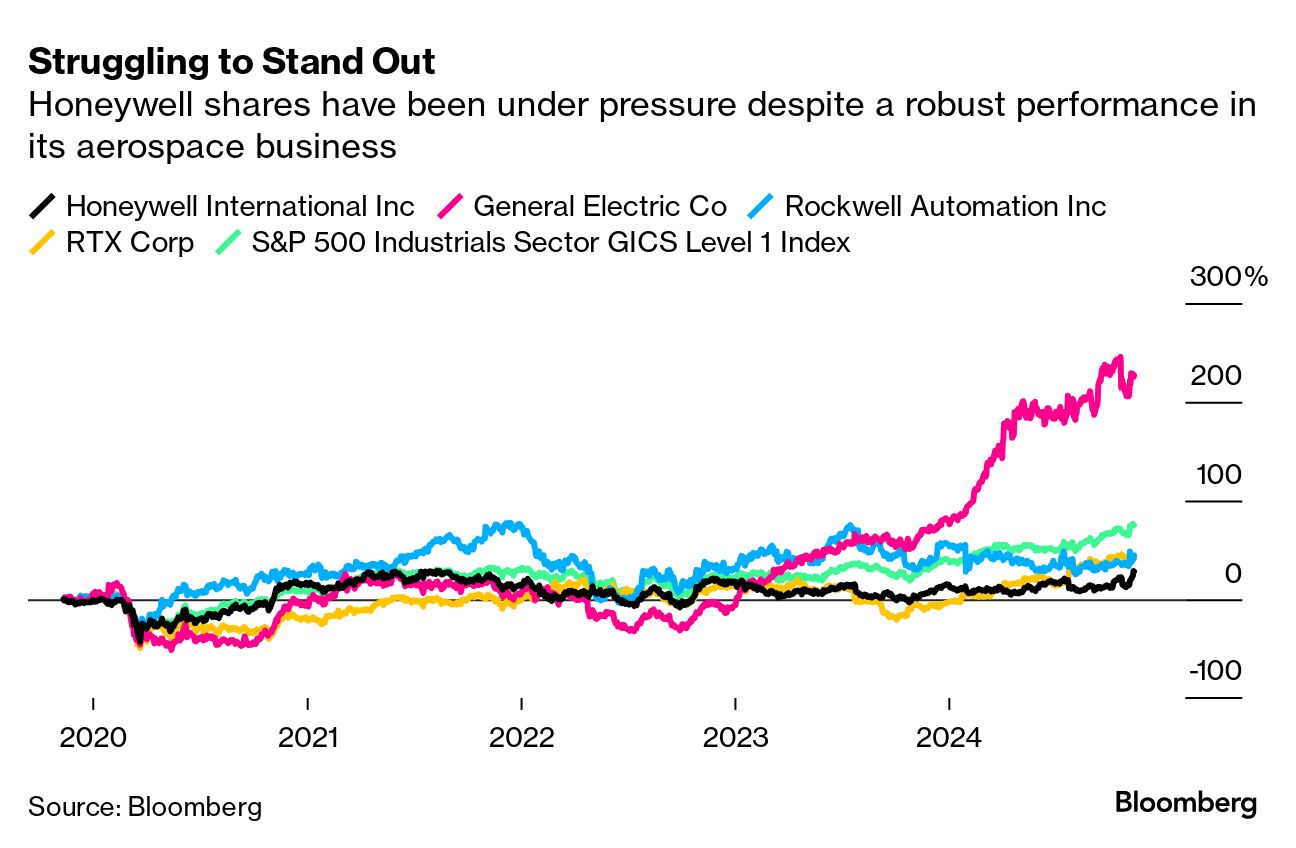

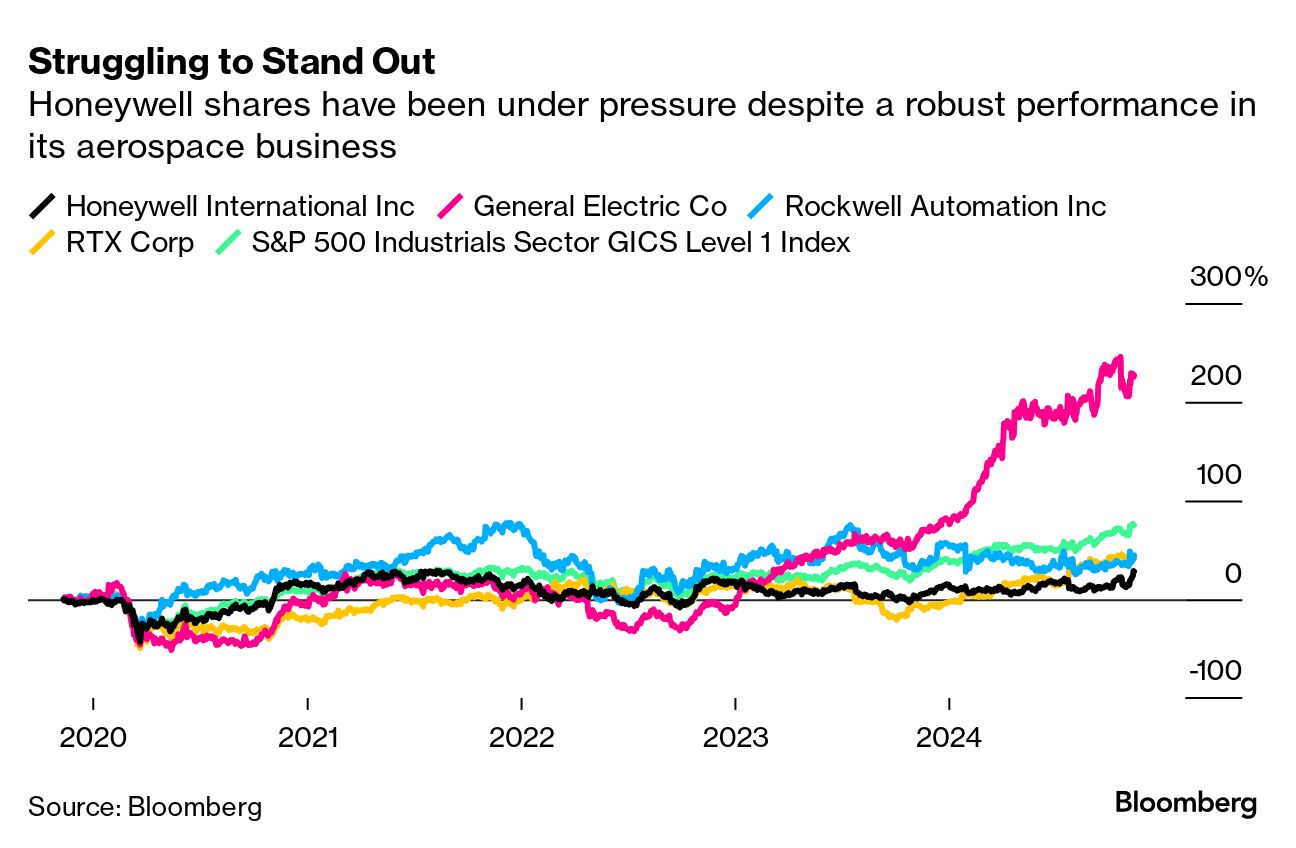

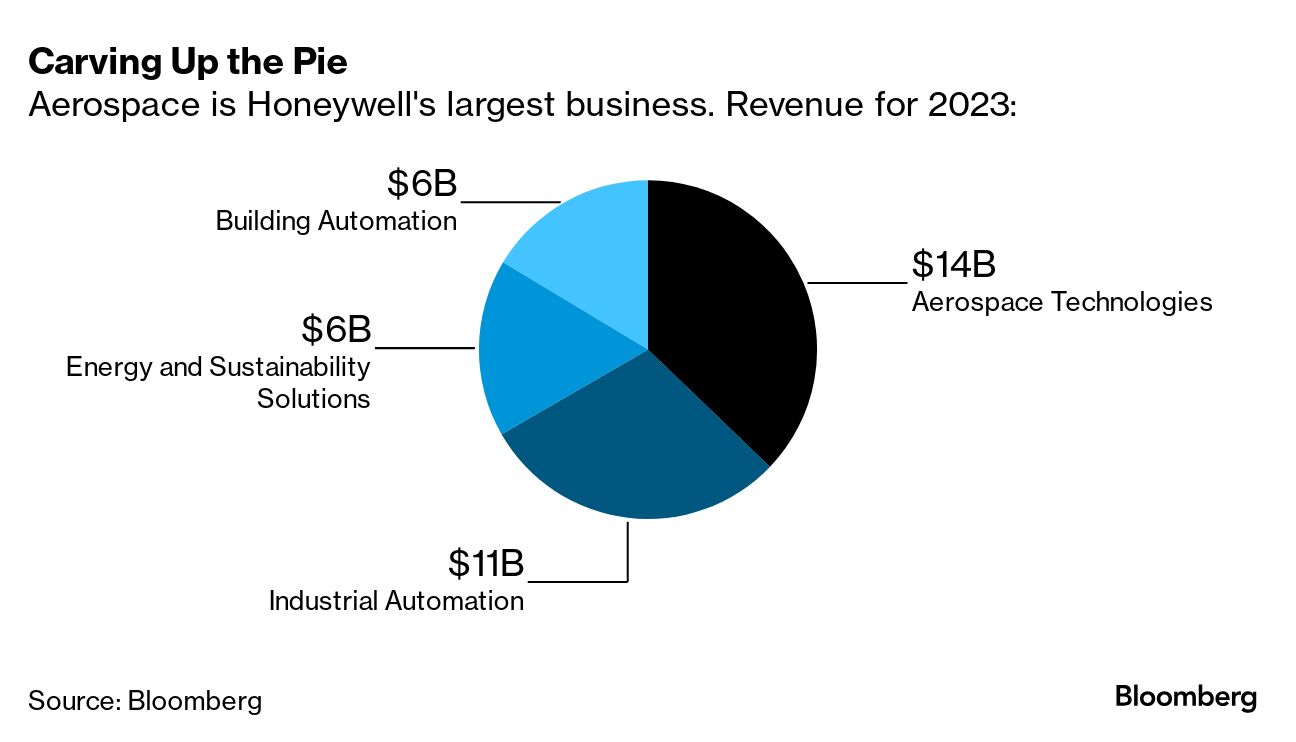

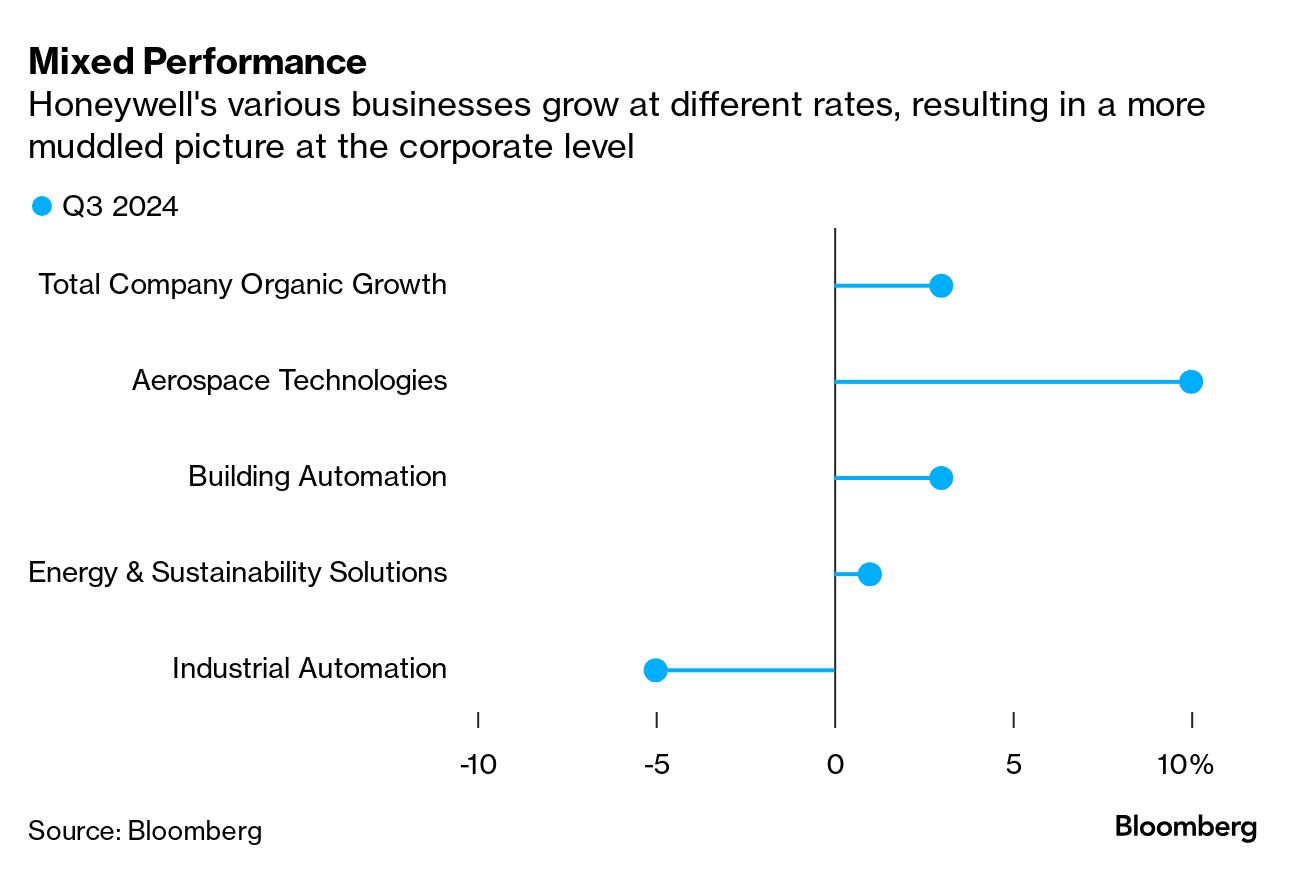

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. Breaking Honeywell International Inc. up would make the company simpler. It would also create opportunities for monster-sized deals. Elliott Investment Management this week disclosed a more-than $5 billion stake in Honeywell, one of the last remaining large industrial conglomerates, confirming an earlier Bloomberg News report. Elliott is pushing for Honeywell to carve out its aerospace arm into a standalone entity, echoing an idea that was initially floated by fellow activist investor Third Point LLC in 2017, which was ultimately dismissed by the company. Such a split would leave behind a still-jumbled mix of automation and energy businesses. But it would be less complicated than the sprawl of pressure gauges, cockpit controls, building management systems, warehouse robots, fuel processing technologies and bar code scanners that will remain after Honeywell follows through on its preexisting plan for a more token simplification. That agenda includes spinning off its advanced materials arm and selling its facemask unit. Read more: One Breakup Isn't Enough for Conglomerates According to Elliott, Honeywell shares could be worth as much as 75% more over the next two years if the company breaks up in a more material way. It bases this on the valuations of peers and an assumption that a more focused company will be easier to manage and more appealing to investors. "The conglomerate structure that once suited Honeywell no longer does, and the time has come to embrace simplification," Elliott partner Marc Steinberg and managing partner Jesse Cohn wrote in a letter to the company's board.  It's not part of the activist investor's math, but a Honeywell aerospace company and a (mostly) Honeywell automation company would also both be able to contemplate deals that would be impossible in the current conglomerate structure. The two mega-sized options that investors and analysts salivate over are a combination of Honeywell's control systems businesses with Rockwell Automation Inc. and an aerospace-focused reboot of its failed merger with General Electric Co., which now does business as GE Aerospace. Either scenario would create a juggernaut. But Rockwell is a $32 billion pure-play automation company, while GE Aerospace is now an almost-$200 billion jet-engine giant that's been restored to its former glory. These aren't the kinds of transactions that can be done with "an automation, aerospace and sustainability-focused technology company" — as Chief Executive Officer Vimal Kapur has described Honeywell. Read more: Honeywell's New CEO Needs to Pick a Lane Honeywell has historically specialized in process automation, which focuses on products produced in batches, such as chemicals or oil derivatives, but it also sells warehouse robots and productivity tools such as bar code scanners. Rockwell's traditional expertise is in discrete manufacturing, which deals with distinct, countable items such as appliances or cars on a factory assembly line, and hybrid automation, which involves a blending of the two approaches in the same environment for goods like bottles of laundry detergent or of shampoo. Rockwell and Honeywell's automation businesses would be an almost perfect fit — and a particularly interesting one with the threat of sky-high tariffs under a second Trump administration. Those levies would likely accelerate manufacturers' efforts to bring factory work back to the US. Inevitably, such a reordering of global supply chains will require significant investments in automation to be cost effective. The prospect of combining all kinds of automation technologies into one company was what drove Emerson Electric Co. to try to buy Rockwell in 2017. The deal failed but the idea didn't: Both Emerson and Rockwell on their own have been striking smaller deals to build out a more well-rounded offering. After its own three-way split, GE Aerospace is now primarily a jet engine manufacturer. This has suited the company just fine: Business is booming as stubborn supply-chain challenges give key parts makers more pricing power and boost demand as airlines fly older planes longer. GE Aerospace shares are up 75% so far this year. But the extent to which GE Aerospace's operations are concentrated on jet engines is unique. Most peers have diversified more aggressively into other parts of the airplane or built up their defense operations. Jet engines are a capital-intensive business, and it's helpful to have other divisions that generate cash flow that can be used to fund development cycles or steady the ship through more challenging moments. Honeywell's cockpit controls, auxiliary power units and wheels and brakes would be highly complementary. The central roadblock to such transformational transactions is antitrust pushback. But bankers expect the incoming Trump administration to reverse President Joe Biden's tougher stance on dealmaking and take a light touch on merger reviews. GE tried to buy all of Honeywell in the early 2000s under former CEO Jack Welch. He walked away after European regulators blocked the combination, arguing that bundling so many different aerospace parts and services together would give the company too much power. This was a novel antitrust argument at the time; traditionally, regulators focus on specific product overlap. When the companies appealed, an EU court upheld the ban on the deal but was critical of regulators' argument about the conglomerate effect. EU regulators had taken particular issue with the competitive advantages offered by GE's aircraft leasing business — which it now no longer owns. Many of Honeywell's one-time conglomerate peers, including Emerson, GE and the former United Technologies Corp., have since unraveled themselves and used their breakups (often combined with large acquisitions) to redefine their identities. Emerson is now an automation and software company, while GE Aerospace and the new entity RTX Corp. (the combination of United Technologies' aerospace and defense businesses with missile-maker Raytheon) are aerospace and defense behemoths. Honeywell could be both of those things, but not at the same time. Read more: Honeywell's Reshuffle Leaves Plenty of Sprawl Under CEO Kapur, Honeywell has lumped its businesses into the three "megatrends" of automation, aerospace and the energy transition. It has struggled to get the valuation credit for these themes that more-focused peers have been able to command. While investors like each of these trends on their own, the logic of packaging them all together in one labyrinthine structure has never been clear. Honeywell's sales and earnings growth has been middling, as trouble spots at one or another of its myriad businesses overwhelm strong performances elsewhere. The industrial giant has announced $10 billion of acquisitions over the last two years — a big number even for a company of its size. It's also a notable ramp up in activity after Honeywell largely avoided the deal market for years. And yet it has seemed like Honeywell is simply cramming more books — radio frequency technologies, security access systems, liquefied natural gas processing equipment — onto an already crowded and bowing shelf. Honeywell says it welcomes Elliott's feedback. After announcing the advanced materials spinoff in October, CEO Kapur had indicated more simplification was coming, although it's unclear if he meant to the degree that the activist investor is proposing. "There are still more opportunities we continue to work on," Kapur said. "Please stay tuned." "Nobody knows what's going to happen. We can project, but the projection isn't so comforting." — Snap-on Inc. CEO Nicholas Pinchuk Pinchuk made the comments in an interview discussing how business leaders are preparing for a second Trump administration. "The grassroots economy is inhabited with a lot of uncertainty now" between the prospect of fresh tariffs, inflation and wars in Ukraine and the Middle East, he said. There was some hope that the election might be a clarifying event, but Trump's proposals on the campaign trail pose uncertainties of their own, Pinchuk said. "No tax on tips, no tax on overtime, no tax on social security, we're going to tax the world, we're going to tax China… It's hard to look at the things that were being said and believe they were a comprehensive and coordinated set of utterances," he said. CEOs, like the rest of us, are waiting to see what unfolds once President-elect Trump moves back into the White House. They're preparing for a repeat of the chaotic governance of his first term — or maybe even more turbulence given the announcements so far on cabinet posts and advisory roles, including a Fox News television host for the Defense Department and Elon Musk for a new government efficiency commission that would audit US spending. They're also preparing to bargain, with the hope that promises of jobs and factories (both real and recycled) will be enough to stave off disastrous economic policies. The one thing that's clear is that CEOs will have to be prepared to think on their feet and pivot when necessary. Read more here. Spirit Airlines Inc. said it's in advanced talks with creditors to restructure its large debt load. That process would happen through a bankruptcy filing, people with knowledge of the matter told Bloomberg News. A deal with creditors "is expected to lead to the cancellation of the company's existing equity," Spirit said. The budget carrier has been lurching toward a potential Chapter 11 process since a planned deal to sell itself to JetBlue Airways Corp. was blocked on antitrust grounds. An eventual default would be a black eye for regulators and for the Biden administration, which had argued they were preserving more choice and competition in the airline industry by thwarting JetBlue's bid. In other news about troubled companies named "Spirit," Boeing Co. and Airbus SE are injecting yet another round of funds to help keep afloat fuselage supplier Spirit AeroSystems Holdings Inc. — no relation to the airline. Boeing has agreed to acquire Spirit for $4.7 billion, but the deal hasn't closed yet. JetBlue, on the other hand, may yet end up making some kind of tie-up with another airline. The company had established a marketing alliance for the US Northeast with American Airlines Group Inc. that was signed off on by the first Trump administration's Transportation Department on its way out the door in January 2021. It was then scuttled after President Joe Biden's Justice Department successfully sued to block it. A federal appeals court this month upheld an earlier ruling that the alliance violated antitrust law. But with Trump returning to the White House and expected to take an "anything goes" approach to deals, both American CEO Robert Isom and JetBlue President Marty St. George this week hinted that there may be a second life for their partnership. "I certainly think there is a structure that could work going forward," St. George said. Cie. de Saint-Gobain, the building materials company, is considering selling its automotive glass unit in a deal that could fetch as much as €2.5 billion ($2.6 billion), people with knowledge of the matter told Bloomberg News. The business could be attractive to private equity firms, particularly those who have done deals in the automotive glass industry previously. A divestiture would be a change for Saint-Gobain, which has spent more than $12 billion on acquisitions over the past five years |

No comments:

Post a Comment