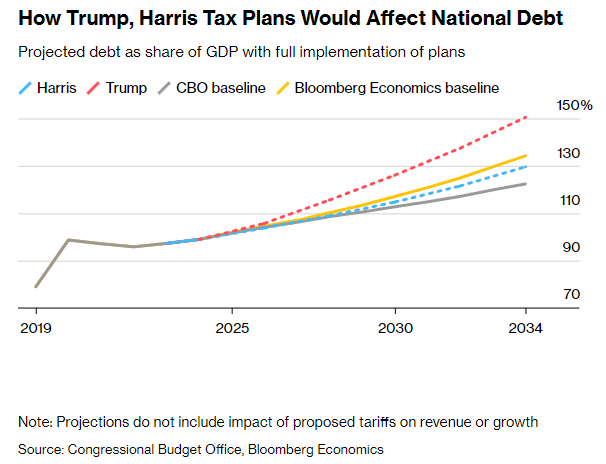

| I'm Cécile Daurat, an economics editor in the US. Today, along with Mark Niquette and Enda Curran, we're looking at what's at stake for the economy and business in the US election. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. There's a lot riding on the US elections. Not just depending on who of Kamala Harris or Donald Trump wins, but also which party captures control of the House and Senate. Without control of Congress, whoever is in the White House next year will have to bargain to get their agenda implemented. That's especially true for tax proposals, which must be approved by lawmakers. Trump has promised to extend tax cuts passed during his first term, most of which are set to expire in 2025, and further lower corporate income taxes. Harris said she would only extend the 2017 Trump tax cuts for households who make less than $400,000 and raise corporate income taxes. In each scenario, a divided government would force a negotiated deal with the other side. American presidents, however, have large purviews on issues like trade and immigration, enabling Trump, should he win, to make good on his promises to slap tariffs on virtually all US imports and conduct a mass deportation of migrants. A Harris victory would provide some continuity with economic policies championed by Joe Biden's administration — especially regarding environmental rules and other regulations. Industries with the most at stake include big banks, health care, electric vehicles, retail and energy. A win by Harris would mean federal tax credits for EVs, as well as subsidies for renewable energy projects, probably stand. Under Trump, they could be scrapped or scaled back — especially for the offshore wind industry. US retailers would be especially exposed to Trump's tariffs because most of the apparel, footwear and other goods they sell in the US are imported. Harris isn't likely to increase tariffs in whole tranches the way Trump is planning. With polls as tight as they can be on the eve of election, one thing is certain: If either candidate has their way, US budget deficits will go up. - How will markets react the day after the election? Bloomberg's Kristine Aquino, Emily Graffeo, Norah Mulinda and Carter Johnson will dive into the data to discuss key market signals that Wall Street is watching — and will answer readers' questions. Join our Live Q&A here on Nov. 6 at 1 p.m. New York time.

- Australia's central bank held its key interest rate at a 13-year high and signaled an ongoing vigilance toward curbing sticky inflation.

- A third of Britain's official "shopping basket" has slipped into deflation, providing another green light for the Bank of England to cut borrowing costs.

- South Korea is considering a plan to boost energy imports from the US if Donald Trump wins the election and steps up pressure on trade partners.

- Chile's economic activity posted its biggest monthly plunge since July 2022 in September, prompting the government to scrap its growth forecast for this year.

- A rise in retail-loan defaults in India is reverberating in the stock market, with analysts worrying about possible spillover into the broader economy.

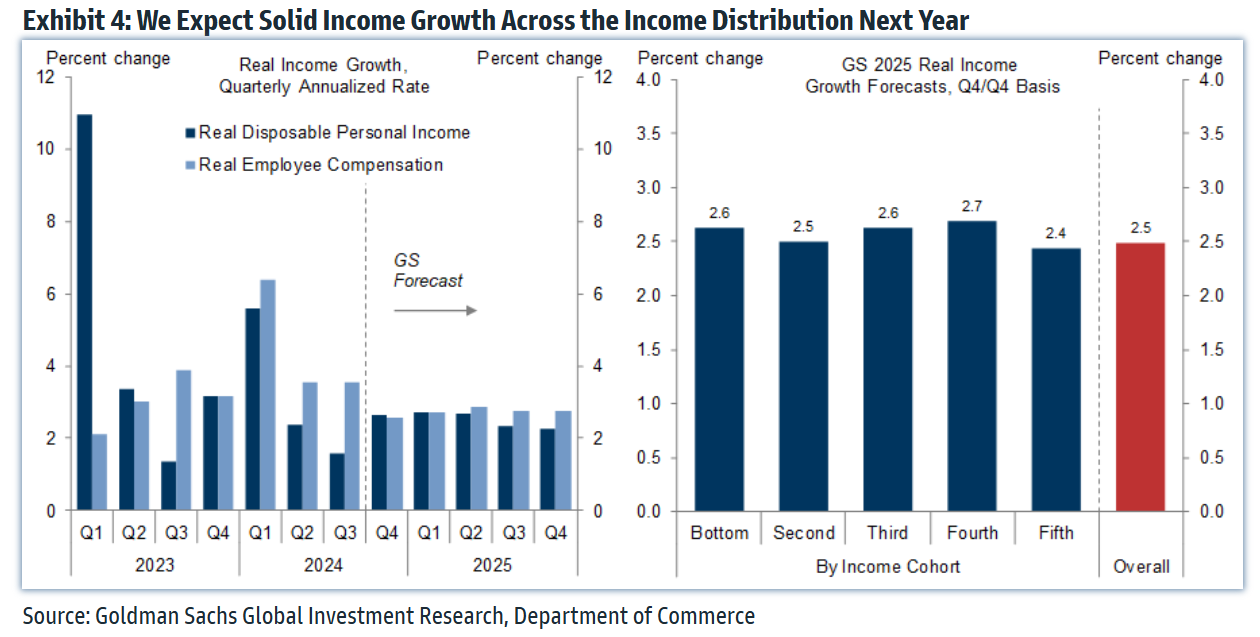

US income and household wealth gains should remain strong in 2025, powering a consumer spending increase that's just a little below that for 2024, Goldman Sachs economists wrote in a year-ahead outlook. Consumption should rise 2.4% next year, measuring the fourth quarter against the fourth quarter of 2024, Goldman's Manuel Abecasis wrote in a note Sunday. That compares with 2.7% for this year. The main risks to the forecast would be weaker job gains and and a drop in house and equity prices, Abecasis wrote. Lower rates should help stabilize auto and credit-card delinquency rates for lower-income households, and encourage others to tap the historically large home equity they've accumulated, according to Goldman. Meantime, income should be supported by average monthly job gains of 150,000. "We also expect real wage growth to remain positive but slow a little, reflecting a less tight labor market but somewhat lower inflation." |

No comments:

Post a Comment