and a whopping 22,900% from a decade ago. Should you invest at a time when some forecasters envision it hitting the once-fanciful price of $100,000 in the not-so-distant future? First things first, let's cover the driver here. Like it or not, a lot of this has to do with Donald Trump. "This particular rally stems from increased demand for cryptocurrency following the results of the presidential election," said Kyle McBrien, senior financial planner at Betterment. "Many investors are interested in buying crypto due to speculation that the new regime will pass crypto-friendly policies." The president-elect has pledged to create a friendly regulatory framework for digital assets, set up a strategic Bitcoin stockpile and make the US the global hub for the industry. Politicians say a lot of things on the stump, and it remains to be seen how many of those promises will be kept — but for now, the atmosphere is exuberant. And it may be leaving even the most risk-averse investors wondering if now is the time to get in. But that's the wrong question to be asking, advisers say. You shouldn't be making an investment based on the best time to get in, but rather on the timeframe you have for your needs and goals. "Is this long-term money?" asks Filip Telibasa, owner of Benzina Wealth in Sarasota, Florida. "Or do we need it to buy anything in the short term? If the answer to that second question is yes, then we don't want to invest in Bitcoin or any of the other cryptocurrencies just because of how volatile they are." But don't count him — or many other conventional financial advisers — as a crypto teetotaler. Telibasa sees a world where 5-10% of a portfolio allocated to crypto could make sense if the investor has a long time horizon, high enough risk tolerance and the wherewithal to see the investment lose a lot of value, at least temporarily, in a downturn. Remember, before this latest surge, Bitcoin plummeted from around $60,000 in 2021 to around $16,500 in 2022. You no longer have to buy Bitcoin directly to invest in it in a simple, liquid way. This year saw the launch of spot Bitcoin ETFs, which track the price of the largest cryptocurrency. There are several on the market right now, and the easiest way to differentiate between funds is to look at costs. As a general rule, Telibasa says people should look for fees (or "expense ratios") of around 1% or less. You can still buy Bitcoin directly, and here's a guide I wrote in the runup to the last boom on how to do that. Advisers also say those who don't want to get into ETFs or direct coin investments might consider buying the stocks of crypto companies, which tend to rise and fall in tandem with the asset. What gets in the way of this rally? Simon Peters, market analyst at eToro, thinks it could be tighter monetary policy. "If we get into a situation where inflation starts to get out of control again and central banks have to tighten conditions," that could be a headwind for Bitcoin, he says. And so with each passing rally, it becomes increasingly convincing that Bitcoin is here to stay. But there's no guarantee it's going to stay up. — Charlie Wells We love hearing from our readers. One of you recently wrote in with a great question and we put it to a financial adviser this week. Here's the question: With potential higher inflation — but also possible higher interest rates — are Treasury Inflation-Protected Securities (TIPS) a worthwhile investment for 2025 or should I avoid them? And here's an answer from David Nash, founder of Tend Wealth in Los Angeles: TIPS can be a valuable tool for hedging against unexpected spikes in inflation. To determine if TIPS are a good investment for 2025, consider whether you're particularly sensitive to the risk of unexpected inflation. Typical TIPS buyers are retirees on fixed incomes. Because they rely on their portfolios to maintain purchasing power for essential goods, they are especially vulnerable to sudden increases in costs. The key focus here is on "unexpected" inflation, not just inflation in general. Markets are forward-looking, reflecting current price expectations. By observing the difference in yield between TIPS and traditional Treasuries, we can gauge what inflation expectations are already priced in. This difference is known as the breakeven inflation (BEI) rate. If inflation exceeds this rate, TIPS would be the better investment. Conversely, if inflation is lower than the BEI, regular Treasury Bonds would be more favorable. Since its recent low in September, the 5-year BEI rate has climbed by about 56 basis points, with a notable increase after the presidential election. For investors deciding between TIPS and traditional Treasury bonds, a key question is whether the market has accounted for the inflationary potential of the new administration's policies enough. It's worth mentioning that for investors with a longer time horizon and higher risk tolerance, alternatives like stocks or corporate bonds may offer greater growth potential than TIPS, though with more volatility. While TIPS provide a hedge against loss of purchasing power, stocks and corporate bonds offer opportunities to increase purchasing power — if the investor is prepared to manage the associated risks. It's most important to design a portfolio around your individual circumstances and goals while only hedging out those risks that can materially disrupt your achievement of those goals.

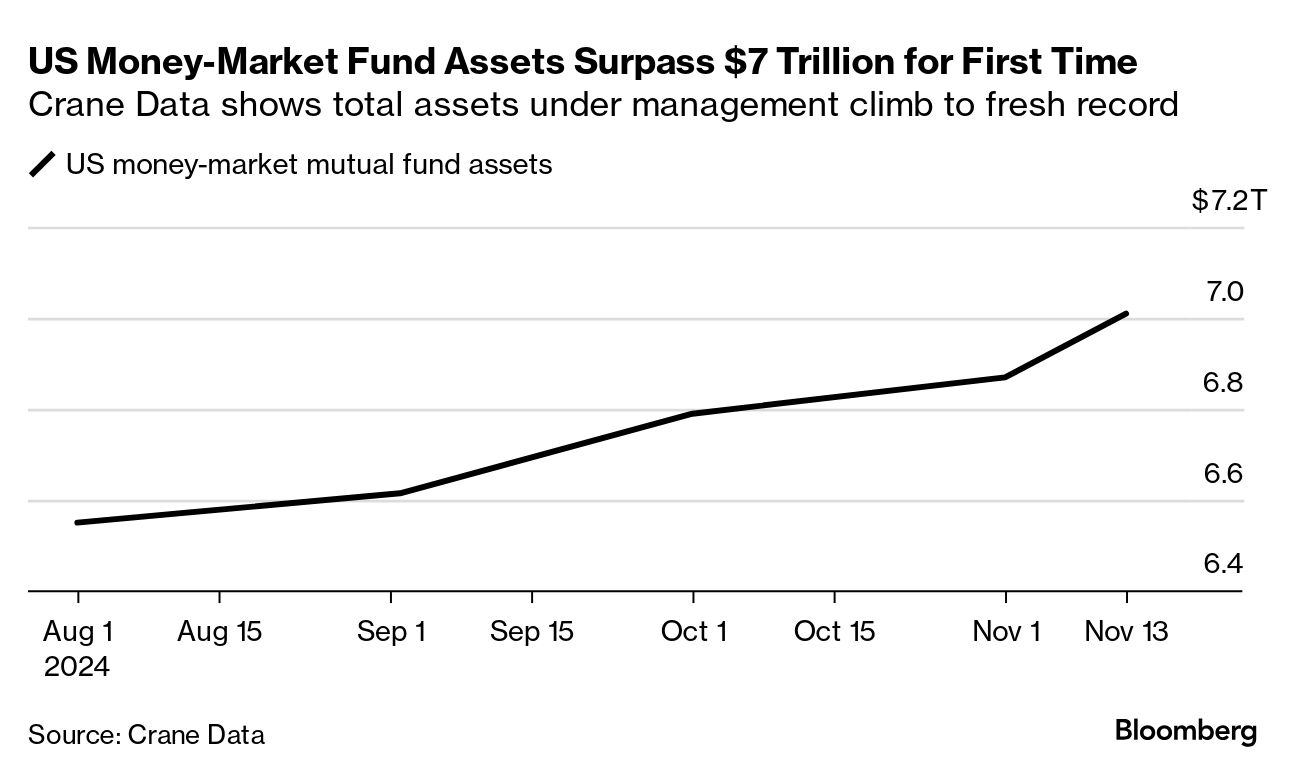

P.S. Send questions about your own financial dilemmas to bbgwealth@bloomberg.net. We may get expert answers for you, and feature your question and the answer in an upcoming newsletter. A gauge of the US dollar hit a two-year high on expectations that Trump's win will boost economic growth and corporate profits. The US dollar's rally is gaining momentum alongside the president-elect's threat of sweeping tariffs, leaving currency strategists in agreement it has further to rise while war-gaming just how far it will go. US money-market funds now have more than $7 trillion in assets under management. It is a milestone for an industry that's skyrocketed in popularity among investors thanks to lofty and dependable yields. The total rose by roughly $91 billion in the week through Wednesday, putting it at a fresh record, according to Crane Data, a money-market and mutual fund information firm. It offers a rebuttal to questions over whether the industry could remain in vogue as Federal Reserve officials pulled interest rates down from a two-decade high. The biggest gainers and losers on the Bloomberg Billionaires Index over the past week: Adam Foroughi was the biggest gainer in percentage terms. The chairman and chief executive officer of AppLovin, a mobile technology and digital marketing company, saw his wealth increase 189% to $10.6 billion. Much of his wealth comes from shares of AppLovin, which have surged in recent days on strong earnings. Donald Trump was one of the biggest losers in percentage terms. He clocked a 12% loss, bringing is net worth down to $6.7 billion. Shares in Trump Media & Technology Group are down over 20% from the election. Much of his wealth is tied up in the company. NYC Council Votes to End 'Killer' Broker Fees Squeezing Renters New York renters would no longer be on the hook for costly broker fees when signing a new apartment lease under a measure passed by the city council Wednesday.  Photographer: David Cabrera/Bloomberg The Fairness in Apartment Rental Expenses, or FARE, Act was approved by a vote of 42-8 with no abstensions, enough support that Mayor Eric Adams wouldn't be able to torpedo the effort. The bill requires landlords who hire real estate agents to pay the agents' fees themselves instead of passing them on to tenants. The bill now goes to Mayor Eric Adams for his signature. If he stalls, it becomes law after 30 days. If he vetoes the measure, it goes back to the council. Based on the number of votes in favor, the council would be expected to override a veto and the bill would become law. Mortgage Rates in US Ease for First Time Since Late September The average for a 30-year, fixed loan was 6.78%, down from 6.79% last week, Freddie Mac said in a statement. Homebuyers are confronting borrowing costs that are markedly higher than a month ago, but some shoppers are forging ahead. In the four weeks ended Nov. 10, contracts to buy previously owned homes were up 4.7% from a year earlier, according to Redfin Corp. data. And a measure of mortgage applications rose for the first time in seven weeks, according to the Mortgage Bankers Association This week, we're looking for people who are either buying or selling Tesla stock and/or Tesla vehicles as a result of this month's presidential election. Some of our best journalism at Bloomberg Wealth comes from your own stories and we'd love to hear from you, your friends or clients. Please email bbgwealth@bloomberg.net or fill out this form. Join us March 4-5 in the heart of New York's Financial District as we convene allocators, dealmakers and investors from across the globe. Led by Bloomberg Global Finance Correspondent Sonali Basak, we'll track, dissect and help you navigate the markets with the industry's most influential voices. Learn more. |

No comments:

Post a Comment