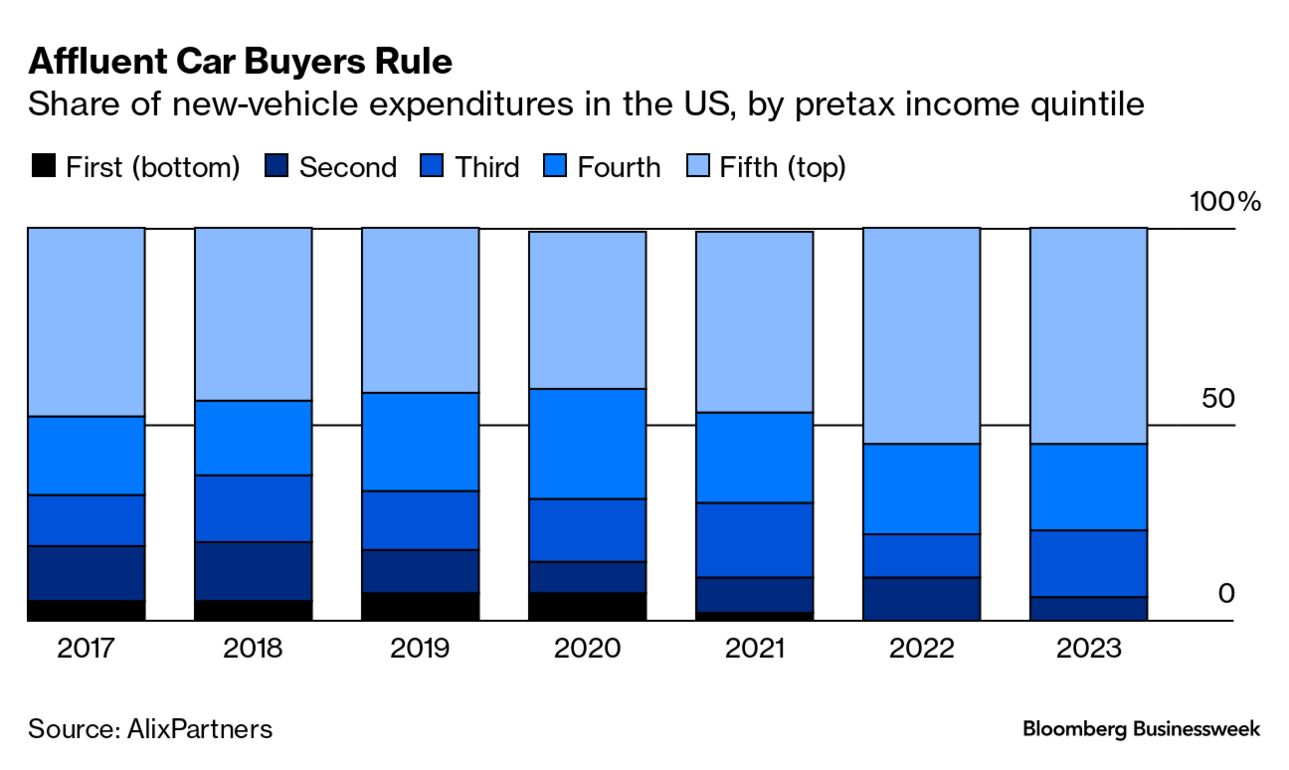

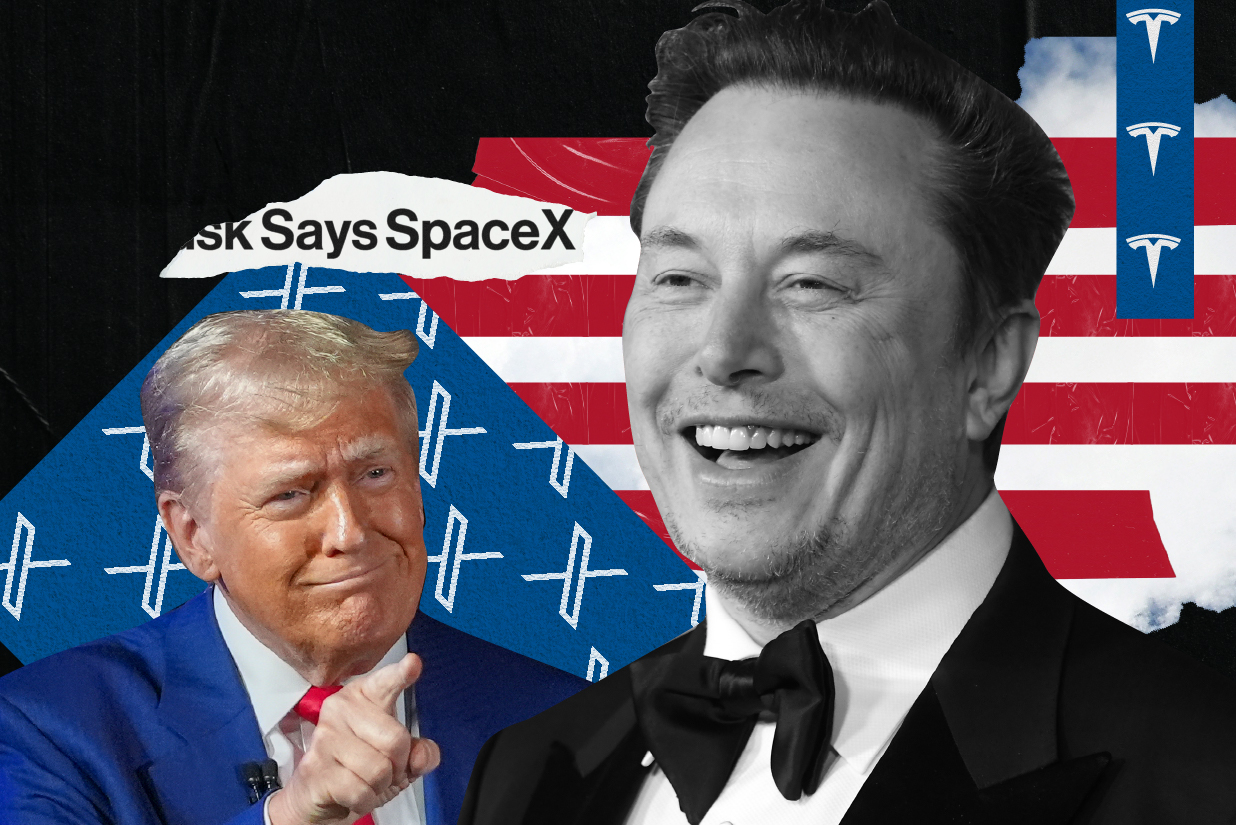

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Marc Levine was used to leasing a new Mercedes-Benz sport utility vehicle every three years, like clockwork. He liked driving a new car and not having to worry about maintenance or running out of warranty coverage. But when he returned to his dealer last year to replace his 2018 GLE 350, he was in for a shock: For the newer version of the same model, his monthly payment would nearly double, to almost $1,200 from $640. "Are you kidding me?" Levine, a cardiologist who lives with his family in South Florida, asked his dealer. He looked at mass-market brands — a Jeep Grand Cherokee and a Toyota Highlander — and the monthly payments on those had grown close to what he'd paid on his previous Mercedes. So finally he asked: "You got anything pre-owned?"  Illustration: Connor McCann for Bloomberg Businessweek And with that, a lifelong new-car buyer joined today's swelling ranks of used-car buyers. Levine purchased a three-year-old Mercedes E-Class sedan with a monthly payment of $748. He says buying used is his "new normal" because prices on new cars have become "ridiculous," but he's not happy about it. "I was never a used-car buyer, because I just felt like that was somebody else's nightmare that I didn't want," says Levine, 61. "But what choice did I have?" Car buyers across America — even those with comfortable incomes like Levine — are dropping out of the new-car market. The pandemic supply shortages that drove sticker prices skyward are in the rearview mirror, but the cost of a new set of wheels continues to climb. The average price of a new car this year is $48,205, up 21% from five years ago, according to Cox Automotive. Growing frustration over auto affordability is yet another "kitchen table" economy concern that's bound to be running through the minds of American voters as they head to the polls tomorrow.  Used cars at a dealership in Indianapolis. Photographer: Jonathan Weiss/Alamy Sticker shock is increasingly scaring off many would-be buyers. A recent survey by Edmunds found that almost half of American car shoppers expect to pay $35,000 or less for a new car. That makes sense because the average trade-in is six years old, which means those buyers last purchased a new car back when the average price was in the mid-30s. When they return to the showroom and discover they'll have to pay almost $50,000, they're walking away. The Edmunds survey found that 73% of consumers are holding off on buying a new car because of the cost. "The prices are just shocking people," says Jessica Caldwell, head of insights for Edmunds. "They're like, 'How come buying the same car costs $300 more a month?'" Monthly payments on new-car loans now average $767, up 17% from four years ago, according to Cox. And 1 in 6 new-car buyers this year will take on payments of more than $1,000 a month, Edmunds says. Blame it on ballooning sticker prices resulting from more technology, automakers' quest for fatter profit margins and skyrocketing auto loan rates. Soaring housing and grocery costs get most of the attention in the inflation debate that's become a flash point in the presidential election. But the auto affordability crisis is laying waste to a fundamental aspiration of American life: a new model in the driveway. That's now becoming the domain of only the wealthy. The top fifth of American households, with an average annual income of $265,000, accounted for 55% of expenditures on new vehicles last year, up from 40% in 2020, according to research conducted for Bloomberg by consultant AlixPartners. Consumers with the lowest incomes, below $16,000 for 2023, have been shut out of the new-vehicle market entirely for the last two years, while those with incomes from $16,000 to $41,000 accounted for just 6% of new-car sales in 2023. "The new-car market has moved to a more affluent buyer," says Mark Wakefield, co-head of AlixPartners' auto practice. "People are having to buy used vehicles, having to keep vehicles on the road longer."  Illustration: Taylor Tyson; Anadolu/Getty Images; Nathan Dumlao/Unsplash; NurPhoto/Getty Images; Steve Granitz/Getty Images; Tesla, TextureFabrik; TGTS; Valeria Reverdo/Unsplash, X Terraforming Mars may be a pipe dream, but Elon Musk is all in on colonizing somewhere closer to home: the White House. The world's richest man is lavishing money and vast corporate resources on ensuring Donald Trump is reelected as the US president. In a joint column, Bloomberg Opinion columnists Liam Denning, Thomas Black, and Dave Lee explore how each of Musk's major companies would benefit from his proximity to Trump. |

No comments:

Post a Comment