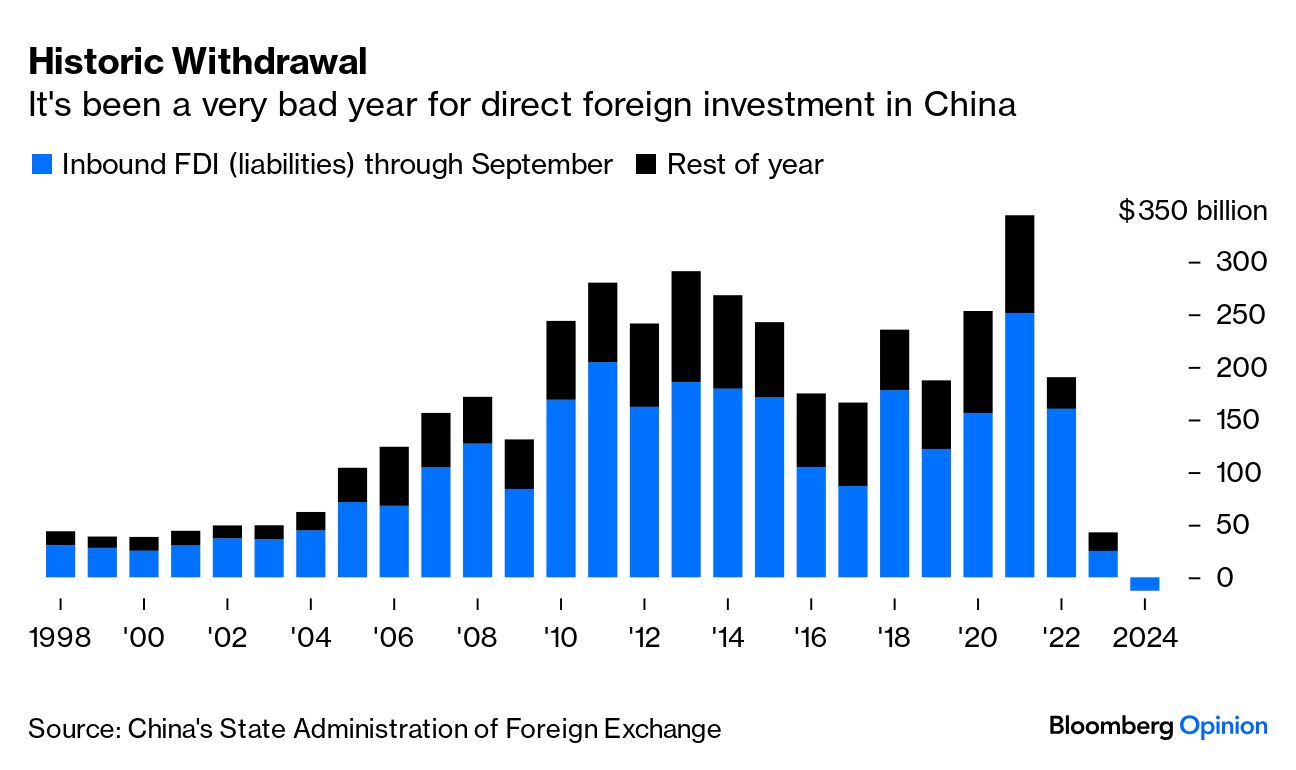

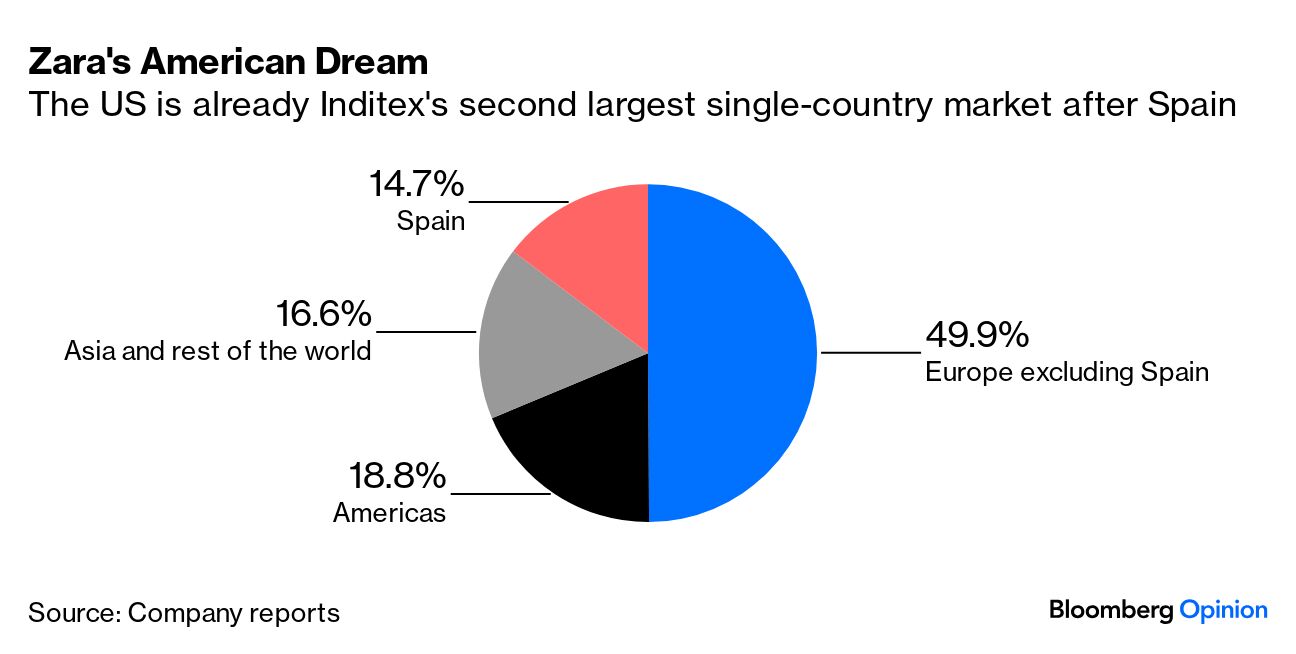

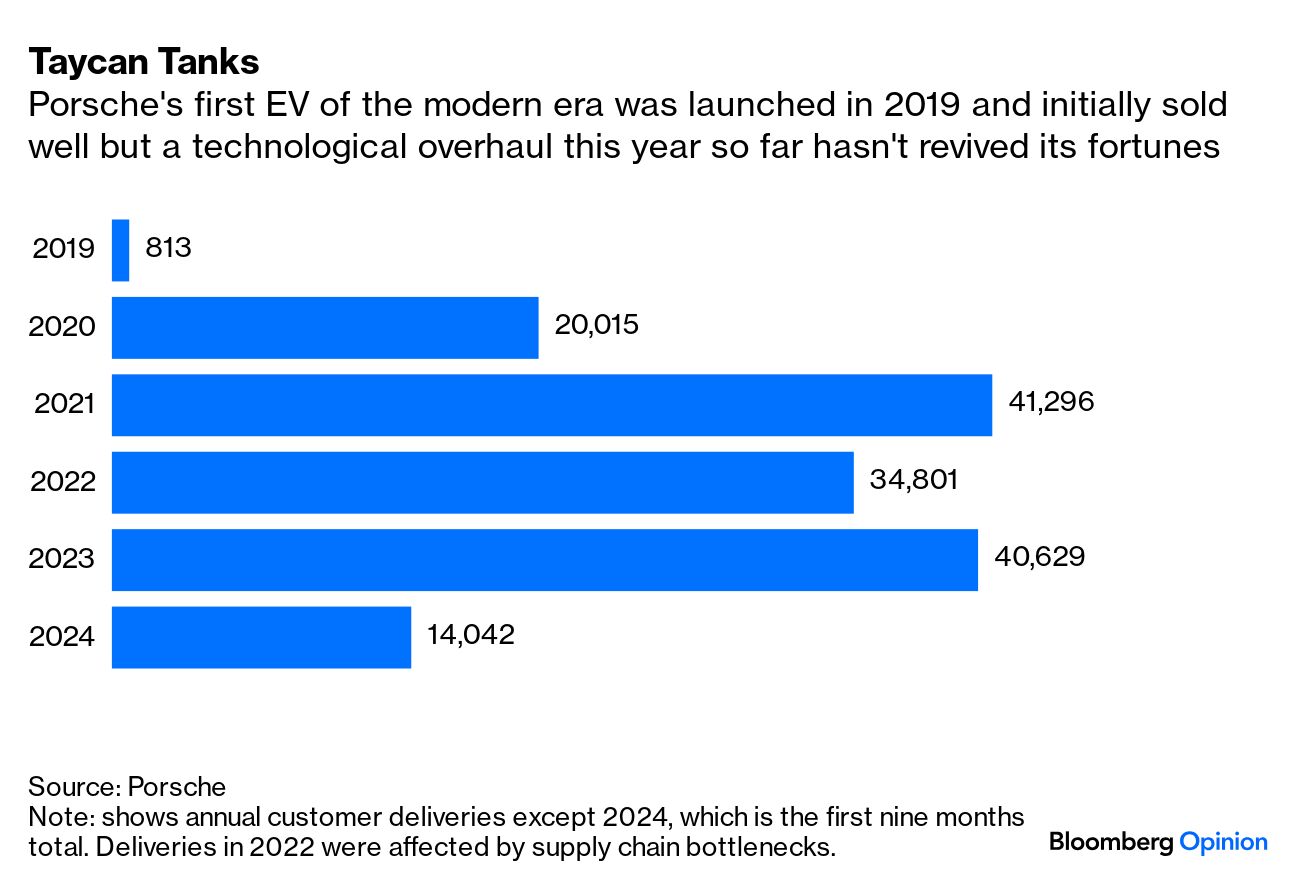

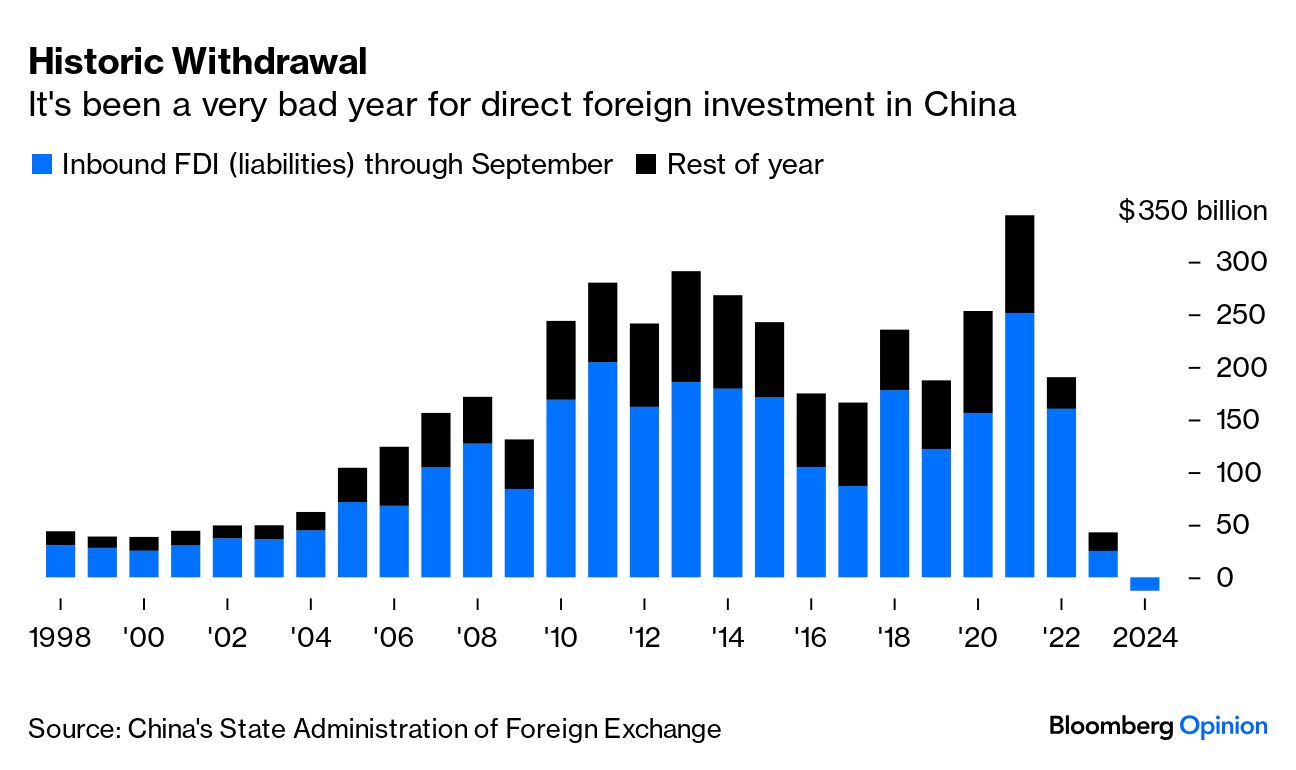

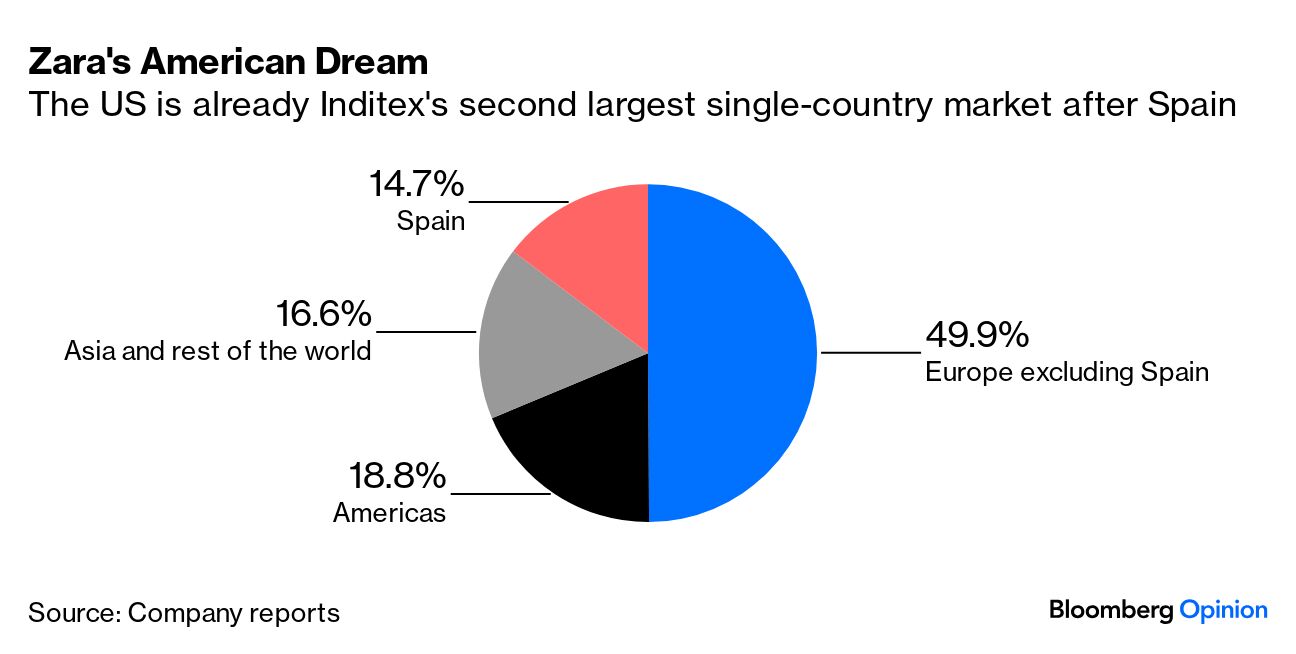

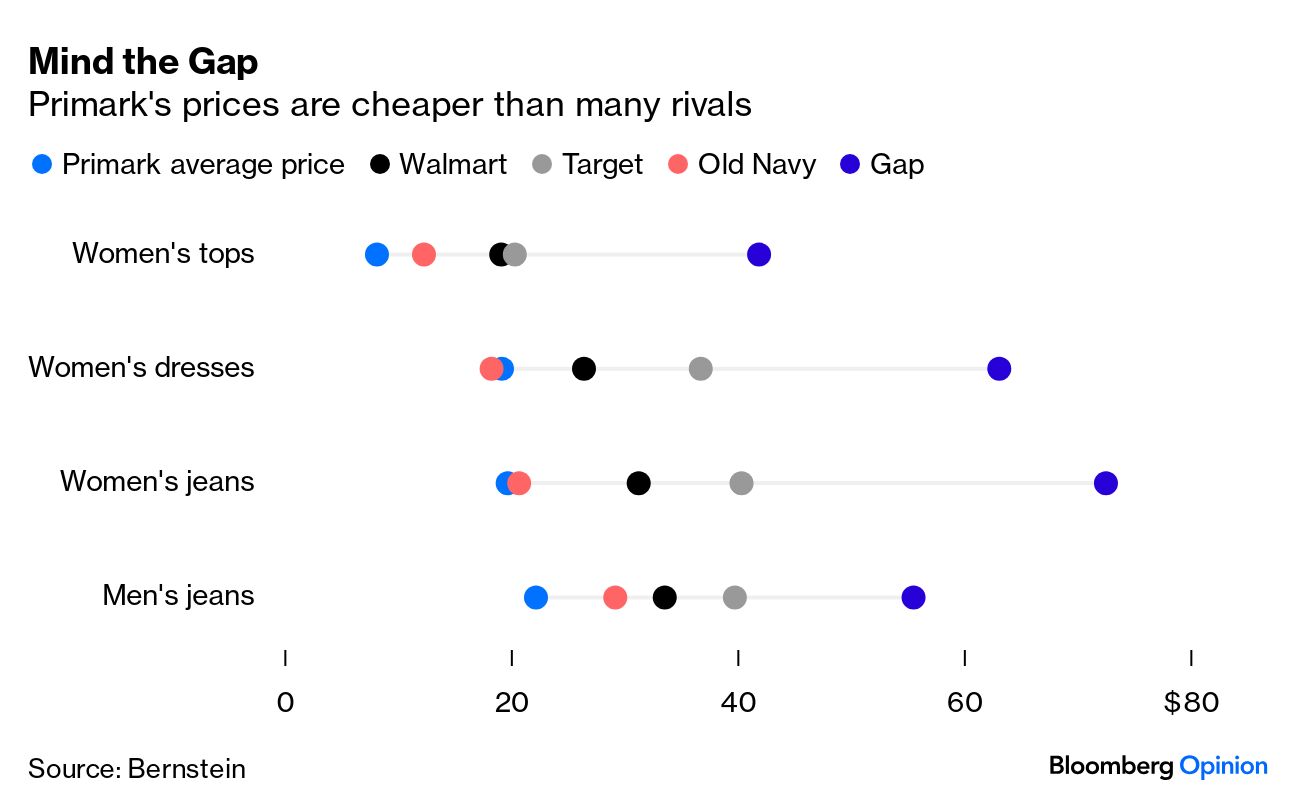

| This is Bloomberg Opinion Today, a concise chrestomathy of Bloomberg Opinion's opinions. Sign up here. I was walking up Leytonstone's high street in North London a couple of weeks ago when I was accosted by a clattering rumble and irritating fumes. While cars in the British capital aren't all electric, the adoption rate is high enough that you can smell the old combustion engines coming. They stink. But what was notable about the disturbance was its origin: an older model Porsche 911 Carrera. The car was a status symbol when I was coming up in the world; a beloved editor of mine had one and liked to crow about it. It made me want to learn to drive (though, not so much to actually qualify for a license). The Leytonstone Porsche, however, didn't make me status-anxious. It was attempting to triangulate out of a tight parking spot, heaving and breathless, like a dinosaur stuck in a tar pit. Disgust over carburetor clunkiness probably fueled the success of Porsche's all-electric Taycan sedan when it debuted in 2019. As Chris Bryant writes, "More than 60% of the sporty sedan's buyers were new to the brand." It was the environmentally correct re-invention of the prestige marque for the new age. Gangbuster sales of the $80,000-plus model gave impetus to Volkswagen AG's lucrative stock market spin-off of Porsche in 2022. But something funny happened on the way to the future. Says Chris: "Taycan sales plunged 50% in the first nine months of this year compared with the same period a year earlier. Meanwhile, Porsche's share price is close to a record low, having fallen almost 50% since last year's peak. Around €50 billion ($53 billion) of value has been wiped out." It's a headache for VW too. It still holds 75% of Porsche stock at a time when its own market capitalization is at a painful low. There are lots of factors for the setback: faulty heating systems, potentially tetchy brake hoses and short-circuiting batteries. And, as Chris says, "For a brand that prides itself on strong residuals, Taycan resale values have been abysmal, in some cases losing 50% of the purchase price after just a year or two on the road." Falling Chinese demand, looming Trump tariffs, the imperfect marketing of an electric SUV and the fact that the company shares its chief executive officer with VW are other likely stumbling blocks. There has been one bright spot in sales, however. "The 911 sportscar remains in high demand," says Chris. So, hold your nose. As President-elect Donald Trump nominates a slew of China hawks to his cabinet, there's a lot of advice, anxiety and prognostication to go around. Daniel Moss says the US is in such a commanding economic position that it doesn't need to worry about China's now very much slowed ascendancy. "There's no longer envy of China," he writes, "nor the belief in some secret sauce that made its performance superior. America is the contemporary star." Meanwhile, foreign direct investment in the People's Republic is falling off a cliff, a situation not seen since Beijing became a (temporary) pariah after it violently put down the 1989 Tiananmen student movement. Conventional wisdom is negative for China's momentum.  Minxin Pei also doesn't believe a trade war is the biggest worry facing Trump — who's threatened to impose humongous 60% tariffs on all Chinese imports. Minxin says President Xi Jinping will work hard to avoid it because "a trade war of such magnitude would indeed gravely injure China." Especially when it is depending on exports to make up for self-inflicted property sector damage. In any case, while the rhetoric has political value, both sides can maneuver around a damaging collision around trade. There is, however, the very real threat of military conflict over Taiwan. Says Minxin: "Although China is unlikely to invade, it could dramatically ratchet up its gray-zone activities to disrupt Taiwanese shipping and air travel. Egged on by hawks and eager to prove his toughness, Trump will be tempted to dispatch a large US force to the region, risking a standoff reminiscent of the Cuban Missile Crisis more than six decades ago." And, even if both sides try hard to avoid triggers, accidents may happen. Short of a hot war, US attempts to impede China may lead to longer-term commercial and security crises. Hemmed in by US export controls, Beijing, says Catherine Thorbecke, "has spent the last six years preparing for further uncertainty by focusing on self-sufficiency, especially in strategic areas such as EVs and chipmaking." Still, with all the maneuvering, Catherine says we shouldn't forget one universal truth: "Trying to predict what Trump will actually do when he's back in the White House has proven an exercise in futility for global policymakers." Best to just buckle your seat belts.  "[Primark of the UK and Zara, owned by Spain-based Inditex SA] are at the vanguard of a group of European retailers making fresh inroads into the American market. … Zara is increasingly stretching upmarket, making it competition not only for traditional fast fashion players such as Forever 21, but also for department stores and mid-market chains such as Abercrombie & Fitch Co. Primark — or 'Primani' (rhymes with Armani) as it's dubbed, thanks to its particular blend of cheap and chic — is a potential roadblock in the turnarounds of Target Corp and Gap Inc." — Andrea Felsted in "Zara and Primark Are Beating US Retailers at Their Own Game." No time to celebrate Shell's victory. — Lara Williams SXSW needs to redirect from London. — Matthew Brooker Austerity isn't a smart move in Mexico. — Juan Pablo Spinetto Guess what was the asset of the Millennium. — John Authers A blueprint for Schroders. — Chris Hughes Hong Kong and Singapore banks can count on the rich. — Andy Mukherjee Three weeks ago, I wrote about art valuation and mentioned Frank Auerbach, describing him as perhaps the world's greatest living painter. The British artist passed away on Nov. 11 at the age of 93. While his works have sold for seven figures, the prices never approached the stratospheric levels of so-called avant-garde artists. The pieces did not have the thunderclap-at-first-sight effect of his contemporaries — Francis Bacon and Lucian Freud — in the so-called "School of London." Instead, Auerbach's paintings were quiet revelations — meditations through paint on how our perceptions of reality change even as we behold familiar objects. One critic in the 1980s called him "the ultimate pig-headed Englishman" for coming back to the same subjects again and again — for example, Mornington Crescent in London's Camden Town, where he had his studio.  One of Auerbach's paintings of Mornington Crescent, at the Offer Waterman Gallery. Photograph by Howard Chua-Eoan/Bloomberg But through his brushstrokes, we reconstruct — slowly and thoughtfully — "the immediacy of experience," as Time magazine's formidable cultural arbiter Robert Hughes put it. Auerbach's work, said Hughes, "reminds us that painting may still connect us to the whole body of the world, being more than just a conduit for debate about novelty, cultural signs and stylistic relations." It's more than a cocktail conversation and sales pitch. For those of you who may be in London, the retrospective of his London cityscapes at the Offer Waterman Gallery, which began on Oct. 4, will end as scheduled on Dec. 7. There are no plans to extend the exhibition, despite the artist's passing. Sometimes, you still need baby steps.  "Keep your distance! I know all about dragon slaying from YouTube." Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send armchair wisdom and feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and follow us on Instagram, TikTok, Twitter and Facebook. |

No comments:

Post a Comment