Ticker Reports for October 18th

Top 3 Stocks to Play Oil's Potential Comeback Rally

Oil prices are on the lower end of the curve in today’s cycle. Still, plenty of tailwinds are set up to potentially bring a new rally for the commodity. Demand has been lackluster lately, and supply isn’t moving the way markets want it to move in order to bring a new rally or oil. But there’s a reason why America’s favorite investor has been buying heavily into oil lately.

Over the next quarter or two, the new business cycle could help investors looking into the energy sector make a profit. However, there are many ways to capitalize on the potential rally in oil, and investors could get lost in the selection process without knowing what their options are today. This is why today’s list is more important than ever to consider.

Considering names like the United States Oil Fund LP (NYSEARCA: USO) to gain exposure to a fund that holds and trades oil futures in order to track the price of oil itself. Then, one of the market’s favorite players at the top of the value chain is Transocean Ltd. (NYSE: RIG). Finally, while not an energy name, FedEx Co. (NYSE: FDX) could become attractive when and if transportation costs rise due to higher oil, and people need more efficient transport services.

Why the US Oil Fund Is a Smart Bet: Rising Oil Prices Could Boost Returns for Investors

The oil futures curve is complex to get right, which is why this fund has a team of traders and managers to make sure that the fund’s oil futures holdings closely reflect the price of oil futures daily, plus or minus a certain percentage due to the contract date mix and management costs.

Realizing that oil prices could rise in the coming months, a few—although smaller—institutional players decided to buy some exposure to the oil fund as recently as October 2024. Leading the buying spree were those at CWM LLC, boosting their holdings by 134.2% and netting their investment to $179,000 today.

Then there is the Creative Planning fund, which added 7.7% to its oil fund positions, bringing its total holding to $942,000 today to show investors there is still some interest in the commodity today. For this reason, some people think oil could be headed higher in the coming months.

Sentiment started to shift when mega investor Warren Buffett decided to buy up to 29% of Occidental Petroleum Co. (NYSE: OXY) over the past few quarters, which got the rest of the market thinking. Then, a major event took place: the Federal Reserve (the Fed) cut interest rates at the most aggressive pace in 16 years, which turned the market.

Lower interest rates will bring more business activity, which will result in more oil demand. However, not all business activity is created equal. Investors need to see the manufacturing sector pick up specifically, which has been contracting for 23 consecutive months, according to the manufacturing PMI index.

Once that happens, investors could see oil prices start to get back on track. Here’s another reason: Chinese stimulus could bring the nation back in the game (it represented 40% of oil demand before COVID-19). Judging by the rallies in Chinese stocks recently, that catalyst might be closer than most think.

Why Transocean Is the Market’s Top Energy Stock Today

It might not be obvious until investors decode the market's language. Comparing Transocean's stock to that of its peers in the rest of the energy sector is critical here, and it all has to do with its business model. As a rig equipment leasing company, it is the first to get paid when the bigger oil producers come to the table looking to produce more oil in the future.

The way to decode this sentiment is through relative valuations and, of course, Wall Street's take. Transocean stock trades at a forward price-to-earnings (P/E) ratio of 64.3x today, compared to the rest of the energy sector's average valuation of 11.5x today.

Markets typically pay a premium for stocks they expect to grow by the most in the future, something Wall Street analysts are already betting on. Earnings per share (EPS) projections are set for $0.14 for the next 12 months, a significant improvement from today's net loss of $0.15.

This is why analysts also have a consensus price target of $6.88 a share, which calls for a net upside of 63.3% from the current price.

Analysts Project Double-Digit Upside for FedEx Stock

After a recent earnings sell-off, FedEx shares could become attractive in the coming quarters if oil prices manage to move higher from where they are today. FedEx’s robust and developed transportation network could help distribute costs more effectively when and if fuel prices rise as a result of more expensive oil.

Knowing that this thesis could play out, analysts at J.P. Morgan Chase decided to reiterate their “Overweight” rating on FedEx stock as of September 2024, landing on a price target of $350 a share for the company. FedEx would have to rally by as much as 28% to prove these targets right from where it trades today.

More than that, some institutional investors came in recently to close the gap between the previous sell-off and the stock’s fair value. Those at Value Partners Investments boosted their positions by 0.3% in the past quarter, bringing their net investment to up to $39.6 million today.

Tesla Super Bull Shares His Ebook For Free

Even though shares of Tesla are only up 3% this year, one man believes Tesla's next bull run is just around the corner.

In his professional opinion, the share price could reach $500 or more…

Now, we understand that may seem far-fetched, but as you'll see in his new ebook, it's not as crazy as it may sound.

In fact, he argues a Trump presidency could make it happen much faster than you might think. which is why we're emailing you now…

For the time being, he's giving away his Tesla ebook for free.

Inside explains how shares could reach $500 in the near future.

Analysts See Growth in CrowdStrike Stock Despite July Setback

In July of 2024, a defective software update by cybersecurity firm CrowdStrike Holdings Inc. (NASDAQ: CRWD) led to global technology outages across multiple industries. In response, CrowdStrike shares plummeted, losing nearly 44% of their value in about two weeks before reaching a low point in early August. Since then, CrowdStrike stock has experienced a fairly steady recovery, although it remains well below its pre-incident levels.

For the most part, CrowdStrike has been fairly quiet about the faulty update since the summer. However, a recent earnings report by Delta Air Lines Inc. (NYSE: DAL) has brought the incident back to the attention of investors everywhere. The airline incident heavily impacted the CrowdStrike industry, with many firms canceling flights for days. Delta was among the hardest hit, with about 7,000 flight cancelations during a week, and its earnings report reflects this—the company posted top- and bottom-line misses, including a $380-million shortfall in revenue due to the incident, and lowered its guidance going forward as a result.

Months after the software incident, investors have largely returned to optimism about CrowdStrike. Thirty-four Wall Street analysts have named the stock a Buy, while just seven currently have a rating of Hold or Sell. Analysts predict that the share price will continue to rise, though with an upside potential of 5.8%, the stock is not expected to reach its highs from before the incident. With so much speculation surrounding this company, it's worth a closer look at its fundamentals to determine if it's likely to maintain this upward trajectory or if perhaps another cybersecurity firm could capitalize on the moment.

Strong Performance in the Latest Quarter and Client Retention

Much of the renewed enthusiasm for CrowdStrike may be due to its impressive results for its second quarter of fiscal 2025, which ended less than two weeks after the incident. During this period, the company posted a 32% year-over-year increase in total revenue and income from operations compared with a loss the year before. Net income per share attributable to the company was 19 cents, compared to just three cents in the prior-year period. The company's Falcon platform continues to drive subscriptions.

CrowdStrike's cybersecurity products are closely integrated into the tech infrastructures of many of its clients—two-thirds of customers use at least five CrowdStrike modules simultaneously—making a switch to another provider cumbersome and costly. This may have contributed to the company's strong retention of customers even after the software update debacle. Indeed, the company has taken on new partnerships since July, including a major new collaboration with NVIDIA Corp. (NASDAQ: NVDA). Overall, as of September, the firm experienced a 98% gross spending retention rate after the incident.

Future Growth Possible

Even though it has been below its peak since the summer, CrowdStrike is still an expensive stock. It is trading at a massively high price-to-sales ratio of 21.5. However, the company has room to grow as it expands its AI-based offerings and gathers new clients. CrowdStrike executives have set a goal of $10 billion in annual recurring revenue by the end of its 2029 fiscal year. This is a lofty goal but one that the company seems on pace to achieve, particularly if it is able to continue to improve its margins.

Analysts are optimistic that the company will also achieve growth measures in the meantime. Based on analyst evaluations, the company's projected earnings growth is a healthy 54.7%.

A Dip Opportunity

Suppose CrowdStrike's future trajectory looks like this. In that case, it will likely seem in hindsight that the July software update incident was a minor blip for the company that provided investors with a rare moment to buy the dip.

While shares remain below their peak levels from earlier in the year, the dip remains—although it gets smaller and smaller as CRWD continues to recover lost ground.

On the other hand, investors may also consider this an opportunity to look to CrowdStrike's competitors like Palo Alto Networks Inc. (NASDAQ: PANW), which currently has a price-to-sales ratio of 15.2.

NOTICE: You have until Tuesday, November 19th

On Tuesday, November 19, 2024 smart investors will collect their share of a $1.2 billion windfall...

It's part of a unique strategy which has nothing to do with risky investments like options, cryptos or forex.

And while it might sound crazy...

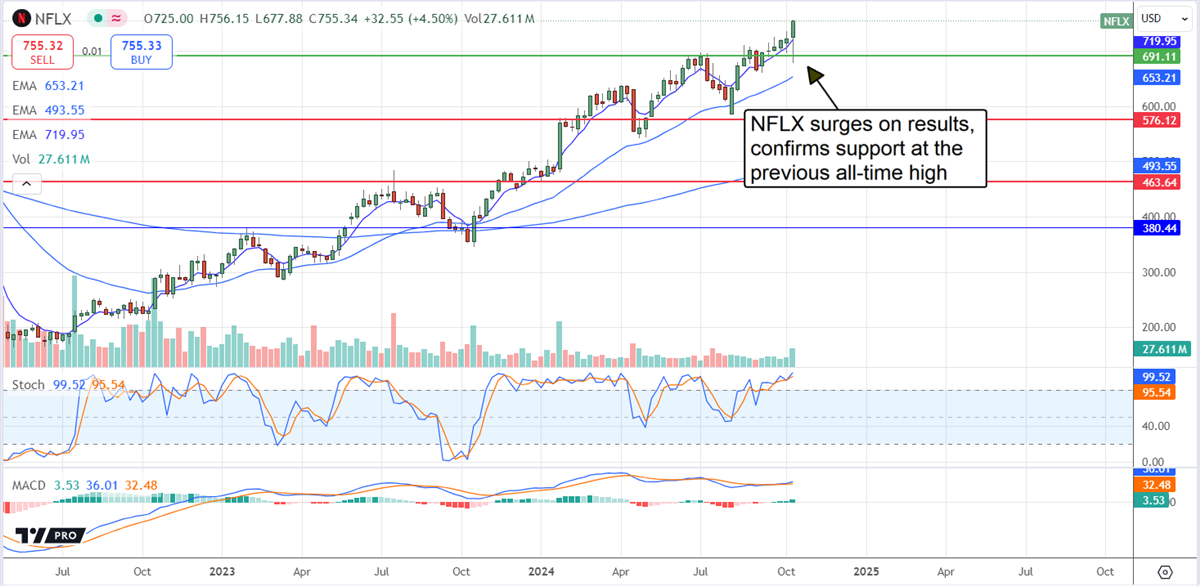

The Uptrend in Netflix Will Continue: Another 15% Upside Ahead

Netflix's (NASDAQ: NFLX) uptrend will continue because the company is still growing and outpacing forecasts. In 2024 and 2025, the company’s growth will be driven by the increasing user base and rising engagement, and in 2026, ad sales will drive it.

The critical takeaway from the report is that business quality is also improving, driving a sustainable increase in cash flow, margin, profits, and free cash flow available to investors. That means the tailwind of share repurchases significantly reduces the share count and will continue to blow. Based on the growth outlook, the technical targets, and analysts' sentiment, Netflix stock could easily gain another 15% by the end of the year and extend the rally to even higher highs in 2025.

Netflix Outperforms in Q3, Raises Estimate For Full-Year Earnings

Netflix's Q3 was strong and provided additional catalysts for the market. The 9.825 billion in net revenue is up 15% compared to last year, outpacing the consensus reported by MarketBeat.com by 65 basis points. The strength was driven by a 14.4% increase in global paid memberships, an acceleration from the previous year’s 10% driven by password lockdown, tiered and ad-supported memberships.

The ad business is growing, driving a significant 50% of sign-ups in ad-supported territories. To attract advertisers, it is approaching what the company described as the “critical ad subscriber scale.” Ads aren’t expected to be a significant revenue driver in F2025 but should fuel growth in 2026.

Margin is another area of strength for this consumer tech company. The only bad news is that the 700 basis points improvement in operating margin is slightly below the consensus forecasts, leaving the top line at $5.40, only 20 basis points above target compared to the slightly more substantial top-line showing. The bottom line is that $5.40 in EPS is up 15% compared to last year, sufficient to lead management to raise guidance for the year.

Guidance is solid. The company expects another 15% in revenue growth, the high end of the previously announced range, with a wider-than-forecasted margin. The margin for the year is now forecasted at 27%, up 100 basis points, which is sufficient to improve the company’s financial outlook. Netflix is a cash-burning machine because of its content slate, but it can improve its balance sheet and repurchase shares because of its cash flow strength. The Q3 repurchases reduced the count by 2.7% on average in Q3 and are expected to continue at a robust pace in Q4 and F2025 because of the $3.1 billion remaining authorization and cash flow outlook.

Analysts Forecast Another 15% Upside for Netflix: Possibly More

The analyst response to Netflix’s results is overwhelmingly positive, with over a dozen revisions issued within the first 24 hours of the release. All include higher price targets, with 15 of 18 or nearly 85% above the consensus. The consensus target implies a slight decline in share price from $742, but it has been up 65% in the last 12 months, including a 5% overnight gain due to the revisions. The fresh revisions put the stock above $800 with a high end of $925, a range of 7.5% to 25% that may be reached before the year’s end.

Netflix's price action surged nearly 10% following the earnings report, which set a new all-time high. The move confirms support at critical levels, including the 30-day moving average and the previous all-time high. The move suggests the uptrend will continue and brings a target of $825 into play. That target is derived from the magnitude of the summer price pullback projected to the critical resistance point, which is now confirmed as support.

No comments:

Post a Comment