| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. This week, we have deep dives into Dubai's post-pandemic rebound and the UAE's first gaming resort. But first, let's turn to the UAE's AI push. This newsletter has previously covered Saudi Arabia and the United Arab Emirates' bets on the technology sector as part of their push to diversify away from oil. This week, Dubai hosts GITEX, which bills itself as the world's largest AI event, so expect a flurry of announcements.

There's been a few this year already. For instance, an updated version of Falcon, an AI model from Abu Dhabi that aims to compete against the likes of OpenAI's GPT, Google's Gemini and Meta's Llama. The Technology Innovation Institute, the group behind Falcon, said the model has been downloaded more than 45 million times. In comparison, Llama models were approaching 350 million downloads for the year to the end of August.

Abu Dhabi has made other inroads into the space. G42 has launched an Arabic large-language model and chatbot called Jais, and the city is beginning to apply generative AI tools into businesses. In November, the emirate set up a new company focused on commercializing Falcon, which has begun to trial the tech inside hospitals, law firms and call centers with local partners and plans to expand outside the country.

The UAE's moves have also kicked off a race with Saudi Arabia to build expensive data centers to support the technology. While there are plenty of challenges to building data centers in the region, the Middle East also offers some advantages.

"The region is next door to some of the fastest growing economies in the world, with electricity prices half of the prices you see in the US," Man Group's Sumant Wahi told Bloomberg TV last week.  "Data centers are extremely power-hungry — a third of the cost in running them goes towards cooling," he said. "If you think about the cost of electricity and how power-hungry these AI data centers are, the Middle East offers an interesting opportunity to host them."

At the same time, entities in the region have also been plowing money into the sector overseas. Late last week, EDGNEX, a unit of Dubai real estate firm Damac, said it plans to invest about $1 billion in a data center project in Thailand.

Abu Dhabi's Mubadala, meanwhile, recently invested in London-based data center developer Yondr. The fund, which has previously backed US-based Aligned Data Centers and Singapore's Princeton Digital, expects cumulative data-center demand globally to grow at a compound annual growth rate of 11% by 2032. On Sunday, my colleagues Abeer Abu Omar and Zainab Fattah examined the extent of Dubai's post-pandemic rebound. An influx of expatriates chasing high-paying jobs is boosting the Middle East business hub's $115 billion economy, while also exposing the limitations of its infrastructure.

The city is home to 3.8 million now, and that's expected to surge to 5.8 million by 2040. That would bring Dubai's population closer to Singapore's and mark a turnaround from the pandemic years. Since 2020, about 400,000 people have arrived, drawn by low taxes, safety and proximity to major markets.  While that's stoked the economy, it's come at a cost. The glut of traders, lawyers and bankers willing to fork out premium prices is pushing up property values and rents, while intensifying competition for school admissions.

Monica Malik, chief economist at Abu Dhabi Commercial Bank sees the pace of growth continuing through this decade. "The lifestyle, ease of doing business and the personal income tax environment are all factors supporting this ongoing expansion," she said. "We expect to see significant investment to support the livability."

Also Read:

Dubai Hosts More Than 40 $1-Billion-Plus Hedge Funds

Millionaires Rush Into the UAE, Private Banking Boom Ensues The US is sending an advanced missile defense system and associated troops to Israel to help shield its ally from attacks by Iran. The Biden administration also approved the sale of billions of dollars in weapons to Saudi Arabia and the UAE.

Wall Street giants have been flocking to the Middle East for a slice of the region's vast oil wealth, but escalating tensions between Iran and Israel are throwing up new uncertainties. Greg Coffey, the macro trader and hedge fund manager, is looking for fresh reasons to invest in Turkey and visited the country in recent weeks for talks.

Wynn Resorts last week received the UAE's first-ever commercial gaming operator's license. Here's a behind-the-scenes look at the firm's quest to develop its newest outpost.  Also Read:

The UAE's $7 Billion Gaming Jackpot Draws Closer

The First Casino Near Dubai Sparks a Region's Newest Gold Rush

Dubai Puts Casino Plans on Backburner as Abu Dhabi Pushes Ahead

Qatar's wealth fund has sold a $351 million stake in Britain's second-largest grocer, Sainsbury's.

DP World reversed its decision to pull out of a UK government investment summit Monday and is announcing a $1.3 billion investment in its London Gateway port that will create 400 jobs.

Also Read: UK's Starmer to Open Key Summit With Vow to Rip Up Red Tape

Lunate, the Abu Dhabi-based asset manager, is evaluating an investment of $1 billion or more in HPS Investment Partners.

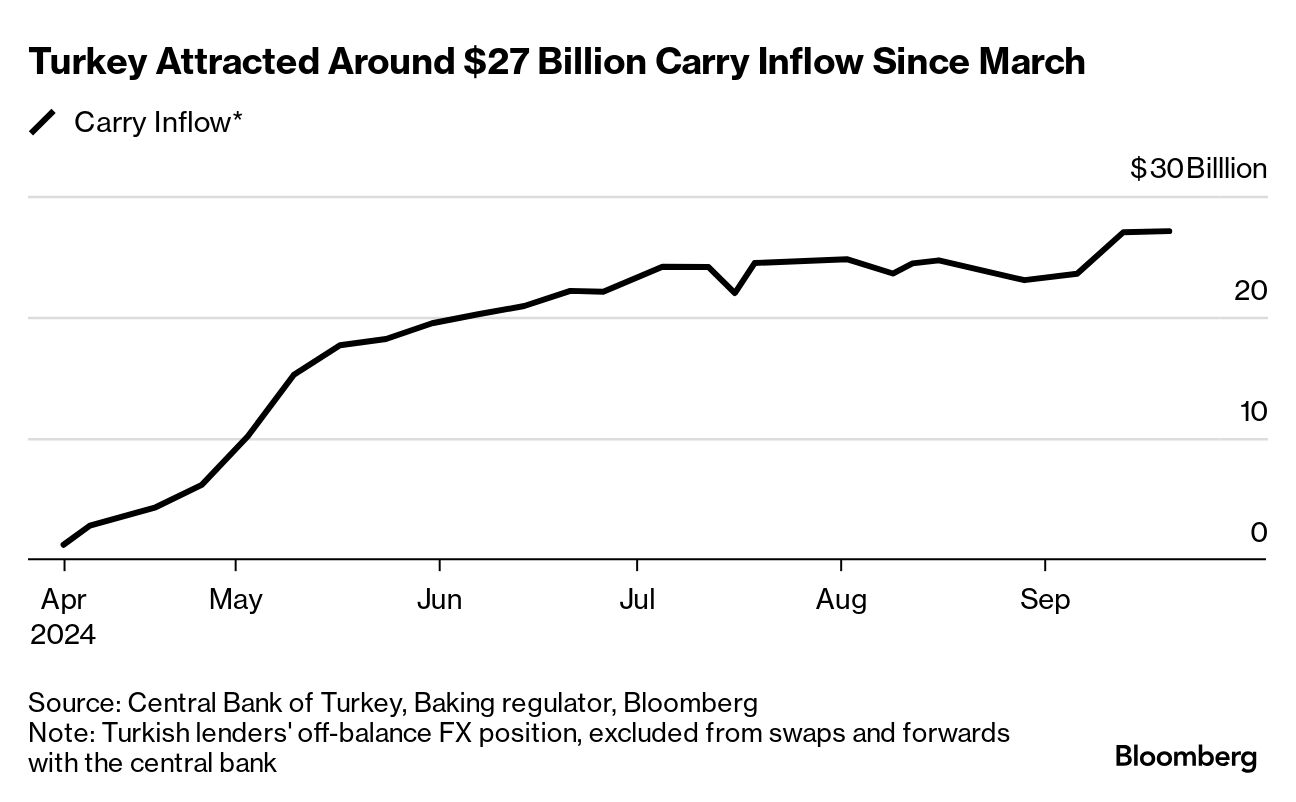

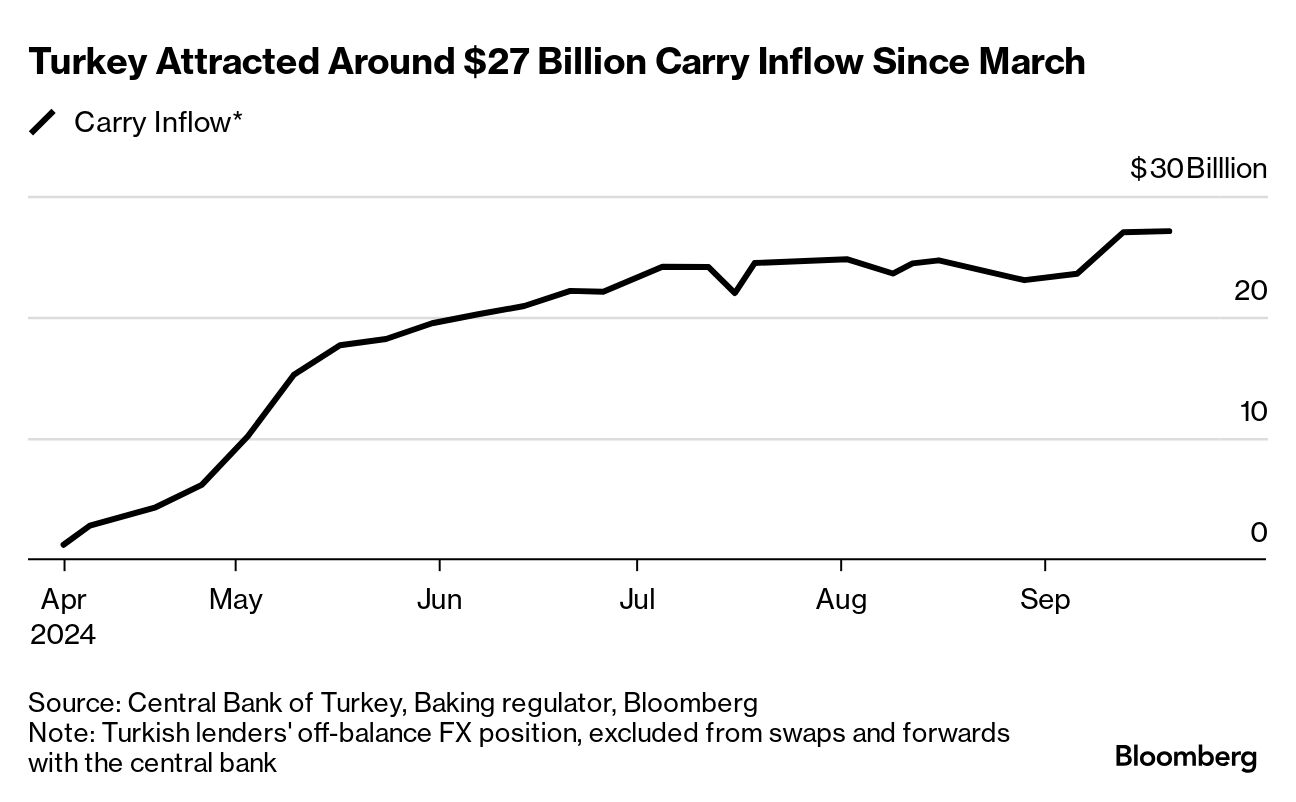

The relative strength of Turkey's lira may be holding back major portfolio inflows even after a landmark shift to orthodox monetary policies that was cheered by investors, according to a senior Citigroup official.  Saudi Arabia is set to make a multi-billion-dollar bet on hydrogen and will launch a new company to produce the much hyped low-carbon fuel.

The Public Investment Fund will become a minority partner in Selfridges after buying out the position of Signa Group. Separately, the Saudi fund disclosed that it has sold down its stake in Nintendo, days after a senior executive said the PIF was weighing deploying more capital into the firm.

Emirates, the world's largest international airline and a major buyer of Boeing widebody aircraft, said it will have "serious conversations" with the US planemaker in coming months following an announcement that the 777X model will be delayed yet again.

Also Read: Boeing's Endless Doom Loop Gives No Respite to CEO Ortberg Chinese stocks overcame a bout of early volatility to post their biggest gain in a week on Monday, suggesting that investors are hopeful the government will deliver on its promise of more fiscal support.

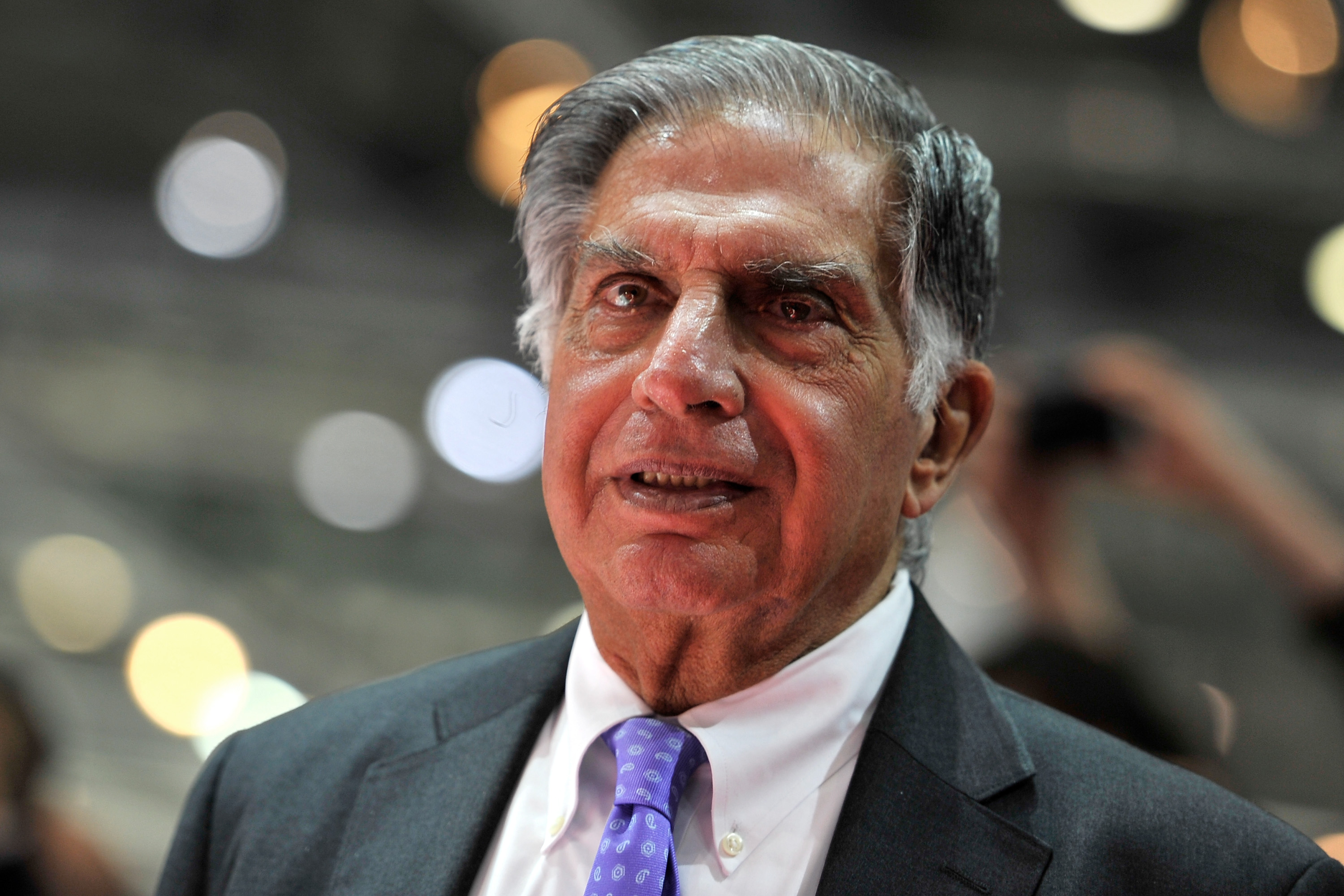

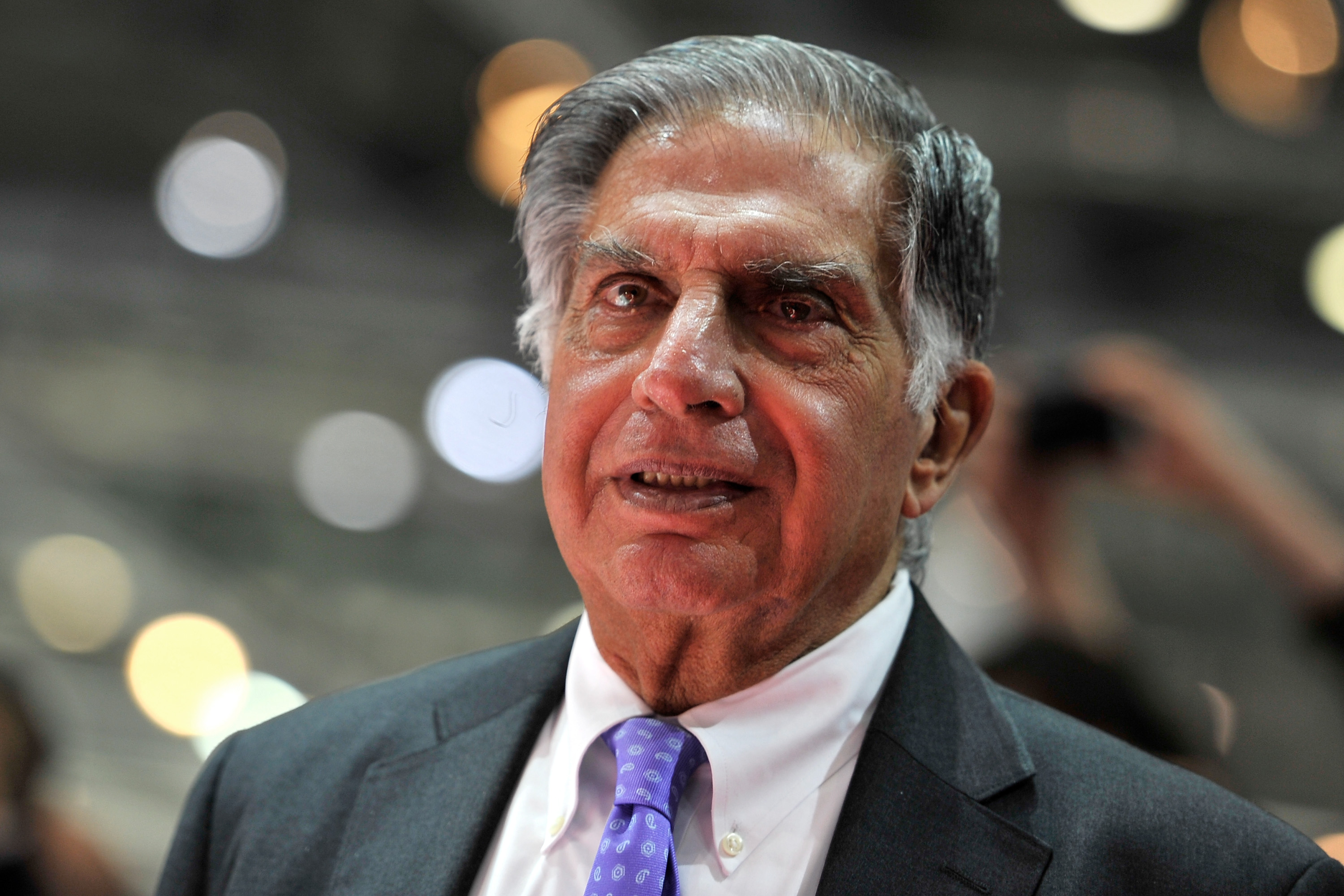

Ratan Tata, the businessman who inherited one of India's oldest conglomerates and transformed it through a string of eye-catching deals into a global empire, has died.  Ratan Tata Photographer: Harold Cunningham/Getty Images Europe Stephen Scherr, the former chief financial officer of Goldman Sachs, is seeking a Wall Street comeback.

Senior economists and think tanks have urged UK Chancellor Rachel Reeves to introduce an "exit tax" on the wealthy to discourage departures.

Also Read: Abu Dhabi Seizes Opportunity to Woo Britain's Tax-Wary Rich

The US Justice Department is considering asking a federal judge to force Google to sell off parts of its business in what would be a historic breakup of one of the world's biggest tech companies.

President Joe Biden said the damage from Hurricane Milton alone could be around $50 billion.  US President Joe Biden Photographer: Aaron Schwartz/Sipa Also Read: Catastrophe Bonds Will Help Florida But Failed Jamaica

Steve Cohen bought the Mets in 2020 and went on a spending spree. This year, it finally appears to be paying off.

Gold's breathtaking surge this year to repeated record highs hasn't stopped bullion from flying off shelves at Costco stores across the US.

Elon Musk unveiled Tesla's highly anticipated self-driving taxi at a flashy event that was light on specifics, sending its stock sliding.

SpaceX made big strides on its path to creating a rocket capable of flying to the moon and Mars. Amateur investors are plunging into the complex world of derivatives-powered ETFs that can dangle huge payouts riding big-name stocks, among other goodies. Industry pros and regulators urge caution.

Lululemon founder Chip Wilson's $60 million mansion was turned into a graffiti-covered flashpoint symbolizing the polarization of a Canadian provincial election.  Graffiti on the home of Lululemon founder Chip Wilson. Photographer: Thomas Seal/Bloomberg Global bond investors have turned the most optimistic in 18 years on the creditworthiness of Middle Eastern governments. The additional yield they demand to buy the region's dollar bonds rather than US Treasuries has sunk to 262 basis points, compared with 324 basis points in January. This market measure of credit risk has continued to narrow in recent weeks amid a worsening war between Israel and its adversaries as well as growing concern that the Federal Reserve may not cut interest rates as fast as previously expected.

Also Read: EM Dollar Bonds Beat Treasuries as Risk Spread Hits Six-Year Low Last week saw a flurry of developments that encapsulated the attractiveness of Dubai's housing market. The surge in home values — they're up for 16 straight quarters now — and higher rents is prompting some to consider moving to other emirates.

Up first, Nick Candy — one half of the sibling duo behind London's One Hyde Park development — said he's turning his attention to the Middle East and promising to set new benchmarks for luxury in a region that's already well known for its opulence.

Candy Capital has formed a joint venture with Abu Dhabi-based Modon and plans to build a series of projects in the Middle East and North Africa, focusing on homes but also including hotels and offices. The developments will aim to have the best architecture, services and attention to detail, said Candy, pointing to the track record at One Hyde Park in London's Knightsbridge, which repeatedly set new price records in the UK capital.  One Hyde Park, a luxury residential and retail complex, in Knightsbridge, London, UK. Photographer: Hollie Adams/Bloomberg Some so-called luxury real estate in the Middle East is nothing more than "mid-market house builder quality," Candy said in an interview. The comments come months after the luxury property tycoon said he would be "running" to the region if he were in his twenties and starting up in real estate again.

Meantime, Abu Dhabi's largest property developer is planning a $480 million project that will include homes, offices and retail locations in Dubai. Aldar Properties has partnered with Expo City Dubai to build a community near Dubai's new airport Dubai World Central.

The six-building project will be constructed on 103,000 square meters of land near the site where Dubai hosted the COP28 global climate summit and the Expo 2020 in Dubai.

And Dubai Holding, a sprawling investment conglomerate owned by the emirate's ruler, is considering setting up a real estate investment trust.  The Burj al Arab hotel is operated by Dubai Holding's Jumeirah International LLC. Photographer: Christopher Pike/Bloomberg The firm is one of Dubai's principal investment vehicles with assets of $72 billion. Setting up a REIT would allow investors to gain exposure to a number of prime income-generating assets overseen by one of the city's biggest developers.

Also Read:

This Hot Luxury Housing Market Is Also a Bargain

Hedge Funds, Golden Visas and UAE's Property Boom

If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment