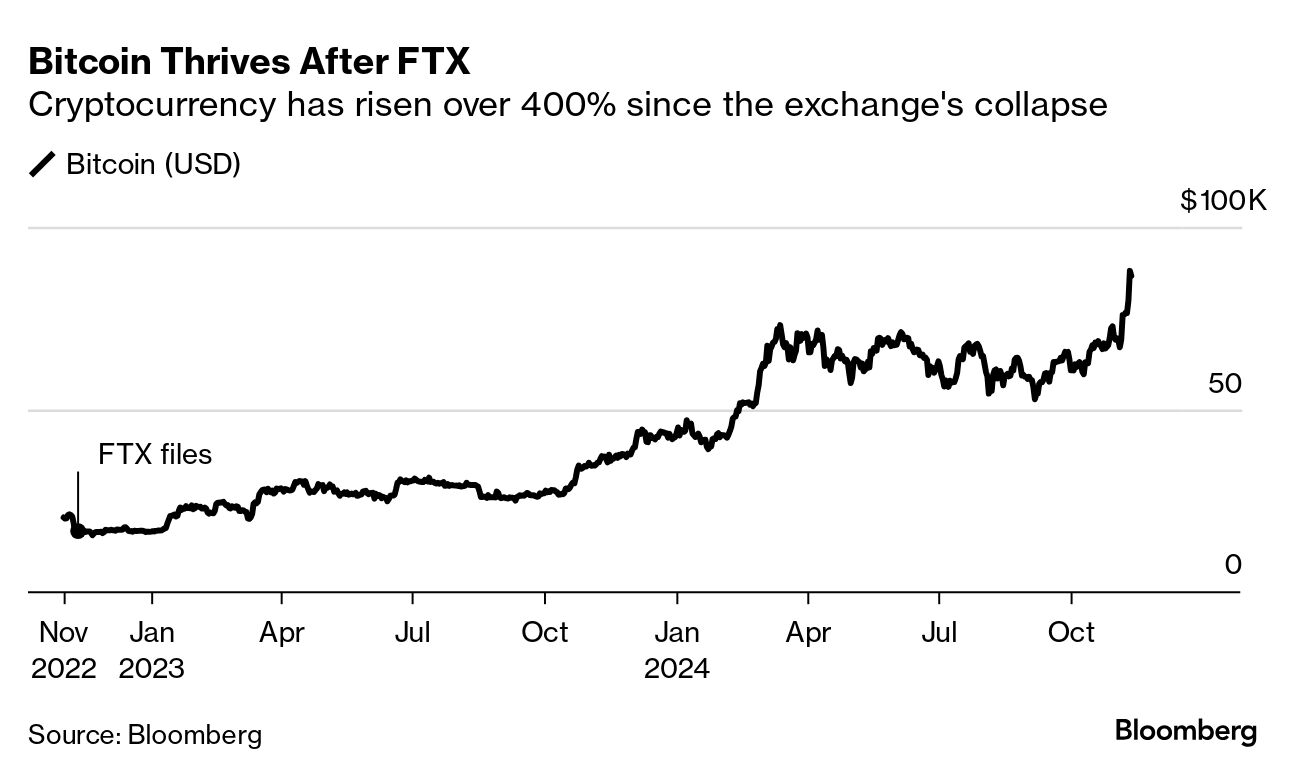

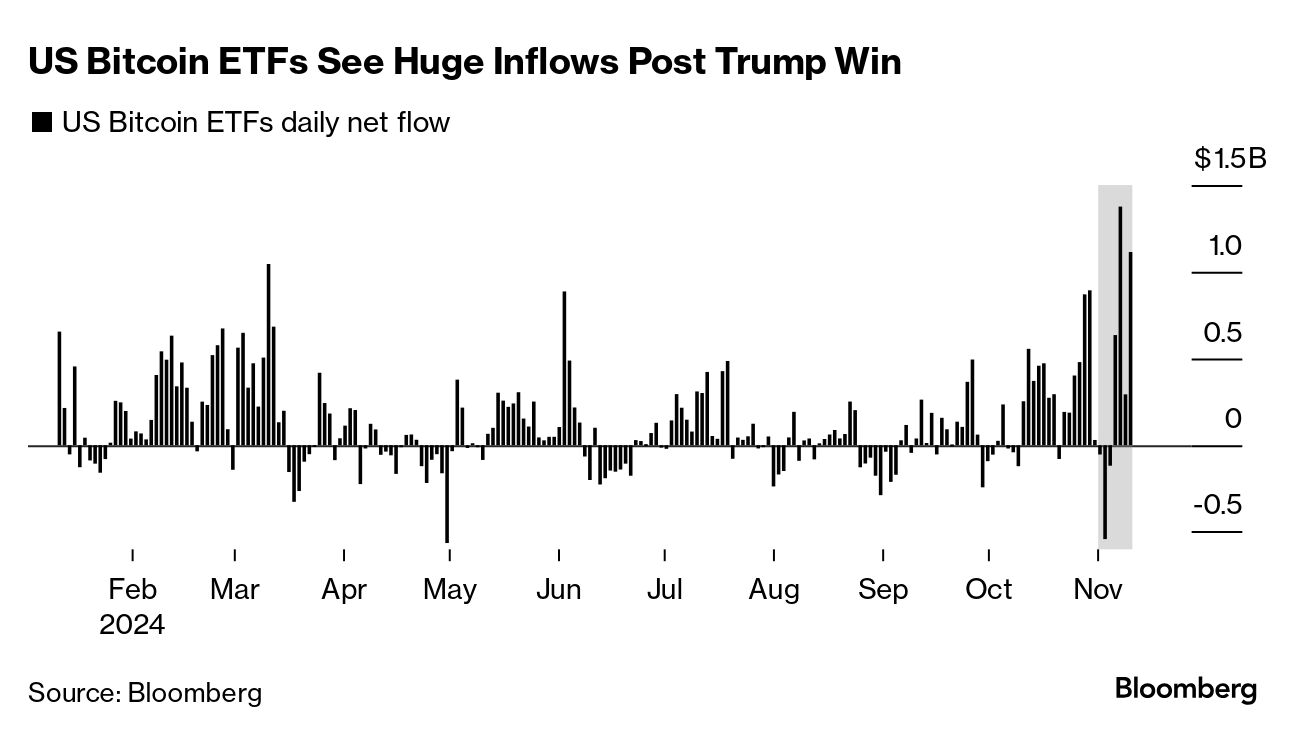

| Monday was the two-year anniversary of FTX's bankruptcy filing — an event that upended the industry as we knew it and later sent Bitcoin to fresh lows in the fallout. But true to its cyclical nature, this year crypto marked the occasion with fanfare. Bitcoin surged to a record high above $89,000 as the sun set in New York, and later approached $90,000 when traders in London woke up on Tuesday to see the token soar. The news that the FTX estate had filed a $1.8 billion lawsuit against Binance, the world's largest crypto exchange, didn't seem to dampen spirits. Markets were further surprised with the reemergence of Sam Trabucco, once co-CEO of FTX's sister trading house Alameda Research, in a court filing later that day. Trabucco, who left Alameda in August 2022 and has been seen little since, will forfeit his 53-foot yacht (jokingly named "Soak My Deck"), two San Francisco properties and the rights for about $70 million in claims against FTX, the filing read. Bitcoin has risen around 425% since the collapse of FTX, showing that even with the advent of institutional buyers somewhat stabilizing the market, crypto is still prone to eye-popping periods of "Number Go Up." Once plagued by a financial hole of as much as $8.7 billion, the meteoric climb in digital-asset values means FTX now says it has enough funds to repay customers in full, plus a little interest. Still, the estate's administrators are keen to find cash in any pocket it has cause to reach into. To date FTX has filed more than 50 adversary cases in Delaware's bankruptcy court against former investors, clients and executives of the exchange and its subsidiaries, largely seeking to recover assets that the new controllers allege were transferred fraudulently due to the platform's apparent insolvency. While Bitcoin's current trajectory might imply that the crypto market is now fully recovered from the events of 2022, the industry continues to feel the lingering effects. Creditors of FTX are set to receive their funds in cash — not crypto — frozen at the value of the time of its demise due to bankruptcy rules. If they had been holding onto Bitcoin all this time instead, they'd arguably be much better off. That's not to mention the increased compliance costs for companies, regulatory scrutiny and skepticism surrounding centralized exchanges that persists among traders.

Even with the bull market back in full force, two years on from FTX, crypto is still forever changed. |

No comments:

Post a Comment