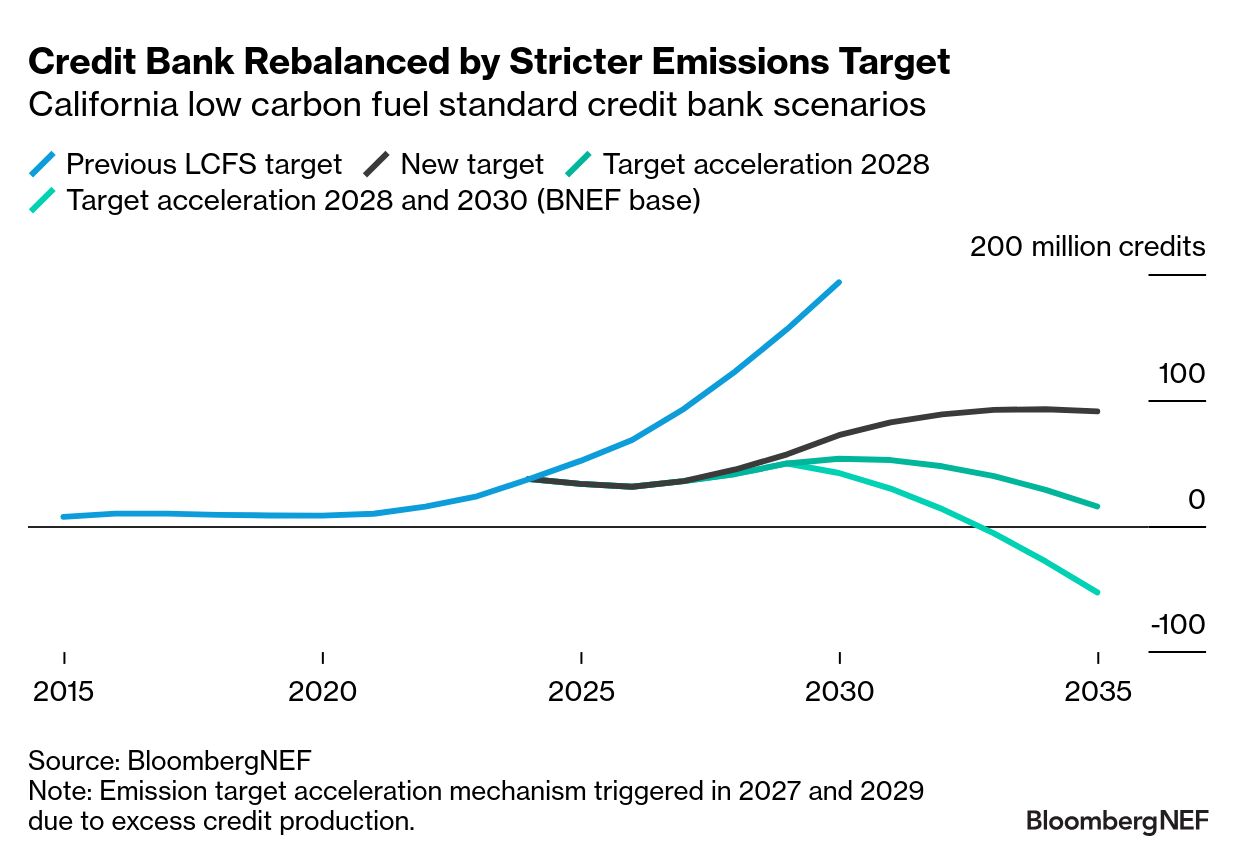

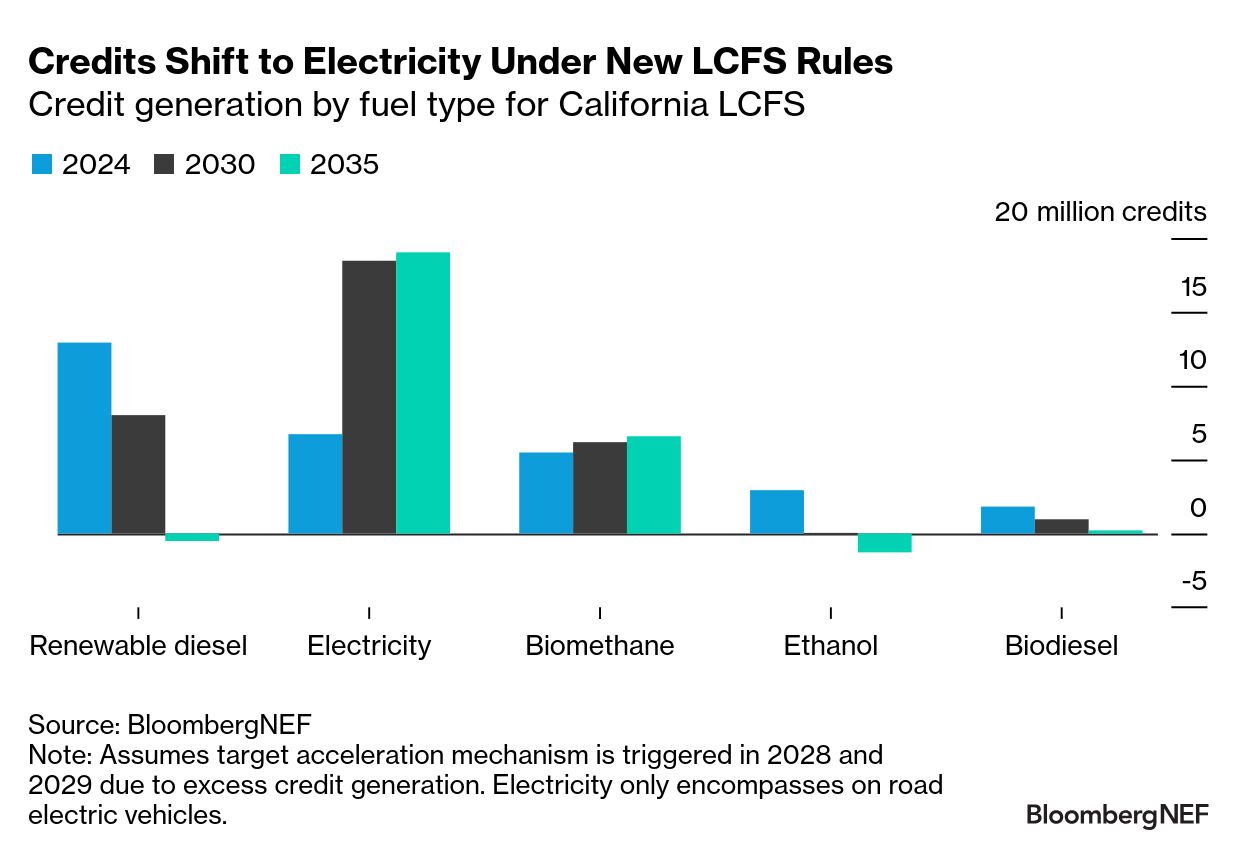

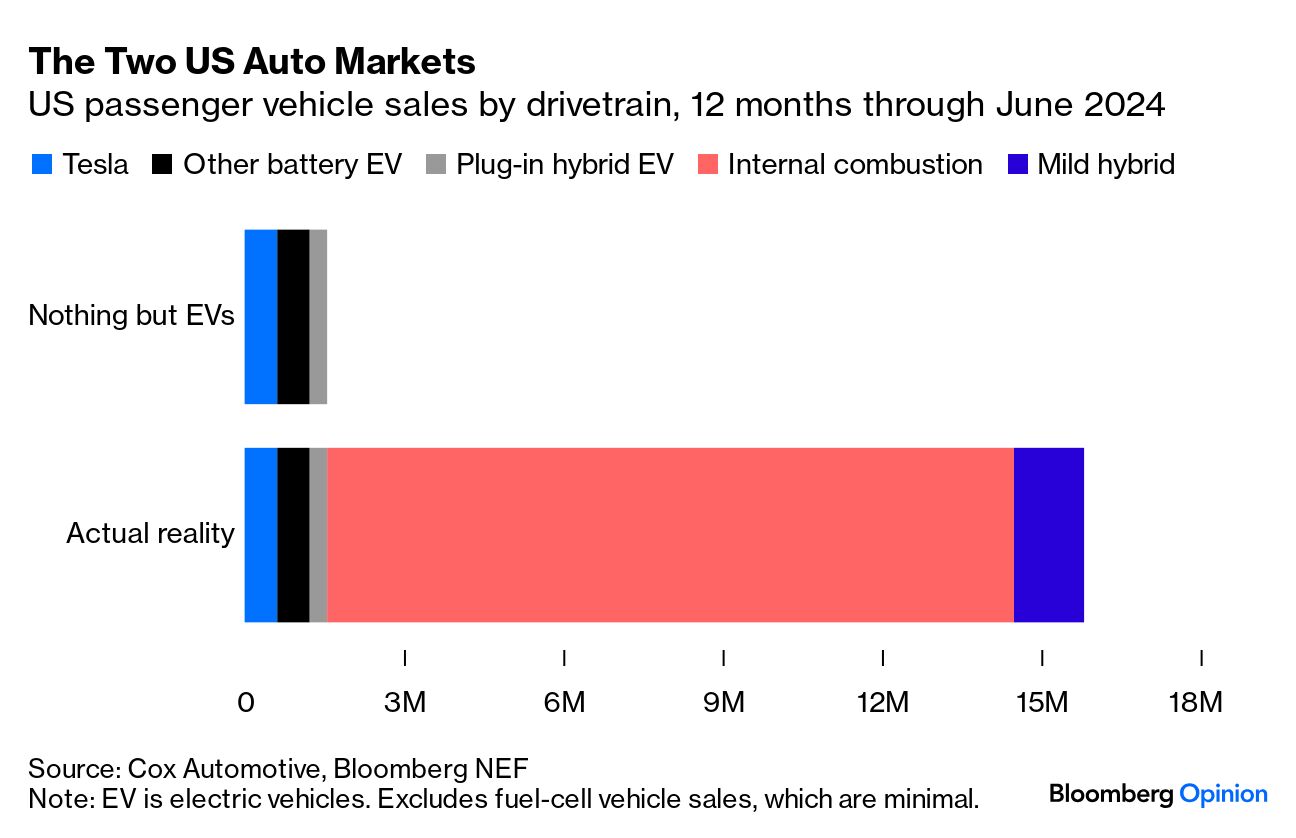

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Days after Americans cast their ballots in an election still dominating news cycles, members of the California's powerful Air Resources Board did some highly consequential voting on a program that was worth $2.8 billion to suppliers of biofuels and electricity for electric vehicles last year. The board approved an update to the state's Low Carbon Fuel Standard, or LCFS, that will make it more difficult for biofuel producers to generate regulatory credits going forward. EV charging will become the program's leading benefactor by the end of the decade, according to BloombergNEF. The program will provide in the range of $500 million to $1.4 billion to the charging sector per year, based on today's credit prices. This will be funded by fossil-fuel suppliers whose product emissions exceed legislators' emissions targets. These funds will flow to companies including EVgo and Tesla. Commercial vehicle infrastructure providers, such as WattEV, Terawatt and Prologis, also get a boost. Grid operators and automakers can take a share of funds, but biofuels producers including Phillips 66 and Marathon Petroleum will see their funds reduced, potentially hampering the viability of certain projects. States and countries around the world will be taking note of the updates, as many already have or are planning to introduce similar programs. Like California, some have struggled with an oversupply of credits tanking prices. LCFS credit prices fell from $187 in 2021 to $66 in the latest weekly report. Credits in Germany's program, known as the GHG quota, have been trading for less than $100 from previous highs of more than $400. Excessive biofuel credits have been blamed for this. BNEF expects California's new rules to rein in credit supply, reduce the size of the credit bank and stabilize credit prices. Under the updated rules, transport fuel emissions must now be at least 30% below 2010 levels by 2030, and 90% below by 2045. Previously, the target was a 20% reduction by 2030. There are also more stringent rules on producers of biogas and biofuels, particularly crop-based fuels. BNEF expects most biofuels, except biomethane, to have a harder time creating any credits by the mid-2030s. Analysis using BNEF's LCFS tool finds that, despite the new targets initially damping the growth of the credit bank, a new mechanism to bring forward emission targets from later years is expected to be triggered twice — in 2027 and 2029 — due to credit production exceeding deficits again. One of the main drivers of credit generation is electricity for electric vehicles. BNEF expects sales of EVs to reach 65% of California's passenger vehicle sales by 2030, and 80% by 2035. This will likely make electricity generation the largest producer of credits in 2030. At today's credit prices, this would provide around 40% of investment required for charging in California in BNEF's outlook. (See the data tool here). The new rules also increase credits for trucks by allowing them to generate capacity credits, enabling operators to generate credits irrespective of utilization. The rules provide more clarity on which entities will receive credits for electricity generated in other charging locations, including grid operators, automakers and charging operators. Expect more discussion about the administration and claims to these credits. The analysis shows biofuels will fall from 74% of credits in 2023 to 45% in 2030, with most biofuels generating deficits by 2035. The generation of credits has become stricter as legislators try to reduce crop-based fuels. Soy and canola oil made up at least 26% of biodiesel supply and 19% of renewable diesel in 2023, but going forward, crop-based biofuels will only be able to make up 20% of total bio-based diesel supply. Restrictions begin in 2025 for new projects, and 2028 for existing projects. The changes will likely push producers to find ways to reduce the carbon intensity of their fuel, such as by using less carbon-intense feedstocks or exploring carbon-capture technologies, which could in turn increase fuel prices for drivers. Opposition to the generous biomethane crediting system was brought up at the Nov. 8 program hearing. But the new rules barely limit credits for the fuel, as restrictions on methane-avoidance credits are not introduced until the late 2030s. Biomethane credits are generated under the LCFS through the capture of methane from landfills, dairies and waste-treatment facilities. Critics argue that subsidies shouldn't be given to dairy farms to power natural gas vehicles. The program will be reviewed regularly and remain a hot political topic as fuel providers battle for subsidies and politicians evaluate how the program affects fuel costs. Those implementing similar schemes around the world will be watching. — By Ryan Fisher and Jade Patterson There's a crazy idea going around, fueled by one Elon Musk, that Tesla would be unscathed if Republicans eliminate federal EV tax credits. But the tailwinds for EV adoption under President Joe Biden may have obscured the fact that internal combustion engines still dominate the US market, Bloomberg Opinion columnist Liam Denning writes. EVs compete with each other, sure, but in a country famously in love with big, hard-to-electrify vehicles, they mostly compete with gas guzzlers. If the US chokes off support for a broad turnover in consumer tastes, and thereby the industrial base, from gas guzzlers to EVs, that doesn't leave the field open for Tesla to take it all. It ultimately closes off the field. |

No comments:

Post a Comment