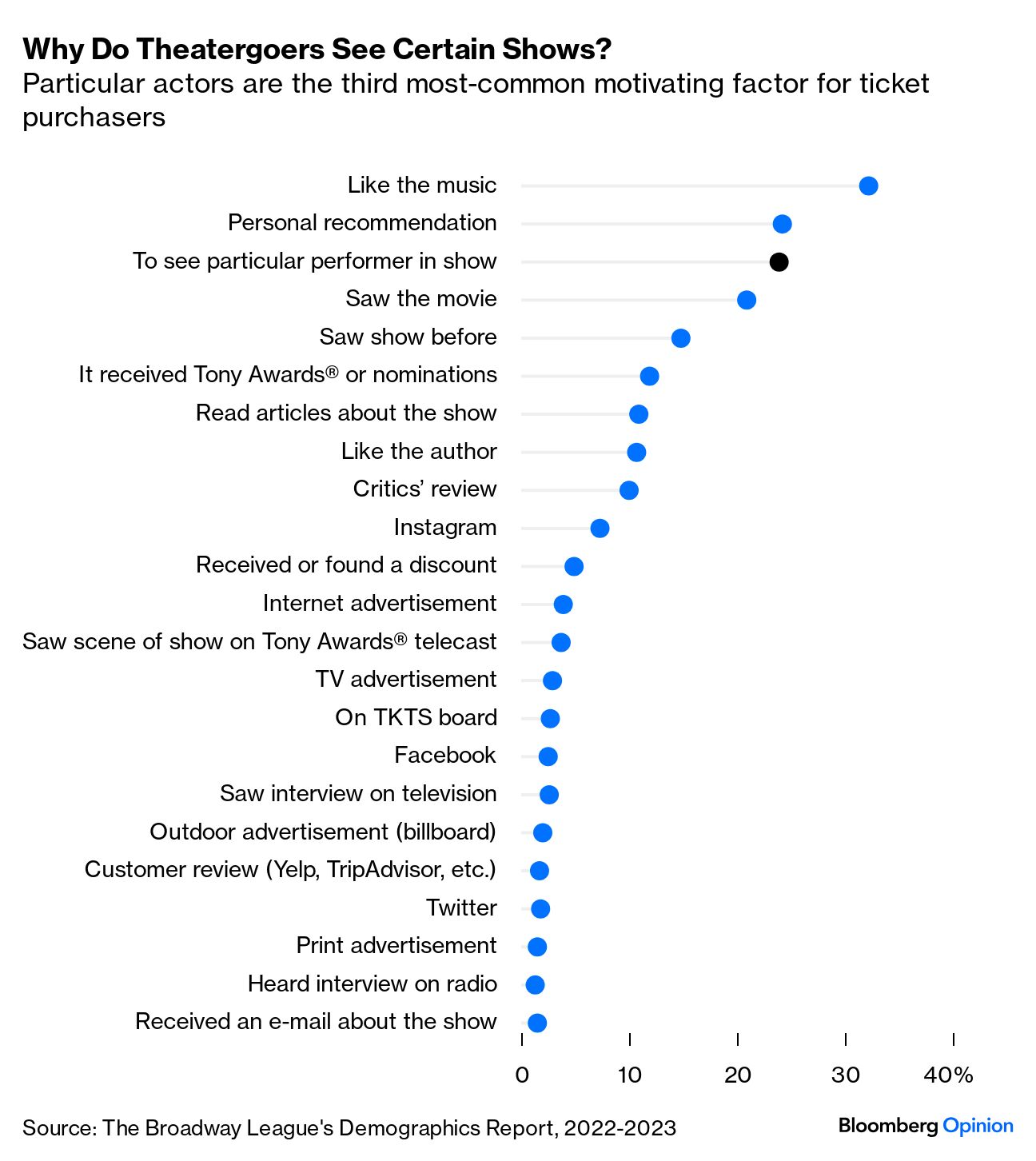

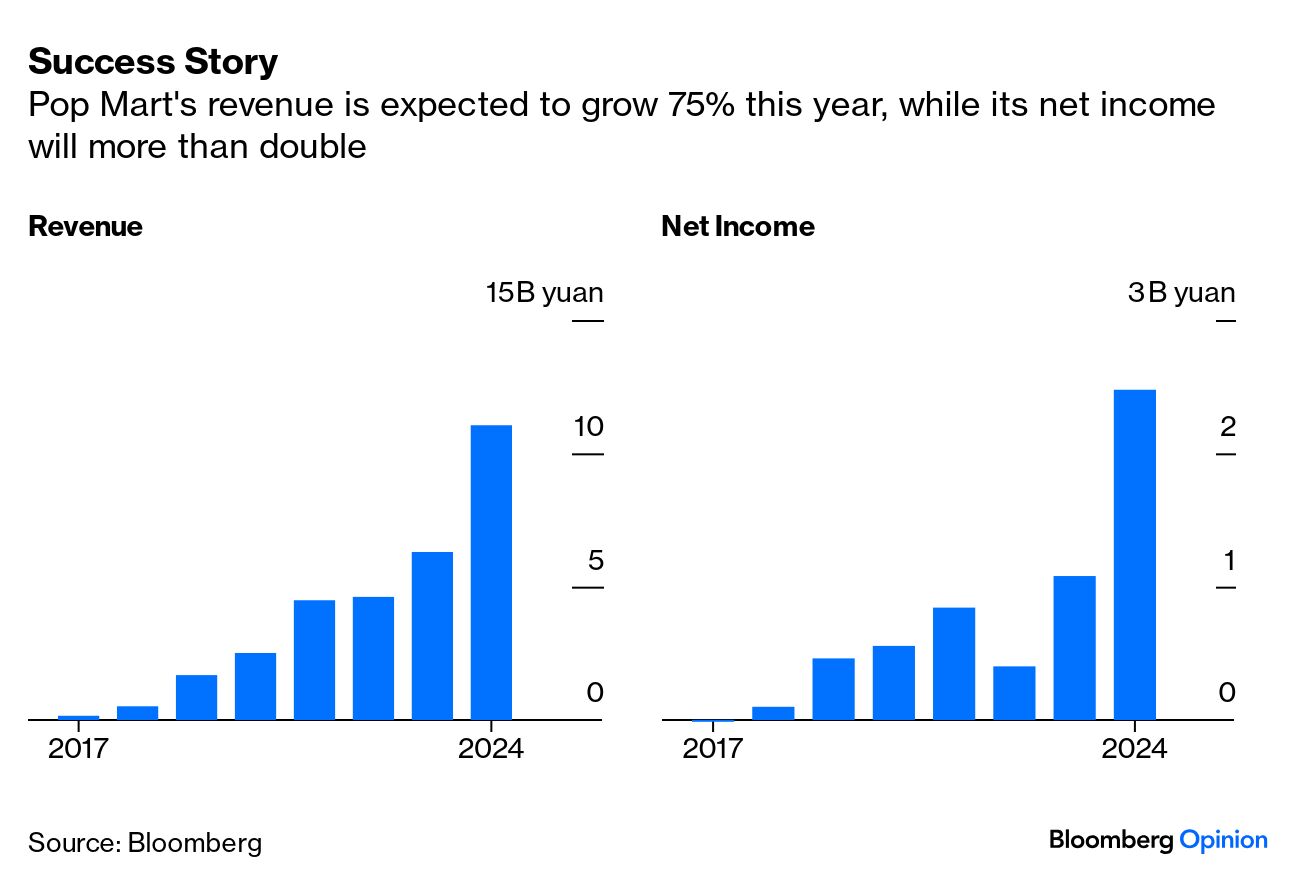

| This is Bloomberg Opinion Today, a scaredy-cat retrospective of Bloomberg Opinion's opinions. Sign up here. The kids have packed up their costumes and are done with the neighborhood boo sessions. However, adults everywhere are still on pins and needles. A lot is riding on the results of the US presidential election on Nov. 5. Will it be trick or treat or some roller-coaster combination of both? The markets already seem to be betting on a victory for Donald Trump. As John Authers writes, "The Trump trade is back in full sway, and many believe that we're heading for a repeat of 2016." For those who've hedged into Trump 2.0, says John, "Even if there are good reasons to believe that a second term could be different from the first, the basic outline of what he plans to do is unchanged: tax cuts, deregulation, tariffs and an immigration clampdown." That expectation, however, does not sit well with the leadership of the People's Republic of China, what with Trump's threatened 60% tariffs likely to end all trade between the countries. Shuli Ren has written about the crisis awaiting President Xi Jinping: "[Trump's] hawkish rhetoric on Chinese imports, as well as the wide latitude that the US president enjoys in setting and imposing tariffs, directly threatens Xi's ultimate passion of transforming China into a high-end manufacturing powerhouse." Actually, says Karishma Vaswani, "Regardless of who wins the election next week, that won't change. China should anticipate a tougher political climate ahead." But, even with the Trumpish hedging, there are clues the market is still anxious about the US. Traders are behaving oddly, says Marcus Ashworth: "The US dollar has strengthened 4% over the past month, so it's evident foreign money isn't fleeing US assets; it's just not being parked in the usual safe spot of Treasuries." Mohamed A. El-Erian agrees, noting "You wouldn't normally expect market yields to surge higher at a time when the Federal Reserve just increased the size of its interest rate cuts from 25 basis points to 50 basis points." We may not know why this is happening till the vote is over. Meanwhile, banks are up to old — and dangerous — tricks. Says the Editorial Board: "They've revived a practice from before the 2008 subprime-mortgage crisis: Reduce capital requirements by repackaging loans into securities and buying protection against losses from other financial institutions. The banks keep the assets, the risk purportedly goes elsewhere." They're called "synthetic risk transfers," and the board warns, "there's a chance you'll hear all about them when the next financial crisis hits." Right now, however, no one in charge is doing anything about it. That would be a real dirty post-election trick to play on the world. Andreas Kluth raises another worrisome scenario. What if we don't know who's going to be in charge of the world's most powerful nation? That would give us "an absence of resolution, through a contested transfer of power that plays out over months, either in the courts or, heaven forbid, in the streets, with verbal or physical violence of the kind that the United States used to criticize in other countries. Neither the US nor the world has experience with such a horror script set in America." That's more than an economic question. That's the stuff an apocalypse is made of. At this time of year, when the word "brain" comes up, pretty schlocky horror movies — if not zombies — come up. I won't even go into the titles because what I have here is a good news brain story. Parmy Olson spoke to a participant in a brain implant study. "Eric" — a pseudonym — suffers from depression and doesn't respond to medication. He's received a chip — "a round, flat disc implanted just above his skull" — that allows him to administer transcranial magnetic stimulations whenever he feels the need for it. Usually, he'd need to travel to a hospital to do it. Parmy remains skeptical about the big business part of making chip implants work, but, she says, "Eric's story is another example of how the brain tech's first steps into mainstream medicine are for now bringing hope, not dystopia." I love Broadway — the glitter, the glamor, the treasury of American musical comedy — but it's in danger. As Jessica Karl points out in her free-to-read column, "Post-Covid, Broadway audiences are down 17%, while attendance at concerts and comedy shows has trended upwards. In an era of 'dynamic pricing' and 'funflation,' there's only so much money people are willing to spend on live entertainment, and everyone's vying for the same eyeballs and wallets." One possible solution: Diversify Broadway's appeal away from "elderly, affluent, White" individuals to younger and non-white audiences. And the way to do it may upset some traditionalists: through their smartphones. At the moment, New York's theater district seems to be allergic to phones. Jessica witnessed an usher nearly kick out a pair of Gen Zers who were filming the stage before a show formally began — but that tool is the best way to socially mediate theatrical productions. We should cheer when productions build in more opportunities for people to take out their cameras to show off on, say, TikTok where they are. It helps build prestige for your show. So does casting social media stars — not just Hollywood A-listers — even if an older crowd has no idea who they are. Jessica applauds TikTok luminary Charli D'Amelio's appearance in the musical &Juliet. All of that can enhance Broadway's appeal and help save the Great White Way. Says Jessica: "Directors who widen the window for audience engagement can generate greater amounts of buzz — and money." "Almost four years after China launched its big consumer tech crackdown, a new breed of companies are catering to underemployed urban youth, and making billions of dollars off their desire to daydream and escape. The most successful is perhaps Beijing-based Pop Mart International Group Ltd. The toymaker is on track to generate 11 billion yuan ($1.5 billion) in sales and 2.4 billion yuan in net income this year. … Pop Mart's biggest marketing win is a "blind box" that contains a cartoon figurine. No one knows what's inside until it's opened. As of June, the company had 34 million registered customers in mainland China, with a repeat purchase rate of 43.9%." — Shuli Ren in "China's 'Blind Box' Magic Breeds Millions of Peter Pans." What's so scary about solar geoengineering? — Lara Williams We may already be at "peak beef." — David Fickling The oddest of oddball billionaires. — Adrian Wooldridge The curse of zombie infrastructure. — Matthew Brooker A look at the Britain's silver (tax) lining. — Marcus Ashworth Europe's big energy squeeze will last till 2027. — Javier Blas How much is that in cash? — Howard Chua-Eoan What UBS still needs to do. — Paul J. Davies It's Godzilla's 70th birthday on Sunday. But did you know that the UK had its own "suitmation" beasts who rampaged through the city? That would be Gorgo. I remember the sea monster from childhood — more from the comic book version of the 1961 film than the eponymous movie. It was a poignant story: The immature Gorgo was found in what sounds a lot like the Aran Islands off the west coast of Ireland. He was brought to London to be put on public display in Battersea, on the south side of the Thames. However, there's a much bigger monster in the plot: Gorgo's mum. She comes to rescue him from becoming a circus act. Heartwarming, yes, but she batters London in the process.  Don't mess with mum: a scene from Gorgo. Photographer: FPG/Moviepix The movie was meant to be an homage to Godzilla, which opened on Nov. 3, 1954, and originally set in Japan. But financing and other issues resulted in Gorgo being filmed mostly in Ireland and in studios in Hertfordshire. I'm a lifelong fan of Godzilla — goodness knows, I'm almost as old as the geezer kaiju himself. So juvenile joys are rekindled as I walk where beastly feet once trod — at least in the cinematic imagination. Here's one more post-Halloween critter for you.  "I'm not a hypocrite. I always speak out of both sides of my mouth." Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send headstrong feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and follow us on Instagram, TikTok, Twitter and Facebook. |

No comments:

Post a Comment