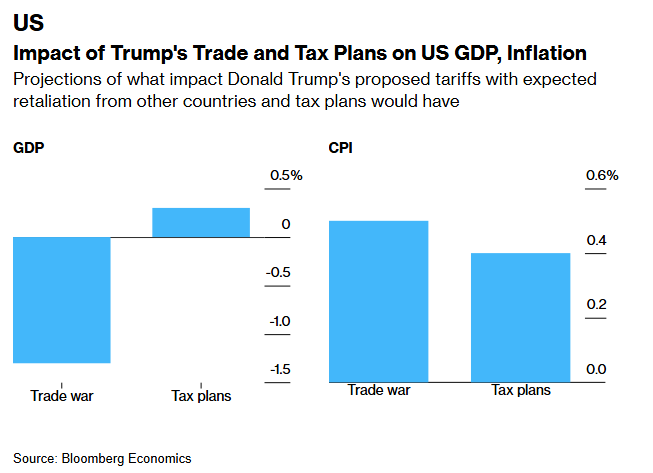

| I'm Cécile Daurat, an economics editor in the US. Today, along with Molly Smith, we're looking at long-term inflation expectations. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. Federal Reserve Chair Jerome Powell stuck to his message last week that long-term inflation expectations appear "well anchored." But are they? Even before the US presidential election, expectations for the next five to 10 years rose among consumers polled by the University of Michigan, while five-year-ahead views barely budged among businesses surveyed by the Cleveland Fed. Now that Donald Trump is president elect, many economists reckon that his policies — namely on tariffs and tax cuts — will boost inflation. Companies have already warned they'll pass higher costs on to consumers — including a maker of cat litter that said China is the only place to source essential silica gel, as well as power-tool manufacturer Stanley Black & Decker Inc. Americans have been dogged by high prices for years, and their frustration played a major role in Trump's decisive election victory. "Inflation is not tamed," Scott Kleinman, co-president at Apollo Global Management Inc., said on Bloomberg Television this week. "You just have to open your eyes and look around." After cutting interest rates by a quarter point last week, Powell twice said that longer-run inflation expectations remain intact. The Fed pays close attention to those views as they can often become a self-fulfilling prophecy — consumers expecting higher prices will ask for higher pay, and employers will have to charge more of their customers in order to accommodate that. Higher rates and anchoring inflation expectations comprise "the standard toolkit to fight inflation," Claudia Sahm, chief economist at New Century Advisors, said in a Substack post this week. But those alone aren't enough — she suggested fiscal policy could play a greater role, like temporary taxes on extraordinary profits. "The existing set of tools for managing inflation is almost entirely based on monetary policy and is useful but insufficient," she said. "New tools to prevent and fight inflation would be a better outcome." - A weakening yen is pressuring the Bank of Japan, Chinese officials are signaling unease on the yuan, and Brazil's central bank is stepping into currency markets.

- Minneapolis Fed President Neel Kashkari said he'll be looking at incoming inflation data to determine whether another rate cut is appropriate.

- A Bank of England official said policy is impacting inflation more quickly than economic theory suggests, allowing officials to wait before making big cuts to rates.

- Chancellor candidate Friedrich Merz is envisaging a reform of Germany's strict borrowing limits, while the Bundesbank chief worries about the impact of tariffs.

- Australia's wage growth slowed in the third quarter, reflecting an easing in price pressures across the economy.

- Zambia's central bank raised its rate to the highest level since 2017 to contain price pressures and prop up its bruised currency.

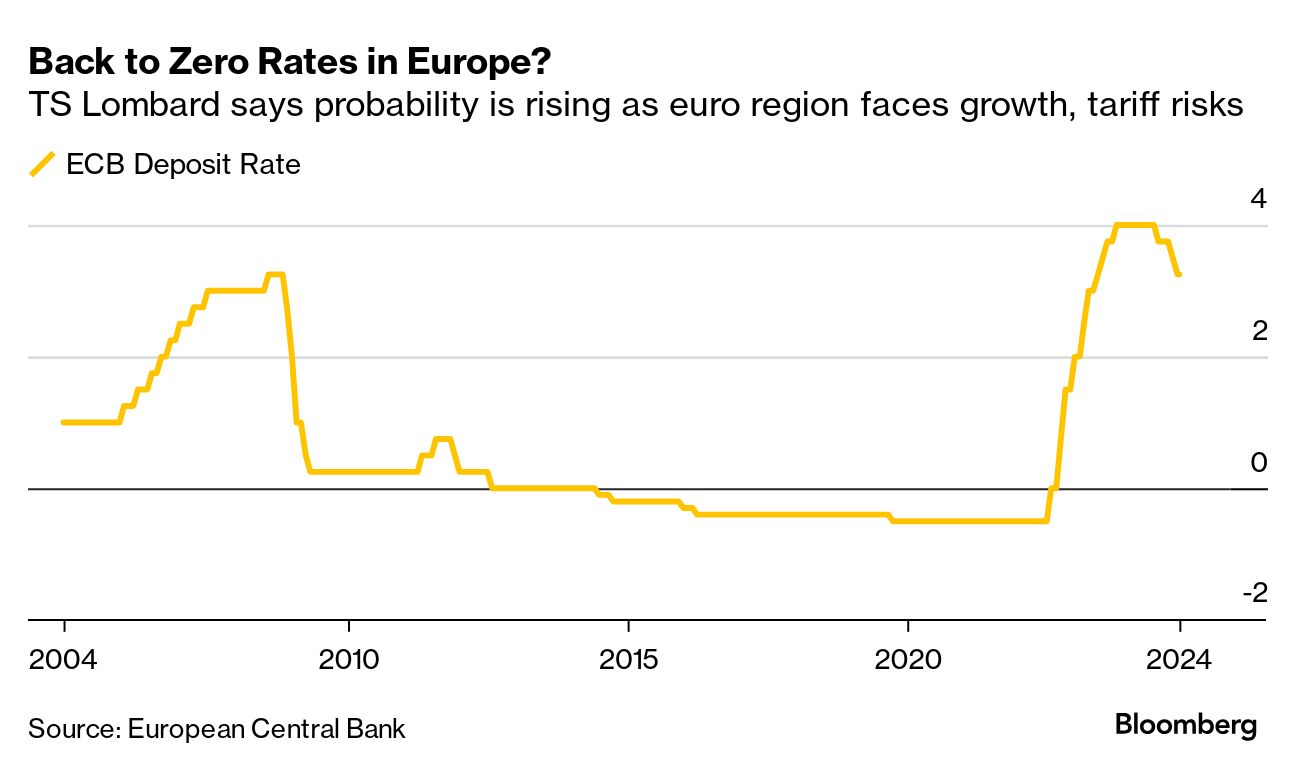

Little more than two years on from the euro zone posting a 10% inflation rate, it would seem unlikely that any return of zero interest-rate policy (ZIRP) at the European Central Bank would be conceivable. But TS Lombard says don't count that out completely. Assuming that Trump follows through on threats to impose tariff hikes on both the euro area and China, that could trigger deflationary effects in Europe, says Davide Oneglia, director of European and global macro at TS Lombard. Those forces could be more powerful if Brussels doesn't act against any move by Chinese exporters to divert shipments to Europe from a less-open US market, he wrote. The question, probably in mid-2025, would then be how far past 2% would the ECB need to cut rates, Oneglia wrote. "Nonlinearities are hard for markets to price in, but – albeit admittedly small for now – the probability of a return to ZIRP is rising." |

No comments:

Post a Comment