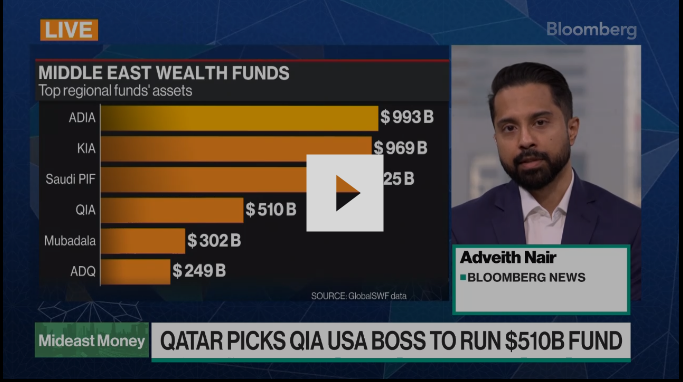

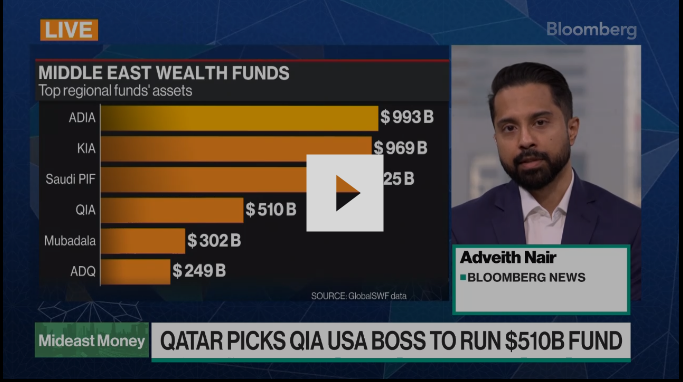

| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. This week, Saudi Arabia's race for cash, the UAE's $1 trillion milestone and an IPO disappointment. But first, let's dive into the changing of the guard at some of the world's biggest wealth funds. Qatar named a new chief executive officer for its $510 billion sovereign investor and Kuwait is replacing the head of its $1 trillion entity, twin moves that have the potential to reverberate across the global financial ecosystem. Qatar kicked things off by naming Mohammed Al Sowaidi as the chief executive officer of its $510 billion sovereign wealth fund, replacing Mansoor Al Mahmoud, who had led the entity since 2018 — longer than a typical four-year term. The fund is expected to reap a windfall from an enormous expansion of Doha's gas output, meaning its size could increase sharply in coming years.  Mohammed Al Sowaidi Photographer: Jeenah Moon/Bloomberg Al Sowaidi's appointment is significant. He joined the fund in 2010, and was most recently its chief investment officer for the Americas region, where he helped establish a US office. By selecting a CEO with extensive US experience, Qatar's rulers are possibly anticipating the "dynamics of a Donald Trump presidency," according to Salar Ghahramani, a SWF expert at Pennsylvania State University and the founder of Global Policy Advisors.

One key question will be the new CEO's appetite for large international deals. While the QIA was previously known for a penchant for trophy assets, the fund changed course in recent years under Sheikh Abdullah Bin Mohammed Bin Saud Al Thani and later Al Mahmoud — whose tenure also coincided with a period of significant domestic spending, including outlay for the FIFA World Cup in Doha. The fund has in the past been led by the likes of Ahmed Al-Sayed, who was among the few executives outside the royal family to hold a senior post in Qatar at the time, and played a pivotal role in some of the Gulf state's biggest overseas investments.  Investors will look to areas of expertise for potential cues on dealflow. The incoming CEO was previously head of private equity funds and portfolio manager for technology, media, telecommunications and industrials at the QIA. Over the past some years, the fund has looked to invest more into the US, partly to re-balance its portfolio away from Europe, while also plowing money into sectors like tech and health care. It plans to deploy more into areas including digitization and infrastructure.

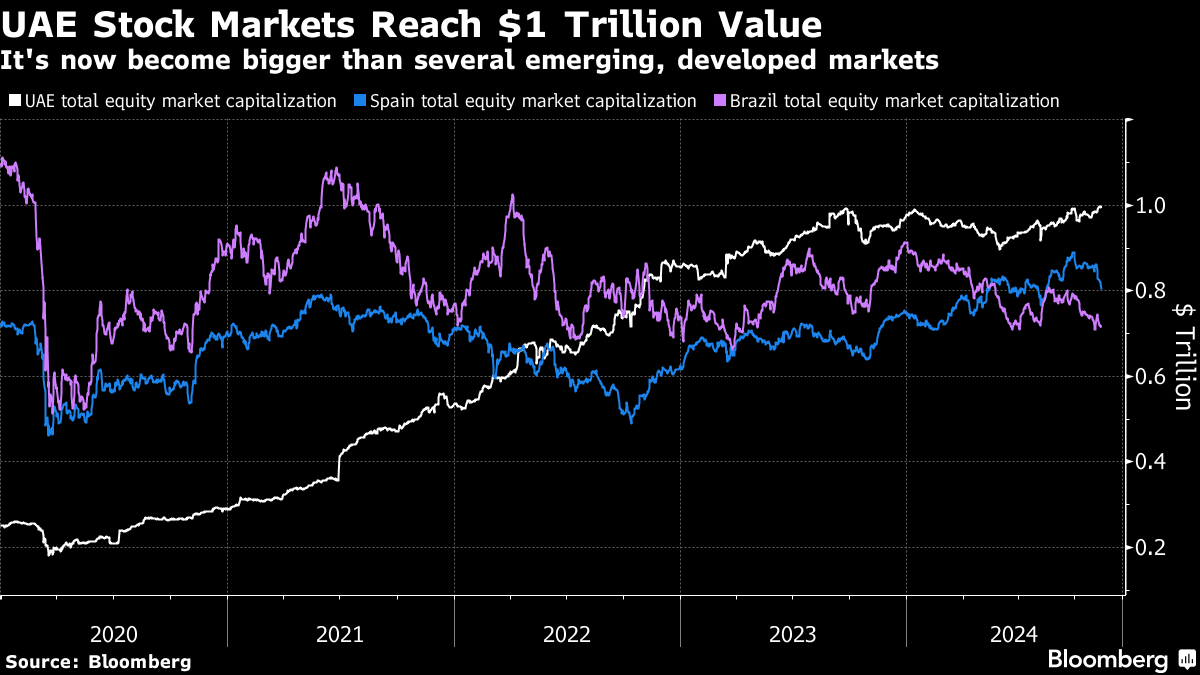

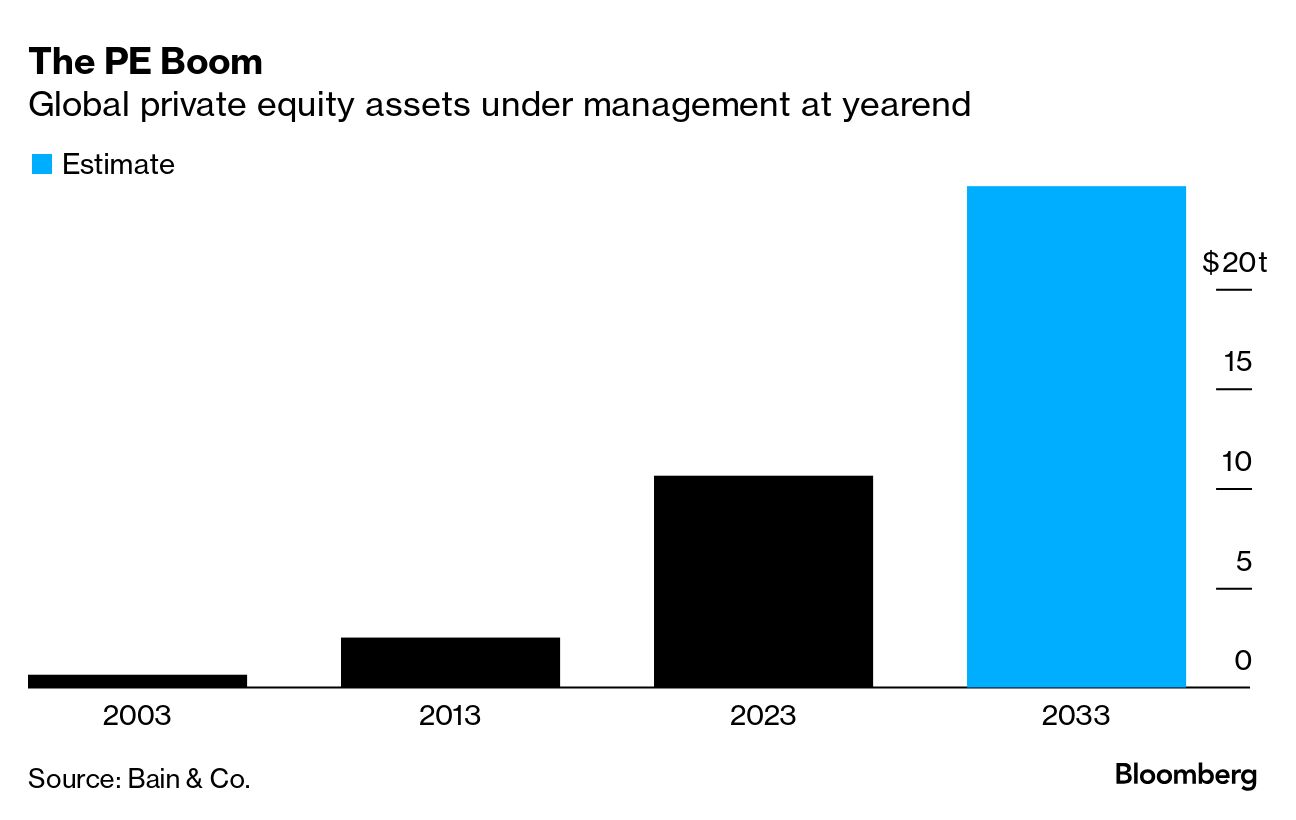

Also Read: The $4 Trillion Gulf Funds and the Power Brokers Who Run Them Meantime, over at the KIA, there's a generational shift underway. Ghanem Al-Ghenaiman, who is 65 and at retirement age, has been replaced by Sheikh Saoud Salem Al-Sabah. The new managing director is about three decades younger than his predecessor but not a lot is known about him. The fund's website details a career spanning 11 years in sectors like investment management, food and beverages and information technology, and he was previously an associate for the Middle East and Africa unit at BlackRock — the US asset manager that has ties to the KIA and has been ramping up its presence in the Middle East. Bloomberg's reporting last week also brought to the fore some strategic shifts in the works. Abu Dhabi Investment Authority's taking an increasingly data-driven approach to investing, and the $1 trillion behemoth is leaning more on its own quant team to speed up decision-making to bolster returns. It's putting money more rapidly in private credit, has continued to ramp up allocations to private equity, and is now working with a wider range of hedge funds. Given ADIA's size — it's the biggest Gulf wealth fund and the world's fourth-largest — even small tweaks can have significant impact. "Today's funds are no longer the passive SWFs of a decade ago," Ghahramani said. They are "setting stricter terms with their external fund managers to ensure decisions align more closely with their strategic goals—or moving in-house altogether if closer alignment is required." Wealth funds are emerging not just as clients, but as key decision-makers, according to Ghahramani. "They're also no longer shy about signaling the importance of politics and geopolitics in their investment and fund management strategies, whether it is through changes in leadership or strategy." A few weeks ago, this newsletter highlighted the United Arab Emirates was close to reaching a milestone that the country's rulers have long coveted — $1 trillion in total market capitalization for stocks listed in the Gulf nation.

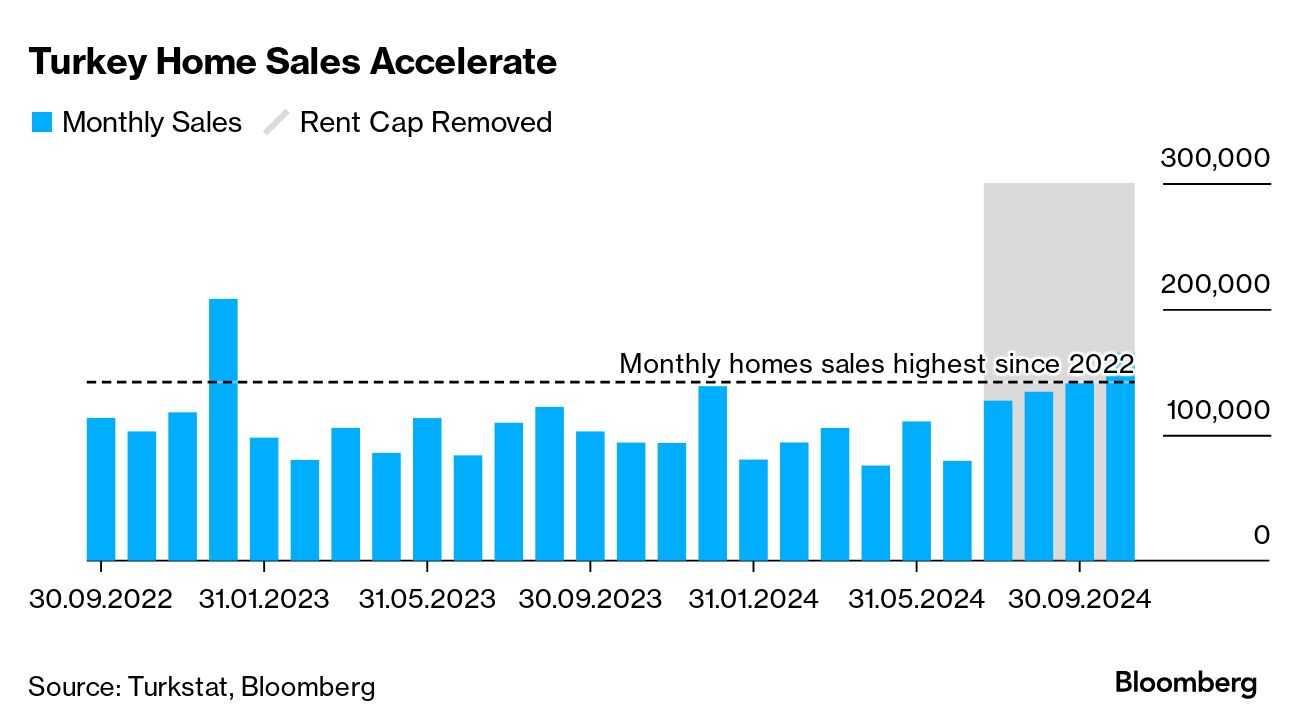

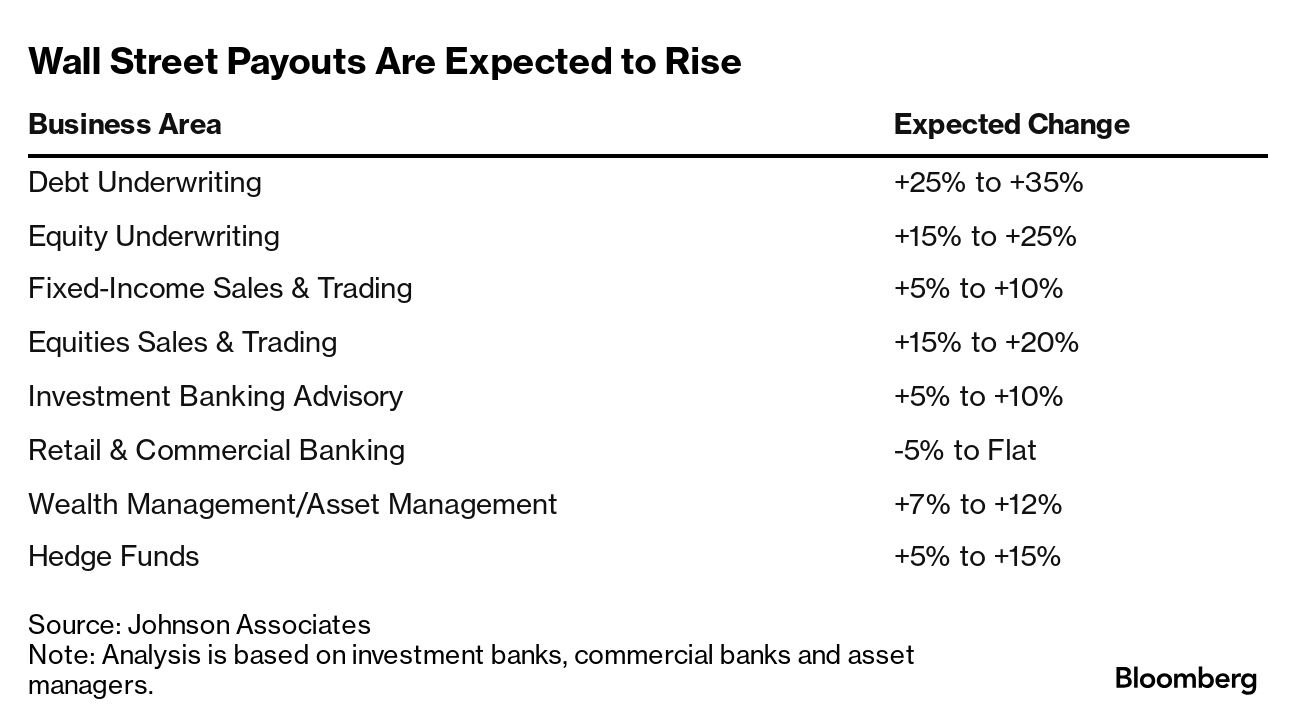

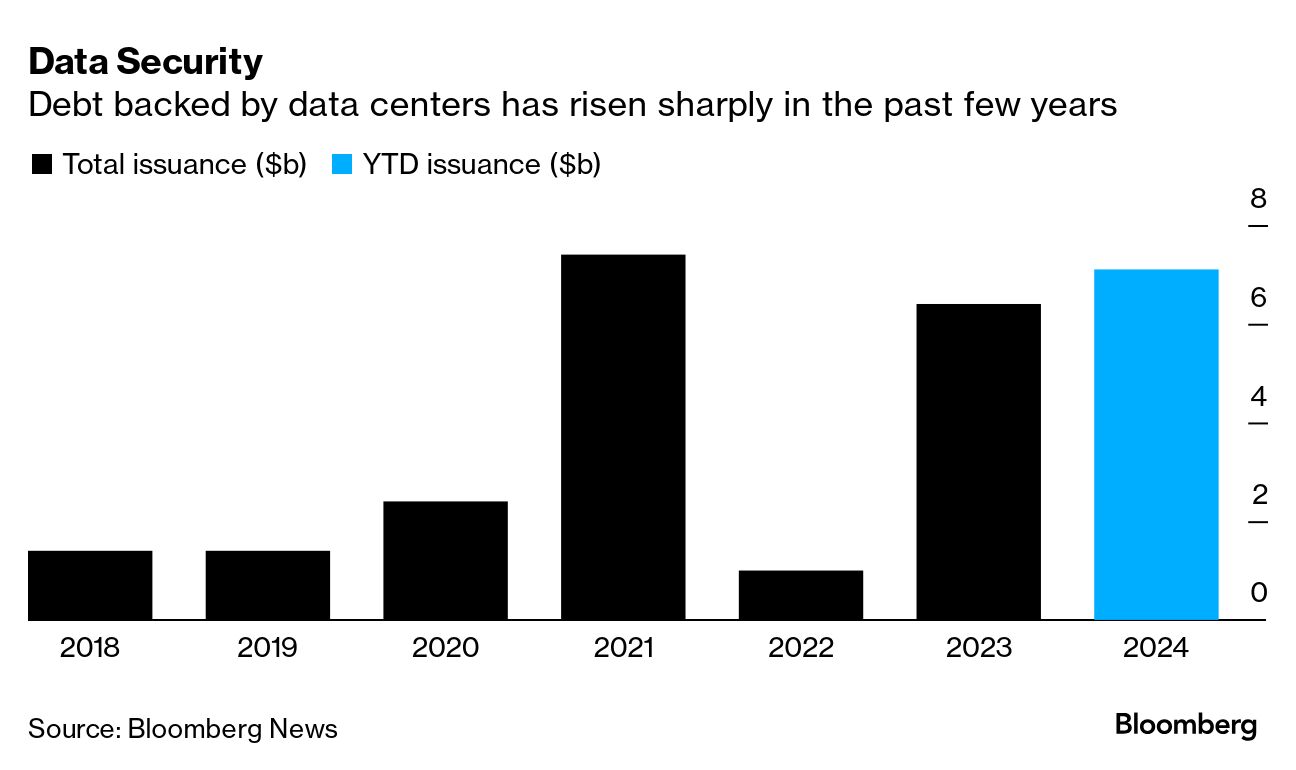

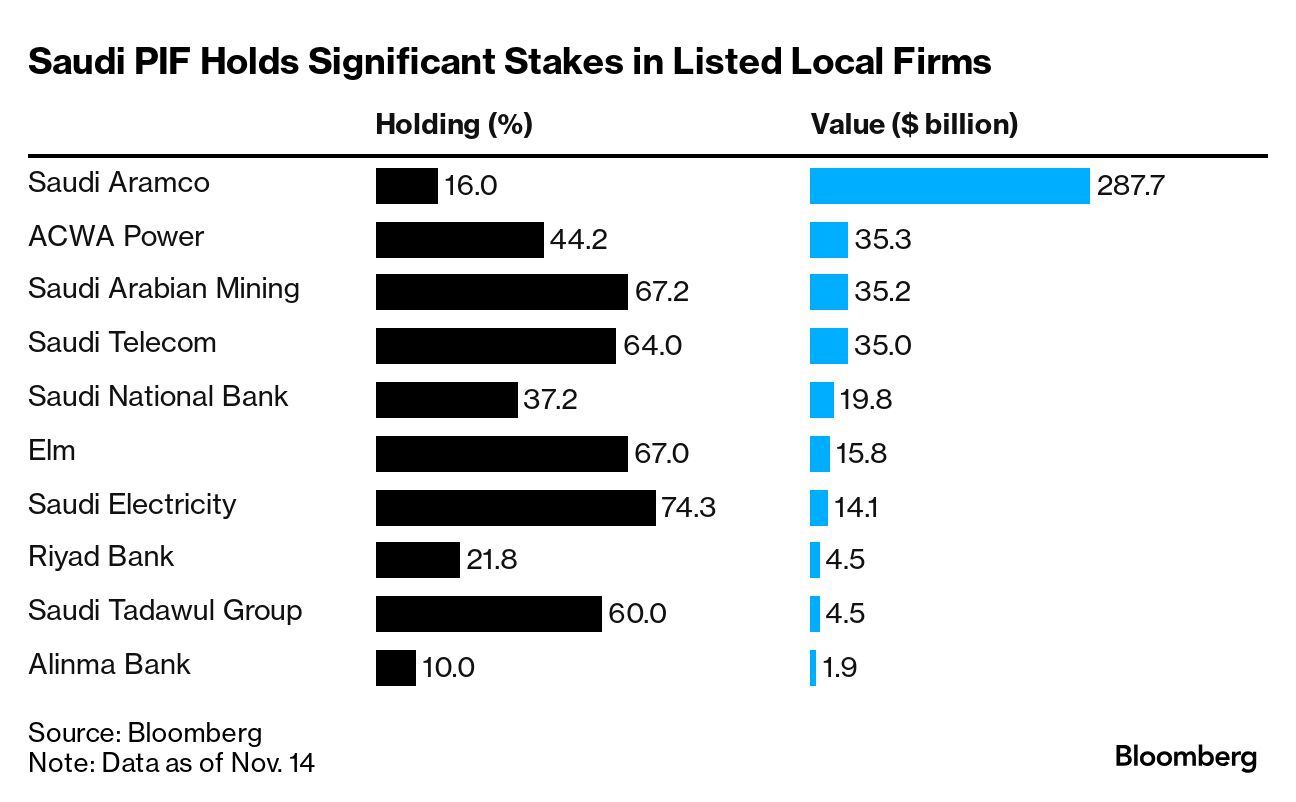

That level has been breached for the first time — making the UAE market, which includes exchanges in Dubai and Abu Dhabi, bigger than Milan or Madrid. While dwarfed by the nearly $3 trillion Saudi Arabian bourse, the UAE is larger than most emerging markets, barring a few like India and China, according to data compiled by Bloomberg. That rally has been driven by a surge in valuations at firms linked to Sheikh Tahnoon bin Zayed Al Nahyan — one of the emirate's deputy rulers, the country's national security advisor, brother to its president and arguably one of the most important men in global finance. A string of IPOs have added to the size. Related Coverage Lulu Retail disappointed in its Abu Dhabi trading debut. The $1.72 billion initial public offering had cemented its founder Yusuff Ali's position as the UAE's second-richest private individual.  Yusuff Ali Photographer: Anindito Mukherjee/Bloomberg Delivery Hero is considering raising about $1.5 billion from the IPO of its Middle Eastern unit in Dubai. A Saudi financial services firm's $264 million IPO got $35 billion in orders. PureHealth, controlled by ADQ, is considering a potential acquisition of hospital operator NMC Healthcare. BlackRock received a commercial license to operate in Abu Dhabi. It's the latest example of Wall Street giants' attempts to balance their relationships with the trillion-dollar wealth hubs in the region. The UK is in the final stages of negotiating a free trade agreement with the six-member Gulf Cooperation Council. Saudi Arabia started a carbon-trading market that'll help fund climate projects across the global south. Also Read: The World's Best Hope to Beat Climate Change Is Vanishing Turkey's housing market is roaring back, spurred by the government's removal of a rent cap earlier this year. Etihad plans to spend as much as $1 billion to overhaul widebody aircraft amid delays from planemakers. Donald Trump made big promises to both the ultrawealthy and the working class. Can he deliver? Elon Musk donated at least $132 million to Trump's re-election and now he has something new to run: the White House. Wall Street bonuses are expected to climb across almost all sectors of the industry for the first time since 2021. Hedge fund Millennium cut one of its most expensive trading hires within a year. Also Read: Citadel Warns Recruiters: Don't Pitch Fake Jobs A small band of Wall Street math wizards is shining a light into the shadowy world of private markets. Private equity firms have sparked controversy by borrowing money against their portfolios. Banks are now backing the funds who make those loans. Family offices are flocking to the $140 billion market for secondary sales. OpenAI, Google and Anthropic are seeing diminishing returns from their costly efforts to develop newer AI models. AI hysteria has largely played out in the stock market. Now debt bankers want to get in on the $1 trillion payday. Asia's richest man Mukesh Ambani is joining the race to popularize human-like robots. Saudi Arabia's wealth fund ramped up its efforts to raise cash to help pay for the government's economic transformation plan. Last week, it further trimmed its stake in Nintendo and sold part of its stake in the kingdom's main mobile-phone operator for about $1 billion. The Public Investment Fund is the main entity tasked with driving Saudi Arabia's Vision 2030 program that aims to diversify the oil-dependent economy, and has been looking to sell down its holdings in companies to raise cash. Over the past year, the fund has also regularly tapped bond markets. Saudi Arabia's need for funding is becoming ever more acute against the backdrop of weak oil prices that have pushed the budget into a deficit, and officials are re-prioritizing projects. Earlier this year, the government sold a sliver of its holdings in oil major Aramco for about $12.4 billion. The kingdom's race for cash might also have a knock-on effect on the region's market for follow-on equity offerings, my colleague Laura Gardner Cuesta reported last week. The PIF holds a 16% stake in Aramco valued at about $290 billion, and has holdings worth roughly $200 billion in other local firms, spanning vast swathes of the economy beyond oil. For the region's sovereign wealth funds focused on raising cash to finance their economic transformation plans, follow-ons broaden their options for state-owned assets beyond the initial listing. Follow-on share sales in the Middle East are developing at a "good pace," but the region still needs to catch-up to international markets, Gokul Mani, JPMorgan's managing director for equity capital markets, said on Blomberg TV. "In international markets, two-thirds of activity is actually follow-ons, IPOs are only a third. In the Middle East we don't have that ratio." If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment