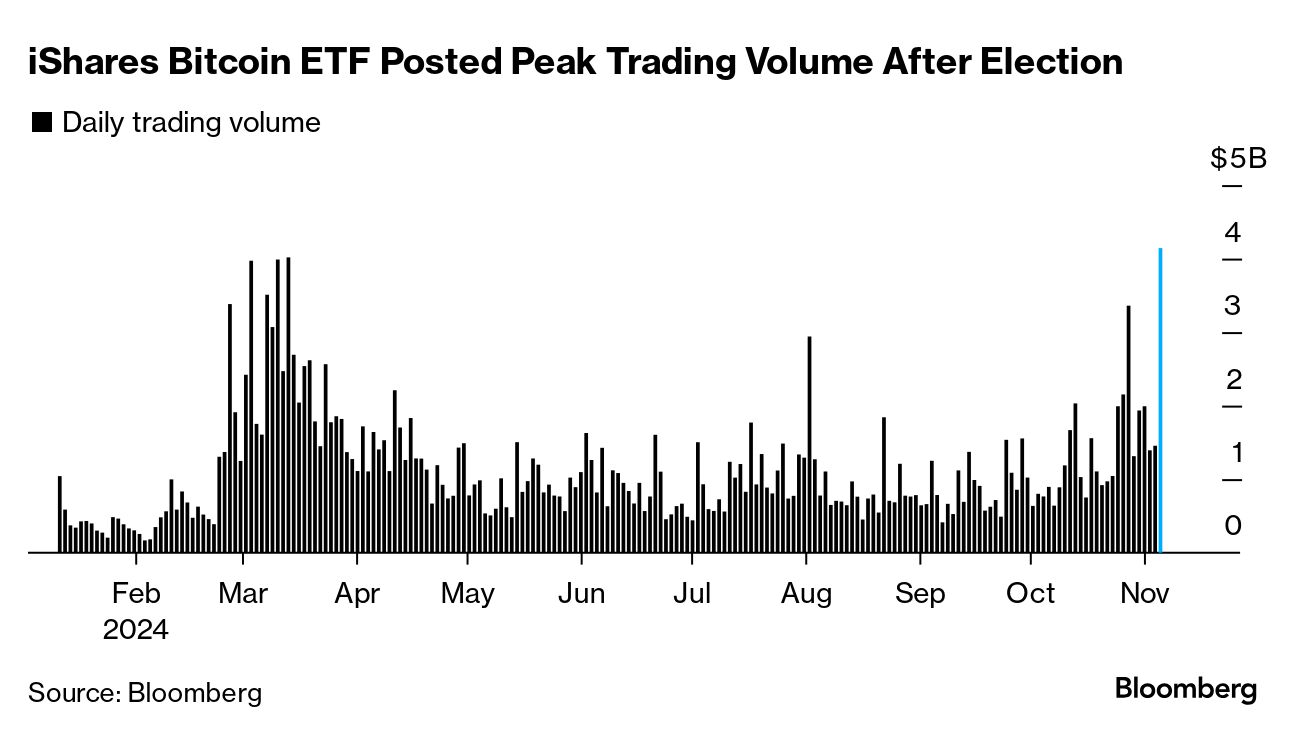

| Donald Trump won the election. So did crypto. And based on the performance of token prices on Wednesday, some of the biggest winners in digital assets are in a corner of the market that has gone quiet for a while: decentralized finance. Prices of tokens associated with DeFi outperformed most other categories the day after the election, according to tracker CoinGecko. Some of the largest DeFi coins by market value include UNI, the governance token of decentralized exchange Uniswap, and AAVE, the crypto from the namesake DeFi lender. The election was "a very big win for DeFi obviously," said Zaheer Ebtikar, founder of crypto fund Split Capital. Regulators and law enforcement in the US have gone after several companies associated with the DeFi sector, which has big ambitions to replace — or at least compete with — Wall Street one day. Uniswap Labs, the developer of Uniswap exchange, received a Wells Notice from the Securities and Exchange Commission in April. The SEC also sued Consensys, the operator of the popular crypto wallet MetaMask, in June. Those types of concerns could go away under the administration of crypto-supporter Trump. Or so the thinking goes. "The SEC and CFTC will likely withdraw or settle many of their ongoing lawsuits and investigations against crypto industry participants and work collaboratively with these businesses," said Michael Selig, partner at the law firm Willkie Farr & Gallagher LLP. DeFi was once the most exciting part of crypto. Those peer-to-peer lenders and exchanges helped fuel the crypto bull market during the Covid-19 pandemic. DeFi at the time was offering double- and triple-digit percentage returns for investors with high risk appetites. Thousands, if not millions, of tokens were created out of thin air to reward their users. But those days were thought to be long gone, especially as the macro and regulatory environment got tougher and the 2022 collapse of the TerraUSD algorithmic stablecoin wiped billions of dollars from the sector. "The crypto industry has failed to grow as quickly as it could because institutions are in many cases reluctant to jump in," said Chris Perkins, president of investment firm CoinFund. "Institutions are happy to take market risk. They don't want to take regulatory risk. Once you eliminate that regulatory risk, institutions are much more inclined to come into the space." Not everyone is expecting a full-scale revival in DeFi, however. "We act like the SEC and regulatory clarity are the main obstacles to DeFi, but that's too simplistic narrative," said Leo Mizuhara, founder of crypto asset manager Hashnote. "DeFi has practical issues around inefficiency of collateral, pre-trade settlement, and lack of accountability. Until we fix these issues, I think it's a little premature for a DeFi renaissance." Rob Hadick, general partner at digital-asset investment firm Dragonfly, added that the adoption by institutions will also be slow. "I expect that slow adoption is probably less driven by the regulatory environment and more driven by just risk appetite from the large corporations," he said. |

No comments:

Post a Comment