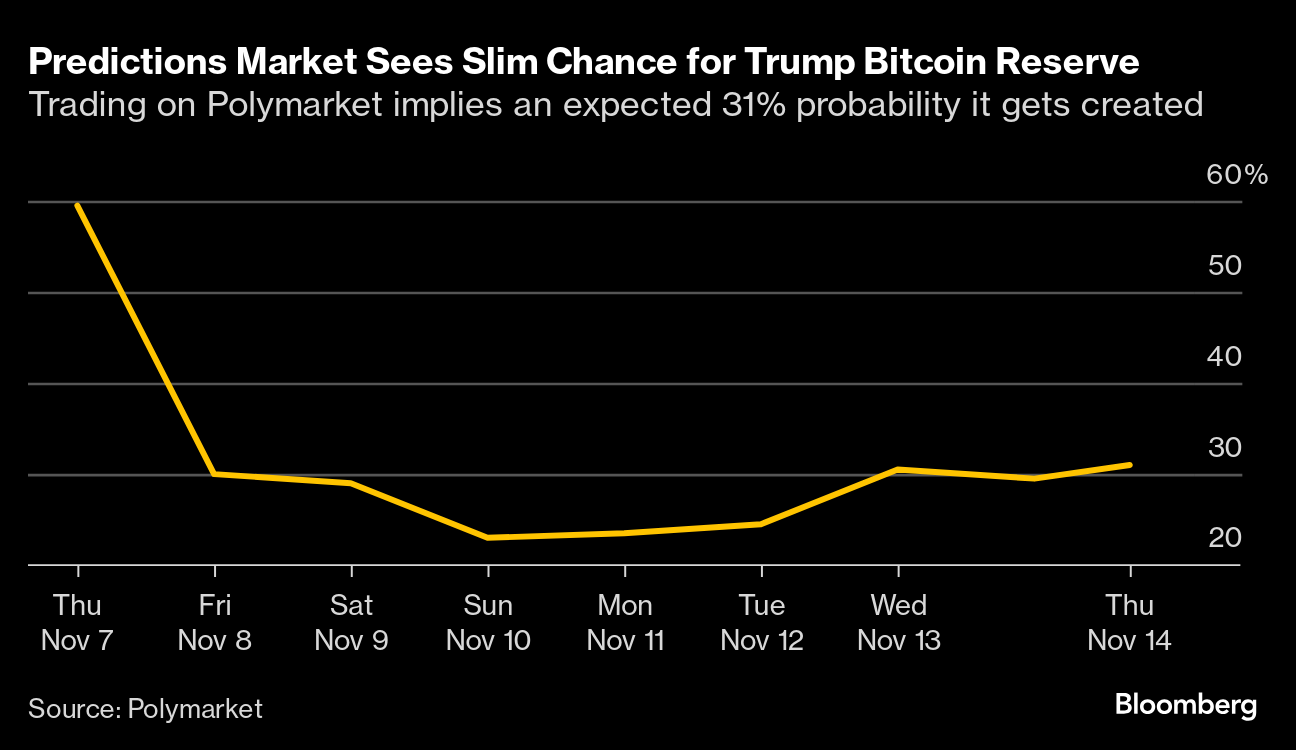

| The seemingly too-good-to-be-true, double-digit percentage yields are coming back in the decentralized-finance sector, as crypto euphoria revives a corner of the market that has struggled for years with reputational damage and a regulatory crackdown. On Aave, the largest peer-to-peer lender, the annualized rate to borrow leading stablecoin USDT went above 15% this week, showing increased demand for cash to chase the crypto bull market in everything from Bitcoin to memecoins. The ratio of trading volume between decentralized and centralized exchanges has also surged to nearly 5%, according to data from The Block, suggesting an upswing in DeFi activity. The rising rates across DeFi lending protocols show that there's more demand for leverage among traders, said Arthur Cheong, founder of crypto investment firm DeFiance Capital, who added that market makers are also borrowing from DeFi platforms like Aave to fund their trading operations. Ethena, a project that allows traders to mimic crypto's version of the basis trade that profits from price differences in spot and futures markets, attracted $600 million in the past three weeks, said Guy Young, founder and CEO of Ethena Labs. The spike in deposits shows that there are more traders hoping to take advantage of the strategy as funding rates – the interest paid by bullish traders to maintain a futures position – surged above 100% on centralized exchanges like Binance. Some argue that a recovery in DeFi shows that the latest bull market has a stronger footing than previous rallies. "In many ways, DeFi's performance is one of the strongest indicators of the market's outlook on the real adoption of Web3," said Rachel Lin, CEO and co-founder of SynFutures, a decentralized derivatives trading platform. "DeFi tends to thrive when entering the second phase of a bull cycle, where the market shows signs of more sustained growth with real demand." Other beneficiaries include decentralized exchanges like Hyperliquid. Its highly anticipated token launch and the market rally have combined to drive up trading activity on the platform. Hyperliquid accounts for about 31% of the total DeFi derivatives market, according to data on Dune Analytics by user uwusanauwu, with a daily average volume of $4 billion in the past week, double that of the second-biggest DeFi derivatives exchange Jupiter. One of the main factors that has slowed DeFi's growth in the past two years is the stricter regulatory environment, in the US especially, and tougher macroeconomic conditions. With the return of President-elect Trump, who is involved in a DeFi project himself, many expect the regulatory environment to improve. "A more crypto-friendly administration poses less of a regulatory threat to decentralized trading and lending protocols" built on Ethereum blockchain, said Josh Lim, co-founder of trading firm Arbelos Markets. |

No comments:

Post a Comment