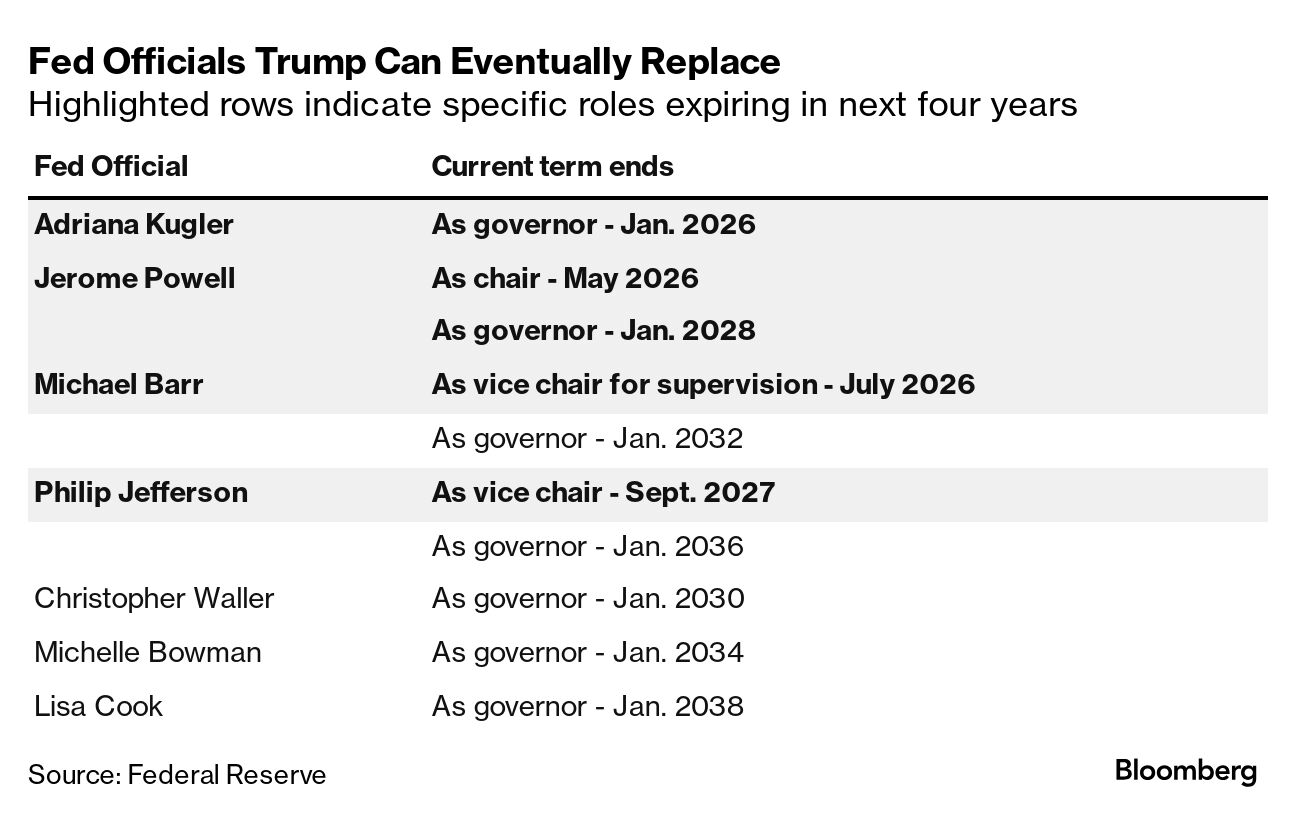

| I'm Chris Anstey, an economics editor in Boston, and today with Catarina Saraiva we're looking at the post-election outlook for the Federal Reserve. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. How far and how fast to lower interest rates in coming months and quarters was already in question for Federal Reserve Chair Jerome Powell and his colleagues ahead of Thursday's policy decision. The US election outcome makes it all the more challenging. Many economists view President-elect Donald Trump's economic program as inflationary, with steep tariff hikes and further tax cuts alongside curbs on migrants — who contributed powerfully to labor supply in recent years. Financial markets certainly reflected that expectation on Wednesday, with Treasury yields surging and taking the dollar along with them. In the same vein, Deutsche Bank's economists said the Fed's preferred core inflation gauge could now end next year around 2.5% rather than the 2.2% they previously thought, and stick at 2.5% for the fourth quarter of 2026. "These revisions would imply a stalling out in progress on the inflation front over the next two years," the team wrote Wednesday, cautioning they weren't yet ready to make a formal change pending clarity on who wins the majority of the House. The Fed's benchmark remains historically high and well above inflation at 5% for the top of the current target range, and most economists expect Powell and his colleagues to keep on loosening. After Thursday's universally anticipated 25 basis-point cut, the same again is expected for December — though Deutsche Bank and others see some risk of a hold. Even before the election, doubts were creeping in on the Fed's path. After rates were slashed by 50 basis points in September, economic data suggested the economy was in better shape than some feared — especially after statistical revisions showed household incomes were notably stronger, and the savings rate higher, than previously thought. And GDP growth came in strong for the third quarter. That all raised the question of whether the economy's speed limit has picked up, suggesting a higher level for the Fed's neutral rate. With the new outlook for economic policy under Trump, that's an even more pressing issue. JPMorgan Chase on Wednesday was among those shaving back projections for 2025 rate cuts, now seeing a cumulative 50 basis points of reductions in the first half rather than a percentage point. Nomura Holdings economists now expects just one cut from the Fed next year, from four projected before the election. As for what Powell might say in his post-decision press briefing Thursday, after being consistent for some time now in avoiding guidance on rates beyond the immediate future, all the uncertainties ahead under Trump make it unlikely he's want to break the pattern. - The Bank of England cut borrowing costs for the second time this year but stopped short of signaling faster easing.

- Japanese workers' base salaries saw the largest increase in over three decades, backing the case for a rate hike in coming months.

- Sweden's Riksbank cut rates by a half point and pledged more easing, while Norway's central bank kept them unchanged and signaled plans for its first move.

- UK house prices hit record levels in October, according to a top mortgage lender.

- Brazil's central bank raised rates by half a percentage point, doubling the pace of tightening and more explicitly urging spending cuts to tame above-target inflation.

- Large US tariffs on China may have an "adverse effect" on Australia, a senior Reserve Bank official said Thursday.

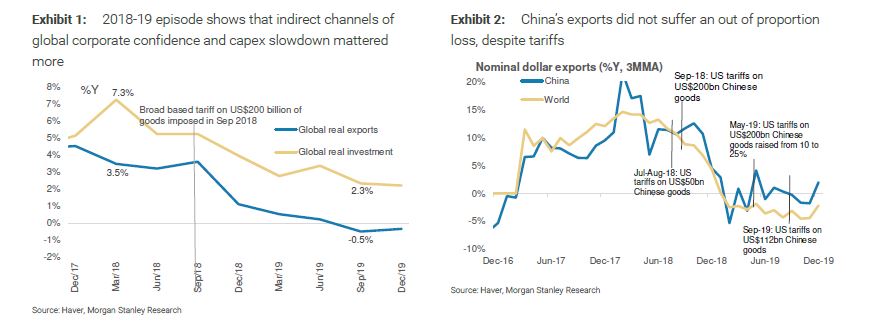

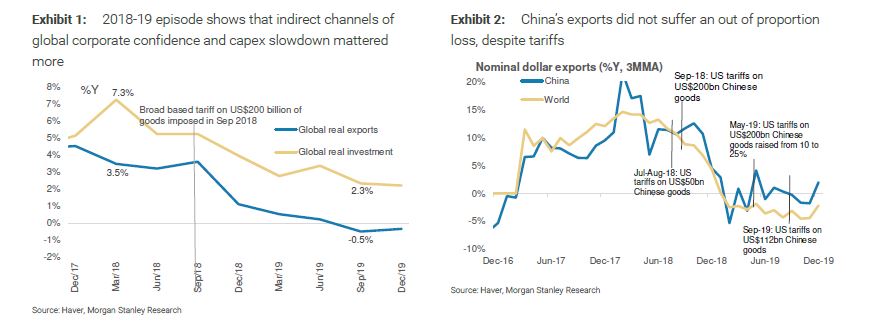

If President-elect Trump does go ahead and swiftly imposes hefty tariffs on China once he takes office, the indirect impact on global capital expenditure and corporate confidence might be more important to watch than the direct effect of the levies themselves, Morgan Stanley Economists led by Chetan Ahya noted in a report that draws on lessons from the 2018-19 trade war. And while the proposed tariffs may be steeper, the growth hit to China this time around might be lower than in 2018-19 as the US share of Chinese exports and the revenue exposure of Chinese listed companies to the US have both declined, they found. Then there's the potential for policy support to offset any economic blow. |

No comments:

Post a Comment